Skift Take

November: The U.S. chose a new president and vaccine manufacturers showed promising test results, but Europe saw coronavirus cases rising and the Singapore-Hong Kong bubble burst before it even took off. Out of it all came some surprising frontrunners.

It has been a strange year full of tests for the travel industry, and the Skift Recovery Index has tracked it all. We have just released the latest highlights report, focusing on the travel performance of 22 countries during the month of November.

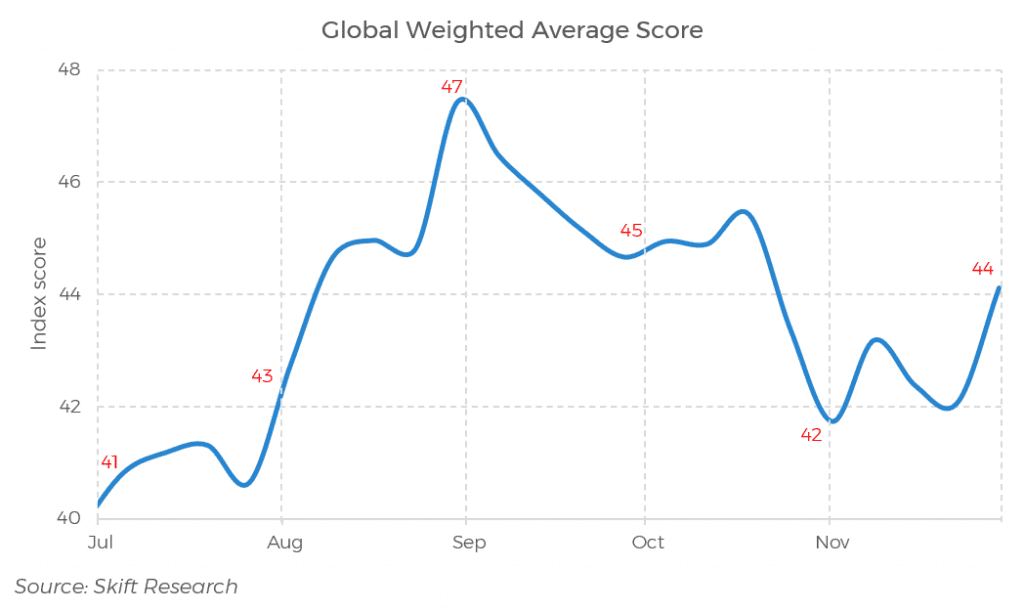

The index ebbed and flowed but moved into December on a high of 44, which indicates that the travel performance stands at 44 percent compared to the same time last year.

While this is a slight uptick from the end of October, in the great scheme of things the index has been relatively flat since strong recovery in May and June. It has not been above 50 percent since March, when it was on its way down.

While a number of countries performed well during November, the United Arab Emirates stood out for its fast improvement, pushing it to the top of the ranking.

After a strict lockdown over the summer, the United Arab Emirates has relaxed its entry requirements.

The country relies heavily on international visitors. Skift Research estimates that domestic spending last year was around $3.3 billion, while international inbound spending was over $21 billion. Dubai, as the main attraction, relies heavily on tourism and welcomed 16.73 million international visitors last year.

What’s behind the country’s success?

For starters the UAE has a relatively well-balanced mix of source markets, not relying too heavily on a single market, like Hong Kong relying on mainland China, or Mexico on the U.S., for example. With ever-changing travel restrictions, this puts the country in a good position to continue to attract tourists from those countries that allow international travel.

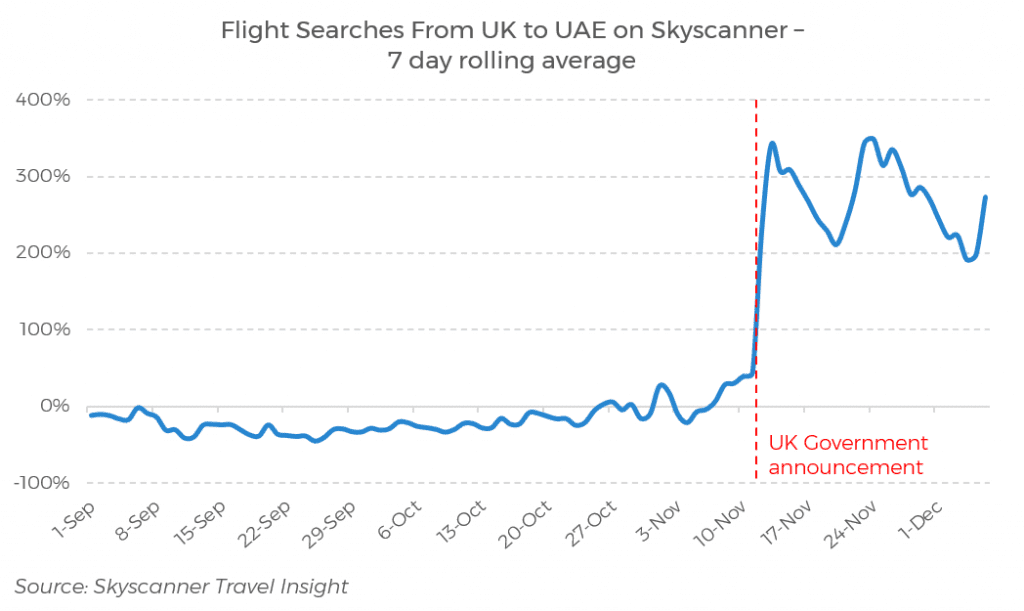

The warm climate is also enticing visitors who lost the opportunity to travel to the sun during the summer months. According to data from Skyscanner’s Travel Insight tool, pent-up demand in the United Kingdom, for example, benefited the country.

Gavin Harris, director of strategic partnerships, flights at Skyscanner told Skift Research: “The addition of UAE to the UK’s safe travel list in November is a positive indicator for recovery. Our demand data shows a dramatic increase in bookings to Dubai in particular, which is a popular winter sun destination for UK travelers in December and January.” In a reciprocal move, the UAE allows UK visitors to test upon arrival, rather than having a negative test result at hand from the country of departure.

Furthermore, a recent diplomatic deal between the UAE and Israel has boosted arrivals, with tourism officials reportedly expecting more than 70,000 Israelis to travel to the UAE over the eighth days of Hanukkah.

According to analysis by CBRE, the number of hotel room nights occupied by UAE nationals already increased by an average of 3.7 percent annually over the 2015-2019 period, and the company’s analysts expect that the pandemic has sped this up considerably. In 2019, UAE residents accounted for 17 percent of hotel guests, and that has likely doubled in 2020, with the Emirates promoting more domestic tourism while international arrivals have declined.

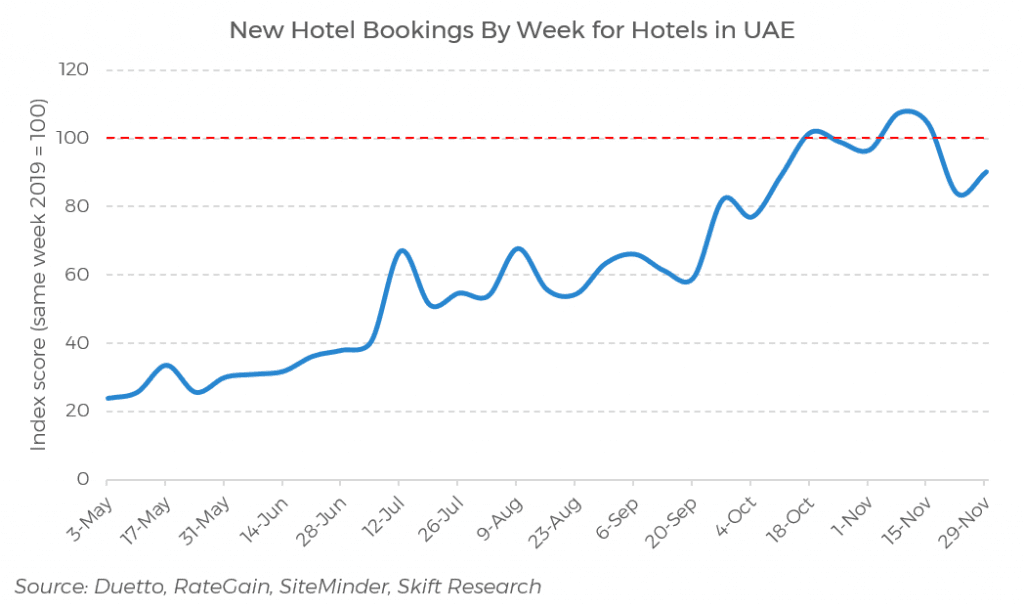

According to data from the Skift Recovery Index, hotel bookings in the UAE have seen a steady rise since May, and in November topped an index score of 100, meaning that new hotel bookings for hotels in the UAE are at the same level as in November 2019.

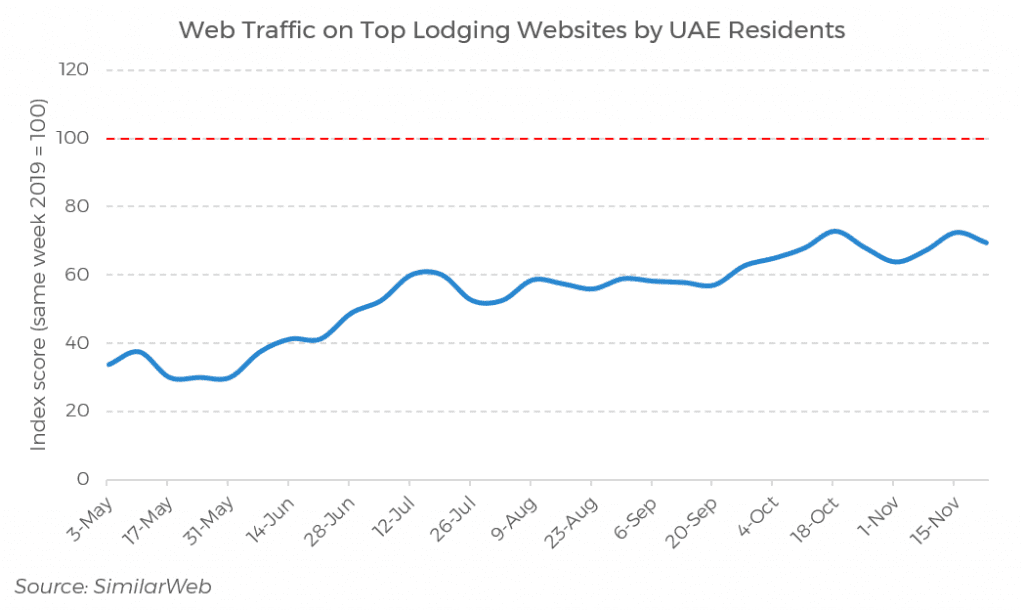

Lodging searches by UAE residents on the 10 largest lodging websites (incl. booking.com, airbnb.ae, cleartrip.ae, and tripadvisor.com), have shown a similar trend in activity, according to data from SimilarWeb.

However, unlike new hotel bookings for hotels located in the UAE, web traffic stemming from UAE residents remains considerably behind 2019 levels, showing that the UAE cannot rely solely on domestic travelers and will continue to focus on keeping its borders open as we move into 2021.

The Skift Recovery Index is a real-time measure of where the travel industry at large — and the core verticals within it — stands in recovering from the COVID-19 pandemic. We work with 18 data partners to track how different sectors and countries are recovering from the current pandemic.

The index provides the travel industry with a powerful tool for strategic planning, of utmost importance in this uncertain business climate. Skift Research members have access to all data and reports.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: abu dhabi, covid-19, dubai, skift recovery index, skift research, travel recovery, uae