Skift Take

Analyzing startups and venture capital trends helps us glimpse the future of travel.

Travel is one of the world’s largest industries, ripe for innovation and disruption. That’s exactly what the latest wave of travel startups is bringing to the table. That wave rose to new heights in 2018, when startups raised $7.5 billion of venture capital, across 647 deals, the highest level of travel venture funding ever.

Skift Research, in its latest report, examines venture investment trends in travel to understand where startups are innovating and growing. Travel startups of the last few years have already disrupted some of the largest sectors in our industry and we expect this momentum to continue.

Last week, we launched the latest report in our Skift Research service, Venture Investment Trends and Startup Opportunities in Travel.

The report breaks the travel startup ecosystem down into several sectors and sub-sectors. Below is an excerpt on venture capital dynamics in the vacation rental property management and ownership space, a part of our broader discussion on alternative accommodation startups. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

Vacation Rental Property Management and Ownership

We are seeing a large number of startups developing large-scale, professional, branded vacation rental property management businesses. Historically, it had been hard to generate economies of scale in vacation rentals, because the distributed nature of both inventory and customers meant that costs grew at the same rate as, or faster than, new revenues.

Platforms in vacation rentals, both on the distribution and operational fronts, are changing that math and creating opportunities that did not previously exist. In many ways, these entrepreneurs feel like the spiritual successors to the Hiltons and Marriotts of the 1950s and 1960s. None have yet to succeed at the same scale, but the concept is still in the early innings of development and attracting lots of investment.

The market is highly fragmented — Wyndham estimates that there are 1.4 million vacation rental properties in the U.S. out of which Vacasa, the largest vacation rental property manager in the U.S., operates just over 12,000. To get to where it is now, Vacasa has made at least 30 acquisitions since 2014.

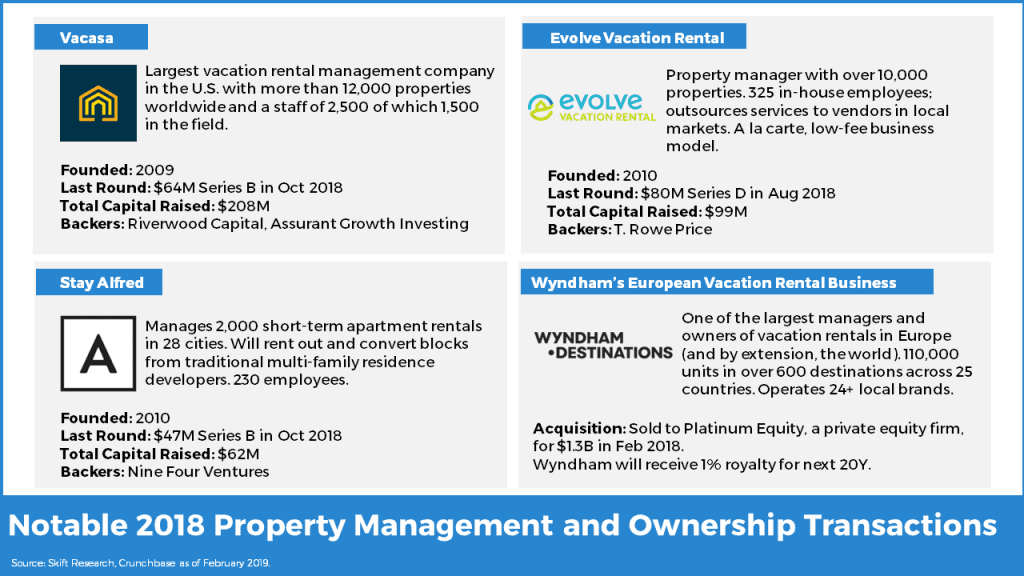

There will be many more mergers to come and investors are, so far, happy to fund this race for market leadership. Vacasa closed a $64 million Series B last year, while rival Evolve Vacation Rental, which has over 10,000 properties, raised an $80 million Series D. Wyndham’s European Vacation Rental business — believed to be the largest in the world with 110,000 units in 600 destinations — was sold off to a private equity firm for $1.3B in February 2018.

And that’s just in classical vacation home markets — think Ft. Lauderdale, FL or Aspen, CO. There is a whole other wave of startups looking to develop short-term rental management and ownership business in urban markets. Many real estate owners are experimenting with mixing short- and long-term rental units within apartment buildings to boost property incomes and offset development costs.

One startup leading in this space is Stay Alfred, which rents out entire floors in multi-family residences direct from developers and convert them into short-term apartment rentals. Stay Alfred now manages 2,000 apartments in 28 cities and just raised a $47 million Series B to further expand.

The company Sonder similarly manages 2,200 units in 18 cities which are branded and designed to reflect the local culture. It raised a $85 million Series C last August. Lyric too has taken a design-forward approach to urban short-term rentals. It has over 400 units and closed a $15.5 million Series A last year.

Some properties are even being built or converted to use solely for travel rentals. Perhaps the leading example of this is Niido, which has partnered with Airbnb and developers to buy entire apartment complexes.

Even this flurry of activity has barely scratched the surface of what’s possible. The market remains one of the most fragmented anywhere. There is a long runway for growth in the management of vacation rental properties and it’s going to take a lot of capital to take off.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: funding, skift research, startups, venture capital

Photo credit: Sonder, which raised $85 million in 2018, offers urban apartment rentals with a design-forward aesthetic. It is one of a new generation of vacation rental property managers. Sonder