Skift Take

Airbnb is going with huge brand marketing campaigns in 2021 to take hosting mainstream. But when travel recovers and rivals turn on their performance marketing on Google, will Airbnb de-prioritizing search engine marketing come back to haunt it?

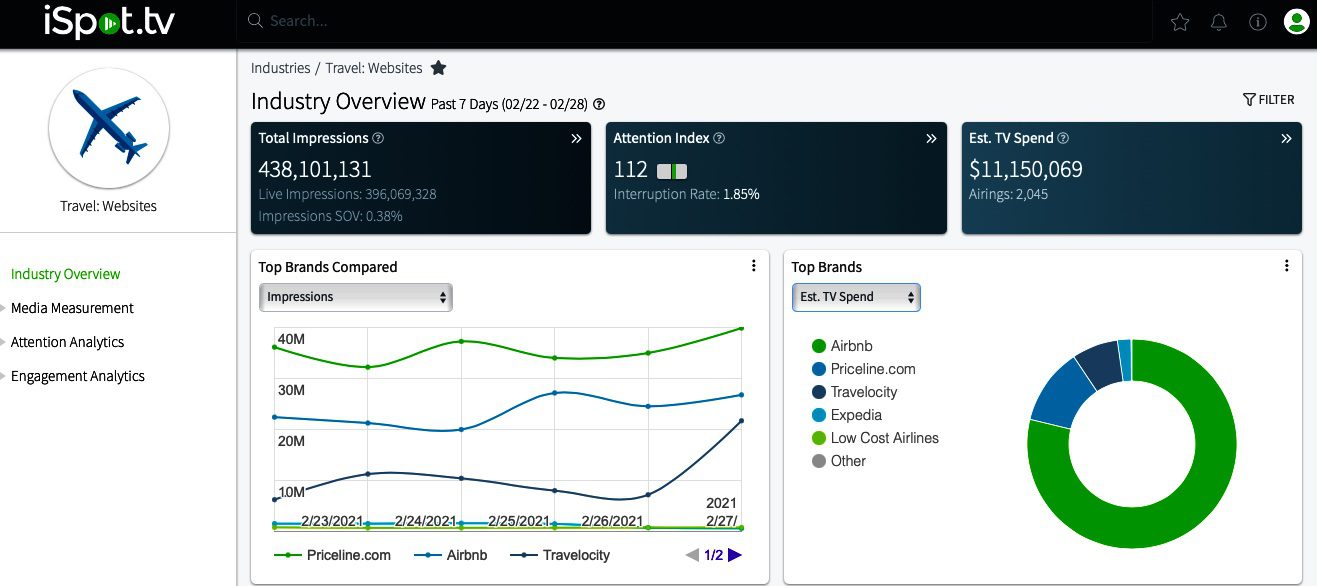

Airbnb’s first global branding campaign in five years appears to be a biggie: The short-term rental company spent close to $9 million during the first week of the advertising blitz on U.S. TV alone, outpacing all online travel rivals by a wide margin.

That estimate of Airbnb’s Made Possible by Hosts Campaign, which kicked off on U.S. television nationwide February 22, according to data from TV analytics firm iSpot.tv.

During the February 22-28 period, Airbnb spent an estimated $8.78 million on U.S. TV, accounting for 78.8 percent of travel website TV ad spending, according to iSpot.tv. The second largest spender was Priceline ($1.32 million or 11.9 percent), followed by Travelocity and sister brand Expedia in a distant third and fourth, respectively.

Consider the potential size of Airbnb’s global advertising campaign, which is designed to create awareness about hosting, with the ultimate goal of bringing more hosts and listings to the Airbnb platform.

If Airbnb were to spend the same amount — $36 million per month — for the next four months in the other markets where the TV spots are also running, namely Canada, the UK, France and Australia, then the advertising price tag could be in the neighborhood of $720 million.

Of course, Airbnb’s current TV ad spend in the United States may be larger than in Europe, for instance, where lockdowns are more prevalent.

Consider two other things: That potential $720 million figure — and it is just a back of the envelope guesstimate — would be just for television advertising in the five countries. However, Airbnb will also be running the ads on social media sites, such as YouTube, globally.

And the Made Possible by Hosts Campaign, which included three spots and 393 airings on shows such as Shark Tank, The Chase, The Bachelor, NBA Basketball, and Jimmy Kimmel Live, is only one of two campaigns that Airbnb is launching.

“In addition, we’re doing a companion campaign called Made Possible by Hosting, and that’s going to talk about all the benefits of hosting,” CEO Brian Chesky told analysts during the company’s fourth quarter earnings call last week. “And we’re going to really target people that are going through a life transition, as I said, people that just renovated their home, bought a new house, lost their jobs, maybe they retired, maybe their kids moved out of the house. So we think this is a really great way to be able to target and recruit more hosts.”

One travel marketer called Airbnb’s $9 million U.S. TV advertising spend during the first week of the campaign “a big buy,” especially as many other brands have pulled back on advertising because of Covid-19. “The $9 million for the first week would be a significant buy just about any time — perhaps not during the run-up to a national election, but otherwise noteworthy — but at this time, they are likely going to stand out even more,” he said.

An Airbnb spokesperson declined to reveal its expected advertising spending on the host campaigns.

Branding Campaign Versus Ads on Google.com

The kickoff of Airbnb’s branding campaign comes at a critical moment in the evolution of Airbnb’s marketing strategy. Officials vowed last week not to repeat the mistakes of 2019, when Airbnb spent $1.62 billion on sales and marketing, much of it with Google, and didn’t get the desired return on advertising spend. The company increased total performance and brand marketing $473.9 million that year, compared to 2018, and a huge chunk of that increase, $314.2 million, went into marketing on search engines like Google.

Airbnb officials said during its earnings call last week that advertising spending in the first half of 2021 will be larger than in the second half, and that the absolute dollar amount, as well as advertising as a percentage of revenue, would be lower than in 2019. Sales and marketing as a percentage of revenue was 33.7 percent in pre-Covid 2019.

In related news, Airbnb informed bloggers and other content creators that it is shuttering its Associates Program for affiliates at the end of the month. The company had only launched the program in May.

The program paid affiliates commissions on home stays and experiences when they came as the result of associates-created content. Airbnb judged the program to be low down in its marketing priority list in light of its new marketing campaigns.

Priceline Aired Way more ads than Airbnb

It’s interesting that from February 22-28, although Airbnb spent more than second place Priceline on U.S. TV ads ($8.78 million versus $1.32 million), Priceline’s ads aired 903 times versus 393 for Airbnb, and Priceline attracted 49 percent of impressions in iSpot.tv’s travel website category versus 32.5 percent for Airbnb.

This was Priceline’s leading spot, Big Deal, featuring actress Kaley Cuoco, last week.

Airbnb ran the following three U.S. TV ads last week designed to make the idea of being an Airbnb host more of a mainstream thing. These ads had no call to action but were merely branding exercises. A forthcoming campaign will target host signups, a key priority for the company, and are expected to have calls to action.

https://youtu.be/3oQ721__9yg

https://youtu.be/BrgvxO1tFOc

https://youtu.be/5BJdIbwLBlk

Note: This story has been updated to include new that Airbnb is ending its Associates Program.

Have a confidential tip for Skift? Get in touch

Tags: advertising, airbnb, hosts, ispot.tv, marketing, priceline, short-term rentals

Photo credit: Pictured is a screenshot from Airbnb's new ad, Landslide, Made Possible by Hosts. Airbnb spent around $9 million on U.S. TV for the campaign, according to iSpot.tv Airbnb