Skift Take

Heading into 2020, we handpicked 10 reports we published in 2019 that touch upon the most important topics and trends in travel. These themes should be top of mind moving forward.

Skift Research had a truly pivotal year in 2019, as cliché as that sounds. With 28 research reports, three custom projects, and two research-driven Skift Forums/Summits to close the year, we believe we’ve added tremendous value to the travel industry and empowered our subscribers and readers with a strong knowledge base for propelling the industry forward.

One of the biggest achievements that the Skift Research team accomplished in 2019 is we’ve established ourselves as a data powerhouse. We believe in data-driven actions. We are passionate about providing the right data around the market trends and developments we cover so that our readers can spot what the real trends are leading to and see where their companies stand in their competitive market. We’ve done that in most of our reports published in 2019.

Below we handpicked 10 reports that touch upon the most important topics or trends in travel in 2019. We hope some (if not all) of these will make you pause and think how these can relate to your work — and help you make a great impact in what you do, in 2020.

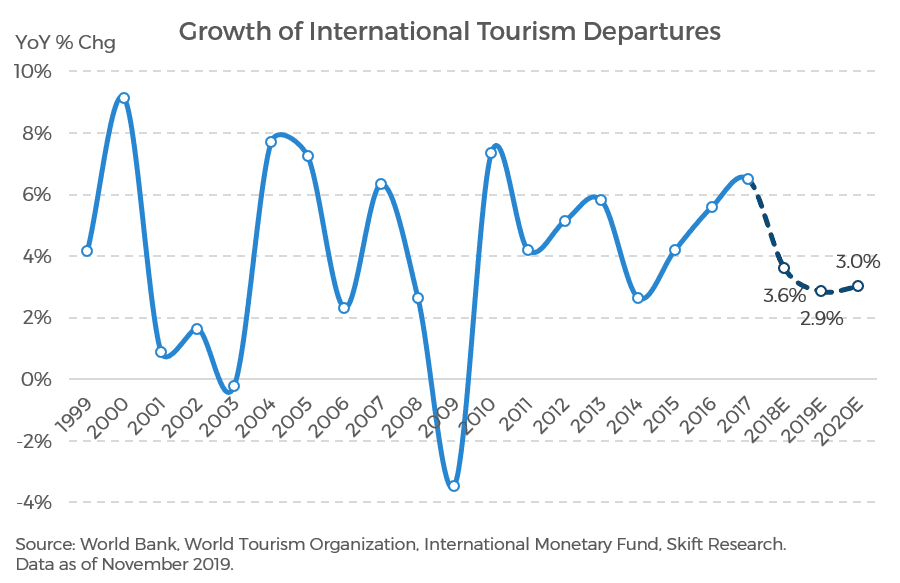

Skift Global Travel Economy Outlook 2020: We head into 2020 with more question marks than any year of this cycle. Risks are rising and the global economy is slowing. But, crucially, we are still growing and our base case forecasts travel growth to continue next year.

In this report, we forecast another good year for international tourism flows in 2020. After what we estimate to be 1.3 billion international tourism departures in 2019, we expect about 40 million new trips in 2020, growing the total by 3 percent to 1.34 billion.

Across the board in hospitality, online travel, and airlines, we anticipate further expansion throughout 2020, though key metrics are slowing, both as a result of a step down in economic growth and due to changing consumer tastes.

Downside risks are still ever present, perhaps most importantly, escalating trade wars across many regions. This could lead to a decoupling of growth where some regions slow more dramatically as others accelerate.

Exhibit 1: Growth of international travel may have slowed in 2019, but we expect reacceleration

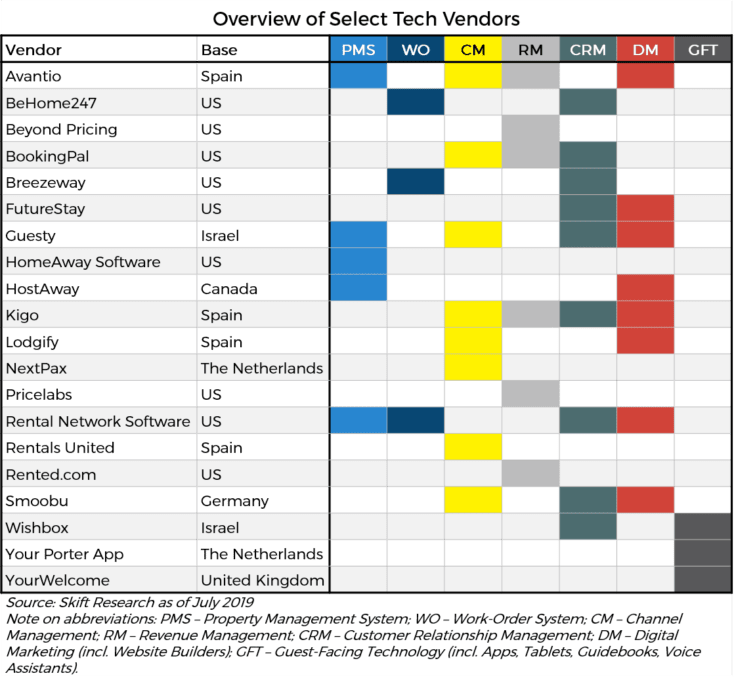

The Short-Term Rental Ecosystem and Vendor Deep Dive 2019: It’s easy to forget that Airbnb is only just over 10 years old, when looking at the impact that the short-term rental sector has had on the travel industry today and the extensive ecosystem that has sprouted up around it.

In this report, we provide data on the growth of the sector over the past decade and into 2019, highlight the performance of the top five companies, and provide a top 100 list of vendors that are shaping the short-term rental ecosystem today. We also discuss the major trends and latest developments, including the convergence with other travel accommodation sectors, and how commercialization will impact the sector and the legislation that is attempting to regulate it.

Exhibit 2: Twenty of the largest short-term rental tech players and their specialties

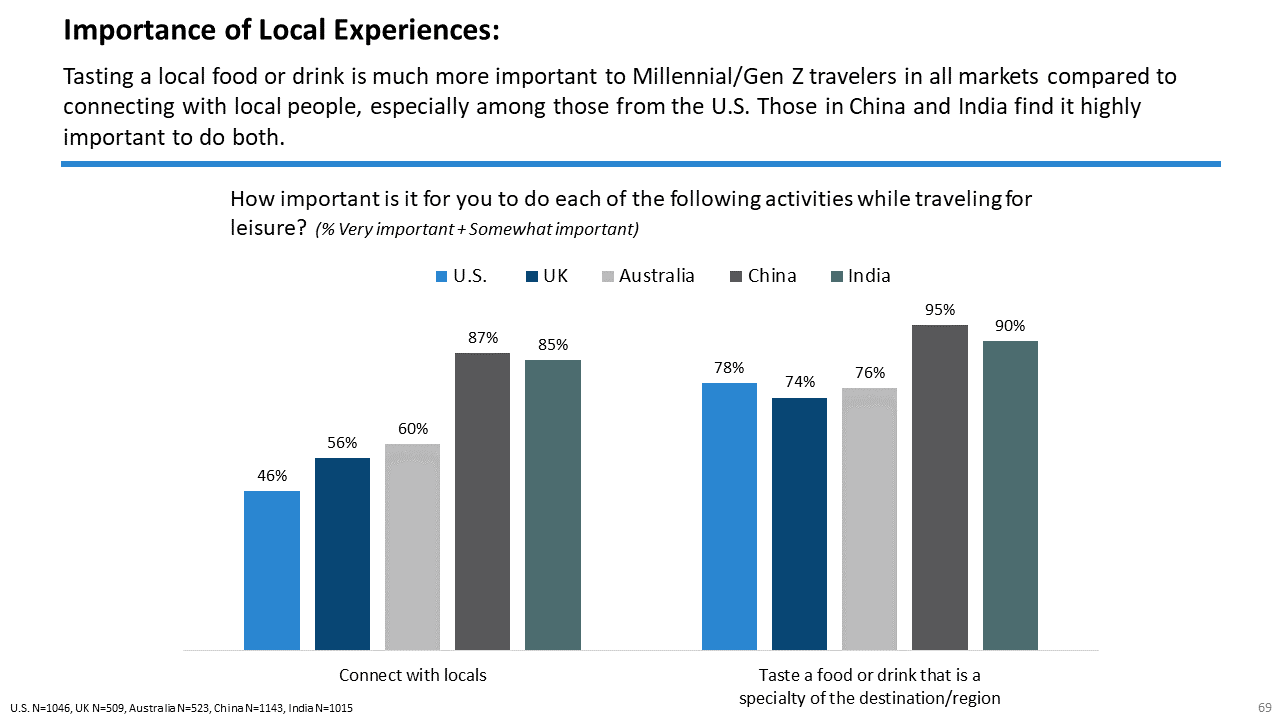

Millennial and Gen Z Traveler Survey 2019: A Multi-Country Comparison Report: Millennials have been in the travel industry’s spotlight for years already, yet they still remain somewhat of a mystery. As they continue to gain spending power, their successor generation, Gen Z, is hot on their heels. Thinking about these generational cohorts as a global collective however, risks painting the picture with too broad a brush.

This report presents findings from the first-ever edition of our Millennial and Gen Z Traveler Survey, a comprehensive look at travel inspirations and behaviors of travelers 16–38 across five major travel markets around the world: the United States, the United Kingdom, Australia, China, and India.

While the report is rich with data across the entire travel journey, we see two major takeaways. One, culture often plays a more pronounced role in shaping a person’s behavior and attitude than generational cohort. Two, life stage intersects with a generational cohort effect in a person’s behavior.

Exhibit 3: Young travelers in emerging markets are more interested in unique local experiences

Defining the New Era of Wellness Tourism: Trends and Best Practices for Stakeholders: There is perhaps no bigger trend in the travel industry today than wellness. Given the wellness boom outside of the travel industry, it only makes sense that it would eventually become a hot topic within it as well.

In this report, we focus on addressing four questions about wellness tourism: How big and important is the wellness tourism market? What are the trends that define the new era of wellness travel? What sectors are impacted by wellness tourism? What are the best practices for various stakeholders looking to attract consumers with wellness in mind?

Exhibit 4: Wellness travel is on the rise among affluent U.S. travelers

A Deep Dive into OYO 2019: The World’s Fastest Growing Hotel Chain: Oyo promises a new type of hotel company. It’s an asset-light brand that seeks to connect the global long tail of mom-and-pop hotels through its tech and distribution platform. But can it live up to the hype? Skift Research dives deep into Oyo’s business strategy and financial performance.

Skift Research sourced and reviewed hundreds of documents from Oyo dating back to 2012, including its internal audited financial statements, articles of incorporation, fundraising documents, marketing and operational agreements, and franchise disclosure documents. We also collected property- and room-level data for all of the publicly viewable listings on Oyorooms.com, giving us a data set of 21,000 properties and 380,000 rooms in 20 countries. We’ve combined these resources with Oyo’s public releases and press statement as well as with additional desk research.

The result is that we have pieced together what we believe to be the most thorough look yet into how Oyo runs its business.

UK Traveler Profile and Key Statistics: The Brexit Effect: The UK is an important contributor to global travel, but the uncertainty over Brexit will impact its place in the world and its residents’ willingness to spend on international vacations. The questions are just how and where the impact will be felt most.

This report starts with providing a better understanding of the UK traveler, with both volume and value data breakdowns for age groups, trip purpose, and travel destinations. Then we analyze the potential impact of Brexit on the travel industry under three possible scenarios. Our proprietary data provides an insight into the possible impact on UK inbound, domestic, and outbound travel for each scenario.

Figure 6: Outbound, domestic, and total trip spending by UK residents

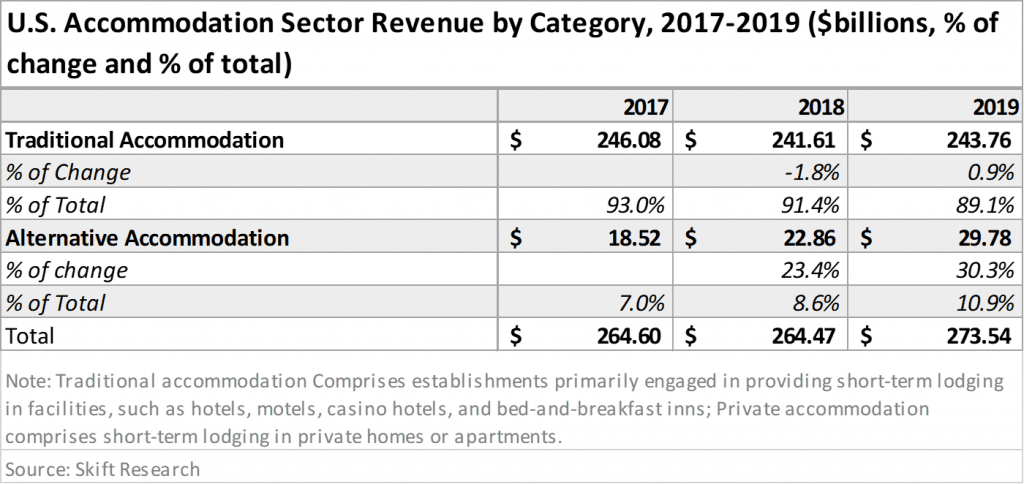

U.S. Accommodation Sector: Skift Research Estimates 2019: As one of the largest travel sectors, accommodations will continue to grow as travel becomes an even more integral part of consumer lifestyles. Yet it remains to be seen if the disruption from alternative accommodations will fundamentally shake up the entire sector.

We launched our first U.S. passenger airline sector estimates report in January. In this report, we continue our effort of sizing up the travel industry by focusing on accommodations, another of the largest and most important travel sectors. We estimate that the total accommodation sector in the U.S. generated $264.5 billion revenue in 2018. Among that, alternative accommodations — short-term lodging in private homes or apartments — reached nearly $23 billion, accounting for 8.6 percent of the market. After a flat 2018, we expect a 3.4 percent rebound in 2019 and forecast total revenue for the sector to reach $273.5 billion.

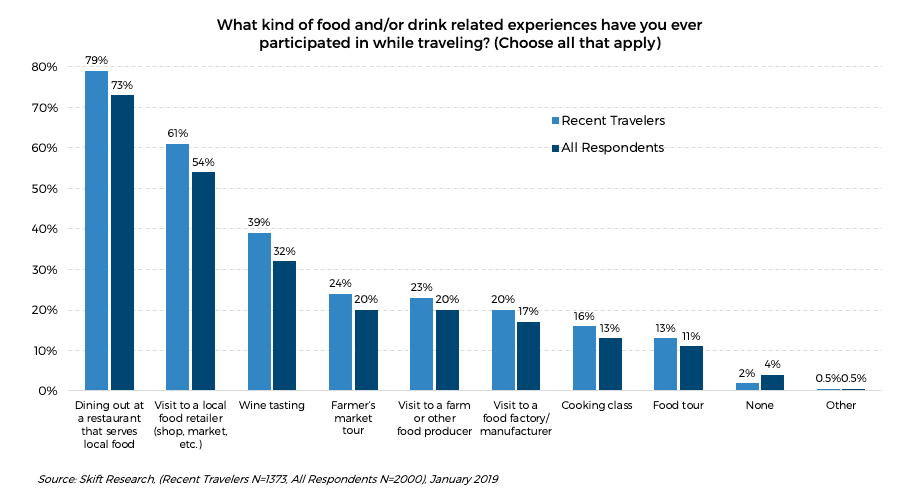

The New Era of Food Tourism: Trends and Best Practices for Stakeholders: Over the past few years, food tourism has been a buzzy trend in the travel industry. Not only is it appealing to a large population of travelers, but it also has the potential to boost in-destination spending, and therefore, positively benefit local economies and small businesses.

In this report, we lay out the emerging trends around food tourism and provide best practices for stakeholders across all relevant sectors.

Exhibit 8: Top food- and/or drink-related activities by U.S. travelers

An Expanded View of Hotel Loyalty Tech 2019: Not so long ago, hotel loyalty programs were front-runners in design and innovation. Today many programs have gone stale, commoditization has wreaked havoc on the perceived benefits and rewards of these programs, and the epicenter of innovation has shifted to industries like retail.

This report introduces an expanded view of the loyalty tech landscape, encompassing tools and services that can instill loyalty by improving service standards, providing a more personalized experience, and an increased and improved guest engagement. Only by including all these services in the loyalty undertaking can hotels win back loyal guests.

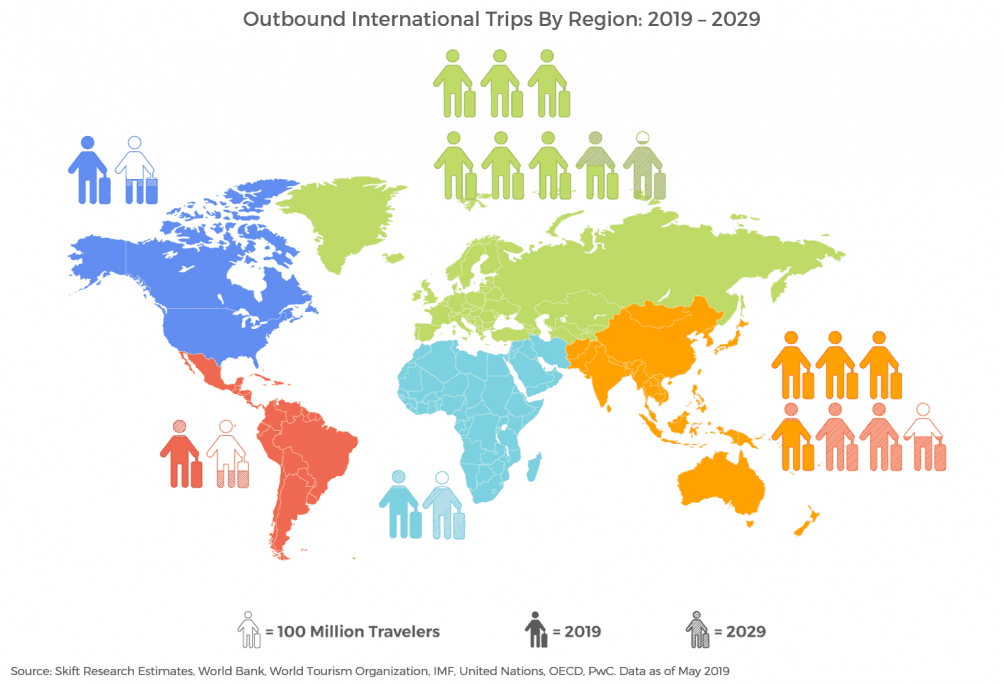

Global Travel Economics 2019–2029: Demographics, economics, and travel are all inextricably linked. Growing populations, especially in the developing world, mean enormous potential for new outbound travelers. This potential energy is converted to the kinetic movement of people when populations experience economic development that allows them to afford international travel.

This report presents a picture of the state of global travel today and to forecast its development over the next decade. We forecast that as many as four out of the next five new outbound travelers in the next decade could come from the emerging world. Are you prepared for the center of gravity in travel to shift?

Exhibit 10: Distribution of the world’s international travelers today and in a decade

Have a confidential tip for Skift? Get in touch

Tags: skift research