Skift Take

Amazon to the rescue? That is narrative you don't often hear associated with Jeff Bezos' company. But advertising is collectively one of travel's largest expenses and few can break free of the Facebook and Google duopoly. Amazon might just be able to succeed where many others have failed.

Amazon is one of the most successful and fastest growing businesses in the world. There are many lessons to learn from its success that apply to the business of travel. It is also important to consider how Amazon could impact the competitive landscape in travel, both as a competitor and as a partner.

To that end, we are excited to present an e-book published by Skift Research on the lessons, threats, and opportunities that Amazon poses for the travel industry, and it’s only $50. It’s a lighter read than our standard in-depth reports, but still packed with the same interesting stats, graphs, and actionable takeaways that you have come to expect from us.

In fact, much of the original data in this e-book is pulled from this year’s diverse slate of our travel research topics, making it an ideal, and curated, entry point into the world of Skift Research. Below is an excerpt from our Skift Research e-book. Get the full e-book here to stay ahead of this trend.

Preview and Buy the Full E-Book

We suspect that many travel execs would think of Amazon entering travel with a certain sense of dread. And it’s true that if Amazon wanted to compete directly with, it could pose a serious threat. But Amazon could also partner with many travel incumbents in a way that may be beneficial.

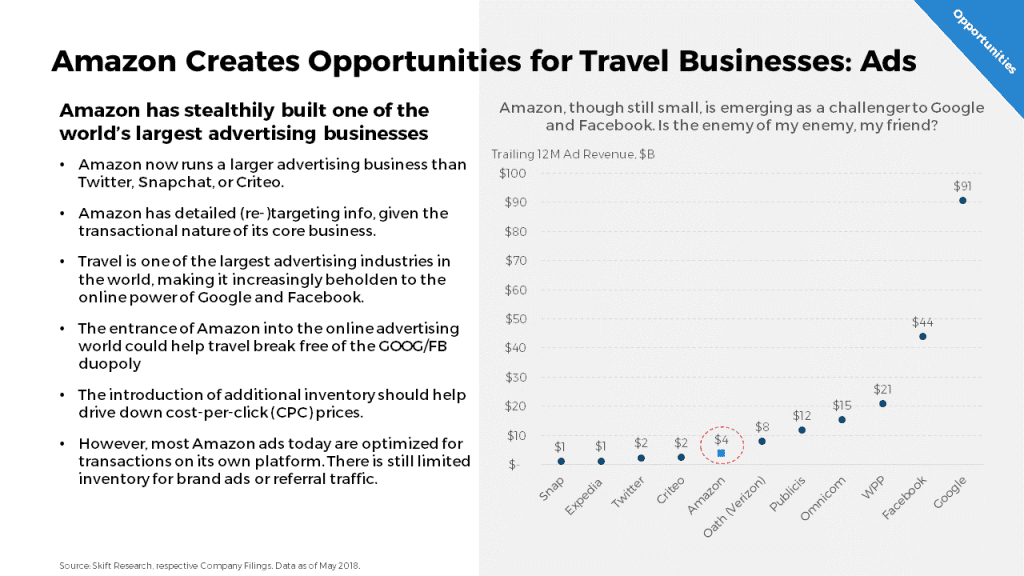

For instance, we think that Amazon could potentially be a powerful advertising partner to the travel industry. Skift believes Amazon Advertising revenues in excess of a $3.5 billion annual run-rate. The business grew at a 92 percent rate compared to last year, and appears to be accelerating, potentially putting it on track for $6 billion or more in sales next year. That means Amazon runs a larger advertising business than Twitter or Snapchat.

Amazon’s advertising bread-and-butter is selling sponsored product listings on its site, but it is increasingly promoting display banner ads, video ads for Kindle and Prime Video, as well as other formats. Amazon is also building third-party display advertising inventory, such as on IMDb, as part of what it calls its Amazon Advertising Platform (AAP). According the Bloomberg, the company is also testing retargeting tools to show product display ads across the web.

These new ad formats could well be to use by the travel industry. Plus, Amazon can target customers and look-alike audiences based on its in-house shopping data. This is a unique dataset that is tied directly to actual purchases, rather than assumed intent as is the case on Google or Facebook.

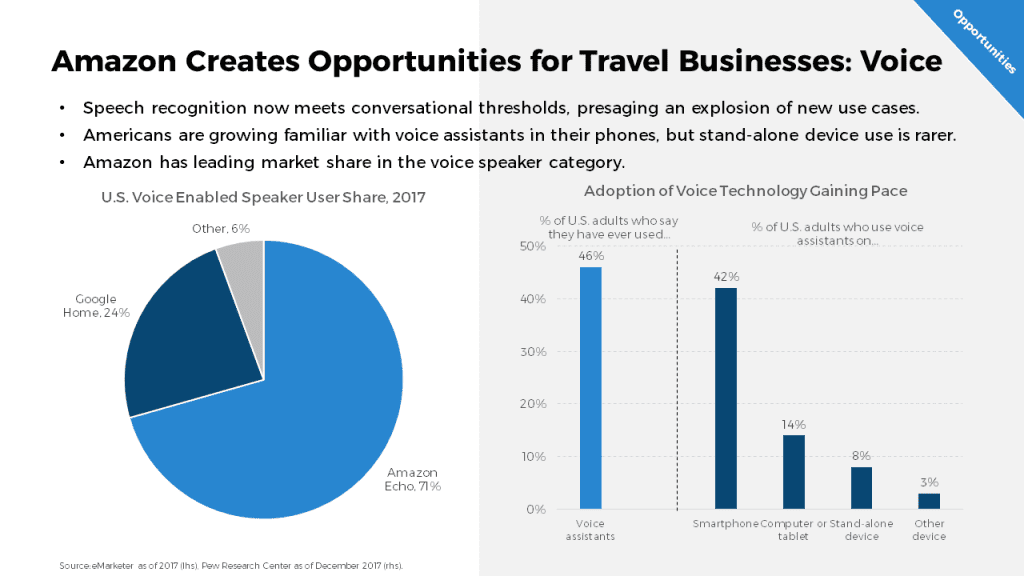

What about the future of search? This question is closely related to the future of advertising and, looking beyond desktop and mobile, voice search could have a large role to play.

Voice technology is being rapidly adopted and Amazon has the leading market share for stand-alone voice speakers. Unlike desktop searches which return pages of links, voice technology will be much higher stakes with only a handful of leading results being read out to the user.

Travel is still not often searched for in the context of voice assistants as it is a complex and research-intensive purchase. But looking forward, we see many potential new use cases for this technology within travel. Here again then, Amazon offers a potentially powerful partnership opportunity for the travel industry.

Preview and Buy the Full E-Book

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: advertising, amazon, skift research, voice search

Photo credit: Could Amazon take flight in the travel industry? It's Prime Air cargo jet is pictured above. Skift