Skift Take

The substantial decline in new Covid cases didn't seem to give travel a much-needed boost. In August, 36 percent of Americans traveled, only one percentage point higher than in July.

Another peak of coronavirus cases seemed to be behind us when we entered August in the U.S. Many universities opened for classes and sent a wave of parents delivering children to campuses. August seemed to be poised to be a minor travel boost from July. Yet the number didn’t change much.

According to Skift Research’s U.S. Travel Tracker August survey, 36 percent of Americans traveled in August, only one percentage point higher than in July. This is despite the fact that consumers were less fearful of the virus, with 50 percent of surveyed consumers saying they were very concerned about the coronavirus, dropping from 57 percent in July.

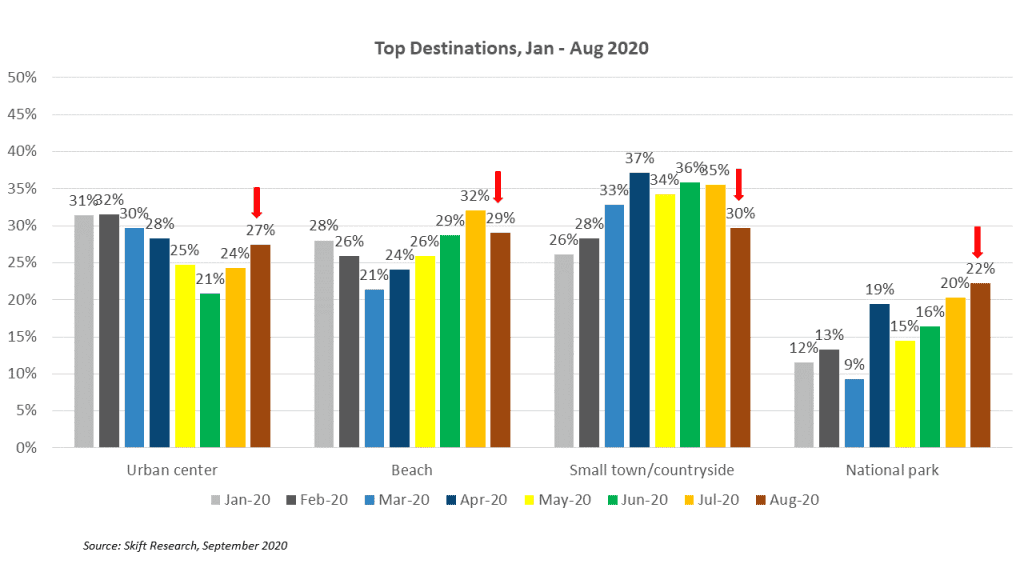

Summer vacation has been the main driver of travel growth since July. However, these are not typical summer vacations in any case. The new normal of vacationing this summer is characterized by staycations, day trips, and road trips. Destinations that are close to vacation-goers’ homes, and safe to travel to, all saw increases in visitations, including urban centers and beaches.

Destinations that have gained the most visitation shares are national parks. In August, 22 percent of all trips taken by Americans were to national parks, thanks to the promise of isolated open spaces that parks have to offer. By comparison, park visitation only accounted for 12 percent of all trips in January, pre-Covid.

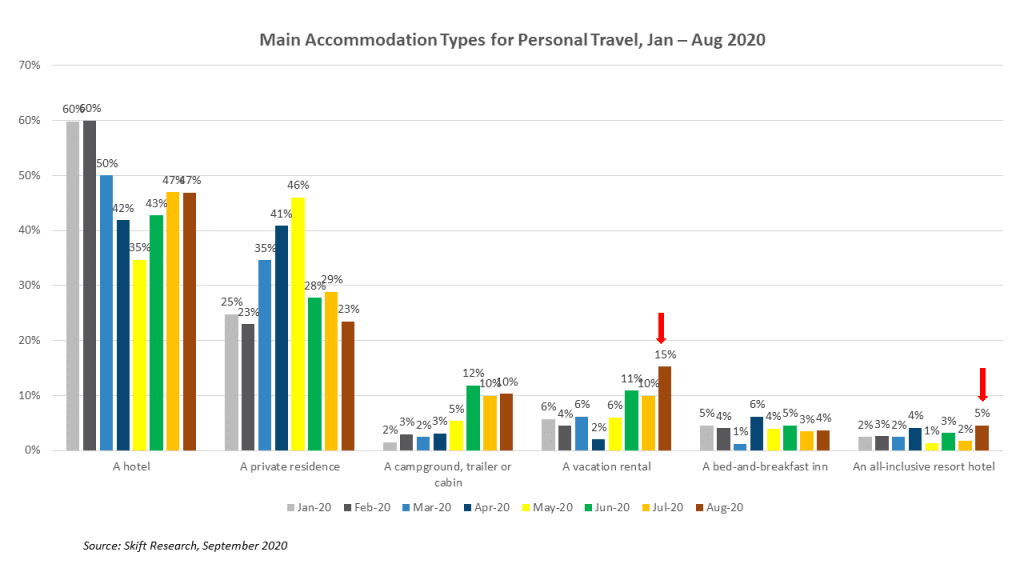

As people seek outdoor access and getaways from being stuck at home, short-term vacation rentals, campgrounds, and RVs are unsurprising winners in their accommodation choices. Since June, campgrounds, RVs, or cabins have consistently accounted for over 10 percent of all personal travel stays. The same holds true for vacation rental stays. The number was especially high in August, with 15 percent of leisure travel stays involving vacation rentals.

Skift Research introduced a monthly U.S. travel tracking survey in January 2020 to examine the travel penetration rates and detailed travel behavior of the U.S. population. In addition to the factual travel occurrences, we also asked respondents their perceptions on the macro-level economic condition as well their personal financial and travel outlook. As we move through different phases of Covid-19, our monthly survey captures the fluctuations of consumer travel behavior and intent in real time.

In our newly released U.S. Travel Tracker August survey report, we highlight new and ongoing trends in travel incidences, consumer sentiments and future travel intents in the pandemic world, distilled from our August Travel Tracker survey.

What You’ll Learn From This Report

- Travel incidences Jan – Aug 2020

- August travel highlights

- Covid-19 impacted travel Feb – Aug 2020

- Changing consumer sentiments on the economic outlook Feb – Sep 2020

- Changing consumer intent on future travel April – Sep 2020

Subscribe to Skift Research Reports

This is the latest in a series of monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our network of seasoned staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: consumer behavior, consumer travel trends, covid-19, skift research, traveltracker