Skift Take

Kudos to Airbnb for a dramatic comeback in its initial public offering. But the valuation, propelled by euphoric investors in a hot IPO market, was divorced from reality.

Airbnb, the longtime travel unicorn almost left for dead when its homesharing business nosedived in March, executed an initial public offering on Thursday of near-mythical proportions.

Priced at $68 per share Wednesday evening, the first trade was $146 per share. The company, which had an $18 billion private valuation during the depths of the recession, was trading at more than $158 per share in the first few minutes of trading, translating to a $109 billion valuation. That makes it larger than Booking Holdings’ at $86 billion market cap and dwarfing rival Expedia’s at $18.5 billion.

The combined valuations of Marriott and Hilton Thursday were $71.8 billion.

However, at the close of trading Thursday, Airbnb’s valuation stood just shy of $100 billion — at around $99.5 billion — at $144.71 per share. The stock price had risen 112 percent over its $68 pre-IPO pricing Wednesday night.

Given some of the headwinds in Airbnb’s future, the opening had a generous touch of unreality to it.

OK, it wasn’t exactly mythical, but ABNB’s public trading debut was the largest travel IPO ever, starting out at $68 per share and a $47 billion valuation, which was more than twice as large as more than two-decade-old Expedia’s current market cap at $18.8 billion.

Airbnb’s $47 billion valuation at the opening bested the previous record holder Hilton, which started publicly trading in 2013 at a mere $19.69 billion. (See chart below).

Airbnb, which raised $3.7 billion Thursday, could also boast of having the largest IPO of the year in a period when public market launches, including SPACs (special purpose acquisition companies, were hot, and investors were seemingly bullish beyond belief in the midst of a global pandemic.

But the pricing of Airbnb’s shares at $68 each at its mid-afternoon opening on Nasdaq, was only part of the story.

The stock price surge at the beginning of trading mid-afternoon was the largest in many years.

In a fertile IPO market, Airbnb’s public coming out party followed by a day the DoorDash IPO, which saw its stock price soar 85 percent at the close of its maiden trading day.

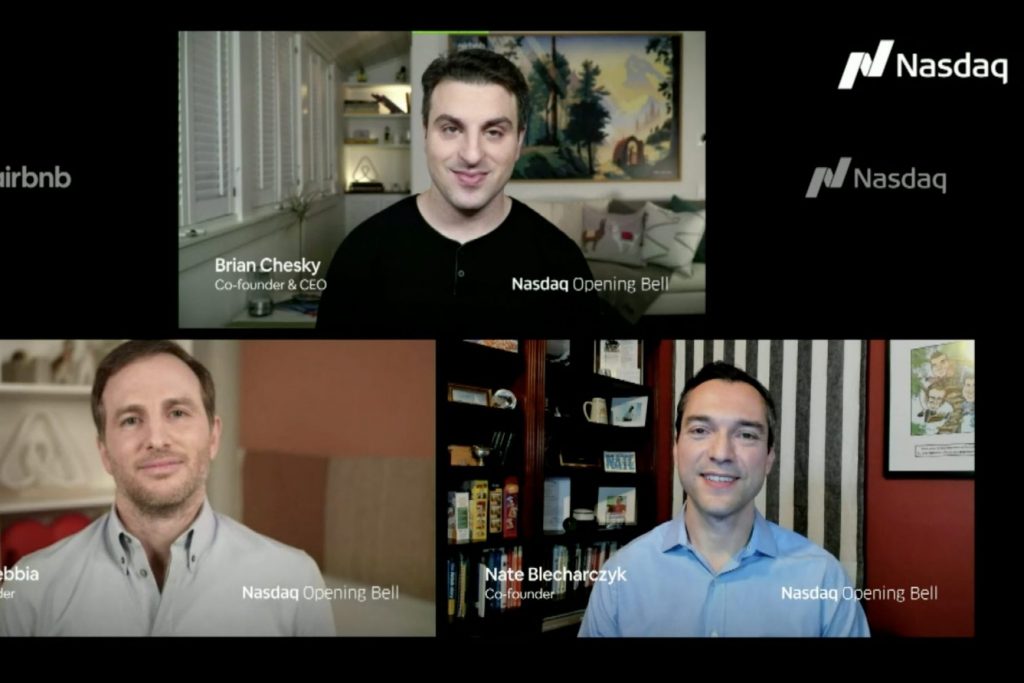

Founded in 2008 by Brian Chesky, Joe Gebbia and Nathan Blecharczyk, Airbnb along the way raised $6.4 billion in funding, including two private equity and debt financing rounds during the depths of the April 2020 downturn.

In the remarkable comeback story, Airbnb had a private valuation of $31 billion during its last raise pre-pandemic, and that plummeted to $18 billion in April when private equity came to the rescue with lending at necessarily double-digit onerous terms.

In 2019, Airbnb announced it would be ready to go public in 2020, but the pandemic wiped out that plan, although the company revived its ambitions in the summer, leading to today’s public trading of ABNB on Nasdaq.

Of the top five initial public offerings in travel, Airbnb’s blockbuster IPO was 138%tk higher than the now-second largest, Hilton in 2013 at $19.69 billion. Among the top five, which also includes Japan Airlines (2012), Amadeus (2010), and the airline IndiGo (2015), Airbnb was the only venture-back startup.

The Largest Travel Initial Public Offerings

| Company | Year | Valuation |

|---|---|---|

| 1. Airbnb | 2020 | $47 billion |

| 2. Hilton | 2013 | $19.69 billion |

| 3. Japan Airlines | 2012 | $8.74 billion |

| 4. Amadeus | 2010 | $6.5B billioni |

| 5. IndiGo | 2015 | $4.21 billion |

Source: Skift Research and Capital IQ

Speaking on CNBC in several appearances Thursday morning before trading began in the afternoon, Chesky acknowledged that before the pandemic Airbnb had been mulling a direct listing in 2020 instead of an IPO, as Skift had pointed out as a possibility in 2019. At that point last year and early in 2020, Airbnb’s primary motivation for going public was to enable employees to exercise soon-to-be expiring stock options rather than raising money.

But all that changed with the arrival of the pandemic.

The Paperwork Had Been Ready

Chesky said Thursday he feels like 39 going on 59 year old after making “a decade worth of decisions” since the pandemic struck. (See a CNBC video embedded below.)

Chesky and his co-founders had been reviewing initial public offering paperwork in March before the outbreak took place, and Airbnb’s business caved. Its revenue declined 80 percent in eight weeks, he said.

“It’s not typical if you run a business and it drops 80 percent in eight weeks, and you live to tell about it,” Chesky said.

He argued that the pandemic made the company incredibly focused — it halted investment in hotels, and put aside an initiative to launch a flights product — and the crisis brought on a sense of resolve.

Among the measures it took, Airbnb laid off 25 percent of its workforce in May, halted investments in products such as hotels, and set aside an anticipated launch of flights. The company also triggered the wrath of many hosts early in the pandemic by unilaterally refunding guests for cancelled reservations, and leaving hosts empty-handed and struggling to pay mortgages in many cases.

One of Airbnb’s rivals, Expedia Group’s Vrbo, took a much more even-handed approach on cancellations and refunds, and it gained U.S. market share since the pandemic took hold.

Co-founder Blecharczyk told Skift Thursday that the IPO was always the plan, regardless of the pandemic. So it wasn’t designed to raise capital because of the strains from the early months of the pandemic, he said. “It’s just a real milestone” that the company could make it happen in 2020, he added.

Quick Bounce Back

Chesky said the business recovered much quicker than he expected when people started taking drive vacations to beaches and rural areas distanced from cities, and people found new ways to use Airbnb. He cited people renting an Airbnb as a place to work, and college kids renting places together instead of staying home with their parents during lockdowns.

Chesky said in that sense Airbnb recreated itself, and millions of people were introduced to the company.

The Airbnb CEO said he couldn’t predict what Airbnb will look like once Covid vaccinations get distributed globally. But he mentioned that the Roaring 20s in the United States followed the Spanish flu of 1918, and people will seek an authentic way to travel with people they feel connected to.

Blecharczyk, who had focused over the years on much the company’s operations in China, said he was encouraged by the travel recovery there, especially since half of Airbnb’s business pre-pandemic had been hosting domestic travelers. “We do hope we see more outbound China travel, however.”

Better Hosting and Personalization in 2021

Looking to 2021, Chesky was somewhat coy about Airbnb’s plans, although he did tell CNBC that the company would seek to “unlock” hosting as a way for people to benefit from economic empowerment.

He said Airbnb will get more “inspirational” about matching the needs of guests with ideal rentals.

Asked why Airbnb’s registration statement had not provided more clarity about the revenue, losses and investments in its Experiences business, Chesky said that before the pandemic he thought 2020 would be a “breakout” year for Experiences.

“And one of the things our guests tell us is they love Experiences, at least from a customer satisfaction standpoint, even more than homes,” Chesky said. “So, 82 percent of our guests will leave a review in a home, leave a five-star review, but Experiences, it’s more than 90 percent. So, this is something we are very focused on and I think it’s just a matter of timing.”

Chesky said he hoped to share more information about its Experiences business in 2021.

But the future can be set aside for now. Thursday was all about Airbnb’s historic stock market debut.

Editor in Chief Tom Lowry contributed to this report.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, alternative accommodations, ipo, short-term rentals, valuations

Photo credit: (From top and counter-clockwise) Airbnb co-founders Brian Chesky, Joe Gebbia and Nate Blecharczyk participated virtually in the Nasdaq bell opening ceremony on December 10, 2020. Airbnb