Skift Take

Package holidays are changing and under pressure, but in markets such as the UK, Germany, China, and Canada, these offline options still have their place. Failure to adapt was a contributing factor in Thomas Cook's demise, but there were a whole bunch of other things going on as well.

In the wake of Thomas Cook’s demise, if you think that the package holiday business is “screwed, it’s over,” as Ryanair boss Michael O’Leary believes, then you’d be wrong.

At least, that’s the case in two very important European outbound markets, the UK and Germany, where package holidays still have a solid foothold. In Asia, package holidays still have a substantial grip in China, as well, for example.

Sure, traditional tour operator package holidays, mostly sold offline and featuring set combinations of flights and hotels, are facing pressure from the growth of online travel agencies and their dynamic packages, where travelers have more flexibility to choose from a variety of flights and hotels.

The propensity by consumers to book online and directly with low-cost carriers or hotels is altering both models.

But offline vacation packages, if not the dominant way to book vacations, are holding their own in certain markets. Although Thomas Cook acknowledged that it had weakness in its business model in terms of the risk it took in pre-buying room blocks and airline seats to create packages when it didn’t own the hotels and planes, its failure to adapt to the digital economy was one among a host of factors that led to its closure.

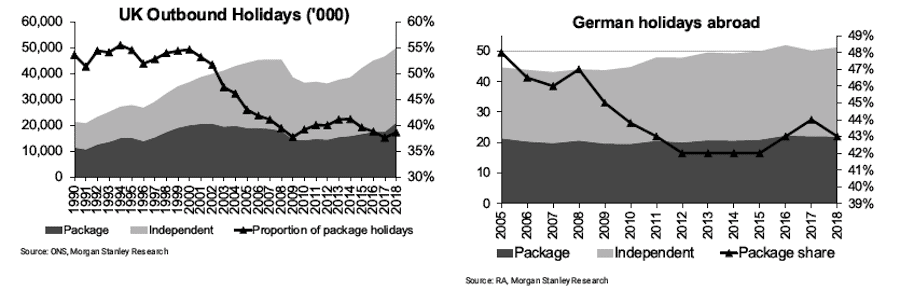

A Morgan Stanley research note last month about the shuttering of Thomas Cook found that both UK and German “package holiday volumes have been increasing for a decade and maintaining market share of total volume.” That means that other ways to book travel, such as through online travel agencies or directly with airlines and hotels, are dominant.

Still, as shown below, the market share of UK and German outbound package holidays was solid and just less than 40 percent and 43 percent in 2018, respectively, Morgan Stanley found.

Outbound Package Holiday Market Share UK and Germany

Low-cost carriers and online travel agencies have put a chill into the businesses of traditional tour operators, with their high overhead costs, Morgan Stanley said, but other factors likewise took their toll.

“Thomas Cook, like TUI, was remixing its business towards more hotels under its control and brands, but the impact of airline overcapacity, a demand shift from Eastern to Western Med, last year’s hot weather, and significant debt burden are also just as much to blame,” the research note said.

The UK travel agency association, ABTA, found in June that half of UK vacationers heading outside the country booked package holidays, and the figure has held steady since 2014. The association noted, though, that their preferences are trending toward “packages that include tailor-made trips, tours that take people off the beaten track, adventure holidays, river and ocean cruises, well-being breaks, and all-inclusive.”

One advantage that package holidays in the UK enjoy over vacation packages booked countries like the United States is their ATOL protections, which ensure that UK travelers will get refunds and repatriated home if their travel company tanks, as Thomas Cook did.

Beyond the UK and Germany, package tours are holding their own in China. Online travel agency Ctrip still conducts a lot of its business, including its package tour segment, over the phone and offline. The Shanghai-based company reported that its packaged tours segment gained market share and accounted for 12 percent of the company’s overall revenue in 2018. Ctrip saw its packaged tour revenue climb 27 percent in 2018 versus the previous year.

Changing Consumer Behavior

Just as the UK’s ABTA acknowledged, both Thomas Cook and TUI realized that they were facing challenges in the traditional tour operator package holidays business from online travel agencies, low cost carriers and cruise lines. The challenge prompted both companies to add more flexibility for customers in booking package holidays online, and for TUI to emphasize exclusive content, including a tilt toward all-inclusives.

In announcing its full-year 2018 results in November, before the ax fell 10 months later, Thomas Cook vowed that among its priorities in 2019 would be to “reduce committed risk capacity and increase dynamic packaging.”

In the traditional tour operator model, businesses often buy room blocks and airline seats, and are on the hook for them even if travelers don’t show up to book these vacations.

Thomas Cook added that while 20 percent of its customers booked more package holidays in 2018 than three years ago, more than two-thirds of its customers expressed an interest to personalize their holidays. In the too-little-too-late category, Thomas Cooked launched new features, Choose Your Favourite Sunbed and Choose Your Room to meet those needs.

Likewise Birgit Conix, chief financial officer of TUI, which is the largest public company tour operator still standing, said during its full-year 2018 earnings call in December that fiscal year 2019 would be challenging, particularly because of “competitive threats from OTAs (online travel agencies) and dynamic packaging.”

Tour Operator Adaption?

Brett Tollman, CEO of The Travel Corp., with its 42 tour operator, cruise, and hotel brands, argues that the death of Thomas Cook had “little if anything to do with the future of package travel and all to do with a poorly run, too-diversified business burdened by over $2.5 billion in debt, no vision or plan to turn the business around since Ms. Harriet Green left four years ago, with an airline, and 600 poorly run retail stores etc.”

Tollman said his company’s repeat guest rates increased more than 30 percent over the past five years as it invests in technology and diversifies the company’s business model “as demanded by today’s consumer behavior.”

“We have no debt, no airline, no retail shops,” Tollman added.

Over at G Adventures, a Toronto-based tour operator, Brian Young, who’s the company’s managing director for Europe, Middle East, and Africa, said the business has notched double-digit growth over the last few years.

In the past few years, the introduction of cruise holidays, low cost carriers, and city break getaways created demand and changed the tour operator market, he said.

“We still have people who want a package holiday to the beach,” Young said. “There is still huge demand for that.”

But increasingly customers are taking vacations of seven or 10 days instead of two weeks, and they are looking for off-the-beaten track or experiential holidays, he said, adding “there is an element of beach boredom.”

Although some customers might do “a separate 2-day holiday to Mallorca to chill” instead of planning just one 14-day excursion, Young said.

One strong advantage of package holidays over online travel agency dynamic packages, Young said, is tour operators can control the product and experience end to end, delivering a higher level of service.

Online Travel Agencies Tweaking Dynamic Packages

U.S.-based online travel agencies such as Expedia and Priceline having been combining flights, hotels and cars in dynamic packages for more than a decade, and they are a staple of those businesses, although the companies generally don’t break out their package revenue numbers.

“In 2018 across Expedia Group, average daily rates remained consistently higher than standalone stays, and booking windows remain longer with an average of 16 days added,” said Bridget Benelisha, an Expedia spokesperson. “Also, cancellations were two times lower than standalone bookings.”

When it comes to international packages, the length of stay tends to be longer than for domestic packages, “and cancellations are four times lower than global standalone bookings.”

In 2018, Expedia ran a marketing campaign to tout a feature that enabled customers to tack on a hotel after booking a flight for one package price — with the price of each element hidden in the bundle.

Expedia Group CEO Mark Okerstrom said in July 2018 that he thought the company was attracting incremental bookings from the package feature, which was generating higher growth in booked room nights.

It’s clear that package holidays will continue to vie with the more flexible online dynamic packages, and their grip will vary according to prevalent consumer behaviors market to market. But even in countries such as the UK where package holidays have been a reflexive way to book travel for decades, consumers want more choice and the business model will have to give.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: consumer behavior, expedia, online booking, package holidays, packages, thomas cook, tui, vacations

Photo credit: TUI customers enjoy a beach holiday. The tour operator favors packaged holidays but has tweaked its model over the years. TUI Group