Skift Take

Luxury all-inclusive resorts may be optimistic about the future post-pandemic, but profits will come alongside heightened green challenges. Then there's an increasingly demanding, socially conscious consumer. Can the resorts return to their former stature as the fast-growing sector of accommodations?

Two months ago, Dominican-American couple Raquel and Junior Liriano drove eight hours from Puerto Plata to Bávaro, Punta Cana, for a weeklong, all-inclusive resort staycation in the Dominican Republic.

“It’s a special place for us, we first met up here,” said Liriano, referring to one of the longest-running resorts in the area.

On arrival, the couple learned the adults-only section was closed, and their reservation had shifted to the family side. “We are reduced to one hotel with almost no restaurants,” Liriano said, noting the low staff morale.

What they encountered next was an even bigger shock. “[T]he tourists do not even wear masks, it’s like they are from a different world.”

Before Covid hit, all-inclusive resorts were the fastest-growing market in the accommodation sector, with increasing demand and offering high return on investment. When Marriott International finally entered the segment in 2019, purchasing a chain of seven luxury resorts in Barbados after years of steering clear from the model, it was the nod that confirmed this segment’s reinvented image and bright future. On Tuesday, the company announced further expansion by signing an agreement with PGA Hotel Management Group to introduce the first Westin all-inclusive resort to South America.

When Covid hit in 2020, all-inclusive resorts, much like cruise lines, suffered a major blow that forced them to reinvent the way they run and market their properties to a changed consumer. Images of crowds sipping piña coladas by the swim-up bar, and beaches lined with bodies on loungers suddenly evoked fear rather than a blissful escape from reality.

Unlike megaships stuck at sea, however, resorts sit on spacious land, allowing them to restart their operations as early as summer 2020, albeit at limited capacity, as destinations in the Caribbean, Mexico, and parts of Europe welcomed visitors back. Demand has slowly trickled back since, ebbing and flowing according to Covid’s progress in source markets.

“This segment is well-positioned to take advantage of the tourism recovery because of the guest profile it attracts, and the ability to impart confidence in the traveler that they’re going to be experiencing a safe vacation,” said Rogerio Basso, head of tourism at IDB Invest, the private sector arm of the Inter-American Development Bank, noting that all-inclusive resorts are masters of crowd control and predictability.

The allure of premium services within a monitored but wide-open space is strong for the post-Covid consumer and that’s what resorts are banking on, along with the pent-up demand for travel on the other side of vaccines. As a result, the sector’s most prominent brands are continuing to close an unprecedented number of acquisitions and new constructions.

But this seemingly bright path for upscale all-inclusive resorts bears cautionary signs, as the post-pandemic traveler is likely to demand that this sector of the tourism industry do better — in safety and value, but also in the balance of people, planet and profits.

The Lirianos’ experience augurs trouble for those brands forced to cut costs and remove privacy perks. Boutique-sized upscale resorts with streamlined models — contactless check ins, outdoor concierge huts, pop up dining options, and private swim out pool options, among other benefits — and fewer crowds are more likely to lure consumers back.

“The trend of the travel industry for the last 20 years has been all-inclusive for leisure because of the convenience.” said Javier Coll, group president of global business development at Apple Leisure Group. “As the hotels got better it’s so convenient that it’s not about price anymore. It’s one of the most relaxing vacations that you can take and most of the people understand that; all-inclusive is not going anywhere.”

But how much has Covid transformed the all-inclusive resort model beyond technology, safety and increased demand for premium suites? Will all-inclusive brands be forced into a greater degree of environmental and social sustainability? Will pushing a luxury product also translate into more benefits for small and medium-sized businesses in the local economy? Will they hold up against the heightened social awareness and scrutiny of the post-Covid conscious consumer?

A Dizzying Ascent Pre-Pandemic

The first half of 2019 saw approximately 1,500 resorts earn $7.9 billion in sales or a 20 percent growth in revenue over five years, confirming an impressive growth path, according to hotel data firm STR.

With its year-round temperate climate and favorable coastlines, the Caribbean and Mexico, in particular, have remained the sector’s favorite bets. According to Marriott International data, at a global level there are approximately 867 branded all-inclusive resorts or 325,000 rooms.

A whopping 56 percent of them are concentrated in the Caribbean and Latin America region, or approximately 432 branded all-inclusive hotels and 182,000 rooms. The “upper and upscale” segment represents approximately 33 percent of this total room supply.

At the close of 2019, a 16.4 percent growth in hotel supply in the Caribbean kept rates and revenue per available room high in spite of a slight dip in occupancy. Visitor arrivals had also risen by 6.1 percent, according to the Caribbean Tourism Organization, a major feat after a series of devastating hurricanes in 2017, amid other challenges.

The rags to riches evolution of the “all in one” hospitality model from its humble origins as a beachside “happiness camp” in the Balearics in the 1950s created by French brand Club Med, has been well documented.

As brand segmentation took hold — Jamaica-based Sandals Resorts is credited for introducing the concept, creating five brands that targeted specific customer groups at varying price points — resorts proliferated and more brands entered the market.

Among the most disruptive of these is AMResorts, a hotel management company with over 60 properties falling under six resort brands that have become household names in the Caribbean, Mexico and South America: Secrets, Dreams, Sunscape, Zoetry, Breathless, and Now.

Starting out as a tour operator 50 years ago allowed the company to build up the largest U.S. customer base to the Caribbean and Mexico, to the tune of four million passengers by 2019. The combination of being asset light and having direct access to consumers has been hugely beneficial during downturns. “When you analyze the value chain of this business, you realize that the hotels are the ones making most of the money,” Coll said, noting why the brand decided to create a hotel management company.

With soaring revenue numbers as well as increasing customer demand for luxury combined with the all-in-one convenience, global hotel brands entered the market and have continued their push into the all-inclusive sector.

“What you’ve seen since the old days of Club Med is a diversification, sort of like cruise ships,” said Martha Honey, CEO of Responsible Travel Consulting and director emeritus for the Center for Responsible Travel. “You now have a range so that tourists can choose. But the model is still the same: keep the spending within the gates of the resort. So they build more amenities like cruise ships.”

Marriott entered the all-inclusive resort space in 2019 with the purchase of Elegant Hotels.

Marriott International’s initial all-inclusive resort investments in Barbados remain on track. “This is our toe dip with Elegant, in shallow waters, and we want not a toe [but] a big footprint in this space,” Brian King, president of Caribbean & Latin America for Marriott International, told Skift.

Last month, Marriott International made its “big footprint” a reality, adding 19 all-inclusive resorts from the Blue Diamond chain in the Caribbean and Central America to its Autograph Collection.

“The level of product quality, fit and finish, and guest services squarely sit in Marriott’s view of premium and luxury offerings,” King said. “We think it is the perfect marriage!”

By the start of 2020 and just before Covid hit, according to STR, an astounding 152 hotel projects were under way in the Caribbean and Mexico regions or 31,787 rooms in construction — “a 26.9 percent year-over-year jump in the number of rooms in the final phase of the development pipeline,” the majority of which fell in what STR described as luxury, upscale and upper upscale categories.

Bullish and Undeterred Post-Covid

In spite of a difficult 2020 for most and an unpredictable 2021, the sector’s major players remain bullish on the all-inclusive model long term.

“[W]hile the pandemic has shifted the timeline for our expansion plans, we’re still moving full speed ahead and are continuing to grow and adapt to each market,” said Carolyne Doyon, president and CEO of Club Med North America, confirming the near future opening of two resorts in the Seychelles and in Canada.

Sandals Resorts is expanding with four newly purchased properties; one in Curaçao — the brand’s first location on a non-English-speaking island — one in Saint Vincent and the Grenadines, plus two more that Sandals Resorts Executive Chairman Adam Stewart said would be announced in the near future. The brand has also expanded two of its current properties since Covid, in Jamaica and in Barbados.

“We will continue specializing in our Caribbean sandbox,” Stewart told Skift in his first interview since taking over the company’s lead from his recently departed father, Sandals founder Gordon “Butch” Stewart. “We have specialized in taking good assets that failed and making them great assets.”

AMResorts closed 2020 with 59 new resort deals across Mexico, the Caribbean, and Europe — 22 new builds and 37 conversions — including its first venture outside of Spain with three resorts on the Greek islands.

“The controlled environment that the all-inclusive provides is in our advantage,” Coll said. “Most of the customers they reduce out of the hotel activities because they don’t know how safe that is yet. But besides that, they feel more comfortable in a controlled environment.”

Karisma Hotels and Resorts is moving forward with completion of Margaritaville Island Reserve and Nickelodeon resorts in the Caribbean region. “[T]o open up four hotels in what is a recovery year is bullish,” Marilyn Cairo, vice president of global sales, said, noting that the brand has demand from its travel agent market and saw the adult client base returning sooner than families.

“We’re very positive we see the demand out there [ ] especially as the vaccines start permeating a larger percentage of the country, of the world,” said Kathy Halpern, vice president of global marketing for Palace Resorts.

Karisma Hotels & Resorts will open four hotels in 2021, including Nickelodeon Riviera Maya.

AMResorts started seeing an increase in bookings about two months ago. Its two longest established brands were the first to bounce back: the luxury family-oriented Dreams and the adults-only Secrets, a sign that customer trust in branding has become more critical in imparting a sense of safety.

“We are over the breaking point in most of the hotels that we have open, so they are making some money, and if you combine that with restructuring finance from the bank, most of our owners will be in good shape until this thing is gone,” Apple Leisure’s Coll said.

The first quarter of 2021 remains soft, an anomaly for this time of year in the Caribbean and Mexico, albeit expected. But the nature of last-minute bookings means the scenario could change at any time.

“We’re literally getting people booking within a week of arrival,” Cairo said. For Karisma’s resort in Montenegro, the return will be slower given that the European traveler remains restricted in comparison to its U.S. counterparts. “It’ll get better; I can definitely say that the second half of 2021 is looking really good, knock on wood it stays like that and the [Centers for Disease Control] doesn’t get too crazy.”

Club Med had a head start in crafting and implementing enhanced safety protocols thanks to its all-inclusive resorts in China, where operations began resuming as early as April 2020, and in the U.S., both of which have solid regional markets.

“Even at reduced capacity, we are faring well in terms of occupancy across our resorts,” Doyon said. “[W]hile we have always seen a large number of family bookings, we anticipate seeing a substantial increase moving forward. We have already noticed an uptick in family bookings for the 2021–2022 holiday season, with a 17 percent increase compared to the 2019 holiday season.”

Marriott International’s “big foot” entry constitutes a rapid expansion of its all-inclusive portfolio in the Caribbean amid the pandemic pause, from a first all-inclusive Ritz Carlton in the Dominican Republic pre-Covid to a slew of new builds with 2022-2024 anticipated openings, including a 650-room Autograph Collection resort in the Dominican Republic, an 800-room Al Amaterra resort in Jamaica, a 283-room Autograph Collection in Curacao, a 675-room W hotels resort in Cancun, and a 300-room Delta Hotels resort in Riviera Nayarit.

“What really is the game changer in this space, as we get into it, is Marriott Bonvoy,” King said, referencing the brand’s 145 million loyalty program subscribers. “That you can use your points to book that all-inclusive experience — there’s huge demand for that.”

A Tech-Driven Model, But Not Error-Free

Download the resort app, get a check in QR code, and head straight to your room when you reach the resort — that’s just one of various long-term innovations that luxury all-inclusive resorts are implementing to lure in travelers with a sense of safety and a “touchless” vacation. Resorts that had either begun pre-Covid to transition into a digitized service or ran behind on technology made a giant leap in a matter of weeks to remain competitive and impart a message of safety.

“[I]n my resorts, people are trying to get to the beach and to our luxury amenities and their suites, as fast as possible,” Sandals’ Stewart said, noting that the key focus for Sandals’ business model moving forward is innovating in design and increasing customer value.

The chain is banking on its low density resorts and new privacy options. “We have hotels that are on hundreds of acres of lands that have, you know, a couple 100 rooms.”

Its newly acquired 50 acres in Curacao fits that vision, part of a 300-acre estate with an 18-hole championship golf course and two marinas, as does the 50-acres on Saint Vincent for a 350-bedroom Beaches Resort. As consumers demand convenience matched with premium suites away from crowds, resorts are pulling the stops with exclusivity in room designs.

Stewart noted that some tech upgrades had to be quickly implemented, such as moving resorts’ menus to apps within 30 days.

AMResorts’ properties had already moved menus to apps and use QR codes and tablets in rooms. “That was a way to save money and [be] more eco-friendly, but it works for Covid too,” Coll said. Additions included sanitizer stations around the property and a touchless checkout process. “[These things] are certainly increasing the costs a little bit but not much; it’s an initial investment in technology but overall, over time, actually we’re saving money.”

Self-serve buffets are a thing of the past, whereas some properties such as Karisma have included more signage on property to reflect social distancing, as well as pop up outdoor concierge stations and on demand housekeeping.

“[W]e are cleaning our air conditioning systems after every visit at Sandals Resorts which is unprecedented,” Sandals’ Stewart said. ”We have wardens to ensure that social distancing is being coordinated; you have more staffing because we have more transportation and more moving parts to keep the social distancing [.]”

While brands said that customers won’t experience a major change in their vacations on the front end since most guests spend their time outdoors, it’s unlikely travelers won’t notice the reduced activity teams and lack of on site big group entertainment due to ongoing government-imposed Covid restrictions.

Some luxury all-inclusive resorts in the Caribbean have been fined by governments for disregarding bans on resort parties, or for failing to control groups of staycationing locals that ignored safety protocols. Others have experienced Covid breakouts at the resort. Despite all the reassurances in marketing messaging then, it’s clear that resorts cannot guarantee being Covid risk free until vaccination has reached global levels.

For now, resorts are focused on travelers’ pent up desires to escape and relax in paradisiacal scenery. “I mean if you walked into one of our hotels right now, people are so happy and so appreciative to be there,” Stewart said.

Consumer Demand Shifts Towards Backyard, Boutique-Sized Resorts

Travelers are choosing to stick to regions close to home in the interim, which could last past 2021. “We have noticed larger numbers of travelers in drive-market regions booking stays at our [Club Med] Sandpiper Bay resort in Florida, and we do expect this trend in domestic travel to continue,” Doyon said.

Bookings for the resort have doubled between January 2021 and 2019, which also consisted of many new customers to the brand, from family reunions, socially distanced weddings, and some meetings and incentives groups.

Doyon said there was also a shift in long weekend bookings. “Since reopening Sandpiper Bay in June, we saw a 9 percent increase in ‘short week’ bookings, or 4-to-5-night stays, that were made during the week,” Doyon said. “We anticipate this trend will continue as travelers will want to extend their getaways and combine it with working remotely.”

In the Caribbean, boutique-sized all-inclusive resorts boasting private swim-out pools and over-the-water cabanas, as well as with rapid beach access, are receiving more demand. “We’re starting to see a trend in clients asking for higher categories, because they realize higher categories mean more privacy,” Cairo said.

Booking windows have become shorter, making it difficult for resorts to project 2021. “What everybody’s concern is the short-term news,” Apple Leisure’s Coll said. “If they see nothing happens, no restrictions, they start booking. So we get an avalanche of new bookings, 15 days, 30 days prior to departure.”

Moreover, some resorts are reporting clients booking directly with the brand. “The brand yields trust,” Stewart said, noting Sandals’ 85 percent brand recognition in North America. “[T]hat’s proven very well for us overall, so we are going to continue to grow.”

A major shift luxury brand resorts have also benefitted from thus far is the fact that cruises aren’t sailing yet. “We’re seeing an increase in bookings from new guests,” Doyon said. “In 2021, 66 percent of bookings are from first-time Club Med guests. Many of them are historically cruisers who have had their plans canceled and were looking for an alternative getaway.”

Is the Future All-Inclusive Resort a Sustainable Model?

With a rise in conscious travelers on the other side of Covid, and resorts expanding further up the luxury scale to profit from a post-Covid surge, it’s likely scrutiny will intensify over the all-inclusive model’s sustainability commitments.

The insular nature of all-inclusive resorts and their disconnect from their often humble community surroundings — what Taleb Rifai, former secretary general of the United Nations World Tourism Organization, once slammed as “modern day plantations” – has been criticized and debated heavily within the tourism sector for as long as the model has been in existence. Economic leakage, for one, continues with respect to the majority of resorts in the Caribbean and Mexico, which are owned by multinationals.

It’s true that since the 1980s most international resort brands have come a long way in adopting and incorporating some form of sustainable management program for their properties, from environmental initiatives that reduce the use of plastic pre-Covid, to offering cultural activities outside of the resort, as a result of customer demand.

But experts note that it’s a mixed bag as to how much of the greening is part of a company’s ethos as opposed to a cost-saving measure.

“What we’ve seen is a trend that is really quite widespread for the chain resorts to adopt some kind of eco certification programs,” Responsible Travel’s Honey said, noting that her last research indicated there were 16 different international certification programs used by hotels and all-inclusive resorts in the Caribbean.

Certifications can be devised by the resort chain itself, but the more rigorous types are third party certifications by groups such as Bureau Veritas and EarthCheck. “Sandals for instance is one of the chains, corporate wide they use EarthCheck so that’s really good,” Honey said. “What you find is that some of the most sustainable hotels are the independent hotels.”

Third-party certified resorts publish annual or biannual sustainability reports on their websites with extensive data on their footprint and approach towards balancing people, planet and profits by geographical region.

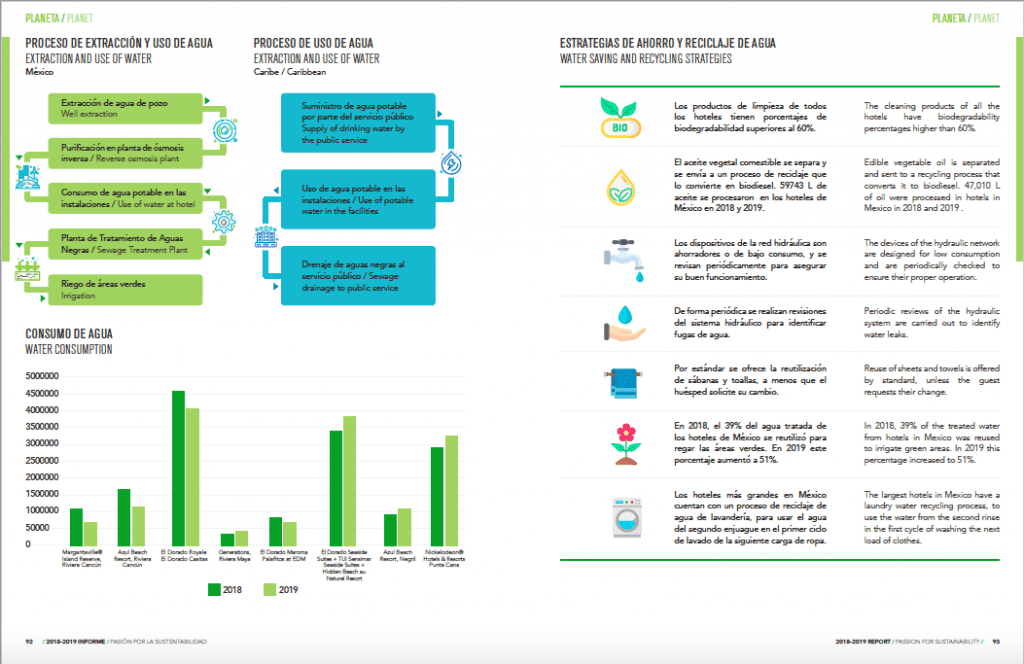

Click to Expand the Chart

Most of the larger luxury resorts, however, tend to focus primarily on energy and waste saving measures, including recycling water, solar panels, low flow toilet taps, and using wastewater in the gardens. “While commendable, those are also primarily based on cost saving,” Honey said. “[T]hey calculate over five years they’ll get back their money if they invest in a new kind of air-conditioning or taps on the faucets and so on.”

What isn’t so easy to green and showcase? Social sustainability: sourcing food locally versus importing, hiring locally rather than importing foreign hotel executives, and paying fair wages, among chief indicators.

Indeed, governments tout resort investments as marks of success because they create thousands of jobs and therefore as an indicator of economic growth, particularly in the Caribbean, the most tourism dependent region in the world. Honey disagreed with this rationale.

“[T]he Dominican Republic has seen the spending go from $300-something per guest night in the 1980s to just $100-something now and the way they’ve kept it up is by building more and more hotels and having more and more tourists coming,” Honey said, noting that this was a short-sighted approach given the carbon footprint and supplies needed for each guest.

Apple Leisure’s Coll said the investment impact of resorts on local communities is evident, comparing them to cruise lines which don’t even use their own money to build the docking facilities. “We’re talking about massive growth because now you have a lot of people employed, getting salaries and spending money,” he said. “In every island where the all-inclusive was restricted, there’s no growth. How can anyone say that the all-inclusive is not contributing to the local economies? This is politics.”

Housekeeping employee disinfecting rooms post-Covid at Sandals Resorts.

According to Honey, the job argument has some validity but it doesn’t paint a full or accurate picture. “You need to look at those jobs — are they paying a living wage, a good wage? How much turnover do they have? How much of the higher paying jobs, the administrative jobs, are held by locals? And how much of the money is spent by the tourist within the resort and how much is spent outside of the community?”

IDB Invest’s tourism lead Basso agreed that more questions needed to be asked of developers, for social sustainability purposes. “In Latin America, about 54 percent of women participate in the tourism sector,” Basso said. “In the Caribbean, it’s about 59 percent,” with the majority of the women employed as front desk agents or housekeepers, while very few have supervisory or managerial roles.

Basso works with the private sector in Latin America and the Caribbean to offer financial solutions and advisory services in transactions determined to have a high developmental impact — not just generating jobs but with a trickle-down effect into the economy, advancing a market and makes it more sophisticated.

“When we’re talking to our developer clients, we’re saying what is it that you’re doing to provide training support guidance to elevate the role of women so that they are not restricted only to this junior staff, where there’s a glass ceiling that they cannot surpass?” Basso said, noting that the same goes for youth employment.

Sandals’ Stewart, who chairs Jamaica’s Tourism Linkages Council, which aims to strengthen the tourism industry’s connection to other sectors of the economy, agreed that the job creation claim was insufficient and that brands must do better, adding that tourism might be more respected and appreciated if indirect employment received more attention.

“It’s the fact that [a] hotel creates an economic catalyst that connects to what we call linkages: the way people get to the resort which is independently owned taxis, the entertainment in the hotels should be primarily local, the food and provisioning as opposed to importing,” Stewart said. “[W]e need to view life beyond direct employment and we need to look at indirect employment.”

The Future Conscious All-Inclusive Customer

Raquel and Junior Liriano are among the growing number of discerning all-inclusive resort customers.

In a post-pandemic climate, consumers are likely to care more about the environment and about brands’ social and cultural sensitivity, aside from safety and hygiene concerns — particularly as competition and choice among resorts increase and as major brand names grow their presence in the segment.

“We saw Dominicans with decision-making positions,” Liriano said about her family’s subsequent and improved staycation at Hilton La Romana, in the Dominican Republic. “Like manager of concierge services, manager of customer relations, manager of wedding services; they are identified by their uniform so they were easy to spot and made things happen for us.”

Like Liriano, travelers of color as well as travelers with disabilities are likely to reward brands that not only market to them directly, but also those that place locals in managerial and leadership positions. Consumer loyalty will lean towards the resort and the destination that embrace inclusivity and multicultural messaging online and on site. Thus far, multinational-owned, all-inclusive resort brands as well as destinations have done a poor job of the latter.

“When I worked with St Lucia, every time we had some new campaign, I was the one that was like, can we put some color in there?” Kelly Fontenelle, a veteran tourism marketing professional and founder of Travel Advisors Selling the Caribbean (TASC), said. “Because I am a consumer too, I travel, so I need representation. If I open a brochure, and I see nobody looking like me, I don’t want to go to those places.”

Fontenelle also pointed to the lack of local culture on site at all-inclusive resorts, particularly when it comes to the food.

Kelly Fontenelle, founder of Travel Advisors Selling the Caribbean

During Covid, Fontenelle’s TASC Facebook group quickly became the primary source for transparent updates on all-inclusive resort closings, reopenings and destination protocols in the Caribbean and Mexico amid lagging resort or tourism office communications. The group has stretched to over 7,000 members thus far, made up of travel advisors, destination marketing offices and media.

“There was that void that was there, but no one realized it was there,” Fontenelle said, noting that her new role isn’t competing with tourist boards.

TASC provides cultural webinars as well as destination spotlights in an attempt encourage travel advisors to deepen their knowledge of the Caribbean and Mexico beyond the all-inclusive resort and help them connect with the local culture so as to sell more authentically to consumers. In January, Fontenelle launched a $19.99 per month subscription service for pro TASC marketing content.

Post-Covid, travelers are likely to opt for agencies that can offer insider knowledge on destinations, and they are likely to favor resort brands that make a significant investment in the communities in which they operate, whether in encouraging guests to frequent local restaurants and choose local tour operators, or in offering “regenerative tourism” activities funded through the brand’s foundation.

Only a handful of all-inclusive resort brands run established foundations as part of their corporate social responsibility, such as Sandals, Club Med and Karisma. That’s because when it comes down to it, resort owners with lifelong ties to their respective destinations tend to care more about the long-term future of their communities.

Building Back Better: Resorts With a Development Impact

Building back better necessarily involves “activating the local value chain” as IDB Invest’s Basso described it, by purchasing produce and goods locally. With Covid shifting the financial relief demand towards supporting existing businesses, the institution’s recent backing has leaned towards impactful brands that are expanding regionally.

“In the midst of a Covid environment, we decided to continue to advance and support the development of a vibrant concept in the region,” Basso said, pointing to IDB Invest’s recent $50 million investment in global lifestyle hotels chain Selina. “We are believers that going forward, those concepts that are able to garner the support of the local community have greater sustainability potential in the long term.”

Another long-term project of IDB Invest is the Four Seasons Tropicalia Hotel on the north coast of the Dominican Republic. Basso was unable to discuss its status but explained the effort as a major departure from the country’s mass tourism resort areas in what will be a sustainability-driven resort model and the country’s first EDGE-certified construction.

Part of the private banking arm’s advisory work for this project includes training local farmers in best agricultural farming practices for hurricane resilience and mitigation of natural event impacts, as well as helping set up a farmers’ cooperative so growers could sell their produce to area luxury resorts.

“Hotels, resorts cannot continue to be built right on beaches, they’re going to be washed away,” Responsible Travel’s Honey said, noting that climate change mindfulness is part of building back better. “There are already estimates that if there’s a two-degree centigrade rise in temperatures in the Caribbean, 150 resorts will be lost across the Caribbean; this was probably two years ago so it’s very short sighted.”

Royalton Punta Cana, part of Blue Diamond Resorts, joined the Marriott International portfolio.

Basso believes there’s greater awareness after the 2017 twin hurricanes that not paying attention to climate change impact is not an option. “[I]t needs to be prioritized in the decision making process and developers are also understanding its importance.”

But will governments have the fortitude and leadership to turn away investments that don’t prioritize climate change issues and sustainability standards, both social and environmental, particularly following a major economic downturn?

According to Basso, in a post-Covid world, the financial world backing the all-inclusive and hospitality industry also has the potential and power, like resorts, to make better choices.

“[T]hat’s the message that we’re trying to impart on the financial community is that, there is room for us to be bold, for us to be creative, for us to roll up our sleeves and identify those developers that are doing the right things,” Basso said. “I don’t think that the driver of change is going to be the resorts. But what’s happening is that consumers are requiring a different type of experience, and what does that mean — clients today, they’re becoming each time more sophisticated.”

Rainforest Alliance Certified greenhouse at Karisma Hotels’ El Dorado Royale resort produces approximately 14 tons of vegetables per month.

Honey believes that two important lessons will have come out of Covid for all-inclusive resorts, which will present a challenge for them.

“A real commitment to local businesses and communities that have come out of the pandemic — and an increased respect and admiration for frontline workers,” Honey said, citing cleaning staff and waiters. “That we recognize that they need to be paid well, need to be trained well and that they deserve more respect from guests, because they are the ones that keep the place running.”

In the meantime, resort executives are keeping their eye on the long-term prize, buoyant and confident that demand will return once the restrictions are lifted from source markets.

“I have no reason to believe with the information that I have in front of me right now, of everything I know about where we are [unless] something dramatically changes that we won’t make big progress by summer,” Sandals’ Stewart said. “And then by the fall even bigger, by Thanksgiving people are going to be eating their Turkey and packing their bags, and I think we’ll have a phenomenal Christmas.”

The return path to record profits may look promising indeed for luxury all-inclusive resorts, but it will occur amid a transformed tourism landscape wrought with deepening social inequalities and environmental crises. This segment of the industry will likely face more scrutiny and accountability than it might expect — from a discerning post-Covid consumer who cares about more than butler-serviced suites and private infinity pools, and from its surrounding impacted communities.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: all-inclusive resorts, club med, coronavirus, coronavirus recovery, marriott, sandals

Photo credit: All inclusive resorts are optimistic about the future, but this business model is likely to face greater scrutiny post Covid. Marquis Los Cabos / Marquis Los Cabos