Skift Take

The past year has been abysmal for the travel industry, but we've seen a few green shoots. Let's build on that as we move into 2021.

Most people in the travel industry will be happy to see the back of 2020. Skift Research has been tracking the travel industry’s performance during this topsy-turvy year with the Skift Recovery Index.

Let’s take a look at how the year unfolded in five charts. Each chart is worth a thousand words.

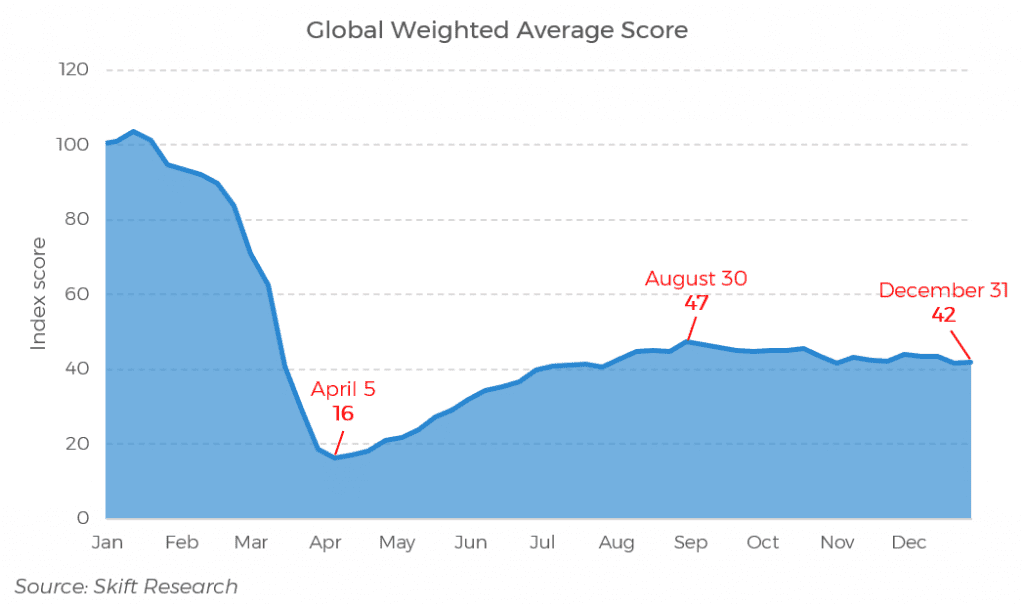

We are still far from a full recovery, but the industry has registered some recovery since the trough in April. European destinations and the U.S. performed relatively well during the summer months as borders within the EU were reopened and states in the U.S. relaxed travel restrictions, resulting in the highest score of 47 at the end of August. Since then the index has been stable or slightly declining.

China and Russia performed well during the initial recovery. By the end of 2020, Mexico, Brazil, and the UAE, all without strict restrictions to international arrivals, also started outperforming their peers.

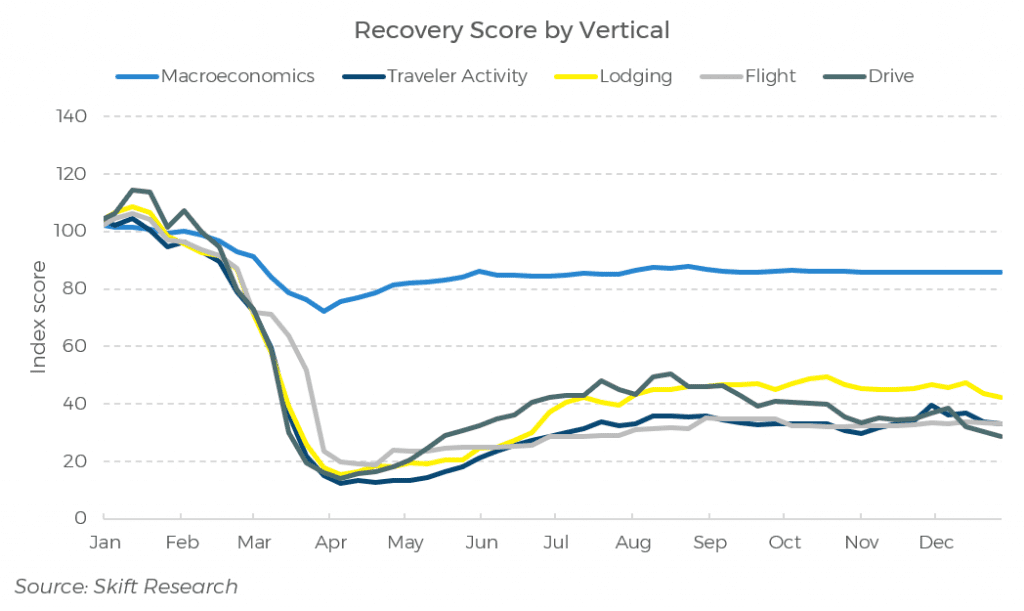

The Skift Recovery Index has built-in macroeconomic metrics, because ultimately the travel recovery is closely tied to the health of the broader economy. We clearly see how the overall economic performance saw a dip in April/May, but has since been stable around 85% of 2019 levels. In contrast, none of the travel sectors has been above 50% of 2019 performance levels since March.

Looking forward, the IMF expects that emerging and developing economies will return to 2019 GDP levels in 2021, but that advanced economies will not get there until 2022. All this points to an uneven and slow travel recovery, as consumers and businesses need to feel financially confident before they start booking trips.

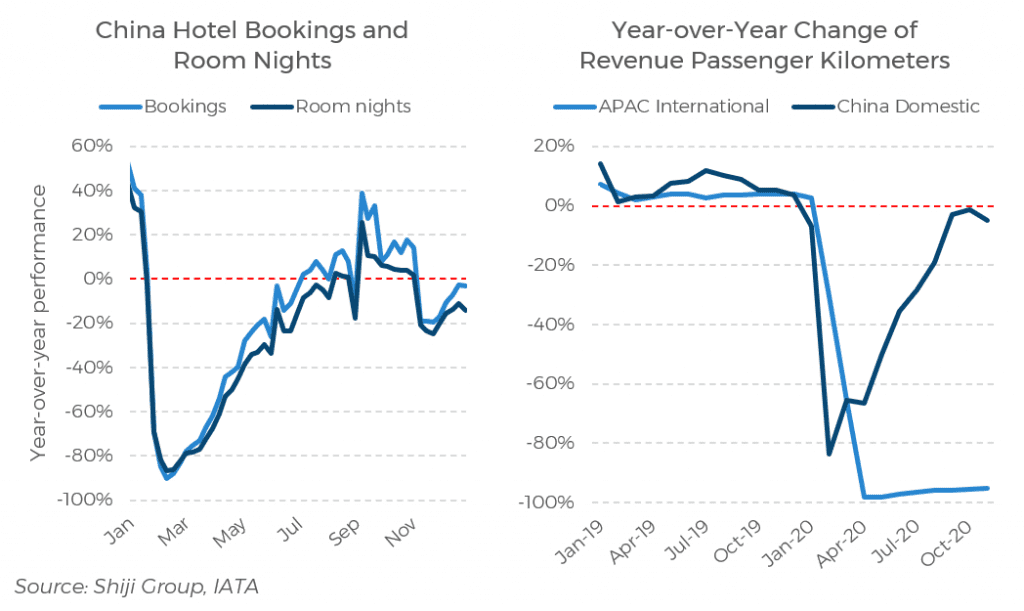

That is not to say the travel performance has been flat everywhere. The domestic performance of the travel industry in China is showing the potential of a swift recovery when the virus is suppressed successfully.

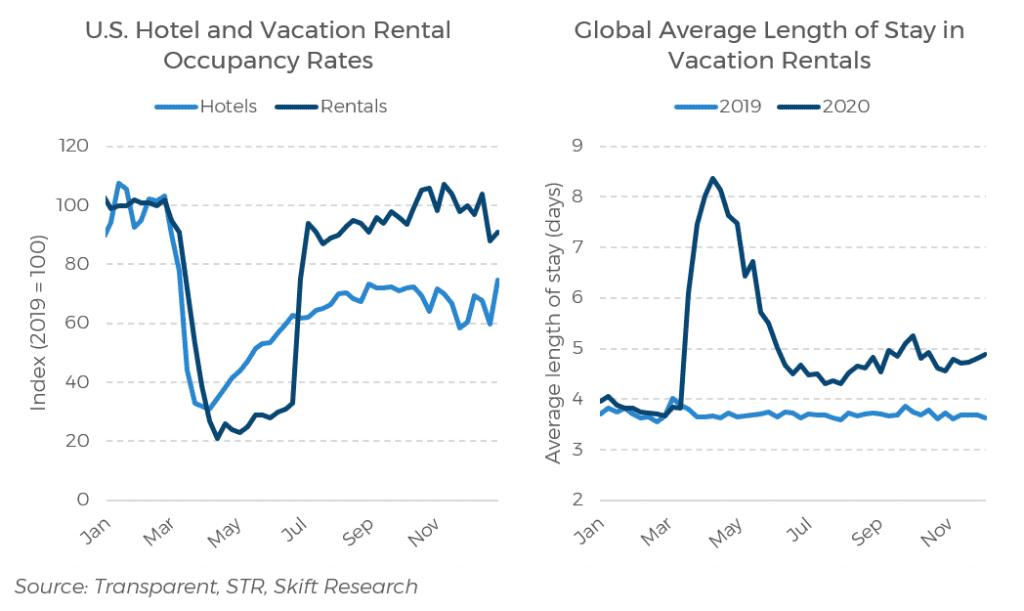

Short-term rentals have also been able to benefit from changing consumer behavior and expectations like longer lengths of stay. Vacation rental occupancy rates moved above 2019 levels in October 2020, and the sector is considerably outperforming the hotel industry, although the U.S. hotel industry also reached over 70% of 2019 levels by the end of 2020.

With vaccinations ramping up, 2021 is widely expected to be a more positive year, but it certainly won’t be back to business-as-usual any time soon. Just look at the happenings in the U.S. capital of the past week. For that reason, we will continue to track the travel industry’s performance in 2021. Together with our data partners we will provide monthly data updates and highlight reports as long as the turbulent times continue.

The Skift Recovery Index is a real-time measure of where the travel industry at large — and the core verticals within it — stands in recovering from the COVID-19 pandemic. We work with 18 data partners to track how different sectors and countries are recovering from the current pandemic.

The index provides the travel industry with a powerful tool for strategic planning, of utmost importance in this uncertain business climate. Skift Research members have access to all data and reports.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus recovery, skift recovery index, skift research