Skift Take

The same rules that apply to run-of-the-mill travel sellers do not necessarily apply to Amazon. While cash back on flights in India may seem loss-generating and unsustainable, for Amazon it could be a winning strategy.

So why would Amazon choose to reenter the travel industry through a seemingly loss-generating proposition, hawking already low-margin airline tickets via a Cleartrip partnership in the domestic Indian market?

It sounds crazy, but Skift Research believes that airline tickets are a sensible entry point for a new Amazon foray into travel.

Flights is a fairly commoditized product with far fewer suppliers to tangle with — hundreds of airlines worldwide versus hundreds of thousands of hotels, for example. But the challenge of selling airfares is that it is a low-margin offering, typically the least profitable product for online travel agencies.

In its most recent fiscal year, MakeMyTrip, India’s largest booking site, earned an aggregate commission of 7.3 percent on the airline tickets it sold. That is before up-front cash discounts, a common travel marketing tactic in India.

Given that margin, there is already little room to maneuver, and this conundrum is compounded by the fact that India has some of the lowest domestic airfares in the world, meaning that fixed rupee discounts can quickly translate into high discounts as a percent of the total booking value.

MakeMyTrip in aggregate provides a promotional up-front discount of 6 percent on the value of travel products it sells. Hotels are more heavily discounted and that airfares tend to be discounted by smaller amounts or less frequently, amounting to about 2 percent in aggregate. We should note, though, that the aggregate cash discount figure is skewed downward by customers who purchase full-fare products.

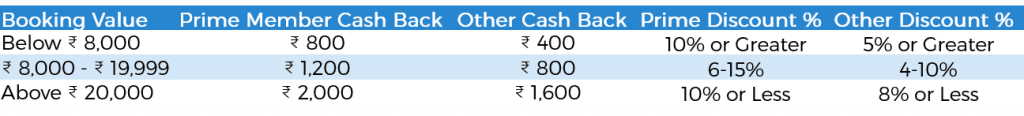

With that baseline in mind, Amazon’s initial promotional discounts on flights in India range from 4 percent to 10 percent for non-Prime members.

That leaves us with some tricky margin math for Amazon: a mid-to-high single-digit commission, presumably a revenue share agreement with partner Cleartrip, and cash back discounts to boot.

To that end, it should be noted that all three major Indian online booking sites, namely MakeMyTrip, Yatra, and Cleartrip, produced a loss in their latest fiscal years.

Amazon Cash Back on India Flights

Source: Amazon

Amazon’s international retail operations (though not India-specific) are also in the red, but we would argue that Amazon has advantages over its Indian travel rivals, namely its Prime membership program and broad product offering.

Amazon Prime members stand to gain an additional 400 rupees in cash back on flights, or in percentage terms an additional 2 percent to 5 percent, bringing the total discount to 6 percent to 15 percent of booking values. However, Amazon Prime in India costs 999 rupees (about $15) annually, meaning the extra Prime customer discount is being more than fully subsidized by membership dues.

An Advantageous Product Offering

Amazon’s second advantage is that it has a broad product offering, much of which are low-value, high-frequency purchases. That stands in sharp contrast with travel purchases, which are typically expensive and bought only once or twice a year. Further, Prime customers tend to stay within the Amazon ecosystem and are estimated to spend twice as much as non-Prime customers.

This means that Amazon can offer potentially loss-making discounts on airfares to Prime customers but earn it back when those same customers return the next week to purchase clothes, electronics, or books; as well as recouping the discounts from those customers’ Prime fees.

On the other hand, MakeMyTrip or Yatra might have to wait months for a customer to return, and in fact may never reacquire that customer.

Instant Gratification

In our Skift Research report Amazon: Lessons, Threats, and Opportunities for Travel, we noted as a lesson for the travel industry that loyalty programs should strive to create true value for the customer and then be unafraid to ask them for something in return.

Amazon Prime offers instant gratification by unlocking a range of discounts and services immediately and, in return, Amazon can ask for a membership fee that it then reinvests in product pricing.

In contrast, many travel loyalty programs are built around delayed rewards from accumulated points or miles. All too often, these programs can be overly transactional, and rather than engendering loyalty, they instead devolve into an end unto themselves to be gamed by customers.

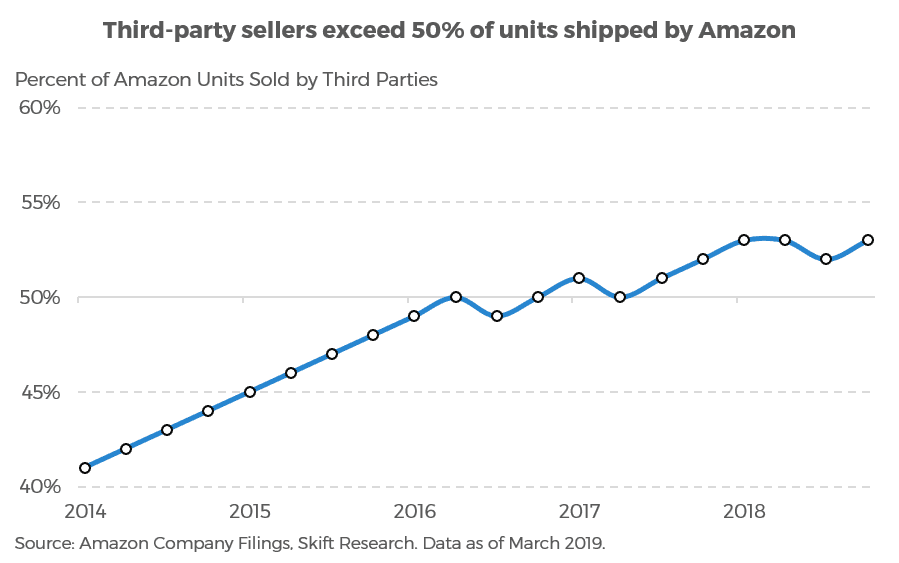

Third-Party Sellers

Source: Amazon

Automotive Metasearch

An Amazon metasearch offering, opposed to a full-fledged booking site, could make sense.

Speaking of the Cleartrip partnership, Dan Wasiolek, senior equity analyst at Morningstar, said: “To me this shows that Amazon’s potential reentry into travel will be more of the partner/metasearch route versus the build-your-own online travel agency that they trialed and moved away from previously.”

In this way, Wasiolek said, Amazon would not be in direct competition with Booking Holdings and Expedia Group.

“In the end, Amazon would be another indirect marketing channel for Booking and Expedia, like Google and TripAdvisor, mitigated by their own direct-booking efforts, which could lead to higher marketing spend for the online travel agencies, all else being equal,” Wasiolek said.

Skift Research also noted in its report, Amazon: Lessons, Threats, and Opportunities for Travel, that there is an interesting parallel between travel and the approach that Amazon has taken to selling vehicles. Like travel, purchasing a new car is a low-frequency, expensive, and research-intensive process. We note that, while Amazon wants a piece of that market, it has so far not entered the space directly by offering inventory.

Instead it launched Amazon Vehicles as a “research destination.” The site features research tools, such as prices, specifications, and images for thousands of new and classic car models. It also offers the ability for car owners to leave reviews and for prospective buyers to ask questions. It is, effectively, a metasearch site.

We believe that this could be another way for Amazon to further develop its travel platform, working with online travel agencies or others in a metasearch-like fashion rather than developing its own in-house offerings.

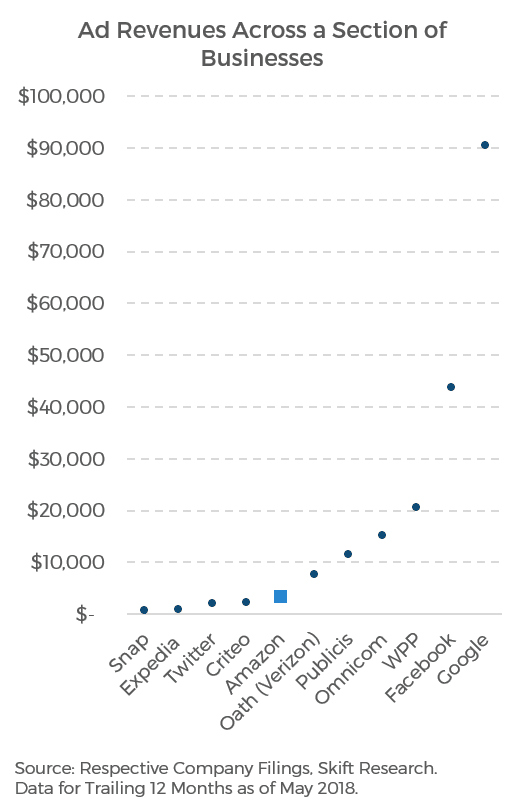

Some form of travel metasearch would also open up the chance for greater travel advertising partnerships with Amazon. Amazon has steadily grown into a large digital advertiser, one which Skift Research believes could generate in excess of $3.5 billion annually, though no precise figures are disclosed. That would mean Amazon’s digital ad revenues already surpass those of Twitter.

Amazon Ad Revenues Surpass Criteo, Twitter, and Snap

Amazon’s advertising bread-and-butter is selling sponsored product listings on its site, but it is increasingly promoting display banner ads and video ads for Kindle and Prime Video, as well as other formats. Amazon is also building third-party display advertising inventory, such as on IMDb, as part of what it calls its Amazon Advertising Platform. It is also trying to add what it calls non-endemic advertisers, which are interested in reaching Amazon’s large audience.

Amazon’s advertising bread-and-butter is selling sponsored product listings on its site, but it is increasingly promoting display banner ads and video ads for Kindle and Prime Video, as well as other formats. Amazon is also building third-party display advertising inventory, such as on IMDb, as part of what it calls its Amazon Advertising Platform. It is also trying to add what it calls non-endemic advertisers, which are interested in reaching Amazon’s large audience.

This is welcome news for the travel industry, which has long been beholden to Google and Facebook. There are clear positive implications if Amazon can crack open that online advertising duopoly.

Initial Steps

Amazon’s decision to mount a travel industry comeback though a domestic flights partnership with online travel agency Cleartrip in India is revealing, but it is merely a tentative first step and doesn’t preclude a variety of other options, including investments and acquisitions, at a later stage.

The move to tap flight inventory via an online travel agency partnership stands in stark contrast to Amazon’s ill-fated effort in 2014 to build a hotel-booking business from the ground up. Amazon abandoned that go-it-alone approach about a year later and hadn’t been heard from in the travel business, apart from nascent moves in travel advertising, as well as more-full-blown initiatives in the form of Amazon Web services, until this week.

Although flight bookings are getting more complex because of the mashup of fees, fare types, and ancillary services, they have tended to be a commodity booking, which is harmonious with the Amazon marketplace approach and its ever-expansive roster of products.

The fact that Amazon is testing flight booking in India via a Cleartrip partnership doesn’t mean that Amazon wouldn’t acquire a metasearch player such as TripAdvisor or an online travel agency such as Expedia Group to grab travel market share and attain a full-fledged travel offering in an expedited manner.

Either TripAdvisor or Expedia would clearly be affordable for Amazon, with its $932 billion market cap.

Amazon could also toy with acquiring a global distribution system, such as Amadeus or Sabre, to spearhead flight connectivity, although Amadeus has nearly twice the market cap of Expedia, $34.2 billion for Amadeus versus $17.3 billion for Expedia.

But buying a global distribution system such as Amadeus or Sabre would be a less-than-stellar solution in terms of hotel relationships, where they fall short. There would also be too much legacy technology and extraneous business lines, such as their airline IT divisions, to make an Amazon purchase of a global distribution system desirable.

Cleartrip Partnership

It perhaps should be no surprise that Amazon is offering flights in partnership with Cleartrip rather than developing its own in-house capabilities and distribution relationships. Not only did Amazon struggle with building out its own hotel offering in 2014, but in the time since, it has found great success in opening up its marketplace to third-party sellers.

Third-party sellers now exceed 50 percent of all units shipped by Amazon and more sellers bring further selection, improving the overall shopping experience for customers. It makes sense that Amazon would want to expand this third-party seller model beyond physical goods and into services such as travel.

Synergies With Expedia

But consider some of the synergies that Amazon could leverage with a purchase of its Seattle, Washington, neighbor Expedia. The online travel agency has been carrying out a massive migration to cloud computing through Amazon Web Services, a task Expedia began in 2016. Tech development in such an environment would fit right into Amazon’s playbook.

Instead of Amazon undertaking the gargantuan task of signing up hotels on its own, Expedia counted 1.1 million properties on the websites of its various brands through March 31, and that included 460,000 listings of apartments and vacation rentals.

With hundreds of millions of visitors perusing Expedia websites, it has built-in travel demand. One could argue that Amazon wouldn’t need it if it struck a flight or hotel tab on the Amazon homepage. At the same time, consumers aren’t used to looking to Amazon for flights or hotels so it could take some time for consumers to get used to the idea and have trust in Amazon as a travel-booking site.

But if Amazon were to buy Expedia and could attract travel demand on its own, then Amazon might be able to greatly reduce the $5.7 billion in selling and marketing expense that Expedia shelled out in 2018, for example.

Still, don’t count Booking Holdings and its brands as eventual Amazon partners or bedfellows. There are signs that relations are warming between the world’s largest accommodations seller and Amazon.

Booking.com and Amazon have been cooperating in an Amazon Prime promotion in Germany and Austria. Amazon Prime members who sign up in these countries enroll in the Booking.com Genius loyalty program, “receive an exclusive 10 percent travel credit on every booking made during the promotional period, redeemable for future bookings on Booking.com within two years of the original booking,” Booking.com said.

What’s clear is that an initial test of domestic flight bookings in India through a Cleartrip partnership doesn’t portend the shape of the travel offering that Amazon might have five or 10 years from now.

Game on.

Skift India Report

The Skift India Report is your go-to newsletter for all news related to travel, tourism, airlines, and hospitality in India.

Have a confidential tip for Skift? Get in touch

Tags: amazon, expedia, flights, india, loyalty, m&a, mergers

Photo credit: Amazon previously tried selling hotel stays via weekend getaways but is now trying anew with flights in India. Skift