Skift Take

The United Kingdom hasn’t left the European Union just yet, but the impact of the Brexit vote is already being felt by the travel industry. Things will likely get worse when the UK actually leaves.

Brexit has turned into one of the most divisive developments in the United Kingdom’s recent history — and a political nightmare. Many industries are caught in the middle, with businesses scampering to prepare for an uncertain future.

Travel is far from immune to the impacts of Brexit. The UK has the fourth largest international travel spend worldwide, with especially the EU benefiting from a strong drive from UK residents to travel beyond their country’s borders. Meanwhile, the UK is the fifth largest destination for travelers, highlighting the importance of travel for the country’s economy.

In UK Traveler Profile and Key Statistics: The Brexit Effect, we define the British traveler by setting out key demographics, behavioral traits, and travel demands. We then build scenarios and estimate the impact that Brexit will have on UK travel over the next five years. With Brexit negotiations dragging on, uncertainty is rife. One thing we can be certain about is that this uncertainty won’t help the UK travel industry.

Last week we launched the latest report in our Skift Research service, UK Traveler Profile and Key Statistics: The Brexit Effect. Below is an excerpt from this report. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

TRAVEL PERFORMANCE SINCE THE BREXIT VOTE

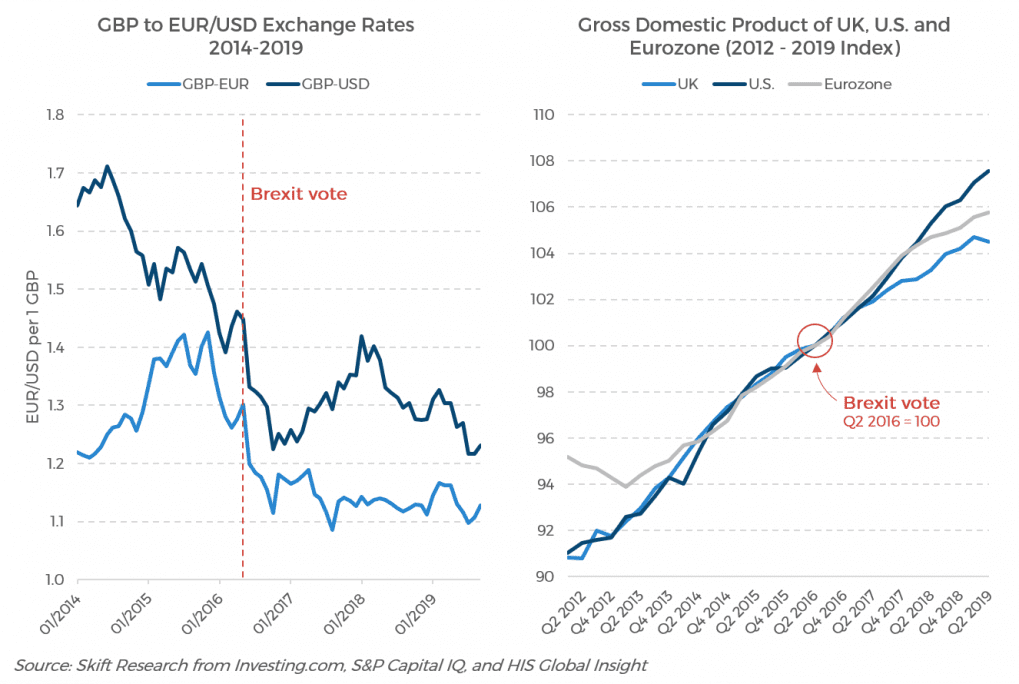

The vote in 2016 was expected to throw the country in an immediate recession, but this did not happen. Instead, GDP continued to grow and unemployment continued to decline. Q2 2019 is the first time since the Brexit result that the economy is starting to show actual signs of contraction, but to put this down solely to the Brexit negotiations would be too simplistic.

What we can say with certainty, however, is that the pound has fluctuated and fallen strongly since the Brexit result, as the political situation can only be described as chaotic, and an investigation of the economic performance of major economies shows that UK growth, albeit largely positive, has fallen behind other countries.

In terms of tourism, we are seeing a similar situation. In the direct aftermath of the Brexit vote, tourism did not seem to be impacted, but as the uncertainty lingers, the first signs of cracks are starting to appear. Again, it is impossible to contribute a fall in tourism solely to Brexit, but it’s likely to be one of the contributing factors.

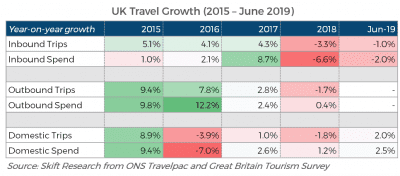

In the first six months of 2019, international arrivals to the UK have fallen by 1 percent, while spending fell by 2 percent. This is on the back of 2018, which saw significant declines as well. This is especially interesting as we would normally expect that a falling pound would make the UK more attractive to foreign visitors (cheaper holidays), and while this seems to have boosted performance in 2017, since then there has been a steady fall.

Preview and Buy the Full Report

A spokesperson for VisitBritain, the UK tourism board, told Skift that its research had shown one of the reasons for the decline was “the uncertainty [that] Brexit is having for visitors from the EU,” although there will be other factors involved too.

The latest results from the domestic travel survey, the Great Britain Tourism Survey, up to June 2019, show a decline in June of 2.1 percent in trips compared to the year before, but year-to-date data actually shows an increase of domestic trips by 2 percent compared to the same period in 2018. Spending through to June 2019 is up by 2.5 percent compared to 2018. This follows several years of decline and limited growth.

The outbound survey Travelpac is undertaken throughout the year and only released at the end of the year, so we do not have any insight into the effects of the latest economic and political developments just yet. Here as well, however, performance was showing signs of stagnation in 2018. Rising domestic trips in early 2019 could indicate a continuing shift away from outbound travel, especially since we are seeing GDP starting to dip in Q2 2019.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: brexit, skift research, skift research estimates, UK Traveler

Photo credit: March from Trafalgar Square to Parliament to protest the result of the British referendum on membership of the European Union. In the latest Skift Research report, we examine the impact Brexit could have on UK travel five years out. Sam Greenhalgh / Flickr