Skift Take

A shoe just dropped. Amazon is stepping into travel again. It may offer travel products in all sizes once it really gets going.

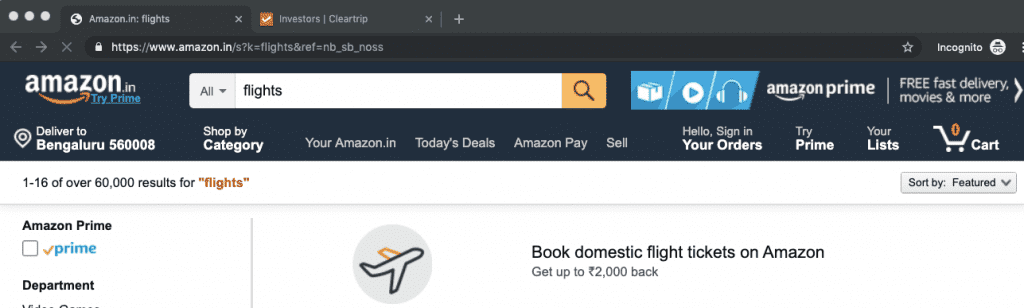

Travel companies have been waiting for Amazon’s inevitable next try at travel booking after shuttering its nascent hotel business in 2015. It now appears Amazon is making tentative steps to start offering flights.

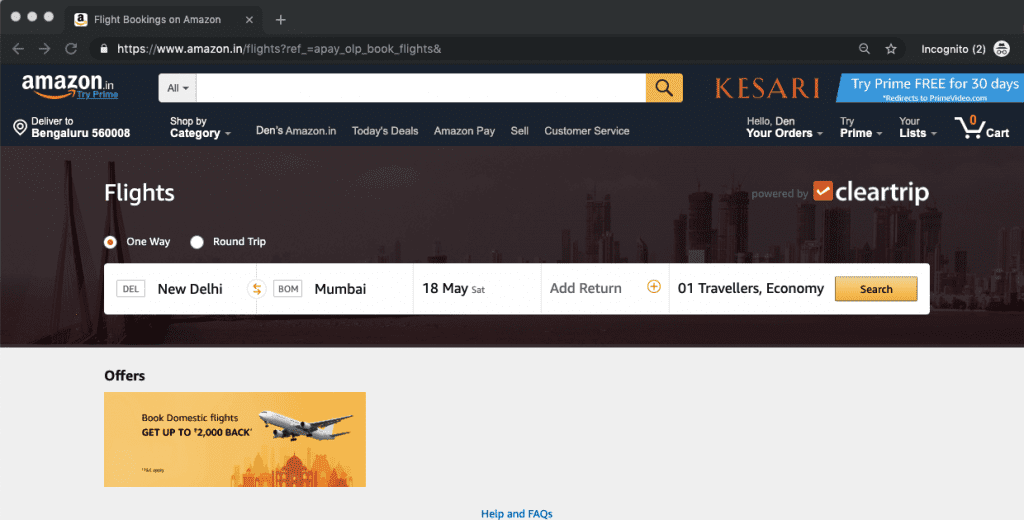

Powered by India online travel agency Cleartrip, Amazon has begun offering domestic flights in India.

Hospitality consultant Robert Cole tweeted screenshots of the Amazon domestic flights.

Big News: @amazon launches #flights in India on @amazonpay page. Travel industry will be buzzing about this for the foreseeable future. Airlines, online & traditional travel agencies, plus all those 100+ million Prime subscribers should take notice… pic.twitter.com/TCzELUN7jO

— Robert Cole (@RobertKCole) May 16, 2019

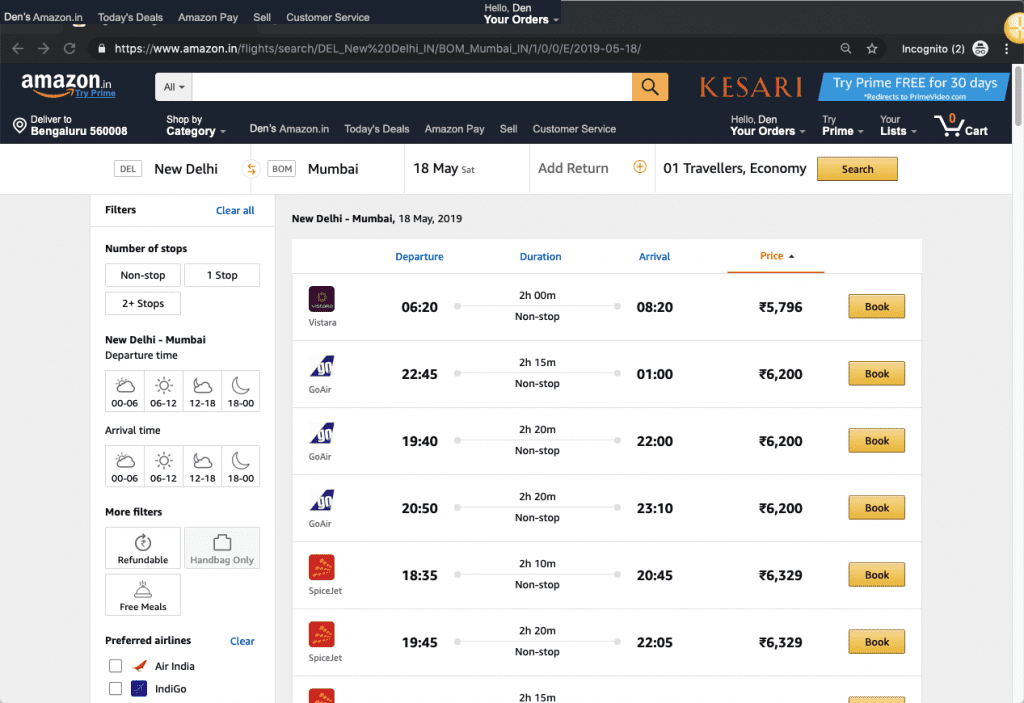

Airlines such as Vistara UK, GoAir, SpiceJet, and Indigo were among the carriers offering flights through the service, which offered up to 2,000 rupees ($28.50) cash back on bookings. Amazon customers would see the rebate in their Amazon Pay balance within 48 hours, according to Amazon.

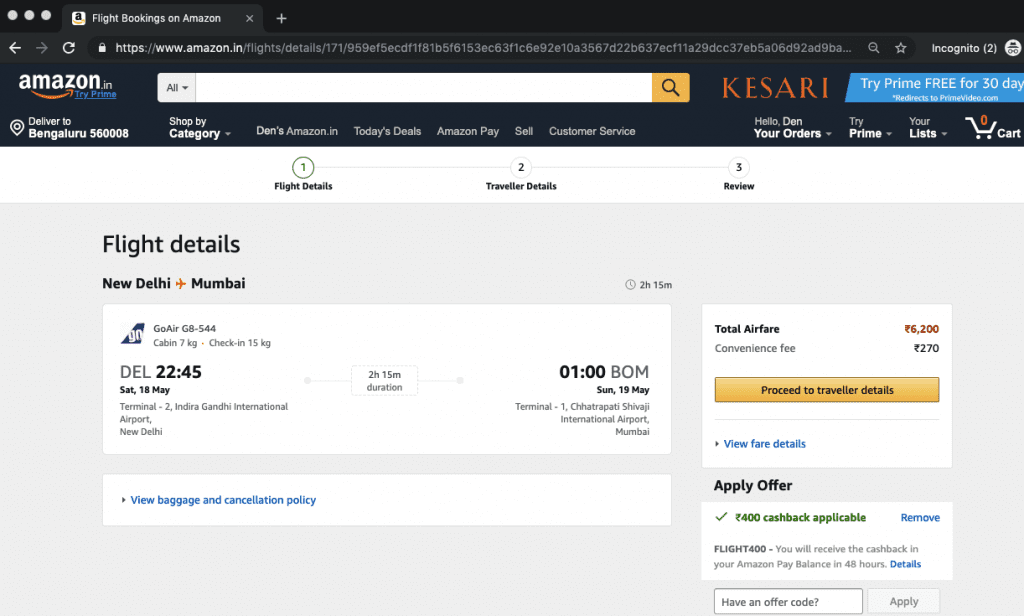

Here are some screenshots of the Cleartrip-powered service.

The 2,000 rupee cash-back offer was for Amazon Prime members on bookings of 20,000 rupees ($285) or greater, and 1,600 rupees ($23) cash back for other customers so there are incentives to join Amazon Prime in India, a key growth market that Amazon is targeting. Amazon counts more than 100 million members in its Amazon Prime loyalty program.

Cash back is a very popular way for Indian ecommerce sites to gain users and traction.

Amazon and Cleartrip didn’t immediately respond to requests for comment.

Travelers booking flights see the total airfare at checkout plus a “convenience fee” that’s tacked on.

Amazon, through partner Cleartrip, was offering a New Dehli-Mumbai roundtrip with Vistara UK May 21-24 for 10,841 rupees ($154.46) with a 3.78 percent booking fee of 410 rupees ($5.84). The cash back offer should be attractive for Amazon users. Without it, the Amazon airfare didn’t seem like a steep discount. Sastiticket.com was showing the same itinerary for 10,290 rupees ($146.41) on Friday morning in India.

What Does It All Mean?

Amazon is obviously testing ways to get back into the travel industry with the burgeoning effort with India domestic flights. It is doing so through the partnership route rather than building an Amazon flights offering from scratch.

Reacting to the news about Amazon launching domestic flights in India, Max Rayner, a partner at Hudson Crossing, saw flights as fitting in nicely with Amazon’s business model.

“Air is much more of a commodity than hospitality and so it makes complete sense to try that first,” Rayner said. “In some ways, Amazon is a metasearch engine for everything with loyalty across inventory types and an easy checkout.”

In 2014, Skift broke the story worldwide that Amazon was entering the hotel business in a serious way by entering into direct contracts with hotels. It was a controversial move with some saying it was a game-changer and others, such as then-Expedia CEO Dara Khosrowshahi essentially cautioning that Rome — or a global hotel business — wasn’t built in a day.

The difficulties, and the competitive moat, surrounding such businesses as Expedia Group, Booking Holdings and even Airbnb in hotels and alternative accommodations can be appreciated by the fact that 20-year-old Expedia added 200,000 properties in 2018, and there are still plenty of markets where its lodging presence is small.

A 2014 Debut That Went Nowhere

Before 2014, Amazon had offered hotels sporadically at steep discounts with vouchers, but it then tried to provide public rates, and build a more ongoing offering, with the initial iteration focusing on weekend getaways from several major cities.

But Amazon abruptly shuttered its hotel business in October 2015, perhaps a year after launching it, when it found the going very tough, and after not getting the results it apparently expected.

Amazon was coy about its precise reasons for abandoning the hotel effort as it didn’t provide any substantial information about its exodus.

But Amazon can potentially have a large impact in travel, both from a booking and advertising perspective. However, if and when Amazon expands its footprint in travel, it won’t be displacing the big players anytime soon.

With all the services, from electronics to groceries and perhaps pharmaceuticals, available on Amazon.com and through its app, adding travel could potentially make Amazon an even more ever-present superapp than it already is.

“If this puts a bullseye on anything, it would be on meta engines,” Rayner said. “Many users searching for products have already pivoted to searching on Amazon rather than on Google, and they could eventually do the same for air, and possibly for other supply types too.”

Skift has written about the superapp trend in a deep dive, Google Is Ready to Transform the World of Superapps. This development finds transportation and food delivery companies, particularly in China and Southeast Asia, developing apps that customers can use multiple times a day for everything from ridesharing to hotel-booking, and electronics purchases. WeChat and Meituan in China, as well as Grab in Southeast Asia, are superapp candidates.

Google Maps, which just consolidated flights, lodging and vacation packages in a one-stop-shop play, is leaning toward such comprehensiveness despite the limitations of user habits, and having maps as the foundational service.

Still, Amazon, which specializes in commodities from books to electronics and now to domestic flight bookings in India, can leverage such services to further a superapp strategy.

In addition, Amazon is building an advertising business that could potentially be a way for travel advertisers to build up an advertising competitor as a hedge against Google and Facebook.

Skift Research recently examined the Amazon factor in travel in a report, Amazon: Lessons, Threats and Opportunities for Travel. The report cites lessons for travel companies that can be taken away from the Amazon business model, and investigates varying ways that Amazon could gain traction in travel. These scenarios include an Amazon online travel agency or metasearch engine, direct marketing through its growing advertising business or voice search, or expanding the reach of its smart devices, which already sit inside an ample number of hotel rooms.

Build or Buy

To be sure, Amazon’s launch of domestic Indian flights in partnership with Cleartrip is a modest — if important for its implications — effort.

Given Amazon’s stilted try at building a hotel business from scratch, some would argue that an acquisition of a major travel company, such as Expedia or TripAdvisor, for example, might be the way to go. Amazon had $23 billion in free cash flow for the trailing 12 months at the end of the first quarter, so buying either company would be affordable.

Buying, which always has risks, would be so much easier than building flights, lodging, cars, cruise, and tours piece by piece.

The global travel puzzle just got a little more complex and interesting.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: amazon, cleartrip, flights, otas

Photo credit: Flights on Vistara is being offered by Amazon in India. 157016