Global Recovery Cools as Anxieties Heat Up: New Skift Travel Health Index

Skift Take

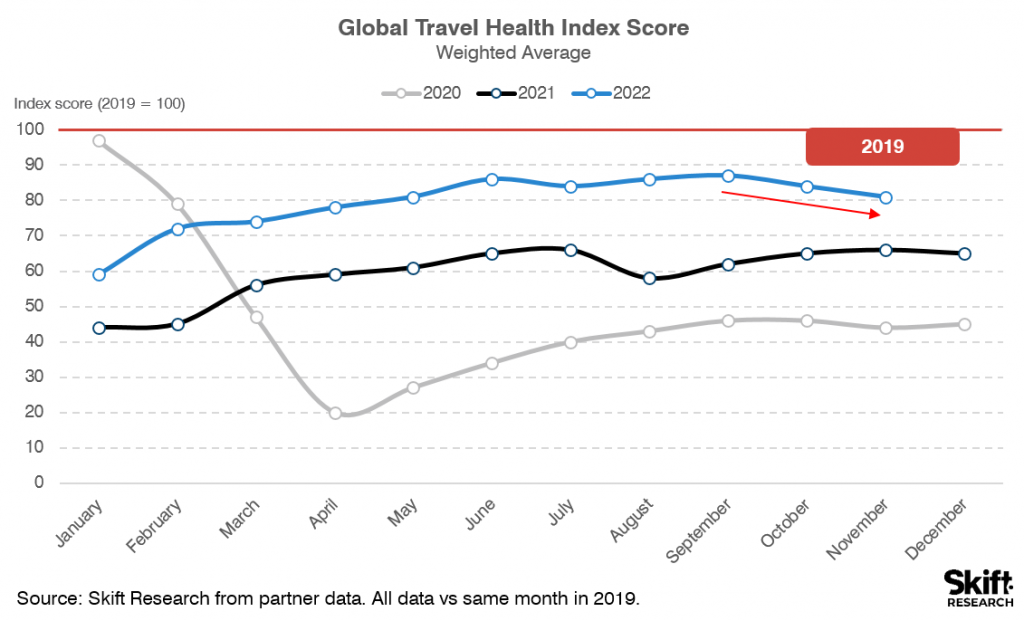

Travel’s performance dropped in November from 84 to 81 points, according to Skift Research's latest analysis in the Skift Travel Health Index: November 2022 Highlights report.

This means that travel’s performance is 19 percent below 2019 levels. This is now the second month in a row that we are seeing performance decline, amidst persistent high inflation, worries about a 2023 recession, and continued high prices for travel products.

Only two countries showed growth over the past month: Brazil and Thailand. Brazil’s incoming president Lula da Silva’s more outward-looking position might have boosted Brazil’s attractiveness.

Thailand is also seeing upside from a continued relaxing of its entry requirements. The country celebrated the arrival of its 10 millionth international visitor of 2022 early December. This is a quarter of the 40 million arrivals in 2019. Next year Thailand is expecting around 23 million tourists and possibly a full recovery in 2024. The return of tourists from Russia and across the Asia-Pacific region are expected to be drivers of growth next year. Thai officials said recovery in the tourism sector is still heavily dependent on China relaxing international travel rules as China was the biggest source of foreign tourists for Thailand in 2019.

| Country | July 2022 score | August 2022 score | MoM Growth (abs) | MoM Growth (%) | YoY Growth (%) |

|---|---|---|---|---|---|

| Brazil | 97.1 | 100.7 | 3.6 | 3.7% | 7% |

| Thailand | 75 | 76.6 | 1.6 | 2.1% | 139% |

| Spain | 95.7 | 95.6 | -0.1 | -0.1% | 30% |

| Mexico | 111.5 | 110.4 | -1.1 | -1.0% | 7% |

| South Africa | 81.1 | 79.8 | -1.3 | -1.6% | 40% |

| China | 55.7 | 54.2 | -1.5 | -2.7% | 6% |

| France | 95.6 | 92.8 | -2.8 | -2.9% | 16% |

| Singapore | 87.8 | 85.2 | -2.6 | -3.0% | 159% |

| Germany | 82.3 | 79.8 | -2.5 | -3.0% | 48% |

| United Kingdom | 98.5 | 95 | -3.5 | -3.6% | 38% |

| Russia | 55.2 | 53.1 | -2.1 | -3.8% | -29% |

| U.S. | 102.7 | 98.7 | -4.0 | -3.9% | 13% |

| Indonesia | 82.4 | 79 | -3.4 | -4.1% | 113% |

| India | 96.1 | 92.1 | -4.0 | -4.2% | 34% |

| Hong Kong, China | 60.6 | 57.9 | -2.7 | -4.5% | 87% |

| Japan | 80.2 | 75.8 | -4.4 | -5.5% | 120% |

| Italy | 97 | 90.8 | -6.2 | -6.4% | 34% |

| Canada | 97.5 | 90.6 | -6.9 | -7.1% | 23% |

| Turkey | 114.7 | 106.2 | -8.5 | -7.4% | 19% |

| United Arab Emirates | 106.4 | 98.3 | -8.1 | -7.6% | 15% |

| Australia | 96 | 88.6 | -7.4 | -7.7% | 65% |

| Argentina | 100.6 | 90.2 | -10.4 | -10.3% | 26% |

Long-Awaited Movement in China

But the big news coming out over the past month is the shift by the Chinese government to a more “dynamic” zero-Covid policy. Things are still moving slowly, although in light of the country’s track record over the past two years, things are evolving pretty rapidly.

On the back of protests, home quarantines have been relaxed, negative Covid test requirements have been lifted by some airports, and testing can now be conducted at a transfer point, something that wasn’t allowed up to now. As Alexander Glos, CEO of China i2i Group notes in an excellent overview on LinkedIn: “This opens the door to global carriers now being able to more effectively service China, including Cathay Pacific, Singapore Airlines, Emirates, Korean Air and many more.”

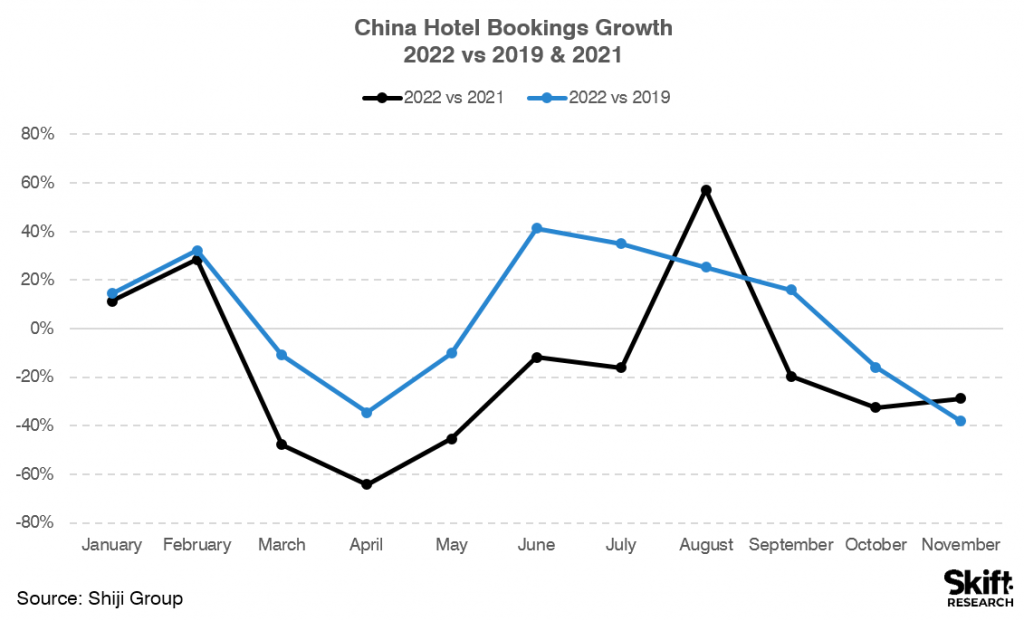

Trip.com data showed that searches for flights to China surged, especially from the U.S. The surge in interest was not seen yet in our data, and hotel bookings data from our data partner Shiji Group, for example, did not show any noticeable uptick just yet. However, December will likely see long-awaited improvements in the performance of the travel industry in China.

More analysis can be found in our November 2022 Highlights report and on our Skift Travel Health Index data dashboard.