Skift Take

Startups should take note of venture capital firm Lakestar's vision of what makes a travel company successful if they want to emerge stronger in the post-Covid world.

Skift Forum Europe is here and we're excited! We have a jam-packed agenda that includes keynote presentations, panels, and brand talks with an array of travel leaders as we explore the future of travel leading out of the pandemic.

Travel startups stand to emerge stronger after the crisis — as long as they don’t stop developing their technology and product.

That’s the advice from a partner at European venture capital firm Lakestar.

“Do not cut costs at all,” warned Christoph Schuh, speaking to Skift’s senior travel tech editor Sean O’Neill at Skift Forum Europe. “The product roadmap, in terms of aggregating supply, and having the best product for the customer — if you want to win the market post-Covid, you have to have the best product. If companies stop investing in product and tech, I think that’s what we don’t like.”

He added activities like marketing and sales, however, were seen as non essential.

Meanwhile, financing is key to ensure that, post-Covid, there’s enough money to get back to the “cruising altitude”. Schuh said he recently took part in a roundtable with CEOs from some of the companies Lakestar has invested in. “We discussed financing techniques,” he said. “All the big guys like Booking, Expedia, Airbnb, they have refinanced. So in this crisis mode, you have to make sure that you are properly financed.”

The Germany-based venture capital firm has to date invested in some of Europe’s most well-known travel startups, including Omio, Getyourguide, and HomeToGo, as well as early stage companies like Impala and Limehome. It has also invested in Airbnb, Skype, and Spotify early on.

O’Neill asked why Lakestar had a bullish outlook for travel. “It’s in the heritage of all of us, travel is an important element,” Schuh replied. “This $8 trillion market will not go away; it will look different.”

Despite coronavirus shutting down the tourism industry, Schuh remains optimistic for tech startups, and believes its new $735 million fund targeting European startups could benefit those entering the growth stage.

“We wanted to follow a founder’s whole journey from seed up to the initial public offering, and that’s what you can only do with a dedicated growth fund. We also don’t want to lose all the interesting and attractive competitive deals to U.S. and Asia. We want to be competitive,” he said.

“For seed and series A, Europe is competing against the U.S. and Asia, but when it comes to growth investments, there’s a big gap in Europe. There’s really no one in that sweet spot of $50 million rounds series C, D and E.”

‘Category Killers’

Lakestar has focused on travel aggregators in the past, O’Neill pointed out, and he asked Schuh if Covid affected that strategy.

“It’s all about the aggregation on the supply side,” he replied. “Take Omio, for example. They have 600 suppliers connected, HomeToGo has 500 different vacation rental suppliers. It’s a lot of API connect work, but it make the marketplace strong. And then they all go vertical. Some started as a metasearch, like HomeToGo, and it’s now going vertical.”

Tying in with the new fund’s principle, Schuh said Lakestar wanted to buy into startups that were ahead of the pack, and across a range of industry sectors.

“You have to invest in the category winners in accommodation, and tours and attractions, in ground transportation and in others,” Schuh noted. “We tend to invest later, like with HomeToGo, where we see they are the clear vacation rental marketplace. We invested later into GetYourGuide because we wanted to see who’s the category killer in that tours and activities segment.”

This tactic also means Lakestar is backing companies that have a stronger chance of survival. “We are fully aware Covid is something that will need two to three years for the full recovery,” Schuh said, “but we see then that if you’re the category killer, it makes it even stronger because at the end it’s one company who will win that marketplace.”

A Driving Force

Meanwhile, Scuch shared trends from another of its portfolio companies, data company Teralytics, which partners with telecom operators worldwide. Globally, it provided a snapshot of mobility patterns. He said air travel was down 94 percent, train down 70 to 80 percent — “but car has fully recovered”.

“Car is the tool that everyone is using. It’s recovered to above the year before. So when it comes to tactics for accommodation and rentals, or hotels, a reach of 200 km is where people feel safe and that’s how they’re planning. That was interesting to see not only for Germany, but also Italy, UK and other countries.”

There’s a slow path to recovery, but those European travel startups that are committed to building their business over the next couple of years, despite the downturn, could be the ones that dominate the field.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: sfe2020, skift forum europe

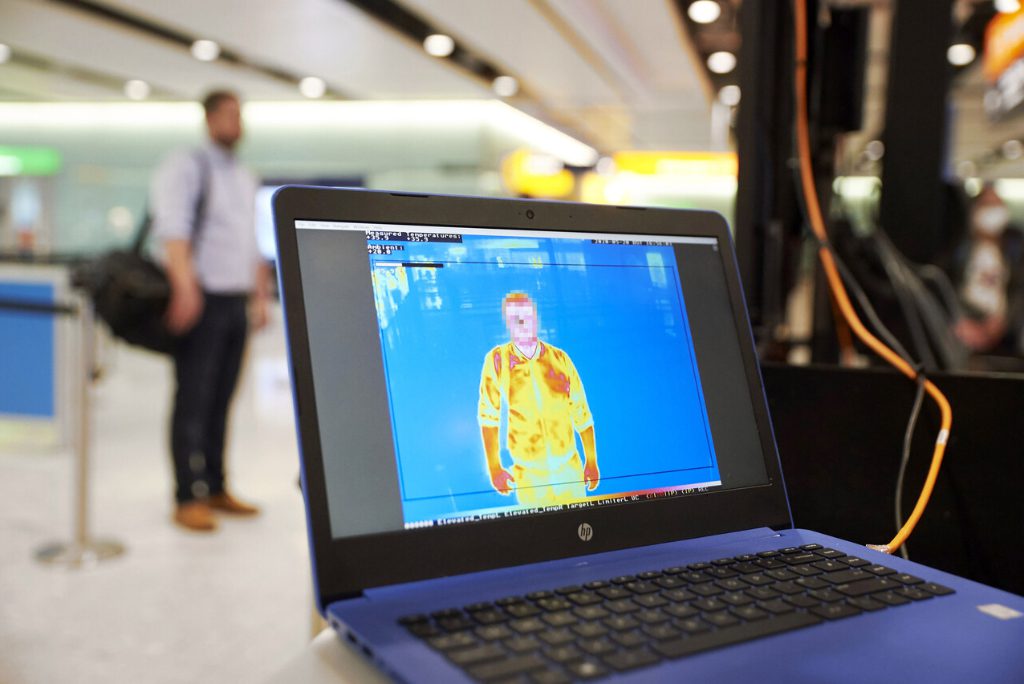

Photo credit: A fever detection machine is tested at London's Heathrow Airport in partnership with a tech vendor. Heathrow Airport