Latin America Is the Future of the Airline Industry

Skift Take

Twelve minutes. That’s all the time it took for the board of directors of Avianca, the second largest airline in Latin America, to set the fate of the carrier and begin a series of sweeping changes to the airline industry in the region.

The date was May 10, 2020. It was a partly cloudy spring Wednesday in Bogotá, where Avianca is headquartered. The weather, however, was likely of little consequence to the board that met via teleconference to decide the airline’s fate at 8:03 a.m. local time. Dialing, or Zooming possibly, in were its 10 directors, including then chief financial officer and now CEO Adrian Neuhauser.

In front of them was a momentous decision: Whether or not to take Avianca into bankruptcy given, as minutes from the meeting show, the airline’s cash flows were “severely impacted by the effects of the Covid-19 pandemic.” If they voted yes, it would be the largest airline bankruptcy to that point in the crisis.

All of the facts in front of the board pointed to a yes vote. Global air travel was a month off its pandemic nadir in April 2020. Airspace in Colombia, Avianca’s largest market, had been closed since March 20, and the airline’s flights suspended since March 25. And then there was the “uncertainty caused by the limited visibility that the industry [had] with respect to the demand recovery.”

Just over a month earlier, then director general of industry trade group the International Air Transport Association (IATA), Alexandre de Juniac, had warned that, without government aid to get through the liquidity crisis facing airlines, the industry would “run out of cash and over half the [airlines] die.”

And the Colombian government, as well as every other government in Latin America, had to that May morning declined to provide any aid to the region’s airlines.

By 8:15 a.m. it was done: The board voted to take Avianca into Chapter 11 and the meeting was adjourned. By 1 p.m. that day, the airline had filed the necessary documents with the court in New York and it was officially bankrupt.

“When we did it, we saw no other viable path,” Neuhauser said with the benefit of hindsight at the annual meeting of the region's aviation trade group, ALTA, in Buenos Aires this October. “In retrospect, it allowed us to survive. It gave us time to breathe. It gave us time to reflect on who we are and why we do what we do.”

Avianca was the first airline domino to fall in Latin America during the pandemic. The region’s largest carrier, Latam Airlines Group, would follow it into Chapter 11 on May 26, and Aeromexico on June 30, confirming de Juniac's warning that airlines would collapse. But bankruptcy was not the death of these carriers, far from it.

Latin America is emerging as the most dynamic region in the global airline industry, a market through history that has been subject to the varying political and economic instabilities from country to country.

Today billions of dollars in fresh investment, including from a slew of new investors, is pouring in. Consolidation is rife. All of this change is creating very real, and new, opportunities for budget airlines and startups alike. The endgame from all this disruption is still unclear, of course, but make no mistake: Latin America is captivating the attention of aviation around the world.

(For more on Latin America's aviation industry, be sure to attend Skift Aviation Forum on November 16 where a session is entitled "What Comes Next for Latin America?")

Breaking Point

Airlines in Latin America were struggling before the pandemic. The industry had racked up a combined $2.2 billion in losses from 2015 through 2019, according to data from IATA. When revenues dried up and many airlines saw “negative bookings” — when there are more cancellations than new reservations — early in the pandemic, the resulting liquidity crisis proved the breaking point for many carriers.

In their initial bankruptcy filings, Aeromexico, Avianca, and Latam all cited a liquidity crunch with, as Avianca put it, “no end in sight.” Each also mentioned the lack of government support as a contributing factor, though none highlighted it as a reason for their respective bankruptcies.

“Airlines had to bear the brunt,” Peter Cerda, the regional vice president of the Americas at IATA, said of the lack of state support for the industry in the region.

This was not necessarily a surprise. Air travel in many Latin American countries has long been viewed — incorrectly — as the domain of the rich and, as such, governments have hesitated to appear as subsidizing the airline industry. Of course exceptions exist, most notably state-owned Aerolineas Argentinas; all of the major Latin American airlines, including the three that went through bankruptcy, were privatized decades ago. These views, as far as airline executives are concerned, contribute to government policies — from heavy taxation to failure to invest in airport facilities — that the industry argues limits its ability to expand.

At the same time, each bankrupt legacy airline faced increasing pressure from budget competition. Viva Aerobus and Volaris were eating into Aeromexico’s home market; Viva Air was doing the same to Avianca in Colombia; and a combination of JetSmart and Sky Airline to Latam in Argentina, Chile, and Peru.

And, conflating the issues facing Latin American airlines, was the industry’s fragmentation. Aside from market leader Latam that was formed by the merger of Lan Airlines and Tam Airlines in 2012, no one carrier had more than a 13 percent share of passenger capacity — Gol in Brazil — and most had shares smaller than 8 percent in 2019, according to Diio by Cirium schedules.

Larger airlines with more scale are typically healthier and, important to travelers, grow faster than their peers in more fragmented markets. This has proven true in the U.S. and Europe where consolidation has created financially stronger airlines and airline groups, as well as sustained growth.

Bankruptcy, as Neuhauser put it in October, was an opportunity for Latin America’s three largest legacy airlines to take a step back, restructure, and refocus on who they are. And, in Avianca’s case, that meant beating discount competitors at their own game.

“Staying independent in aviation in the 2020s is not an option. It was hard pre-pandemic. It's not an option now.”

Viva Air CEO Felix Antelo

If You Can’t Beat Them, Join Them

Avianca CEO Neuhauser, in several conversations over the past year, has repeatedly highlighted the changes in the Colombian market. Growth, he has said, was in expanding the pool of flyers — converting bus riders to planes, for example — rather than doubling down on the airline’s traditional corporate and upper middle class segments. And, to tap this market, Avianca had to cut costs, become more flexible, and adopt an a la carte pricing structure with cheaper fares and lots of fees.

In other words, Avianca had to become a budget airline.

“We exist to serve the region we fly in, and that's everybody that needs to fly there. Not just the customer base that we originally had,” Neuhauser said in October. “That's what made us really change our business model, because it means that to some extent we have to migrate our customer base to be broader.”

Bankruptcy brought big changes to Avianca. The airline's CEO when it filed in 2020, Anko Van der Werff, who had been brought in only a year earlier to lead its turn around, jumped ship for SAS in April 2021. Neuhauser, a former investment banker, was promoted from finance chief to the top job. Under Neuhauser, Avianca unveiled a restructuring plan to become more like its budget competitors while cutting costs by more than 40 percent, and debt "significantly." Its partnership with United Airlines was preserved, and the U.S. carrier increased its investment in the new Avianca to roughly 16 percent.

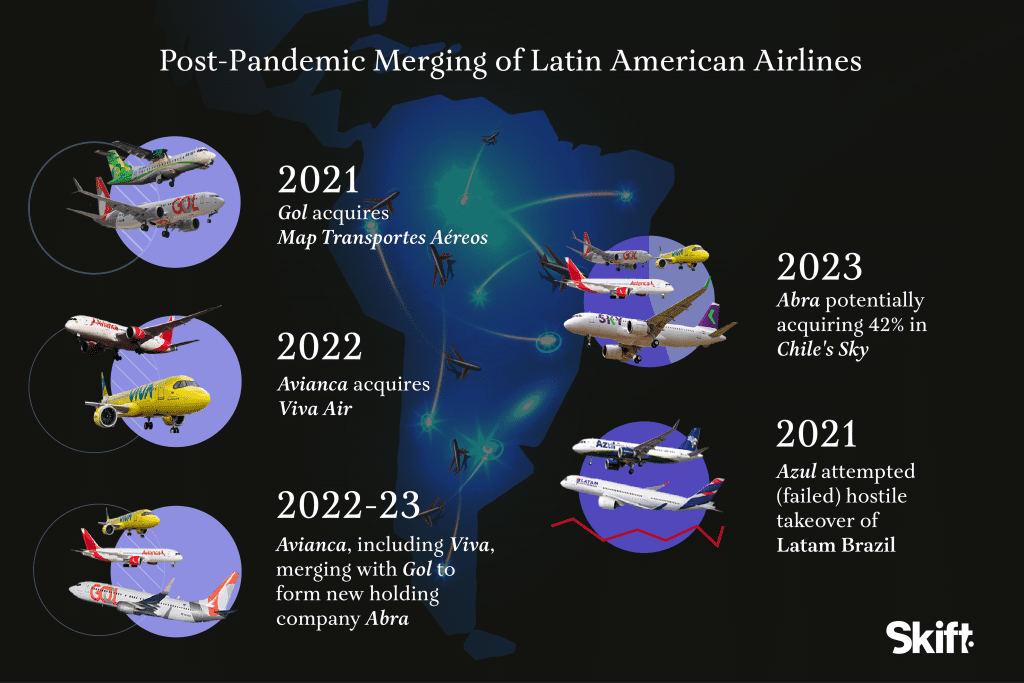

But Chapter 11 proved to only be a starting point for Avianca. The airline unveiled plans to acquire its main budget competitor, Viva Air, in April. And, less than a month later, a merger with Gol to form the new Abra Group, or a South American equivalent of Europe’s International Airlines Group (IAG). The Abra deal, if approved by regulators, would be the biggest change in Latin American aviation since the since the Lan-Tam merger a decade ago.

Abra would also include Viva Air, and maybe Sky in Chile and Peru. Avianca and Viva Air anticipate Colombian approval of their merger by year-end, and Avianca holds a convertible bond from Sky that it could convert to a 42 percent equity stake in the airline.

“Latin America as a whole needs to be more rational in dealing with the recovery,” Gol CEO Celso Ferrer said at the forum. “If [airlines] don't have scale, if they don't have, let's say, market strength and presence, it will be really tough for them.”

Ferrer, like Neuhauser, also stepped into the top job at Gol during the pandemic. Before taking over from Paulo Kakinoff on July 1, Ferrer was the airline's chief operating officer. However, unlike at Avianca, the transition at Gol was expected, and Ferrer has so-far continued with the strategy laid out under Kakinoff.

If one looks at the U.S. market, airline profits grew and capacity growth accelerated after eight airlines merged to become the Big Four — American Airlines, Delta Air Lines, Southwest Airlines, and United — between 2008 through 2013. Today, each of those four airlines has scale with more than a 17 percent share of the U.S. domestic capacity, Diio data show. The next tier of U.S. airlines, Alaska Airlines and JetBlue Airways, are significantly smaller with 7 percent and 6 percent shares, respectively.

Abra’s four member airlines will operate a combined 22 percent of airline passenger capacity in Latin America during the fourth quarter, according to Diio. Latam will fly roughly 23 percent of capacity.

And Gol is not a stranger to consolidation. The airline opened the current round of Latin American airline consolidation buying Brazilian regional carrier Map Transportes Aéreos for nearly $6 million in 2021. It netted lucrative slots at São Paulo’s close-in Congonhas airport from the deal.

Asked why the pandemic was the spark for Abra, and the other consolidation talk in the region, Ferrer said: “It was the need to have better market presence — a bigger market presence — better yields, and more stability on the revenue side.”

“Staying independent in aviation in the 2020s is not an option,” Viva Air CEO Felix Antelo said at the forum. “It was hard pre-pandemic. It's not an option now.”

Antelo cited the “financial muscle” that will come from, first, the merger with Avianca that is pending in Colombia. The two airlines plan to maintain their own brands but will coordinate flights and other commercial activities. And, second, the larger deal to create Abra where Viva Air will be the “low-cost carrier branch” of the group, as Antelo put it.

Spurned Suitor

“Consolidation that brings value to your shareholders, and to everybody, is true domestic consolidation,” Azul CEO John Rodgerson said at the forum. He’s very much a proponent of these combinations citing, for example, the airline mergers in the U.S.

Where Rodgerson does not see value are in cross-border deals, like the creation of Abra. “When you do cross border consolidation — it's hard for me to see, it's not intuitive to see the synergies,” he said.

But Rodgerson is a spurned suitor. Azul failed in a hostile takeover attempt of Latam last year; a deal that could have created a Latin American airline with a nearly 32 percent share of capacity in the region. And, aside from Latam, the only other domestic Brazil merger option for Azul would be Gol, which is already spoken for with Abra.

Given his lack of good options, it’s not surprising that Rodgerson is a bit glum on the idea of cross-border airline integration.

European airlines have shown that cross-border mergers can work. Air France-KLM, IAG, and the Lufthansa Group are all stronger than they were as independent airlines before consolidating over the past 20 years. Yes, the mergers have not answered all of their problems — just look at the Lufthansa Group’s lackluster margins from 2015 to 2019 dispute having acquired Austrian Airlines, Brussels Airlines, Eurowings, and Swiss Air. But all would agree: The three big groups, and their constituent airlines, are stronger today than they were before consolidation.

Latam, for its part, has doubled down on its status as the region’s largest airline. The carrier emerged from Chapter 11 in the U.S. on November 3 having slashed its debt by roughly 35 percent. Delta and Qatar Airways, which owned 20 percent and 10 percent, respectively, of the airline before its bankruptcy, both provided millions of dollars in new capital and kept strategic investments in Latam. And new investors, including State Street and hedge fund Sculptor Capital Management, also invested in the restructured airline.

Roberto Alvo, CEO of Latam, said at the forum that he expects the airline’s — as well as the industry’s — capacity to fully recover to pre-pandemic levels by next year. Latam has moved quickly to resume and add flights in Latin America's domestic markets, including taking — for now — Gol’s pre-pandemic title as the largest in Brazil.

And Latam is pursuing its own form of consolidation: A joint venture with Delta. The partnership will allow the two airlines to coordinate flights and other commercial activities between the U.S. and South America. This, they say, will allow them to expand, including adding at least nine new routes in the market. The U.S. signed off on the pact in September, however, neither airline has said when they will launch the partnership.

Gol has a similar pact with American. The U.S. airline owns just over 5 percent of the Brazilian carrier. But, for now, neither airline plans to form a joint venture covering flights between the U.S. and Brazil as Delta and Latam have.

Azul has smaller partnerships with JetBlue and United. Rodgerson said the airline was not looking at a joint venture with United, which owns a small stake in Azul, currently.

Budget Winners

“The big winners [are] the LCCs in the region,” Viva Air’s Antelo said, referring to low-cost carriers, another name for budget airlines.

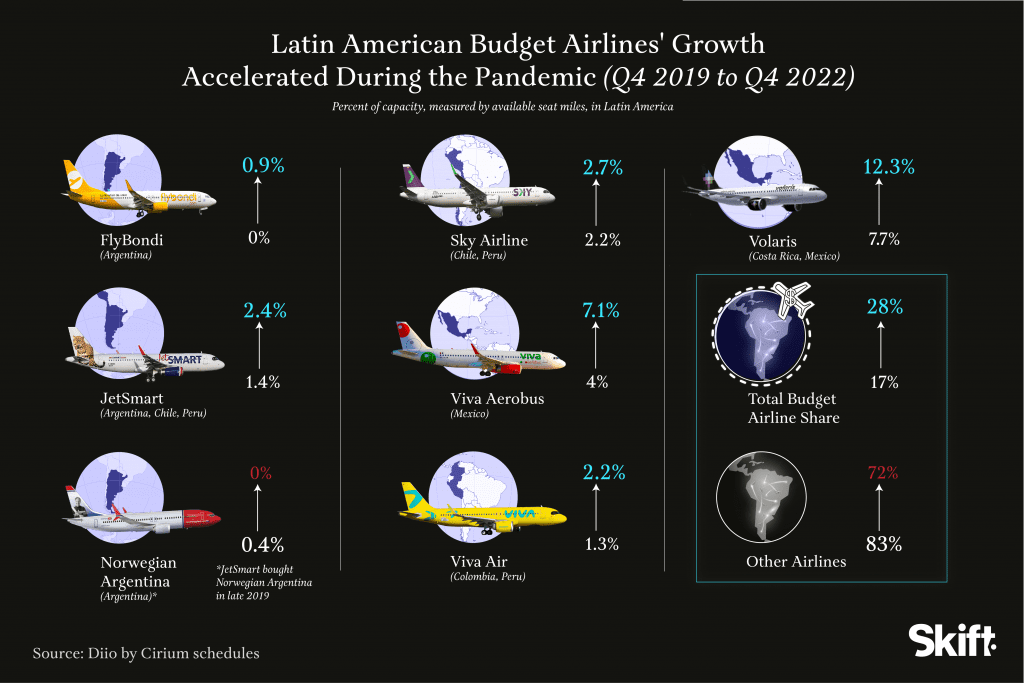

Discounters expanded its share of passenger capacity in Latin America dramatically during the crisis. Budget carriers are scheduled to operate roughly 28 percent of capacity in the fourth quarter, a nearly 11 points increase from the same period in 2019, according to Diio. No where is that growth more pronounced than in Argentina where discounters FlyBondi and JetSmart expanded their combined share of domestic capacity by 20 points to 32 percent in the fourth quarter.

The two Argentinian discounters have expanded into the hole left by Latam. The legacy airline closed its local operation as part of its bankruptcy in 2020. Aerolineas’ share of domestic Argentina capacity is roughly flat in the fourth quarter compared to 2019, Diio data show. But that growth is indicative of the direction of the market in Latin America towards a larger budget airline presence.

“The pandemic was good for JetSmart,” the airline’s CEO Estuardo Oritz said at the forum. “[It was] a moment for us to get the airline to a much better level of performance.”

That better performance included tighter cost control, adding new ticket distribution channels, and the previously mentioned launch of JetSmart in Peru, Ortiz said. In addition, JetSmart signed a new strategic partnership with American that will include a small investment by the U.S. carrier. Ortiz said approval of the deal is taking longer than initially planned but the premise remains the same: Continue to grow but as part of American’s AAdvantage loyalty program.

JetSmart, for now, is focused on expanding its depth in its existing markets, particularly Argentina and Peru, Ortiz said. He does not see the airline adding new domestic operations in other Latin American countries in the near future.

Mexico was another market where discount carriers posted large share gains during the crisis. Viva Aerobus and Volaris expanded their combined share of domestic capacity by nearly 18 points to 77 percent in the fourth quarter compared with 2019, according to Diio.

The expansion of Viva Aerobus and Volaris was primarily driven by two things: First, Aeromexico’s bankruptcy that limited its ability to grow until it exited Chapter 11 in March. And, second, the collapse of mid-tier airline Interjet at the end of 2020. Before it left the market, Interjet operated nearly 17 percent of domestic Mexico capacity, Diio shows.

Aeromexico, as part of its restructuring, doubled down on its traditional market, that is corporate and premium travelers particularly in Mexico City, as well as increasing connecting opportunities via its Mexico City hub. A partnership with Delta, which saw its investment in the airline cut to 20 percent from 51 percent as part of the restructuring, was retained. And Aeromexico raised nearly $1.5 billion in new equity and debt, including from private equity firm Apollo Global Management, which took a 22.4 percent stake in the carrier.

“We were headed down that direction already,” IATA’s Cerda said of budget airlines’ pandemic growth. These airlines focused on expanding the number of Latin Americans who fly, rather than taking passengers from the region’s legacy carriers. The pandemic accelerated this shift, he added.

But even in a growing market, not every airline will be successful no matter how low their fares. In Brazil, startup discounter Itapemirim Transportes Aéreos survived for only six months in 2021.

Leading The Industry

What Latin American aviation looks like when the dust settles from the pandemic is still unknown. But an educated guess would be one that looks a bit more like Europe; one with a few large legacy airline groups — think Abra and Latam — complemented by a few large discount carriers. In other words: Consolidation.

This is what de Juniac, and other leaders at IATA including Cerda, suggested in 2020 would happen to the global industry as it emerged from the pandemic. That financially weakened airlines would look at combining as a way to financially recover, and better prepare for the next crisis whenever it came. Latin American airlines just got there first.

“One of the long lasting impacts of the pandemic in the region will be accelerating — perhaps [by] two, three, to five years — the consolidation of the industry,” Viva Air’s Antelo said. “Absent a pandemic, that would have taken longer.”

Other regions are beginning to follow Latin America's lead. In Europe, the privatization of ITA Airways remains anyone's guess with the Lufthansa Group back in the running with Air France-KLM. TAP Air Portugal has caught the attention of both Air France-KLM and IAG. And IAG also wants Air Europa, and maybe EasyJet. Kenya Airways and South African Airways may partner to form a larger African group. And in Asia, Korean Air's takeover of Asiana is slowly winding through the approvals process.

But airline consolidation comes with its tradeoffs. In the U.S., for example, budget airlines — also a growing market segment there — repeatedly talk of issues expanding into sought after airports, from New York to Los Angeles and Chicago, where large incumbents control the majority of available slots (the right for a flight to either land or takeoff), gates, or both. This is something Latin American regulators must take into account as they look at the Abra deal and others that emerge, especially given the region's notorious underinvestment in airport infrastructure.

Latin American aviation does have one thing on its side: Growth potential. The number of flights per capita in most South American countries is well below the number in Europe or North America, two mature airline markets. That, plus continuing strong travel demand through at least the end of the year, gives industry leaders some comfort in the future.

“There's room for everyone,” Copa Airlines CEO Pedro Heilbron said at the forum. “It's a continent, Latin America and the Caribbean, of over 600 million people. It needs aviation. The distances are very long. So we think there's room for all of us.”

And Copa, which has long been one of the region’s most steadily profitable and largest airlines, has managed to buck the trend, avoiding both bankruptcy and consolidation so far. That, Heilbron said, will not change: “We try to do the same thing but better.”