Skift Take

Travel startup Hopper has raised $175 million in additional investment, underscoring the potential of its financial services products and offering an interesting case study in new appetites in travel for fintech. It seems very much in the cards that the company will go public by, say, 2022.

Rather than crushing it, the pandemic helped travel startup Hopper speed up its metamorphosis from a mobile app that tracked changes in flight prices to an online travel company making a majority of its money from selling ancillary services such as price protection and trip protection.

“It’s weird it took a pandemic to realize this, given that we first debuted the financial service products in 2018,” said founder and CEO Frederic Lalonde. “But the crisis made it much clearer that the financial services increased the customer spend while also being higher margin than the travel products themselves.”

Hopper said on Tuesday it had closed a $175 million investment, led by GPI Capital, a private equity firm.

Glade Brook Capital, WestCap, Goldman Sachs Growth, and Accomplice also participated in this round, which was all equity.

Hopper’s Fintech for Travel

As Skift has reported, Hopper’s “fintech” offerings now represent “a majority” of its revenue, which a spokesperson’s email specified as “50 percent” of its revenue. Its solutions have been boosting the total transaction size by $40, on average, and generating an average 55 percent greater margin than travel sales, it said.

Hopper has dubbed its products “fintech” after the trend in companies offering financial services that use technology but skip the traditional bank structure.

“Hopper has created a large market opportunity with unique fintech products for the travel industry that applies an entirely differentiated and attractive business model,” said Khai Ha, managing partner at GPI Capital.

One product is “cancel for any reason” protection, which lets a traveler bail on a flight up to 24 hours before departure and get back most of the ticket price. The other policy is a “price freeze” product that enables a traveler to hold a price for up to two weeks before booking.

The products rhyme with the parallel rise of “insurtech.” These companies aren’t traditional insurers but they help to create insurance-like policies by collecting data creatively and by crunching numbers using new techniques. Hopper has begun selling some of its technology for creating fintech products through third-parties. In a parallel move, Hopper offers “white-label travel portals for companies that aspire to sell travel with a differentiated consumer experience and offering.”

“If all travel distribution channels offered our fintech, it could increase the total consumer spend for the sector by $200 billion annually,” Lalonde said, referring to Hopper Cloud.

Earlier this year, Hopper announced that it is working with the U.S. bank Capital One to power Capital One Travel, a travel booking “experience” designed for the bank’s cardholders that will appear later this year.

Since its launch in 2007, Montreal-based Hopper has raised $584.6 million, including this latest round. Only about a dozen other travel startups worldwide, such as Airbnb, Oyo, Deem, and GetYourGuide have ever raised as much.

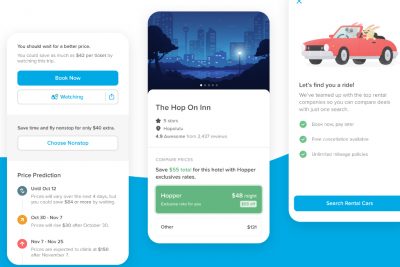

The travel booking flow on the Hopper app. Source: Hopper.

A Hopper IPO May Be the Next Stop

Hopper called the latest round a “Series G” round — a term that typically means a company’s next step will be to go public or get acquired.

“Right now there are no plans at the moment for a traditional IPO or going public via a SPAC [a special purpose acquisition company],” Lalonde said. “The company is focused on iterating our fintech capabilities in the Hopper app and building out the Hopper Cloud line of business. Hopper is funneling all profits back into marketing spend to accelerate growth.”

While Hopper may not have plans to go public right now, the lead investor for its latest round, GPI Capital, has seen many companies it has invested in since 2016 go public.

Among GPI’s recent investments include Social Finance, a provider of consumer debt such as student loans, which went public in June. GPI also invested in Zeta, a cloud marketing software vendor, which had its initial public offering in June.

GPI Capital is also an investor in Grab Holdings, a superapp in Southeast Asia that aims to go public via a SPAC in a $39.6 billion arrangement led by Altimeter Growth and other investors.

Hopper Plans Small Acquisitions

The company did an acqui-hire earlier this year that has not previously been disclosed, namely, of being Paris mobile travel deals app Mowgli, for an unsaid value. Hopper has since 2019 also obtained the intellectual property of small companies such as Journy, OptionsAway, Gravy.AI, and GDX Travel.

“The company is actively looking to acqui-hire other teams in travel, data science, or engineering-heavy startups to introduce new product offerings and fuel international expansion,” a spokesperson said.

It also said it had begun hiring 500 more employees, with about 300 of those focusing on customer service.

In other news, earlier this month Lalonde became an independent director of Ixigo, an online travel company based in India that filed papers with regulators last week about its plans to go public.

OTA Plus Meta

The company described itself as a “mobile-only” marketplace and an online travel agency. But for a couple of years, it has also offered hotel price-comparison search, or metasearch, on the desktop version of its U.S. site as well as its mobile app. In short, its user interface often blends the online travel agency model with a touch of the metasearch model.

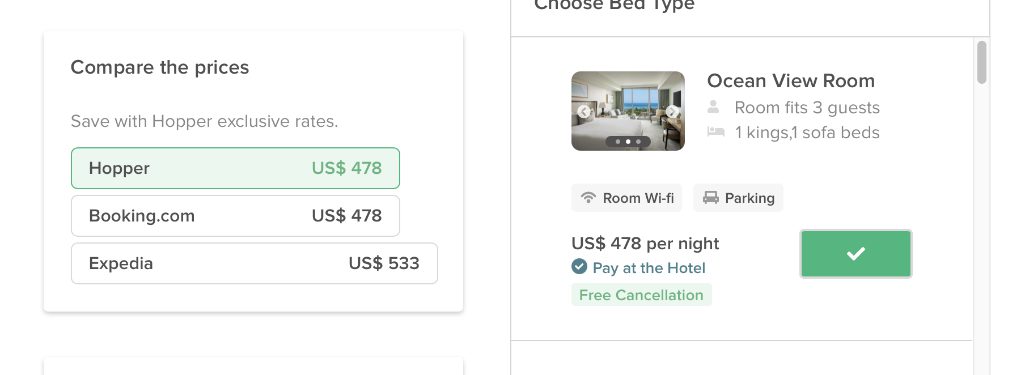

On its desktop site, the brand frequently advertises “Hopper exclusive rates.” In several sample searches, it compared the “Hopper exclusive rate” against price quotes from online travel agencies such as Expedia and Booking.com without providing links to see those quotes on those sites. Hopper generally handles the transaction and customer service on behalf of the property at a typically reduced commission rate to the major giants.

A screenshot from a recent search on Hopper’s desktop app for The Ritz-Carlton Residences, Waikiki Beach, for dates in October 2021.

Repeating the searches on the startup’s mobile app, we found similar “Hopper exclusive rates” but the online travel agency also provided links out to the other online travel agencies in a metasearch style.

Hopper cofounders Frederic Lalonde, left, and Joost Ouwerkerk. The online travel startup said it had closed a $175 million Series G round of equity financing, led by GPI Capital a private equity firm. Source hopper

All that said, flight sales remain the biggest revenue generator for Hopper. The company forecasted it would surpass $1.5 billion in gross sales this year, with 60 percent of the travel sales coming from selling plane tickets and related products and services.

Its signature interface is a mobile-only experience that includes the option to track flight price changes and buy various protections, such as to instantly rebook if a consumer misses their flight, as a new promotional video explained. The company claimed it now has a larger air travel market share in North America than it did before the pandemic.

“Hopper has five times its valuation from early 2020,” a spokesperson said on Tuesday. Its current valuation is above $1 billion.

The startup said it had “already surpassed its pre-pandemic revenue peak from the first quarter of 2020,” with “triple-digit revenue growth” of “more than 100 percent” from that peak. Skift Pro subscribers seeking context on Hopper’s rise can read Dennis Schaal’s recent analysis of the company.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: fintech, funding, fundings, hopper, investments, online travel agencies, private equity, startups, venture capital

Photo credit: A user of Hopper's travel booking app. The online travel startup said it had closed a $175 million Series G round of equity financing, led by GPI Capital a private equity firm. Hopper