Assessing a Return of Chinese Outbound Travel: New Skift Travel Health Index

Skift Take

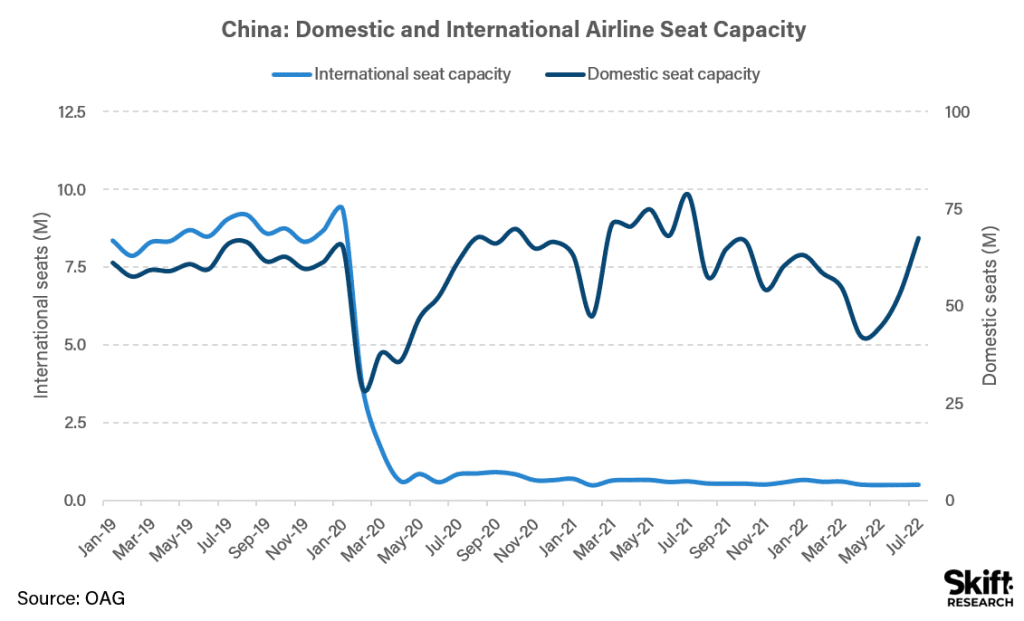

Recovery from the Covid-19 pandemic has been choppy in China. One of the first countries to see recovery in early 2020, according to our Skift Travel Health Index, the country has suffered under its government's zero-Covid policy ever since. International border closures and regional lockdowns have impacted inbound and domestic travel. Importantly, for its neighbouring countries, the complete lack of Chinese travelers has slowed recovery as well.

Seat capacity data from flight data provider OAG, showing the volume of available seats on scheduled flights, highlights the chasm between the country's domestic and international travel performance.

In our July 2022 Highlights report, which forms part of our Skift Travel Health Index data tool, we analyze the impact of the absence of Chinese travelers on the recovery of 21 countries that are covered in our Index.

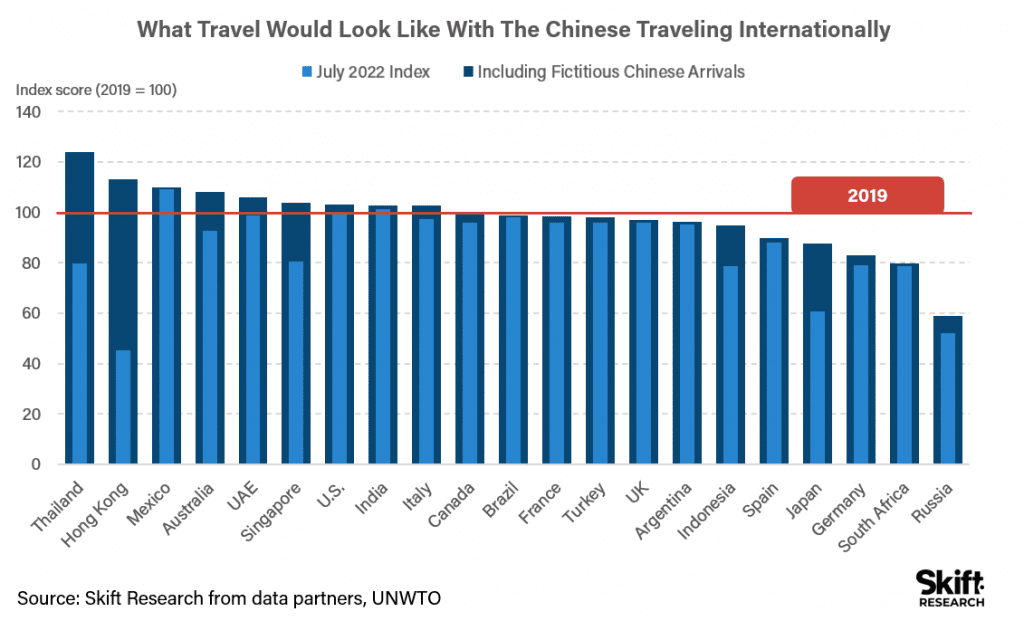

Due to its proximity, Hong Kong is the destination most reliant on Chinese travelers, followed by other Asian countries like Thailand, Japan, and Singapore, which all saw over 20% of their foreign arrivals stemming from China before the pandemic.

Chinese Outbound Travelers (2018) by Destination

| China Outbound ('000s) | China as % of total | |

|---|---|---|

| Hong Kong | 19,902 | 68.0% |

| Thailand | 16,874 | 44.2% |

| Japan | 8,380 | 26.9% |

| Singapore | 3,418 | 23.3% |

| Indonesia | 2,139 | 16.0% |

| Australia | 1,432 | 15.5% |

| UAE | 1,481 | 7.3% |

| Russia | 1,690 | 6.9% |

| Italy | 3,201 | 5.2% |

| Germany | 1,592 | 4.1% |

| U.S. | 2,992 | 3.8% |

| Canada | 737 | 3.5% |

| France | 2,176 | 2.4% |

| Turkey | 1,028 | 2.2% |

| Spain | 1,452 | 1.8% |

| India | 282 | 1.6% |

| Argentina | 72 | 1.0% |

| UK | 391 | 1.0% |

| South Africa | 100 | 1.0% |

| Brazil | 56 | 0.9% |

| Mexico | 168 | 0.4% |

Source: UNWTO

While our Skift Travel Health Index provides a holistic insight into the health of the travel industry in each country, and this is not directly comparable with simple arrival numbers as provided above, collating the two datasets does provide an interesting insight into the impact Chinese travelers would have on global recovery.

Taking the Index score for each country, and adding the share of Chinese travelers to each destination, highlights how a full return of Chinese travelers could pull Thailand, Hong Kong, Australia and Singapore back to pre-pandemic travel performance.

While very much a ‘back of the envelope’ exercise, it clarifies why Asian destinations in particular are not back to pre-pandemic levels of performance yet, and what the impact of an opening of Chinese borders could have for those destinations.

More analysis can be found in our July 2022 Highlights report and on our Skift Travel Health Index data dashboard.