Skift Take

SAS is correct to raise the possibility that coronavirus will stick around. If the number of cases in Europe continues to rise as we head through the rest of the year, the impact on airlines in the region is only going to increase. The big caveat though, is that fuel prices are likely to remain pretty low in that scenario.

The CEO of Scandinavian airline SAS is concerned that the coronavirus outbreak might hang around until the peak summer holiday season, when it would have a much bigger impact on the aviation industry.

SAS estimates it will take a revenue hit of around $20.6 million (200 million Swedish crowns) with the overall impact described as “manageable” given the time of year.

“[If] this situation is spreading globally, and if it’s not contained before we enter into the summer season, it might be more problematic, not just for SAS but also for the industry as a whole,” Rickard Gustafson, SAS CEO told analysts on Wednesday.

That said, Gustafson has yet to observe any significant fluctuations in the booking data.

“It’s hard to guess where this is going. We don’t have a crystal ball to assess what’s going to happen. But what we can say is, as of now, when we look into the booking patterns for the summer season, they show kind of normal booking procedures. We see no abnormal events or happenings or development in our bookings,” he said.

Join Us at Skift Forum Europe in Madrid on March 24–25

The coronavirus outbreak shows no sign of abating with more countries across the world now reporting cases. The World Health Organization (WHO) said for the first time that the number of new cases reported outside China exceeded the number of new cases in the country.

The have been 80,239 cases across the world, according to the WHO’s most recent update with 2,700 deaths.

Aside from canceling routes to China and the softness in demand in other parts of Asia, the outbreak so far has had a fairly limited effect on non-Asian carriers — with some benefiting from the fall in fuel prices — but if it continues to spread, finances will take a hit.

On Wednesday, both Lufthansa and KLM said they were making some budget cuts because of coronavirus.

Flight Shaming

While SAS is keeping a watchful eye on coronavirus, other external issues are providing a more specific challenge.

Sweden, where SAS is headquartered, is arguably at the epicenter of the flight-shaming movement and the drift away from aviation, particularly in the domestic market is continuing.

Gustafson acknowledged that he had observed a “somewhat challenging market environment” with “a decline in overall demand for aviation services, especially in Sweden.”

He said, however, within that context, SAS had moved towards a “strengthened market position” but added that he did not want to see governments increasing aviation taxes.

“[If] there will be additional, taxes and fees that [are] being imposed by the government on the consumers, that will have a negative impact on demand.” Gustafson said.

“And I’m especially concerned that, that will not help our strive to quickly transform towards a more sustainable future, because these thin margins that we have will be even thinner and our ability then to free up the capital required to transform towards more sustainable future will be difficult.”

A New Airline Brand?

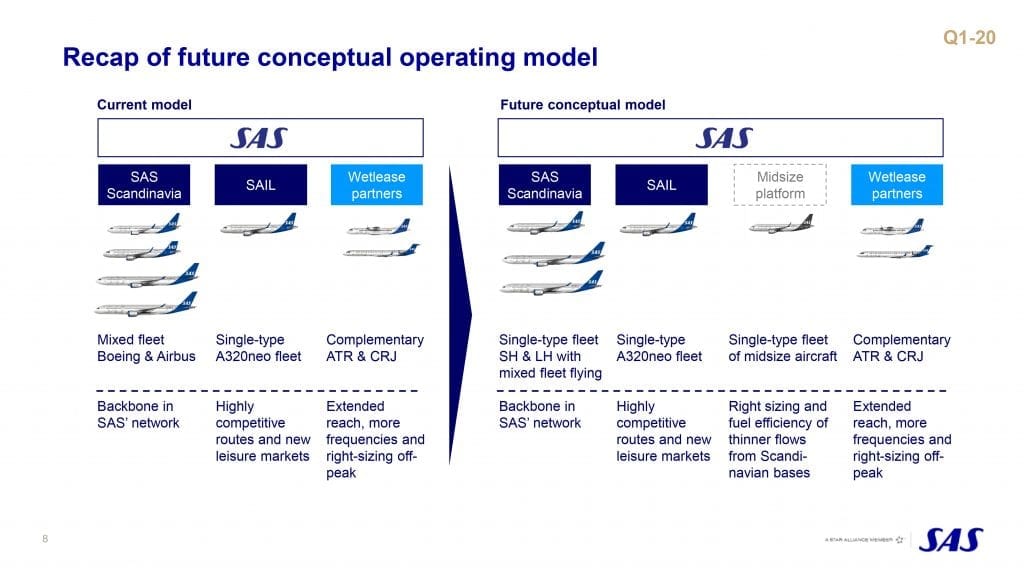

Over the last couple of months, SAS has floated the idea that it may add a new airline unit to its portfolio and in its first-quarter update offered some more details (see slide below.)

A slide from SAS’s Q1 presentation. SAS

SAS is thinking about a change to its group structure because of the need to replace some of its older Boeing 737-800s and Airbus A319s in its regional network.

The idea being, according to Gustafson, to “operate a regional structure on its own merits on competitive terms tailored for a regional operation in Scandinavia on Scandinavian terms.”

SAS has already reached an outline agreement with a Danish union over the potential operation.

In 2017 SAS created an Irish subsidiary (SAIL) in order to help it better compete on costs with its rivals.

First-Quarter Results

SAS reported a widening of losses during the company’s first quarter. Pre-tax losses increased by 88.7 percent to $111.7 million (1.1 billion Swedish crowns) for the three months to the end of January 2020. The company mostly blamed unfavorable currency fluctuations for the change.

Revenue during the period rose 3.2 percent to $997 million (9.7 billion Swedish crowns.)

Register now for Skift Forum Europe in Madrid on March 24–25

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: earnings, europe, sas, sas airlines, scandinavian airlines

Photo credit: SAS CEO Rickard Gustafson. The company reported its first-quarter results on Wednesday. SAS