Skift Take

Canada’s newest airline, Swoop, is now up and running with some of the lowest base fares in Canada. While an important milestone, the larger focus continues to be on WestJet’s challenging financial year and ability to execute several big projects at once.

WestJet Airlines’ new ultra low-cost carrier Swoop descended into the market on June 20, bringing an unbundled business model to a country where new entrants typically have had a hard time breaking in.

However, the carrier is banking that its executive team, as well as backing from parent company WestJet and a focus on technology, will set it apart from past failures and current competition. And even if it doesn’t succeed as a standalone entity, its presence in the market may help WestJet fend off new competition from Canadian ultra-low-cost-carriers.

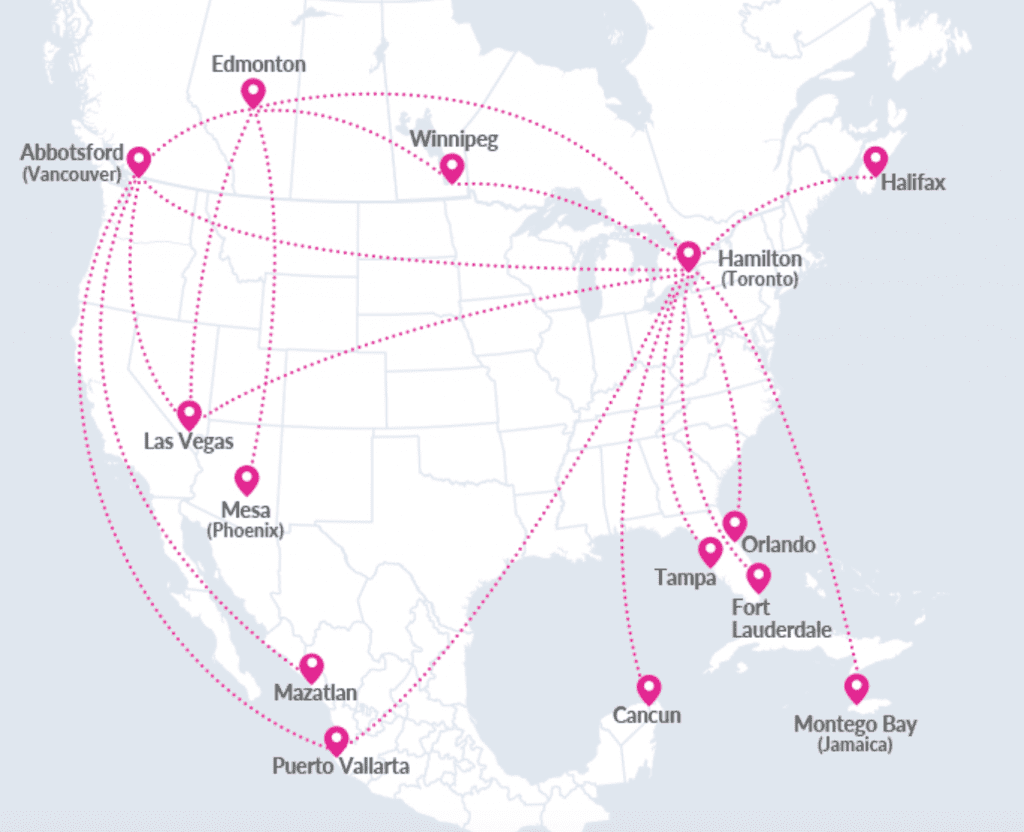

Swoop flies to 10 destinations in the United States and Canada, and will add more international destinations in coming weeks, including service to Montego Bay, Jamaica (Dec. 16) and three Mexican destinations: Puerto Vallarta (Jan. 8), Cancún (Jan. 14) and Mazatlán (Jan. 20).

Swoop remains a small operation, and will see only measured growth in 2019. Right now it flies six Boeing 737-800s acquired from WestJet, outfitted with 189 seats, or 21 more than they had with WestJet. Swoop plans to add four more jets next year, Swoop President Steven Greenway told Skift.

The carrier is offering some of the lowest base fares in the market — the cheapest fare in the network is C$9, or about $6.75 U.S., each way between Edmonton, Alberta and Abbotsford, British Columbia. Average prices for one-way flights are under C$100, Greenway added. As with typical discount airlines, these prices do not include add-ons such as baggage or food on board.

Swoop is focused on stimulating the market, and attracting travelers that may not have been able to fly previously, Greenway said. WestJet and Swoop only overlap on two different routes —Winnipeg-Edmonton and Edmonton-Vegas.

“Really, the vast bulk of our travelers are first-time flyers, or infrequent flyers, [as] the price point was just too much for them previously,” Greenway said. “It’s not about stealing customers from WestJet. That’s not what we’re about, and that’s not what we’re seeing.”

Technology Focus

Swoop aims to be a leader in digital communication. In fact, it will provide more functionality to customers who use its app than on its desktop website, Greenway said.

“Our core focus is the mobile app,” he said. “The website only has 20-30 percent of functionality. If you want 100 percent of Swoop functionality, you have to download the app.”

This could take the form of sending meal vouchers automatically through the app, or allowing passengers to load money onto their phone for onboard purchases. Customer service inquiries would also be done via mobile as well.

“We want everything to be done through the app so it’s fully automatic,” Greenway said.

Rocky Start

While Swoop’s introduction is an important milestone for the Canadian market, some of the fanfare has been stifled by a few mishaps.

Just a few weeks after Swoop began flying, parent company WestJet reported its first quarterly net loss in 13 years, of C$20.8 million. Over the past year, the parent airline has faced labor disputes, higher fuel prices and competition from other ULCCs entering the market.

While not related to Swoop, WestJet’s financial performance raised broader questions about how it will execute the many parts of its strategy. Along with expanding Swoop, WestJet is seeking higher-end customers by introducing first Boeing 787 routes next year. Those planes will be the first in WestJet’s fleet with flat-beds in business class and will mainly fly long-haul routes.

Additionally, Swoop’s plans to launch U.S. services on Oct. 11 were pushed back due to unforeseen delays in the regulatory process. Greenway said the carrier came up short in its expected timelines. “It’s quite simple — we screwed up,” he said, noting that the airline needed about 15 more days to execute the approvals than it had previously planned.

As a result, Swoop had to cancel 12 roundtrip flights. It called customers a week or two before the delays, Greenway said, and WestJet stepped in to operate the rest of the flights.

However, he calls this a “very much a one-off” situation that is not expected to have any more impact.

Challenges Ahead

Some longer-term challenges may persist for Swoop, and any carrier hoping to hone the ULCC model in Canada.

The country is geographically large with only about 36 million people, and also prone to inclement weather. That means Swoop’s average stage length is 1,200 miles, or as Greenway notes, more than double what the usual ultra-low-cost-carrier flies. Discount airlines usually prefer shorter stage lengths so they can fly more passengers each day, while turning aircraft on the ground as fast as possible.

But other Canadian discounters face the same issues, and Swoop is probably better prepared than the competition to handle them, analysts say. One is competitor Flair Airlines, which is already flying, and other is Jetlines which seeks to begin operations next year.

And even if Swoop falters, it will probably help its parent company fend off the new competition.

“Swoop will make it very difficult for any other ULCC to stay in the air or get off the ground,” a January Raymond James analysis stated. “In this respect, we see it as more of a defensive tool than a growth initiative,”

Even after the issues with the U.S. launch, the firm said: “On balance, we still view Swoop as an effective defensive tool for WestJet.”

Separate Carrier

To passengers, Swoop is a separate airline from WestJet, employing its own pink-and-white livery and a separate network with its own reservation system. But WestJet is factoring in Swoop into its unit revenues and capacity plans because it is a full subsidiary.

Greenway notes that while the path forward for WestJet is “not without its challenges,” Swoop has a “minimal impact” on the WestJet group overall. When it does lean on the parent carrier, it does it in a way that benefits the airline, and doesn’t strain WestJet, he said.

So while its branding and marketing is completely different, it works with WestJet on fuel and other more behind-the-scenes items such, as safety frameworks.

“We would never be able to get the fuel deal that we get through the WestJet group as an independent airline—we just simply don’t have the scale,” Greenway said.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airline innovation, swoop, ultra low-cost carriers, westjet

Photo credit: WestJet has created a new ultra-low-cost-carrier called Swoop. This is one of its Boeing 737-800s. Swoop