Skift Take

The vacation rental sector is still pretty fragmented with plenty of single destination specialists still around. Awaze, with its private equity backing, wants to change this.

Awaze, the newish name for what was once Wyndham’s collection of European vacation rental businesses, is looking to buy up more of its competitors in a bid to consolidate its position across the continent.

Platinum Equity bought the company — which operates brands including Hoseasons, Landal GreenParks, and Novasol — for $1.3 billion last year and is backing the management team with further funding.

“We have an ambition to both grow organically and through acquisitions if we find a good, attractive deal out there,” CEO Henrik Kjellberg told Skift.

Join us at Skift’s Short-Term Rental Summit in NYC on Dec 5

According to accounts recently filed in the UK, the group spent $23.1 million (€20.9 million) on five acquisitions during the course of 2018, helping to boost the number of properties in the UK, Greece and Spain.

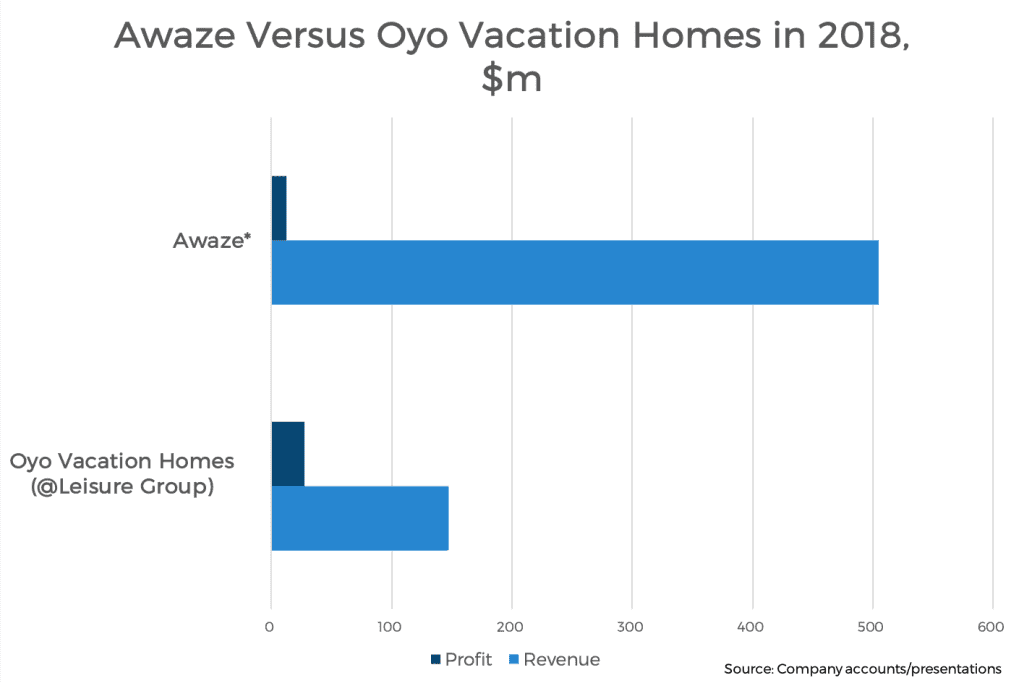

For the final 11 months of 2018, the group generated $505 million (€457 million) in revenue and made a profit (EBITDA) of $12.8 million (€11.6 million). Comparative figures for the previous year were unavailable.

Kjellberg said the 2018 numbers included quite a lot of “one-offs” associated with the Platinum acquisition and that 2019 was “looking good”.

“There’s massive opportunity in the market and we are investing in delivering better technological solutions and acquiring more properties. If anything, I think we’re taking a more aggressive outlook…in terms of wanting to conquer more market share,” he said.

Wouter Geerts, Skift senior research analyst, and the author of The Short-Term Rental Ecosystem and Vendor Deep Dive 2019, said the gradual professionalization of the short-term rental sector was good news for a company like Awaze.

“While the majority of short-term rental properties today are hosted by amateur hosts, there is a growing demand for professional standards in the sector. Awaze is in a great position to benefit from this, with a proven track record of managing properties,” he said.

“That being said, there is a thriving ecosystem of other management companies popping up left right and center trying to emulate this business model. Competition will become stiffer, but with extra investment, the company will surely look forward to this challenge.”

Booming Sector

Many of the businesses in the Awaze portfolio have been around for decades but the buzz around vacation rentals has gathered pace in the last few years.

Airbnb, HomeAway and others have made it possible for anyone to list their home, expanding the number of properties available and moving the supply into urban areas.

Awaze is slightly different to the above two companies in that it manages the properties as well as distributing them both directly — its preferred option — and through third parties.

“In fairness one of the things that I’ve learnt is that many of these distribution channels are actually quite happy to have us because when you have managed vacation rental as opposed to vacation rental by owner typically the service for both guests and owners is better and therefore conversion is better and overall satisfaction rates are better,” Kjellberg said.

With the sector becoming more popular with consumers, new entrants are joining the alternative accommodations rush. Hotel companies like Accor and Marriott have their own offerings and earlier this year fast-growing Oyo bought @Leisure Group — which has managed and self-service brands — from media giant Axel Springer and other shareholders for $415 million (€369.5 million), rebranding it Oyo Vacation Homes.

*11 months only

Looking at the most recent annual results Awaze generates more revenue but Oyo Vacation Homes is better at squeezing out profit – at least for now. By way of comparison, Expedia’s HomeAway division, which is mostly made up of independent hosts, generated revenue of $1.2 billion in 2018 and profit (adjusted EBITDA) of $288 million. (The numbers for Awaze only cover the final 11 months of 2018, so its profit and revenue are likely slightly higher.)

“The market for people who traditionally went only to hotels is now going much more into vacation rental as that happens I expect lots of people to be interested in it, whether that be Oyo or Expedia or Booking or ourselves,” said Kjellberg.

Anti-Flight Movement

The flight shaming movement has gotten a lot of attention in Europe, especially in Scandinavia and while most people aren’t willing yet to give up their holidays abroad, there’s at least a recognition that flying is bad for the environment.

In five or 10 years things could be very different, especially with the growing number of eco-taxes. If that’s the case then companies like Awaze, which mainly market to domestic travelers might see a considerable bump in sales.

“What we offer is very much an eco-friendly, stay local product and that is indeed where we see most of our demand coming from,” Kjellberg said.

Details of the financial results of the entire Awaze group are contained in the accounts for PE Compass Holding II Ltd. The consolidated income statement for the company shows an overall pre-tax loss of $97.2 million (€88 million), with net finance costs of $35.7 million (€32.3 million). Substantial loan interest repayment charges are a common occurrence in private-equity backed takeovers.

Get your tickets for our Short-Term Rental Summit – Dec 5, NYC

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: alternative accommodations, awaze, expedia, homeaway, oyo, vrbo

Photo credit: Landal De Vlinderhoeve in the Netherlands. Parent company Awaze is looking to grow. Landal GreenParks