Skift Take

Warren Buffett provided a no-confidence vote in the near-future of U.S. airlines, but elsewhere in travel private equity firms are betting billions of dollars that Expedia Group and Airbnb will emerge from the coronavirus crisis in relatively strong positions. Uncertainty reigns.

It’s a pointed debate of the moment: How will travel get reshaped when the coronavirus crisis gets resolved?

Warren Buffett, chairman of Berkshire Hathaway, didn’t precisely wade into the discussion about which travel sectors might have an edge, but he made it clear in his annual address to shareholders Saturday that he’s not betting on airlines resembling their former selves in the next few years.

Buffett said Berkshire Hathaway has sold all of its shares in United, Delta, American and Southwest, stakes worth billions of dollars, CNBC reported.

“The world has changed for the airlines,” Buffett said, according to the CNBC story. “And I don’t know how it’s changed and I hope it corrects itself in a reasonably prompt way. I don’t know if Americans have now changed their habits or will change their habits because of the extended period.”

The Berkshire Hathaway chairman mused that passengers in the next three or four years may not log as many flying miles as they did last year — before the pandemic.

Buffett said Berkshire Hathaway sold all its airline shares in a block, as is its custom, rather than merely paring down its stock positions. He added that all four airlines have “excellent CEOs.”

In 2016, Berkshire Hathaway had reversed its longtime distaste in airline investing when it bought shares in the four largest U.S airlines, and now the company has done an about-face again.

“When we bought [airlines], we were getting an attractive amount for our money when investing across the airlines,” he said. “It turned out I was wrong about that business because of something that was not in any way the fault of four excellent CEOs. Believe me. No joy of being a CEO of an airline.”

Will Online Travel Agencies Be a Weak Link?

While Berkshire Hathaway placed its bet that U.S. airlines won’t revert to form for years, The Wall Street Journal on Saturday ran a story entitled Postvirus, Travel’s Middlemen Could Bear New Weight.

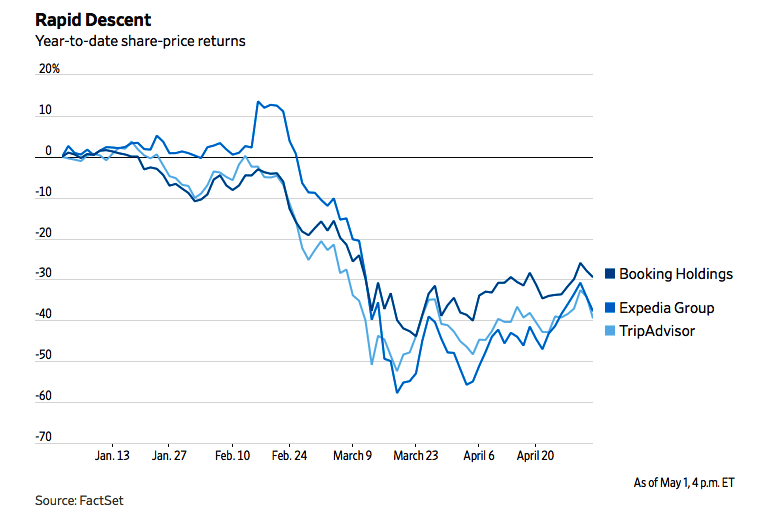

The Wall Street Journal story shows how the big public online travel companies —Booking Holdings, Expedia Group and Tripadvisor — have seen their share prices plummet 36 percent, on average, since January 1, and cites Airbnb as being in free-fall, as well.

Like Buffett, the Wall Street Journal argued that travel behavior may look different post coronavirus: Airlines are blocking off middle seats, and Airbnb is enforcing home downtime for cleaning with no guests allowed for 24 to 72 hours between stays.

There is also some evidence that some countries that recovered from coronavirus relatively quickly may blacklist still-recovering countries’ travelers from obtaining tourist visits.

“Flexibility, in addition to selection, might be a particularly compelling way for online agents to compete in a postcoronavirus market,” the Wall Street Journal story said. “The billions raised by online-travel companies assume they will re-emerge as independent marketplaces once the outlook clears. But takeoff could require far more expensive service.”

There are hundreds of questions about a travel recovery. Will homes in non-urban areas have an edge over hotels when travelers get on the road? Will the drive market be king and airlines be slower to come back?

While Buffett cashed in his airline picks, a bunch of private equity firms, including Silver Lake Partners, Apollo Global Management, and Sixth Street Partners, in the last few weeks have poured billions of dollars into Expedia Group and Airbnb, although these investors have guarantees of a hefty return.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, airlines, coronavirus, expedia, warren buffett

Photo credit: A Delta 747-400 aircraft. Berkshire Hathaway sold all of its shares in U.S. airlines, including Delta. Ted S. Warren / Associated Press