Skift Take

By combining travel, expenses, and payments in one tool and implementing dynamic policies, companies can reap the positive benefits of business travel by managing costs in a challenging economic environment — and supporting happier, more compliant employees.

This sponsored content was created in collaboration with a Skift partner.

The corporate travel, expense, and payment landscape in Europe continues to evolve rapidly as employees return to the road in force. According to the 2022–23 Skift and TripActions State of Business Travel Survey, nearly 50 percent of business travelers in Europe said they would take at least six trips in the next 12 months.

Amid this bounceback, companies are reevaluating their travel, expense, and payment policies in the new post-pandemic reality. Remote and hybrid working scenarios have shifted paradigms, and global economic headwinds, including rising inflationary pressures, are also complicating policy planning by driving up the cost of airline tickets, hotel rooms, and gas prices.

There’s a growing need to keep up with volatility and unpredictability by offering traveler interfaces that are easier to use and back-end features that are easier to manage dynamically and report upon.

Supported by data from Skift and TripActions’ recent survey of more than 500 corporate travel and finance managers in EMEA — primarily located in France, Germany, and the UK — this article will explore how combining travel, expense, and payments in one tool and implementing dynamic policies can help companies reap positive benefits of business travel by managing costs in a challenging economic environment and supporting happier, more compliant employees.

Further reading on this topic and more research across global markets may be found in Skift and TripActions’ recent report, “The State of Corporate Travel and Expense 2023: New Priorities, New Opportunities”.

Changes to Travel Policies Upend the Status Quo

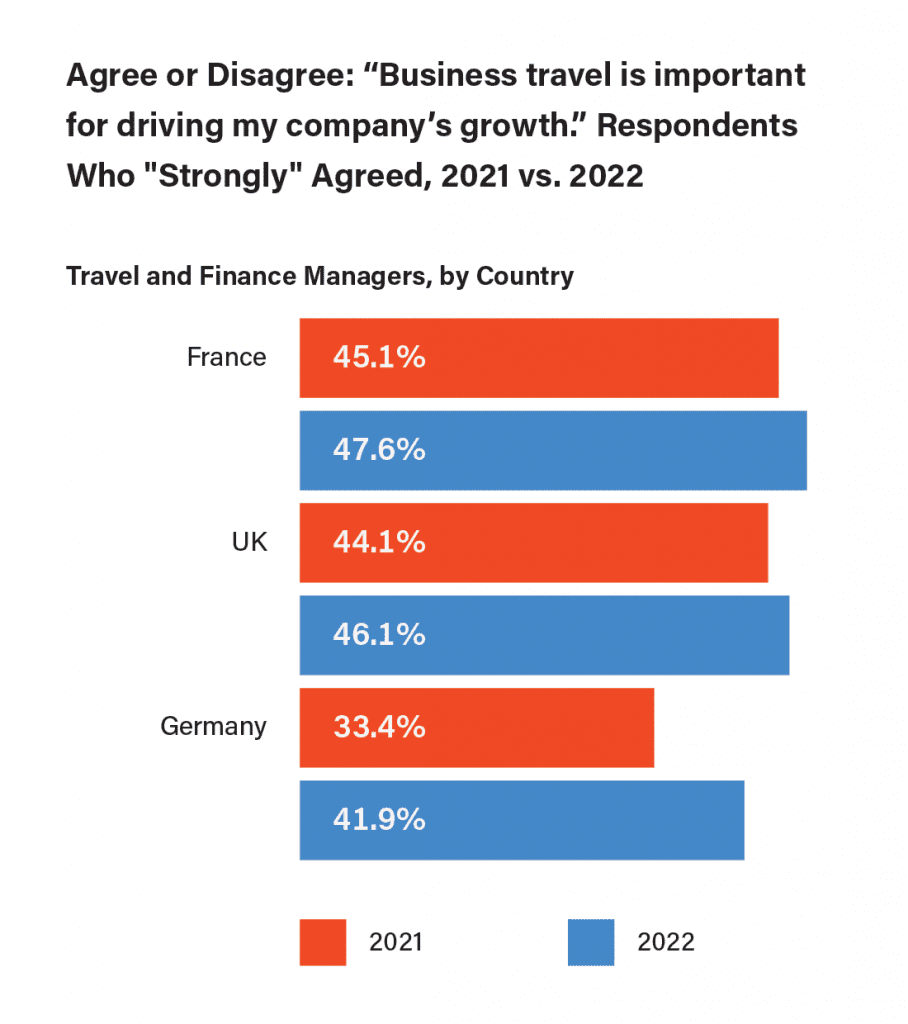

Across key markets in Europe, there’s been an uptick in companies recognizing the value of corporate travel since just last year.

According to Skift and TripActions data, nearly half of all travel and finance managers in France and the UK “strongly agreed” that business travel is important to their companies’ growth, with each country seeing about a two percentage-point gain in comparison to the 2021 survey. In Germany, while the sentiment was lower (about 42 percent), travel and finance managers affirmed this statement by more than eight percentage points over the previous year.

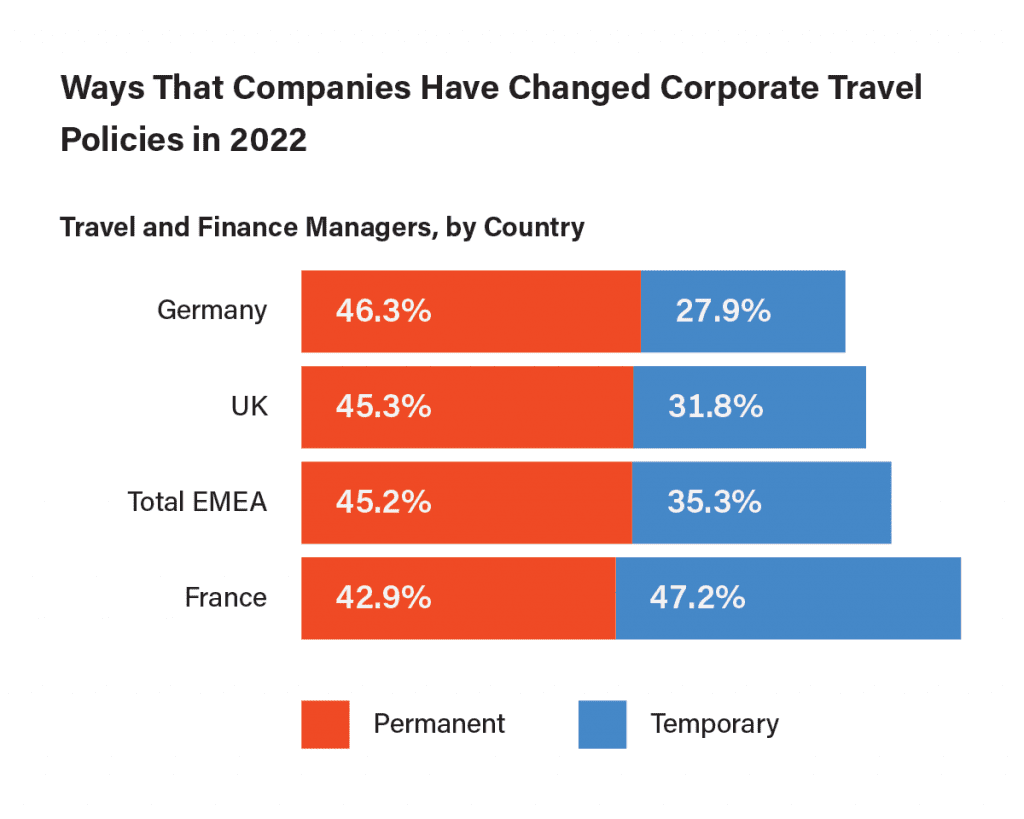

Business travel continues to increase as Covid-19 restrictions become less and less of an influence on travel policy. However, the legacy of the pandemic means that many corporate travel, expense, and payment rules have changed permanently. For example, about 45 percent of companies in Europe have made permanent changes to their travel policies in the last two years. In France, 47.2 percent of travel and finance managers have also made temporary changes, far more than any other market in the study.

“We’ve seen companies really move to prioritize employee well-being and sustainability, and that’s shown up in their travel policies,” said Michael Riegel, general manager, EMEA, TripActions. “One example is surfacing nonstop flights over ones with layovers — even when it would save the company money. It’s a better experience for the traveler, and it’s better for the environment.”

Such changes are meant to benefit travelers — for example, the survey found that in 2022, about 35 percent of European companies are allowing more travel expenses than in the past. But that doesn’t mean it’s easy to communicate what’s going on to employees. Illustrating this fact, nearly 60 percent of travel and finance managers in France said that their biggest concern as their employees travel for business in 2022 and 2023 is delivering good information about changes in travel procedures. Managers in Germany and the UK also selected this as their top concern.

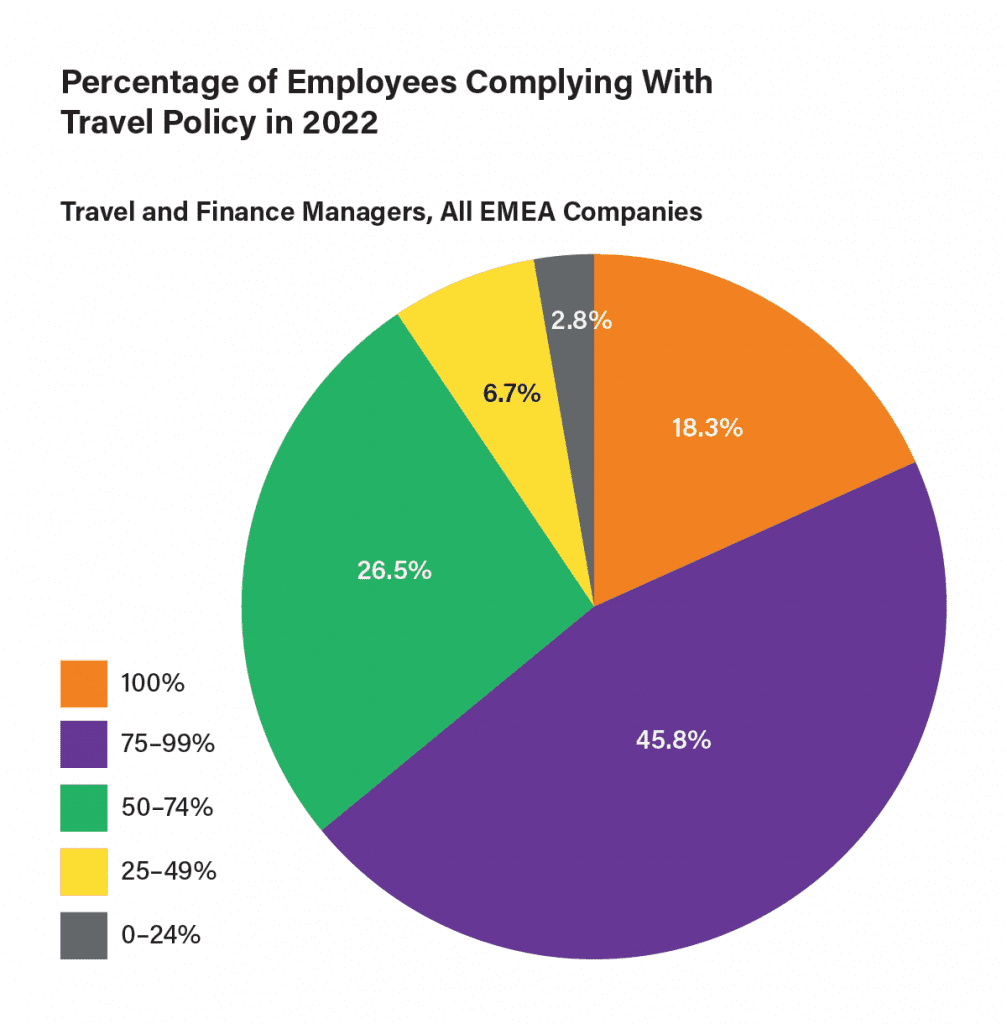

Moreover, more changes mean more opportunities for employee compliance issues. Only about 20 percent of travel and finance managers in Europe said that they had 100 percent policy compliance, and more than one-third said less than 75 percent of their employees were complying with travel policies in 2022. Across France, Germany, and the UK, reported compliance was down from 2021 to 2022.

“Companies have to ensure they’re communicating these policies — and these benefits — every way they can at the executive level as well as the manager level, through intranets and newsletters, texts, tweets, whatever it takes,” Riegel said. “People are busy; it’s easy for messages to get lost amid the mayhem of a business day.”

How All-in-One Solutions for Travel, Expense, and Payments Have Become a Necessity

The evolution of the corporate travel environment has created a groundswell of support for companies to reevaluate and overhaul the way that they manage travel policies, corporate cards, and expense solutions.

Today’s travel, expense, and payment landscape is unpredictable, given pressures from inflation leading to rising hotel prices and shifts in flight capacity driving up fares or canceling routes. Age-old problems still exist as well, such as dealing with higher-than-usual rates during an essential business trip to a city that’s hosting a major event at the same time.

Companies that want to be able to adjust based on market conditions need tools with dynamic policies. Traditionally, many corporate travel programs have had fixed, written documents that take a lot of manual effort to update. If they’re not dynamic, every request may require approval, or travel managers will have to sit on hold with agency customer service to make the slightest change to their programs. These scenarios can hinder productivity and increase out-of-compliance activities if they’re not rectified quickly enough.

“Dynamic policy is key to a successful travel and expense program; it’s the basis for controlling costs,” said Tim Russo, senior director, fintech partnerships and business development, TripActions. “A system that automatically sets benchmarks for fair prices in particular destinations for particular dates allows companies to decide what’s in and out of policy.”

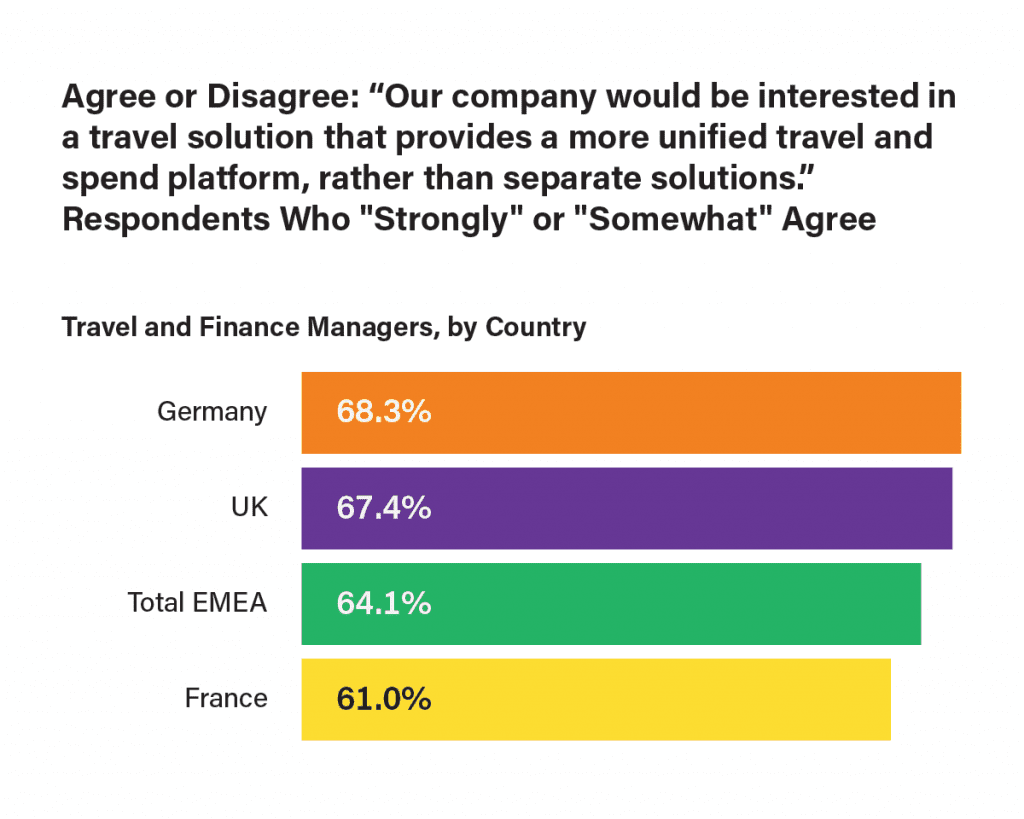

Another way companies are mitigating some of today’s policy challenges is by implementing technology solutions that combine travel planning, corporate card payments, and expense reporting. According to Skift and TripActions data, nearly two-thirds of managers in EMEA either “strongly” or “somewhat” agreed that they would be interested in a travel solution that unified all travel and expense functions, in contrast to individual tools for each — which is the way most companies operated in the past.

“For some [of our customers], their travel and expense systems have become more complicated than ever before,” said Riegel. “Many of these companies now realize that every new issue will require yet another tool or process layer. So when they hear that one tool can streamline the entire travel and expense process, improve traveler safety, save the company money, and make employees happier, they see that this is a proactive choice that can help set them up for the future.”

“The number one benefit of an all-in-one solution for me is reporting all in one place. I’m not having to morph reports with all of the data from travel and all of the data from expenses from here and here and here, which I had to do previously,” said Mindy Owen, travel and expense manager, ConnectWise. “My end users like having one system as well.”

For further reading on this topic and more research across global markets, please download Skift and TripActions’ recent report, “The State of Corporate Travel and Expense 2023: New Priorities, New Opportunities”.

This content was created collaboratively by TripActions and Skift’s branded content studio, SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: business travel, corporate travel, corporate travel management, europe, expense technology, travel and expense, travel research, tripactions