Skift Take

This past year served up headlines that certainly didn't end with the start of another news cycle. The ripple effects were felt across all of travel. Follow the trends of the moments that we have pointed out here — and be prepared to ride their waves well into 2019 and beyond.

Following a year in which much of the news was subsumed by politics out of Washington, D.C. and the effects of extreme weather, 2018 was a return to good, old-fashioned business in travel, with strategic acquisitions, investments, and a notable startup or two. As you’ll see in our annual presentation of 25 Travel Moments That Mattered, this past year also saw companies and countries pivoting on cultural issues like MeToo, same-sex marriage, and gun control. And we saw the beginnings of a story we think will only get bigger moving into 2019: labor.

Whether it was Booking Holdings and TripAdvisor buying up tour-tech companies in rapid-fire succession, or airlines grappling with higher fuel prices, only to see them fall, or Marriott disclosing a massive data breach, the headlines this year signaled big changes for the industry. The Big Three in airline distribution found their way into the news with an anti-trust investigation in Europe of Amadeus and Sabre, and then Travelport’s proposed buyout by private equity. Even JetBlue’s relentless founder David Neeleman piqued new interest in 2018 when he confirmed he was launching a new U.S. airline. The cruise industry saw some power plays, as Royal Caribbean Cruises spent $1 billion to enter the luxury market with the buyout of Silversea.

Keep an eye on workers’ rights because the writing was on the wall this past year, with hotels issuing panic buttons to some employees, workers walking off their jobs at Marriotts across the U.S., and Ryanair signing its first labor agreement — ever.

It was an exciting and fruitful year, if only because we were less bombarded by news about a certain president in relation to travel, and gripped by stories about significant core business moves. We can’t wait for 2019 when some big players like Airbnb, Uber, and Lyft are likely to emerge as public companies. Fears of a global economic downturn are rising, but the travel industry has not seen any major evidence yet to support that anxiety. Take a deep breath, enjoy your holidays, reflect on these 2018 moments, and get ready for a whole new year of surprises. — Tom Lowry, Managing Editor

Commission Cuts Force Meeting Planners Into Brave New World

January 23

Why It Mattered:

Many meeting planners in North America are now under pressure to refine their business models, consolidate, or fade away.

The intersection of the meetings sector and hospitality is complicated, and got even more complicated when Marriott International announced it would cut commissions on group bookings from 10 percent to 7 percent at North American hotels.

The move represents a competitive edge for hoteliers, who can now pocket more money from each event they hold. For planners, the impact is more complicated: While some have moved business to hotels offering the standard 10 percent, others are evolving to different models of compensation for their work. Still unsolved is the friction in the marketplace for hotel meeting space, which has been disrupted by companies like Cvent.

Hyatt Hotels and Hilton Worldwide followed Marriott’s lead later in the year, further entrenching a period of tough times for the planners most reliant on commissions to keep the lights on.

Read More

Marriott Commission Cut on Group Bookings Could Ripple Across Hotel Industry

Hilton Follows Marriott on Commission Cuts in New Challenge for Meeting Planners

Marriott and Hilton’s Group Commission Cuts Put Pressure on Industry

Ryanair Reaches Historic Deal With UK Labor Union

January 30

Why It Mattered:

Ryanair’s first union agreement signaled it was no longer in open warfare with the more vocal portion of its labor force. But as is always the case with the airline that likes to say it is “always getting better,” things were not quite that simple.

With the threat of strikes hanging over the airline in the latter half of 2017, Ryanair wanted to improve relations and managed to agree to its first formal union deal at the beginning of 2018.

While similar agreements followed during the course of 2018, the prospect of industrial action didn’t go away and the airline endured a number of walkouts.

Despite a thawing in relations, Ryanair management hasn’t totally abandoned its tough-talking stance.The carrier’s ethos as a ruthless cost-cutting, ultra-low-cost airline is always going to put it in some kind of conflict with the people that work there. While the two sides are never going to see eye-to-eye, making peace with some of its unions was certainly a move in the right direction.

Read More

Ryanair Union Dispute Takes Strange Turn

Steve Wynn Resigns Following Sexual Assault and Harassment Allegations

February 6

Why It Mattered:

The Me Too movement hit the travel industry with its first high-profile CEO case.

When the highest-paid CEO in the hospitality and gaming industry stepped down following scathing allegations of sexual harassment and assault against his own employees, it not only put into doubt the future of Steve Wynn’s multibillion dollar company — it was a clear signal that the Me Too movement had arrived in travel, and it had the power to oust even the most powerful of CEOs.

In the months that followed Wynn’s resignation, there was plenty of speculation about what would happen to his namesake company. An internal fight broke out over the composition of the board, and there were even rumors that the company might even be up for sale.

While the spotlight on Wynn has somewhat receded since earlier this year, that doesn’t take away from the fact that his reported actions had serious consequences, and that they will follow from here on out, no matter what the gaming visionary intends to do going forward. While Wynn is actively suing some of his former employees for defamation, he’s also being investigated by the Massachusetts Gaming Commission for his failure to disclose a $7.5 million settlement with one of his alleged victims.

Read More

Wynn Resorts Founder Steve Wynn Subject to Multiple Sexual Harassment Allegations

Steve Wynn Is Out as Wynn Resorts CEO Effective Immediately

Wynn’s Departure Signals an Opportunity for Women to Rise in Gaming Leadership

Corporate Travel’s Biggest Power Gets Even Bigger

February 9

Why It Mattered:

Increased consolidation ensures that corporate travel will be dominated by a handful of powerful companies for a long time to come.

Business travelers, like these at Heathrow Airport, are further beholden to a smaller group of giants as Amex GBT purchased Hogg Robinson. Photo: Heathrow Airport.

Corporate travel giants compete on their worldwide reach and expertise handling the complex minutiae that define a company’s travel and expense programs.

So when American Express Global Business Travel, the top travel management company by volume of travel sold, announced its intention to buy Hogg Robinson Group, which ranks in the top 10, it made all the sense in the world. More volume means more revenue and money to invest in next-generation technology tools, leaving its competitors to potentially play catch-up.

More consolidation is on the horizon for the sector from American Express Global Business Travel’s competition, as well as an increased focus on the small- to medium-sized business travel market.

Read More

American Express Global Business Travel Agrees to Buy Hogg Robinson Group

American Express GBT Deal Means More Mergers Will Be Coming

Will Lola’s new Partnership With Amex Revive the Struggling Startup?

Travel Brands Sever Ties With the National Rifle Association

February 22

Why It Mattered:

It’s rare when big public or private companies risk financial repercussions and get political, even though many did not characterize withdrawing National Rifle Association member discount programs as such. They did the right thing because the mass shooting epidemic has become insane.

A Florida high school shooting that involved an AR-15 like one of these prompted some travel companies to say enough is enough to the NRA. Photo: Bloomberg.

It took a little more than a week after a gunman toting an AR-15 semi-automatic rifle shot up Marjory Stoneman Douglas High School in Parkland, Florida, killing 17 students and staff members, that car rental companies, a hotel chain, and airlines began withdrawing from deals to provide discounts to National Rifle Association members.

First Enterprise Holdings, including its Enterprise, Alamo, and National car rental brands, as well as Wyndham Hotel Group, tweeted that they would be ending their NRA discount programs. By Feb. 24, Hertz, Avis-Budget, Delta, and United had dropped out of the program.

The surviving Marjory Stoneman Douglas High School students inspired people around the world to take a stance against senseless gun violence even as the NRA fought any meaningful reforms, and even blamed the uproar on the media.

In March, Delta Air Lines CEO Ed Bastian said the carrier would end discounts for all politically divisive groups, even as the Georgia legislature took punitive action against the airline for terminating the NRA discounts.

In the aftermath, United Airline CEO Oscar Munoz answered a critic of the move at the airline’s annual meeting in May, saying, “It wasn’t political. It was personal with regard to my family at United.” The daughter of one of the airline’s captains died in the shooting.

Read More

Here Are the Travel Companies That Have Cut Ties With the NRA

Interview: HotelPlanner CEO Defends His Company’s NRA Ties

United Airlines CEO on Dropping NRA Discount: ‘It Was Personal’

Delta May End Discounts for All ‘Politically Divisive’ Groups After NRA Controversy

Airbnb Officially Launches Airbnb Plus

February 22

Why It Mattered:

If Airbnb is ultimately successful with its newest product, Airbnb Plus, it will ensure that alternative accommodations are no longer seen as an alternative, but as more of a mainstream choice. But making it a success will be easier said than done.

On Feb. 22, Airbnb CEO Brian Chesky took to the stage in the company’s hometown of San Francisco to announce a new product that the company had been piloting for years under the name “Airbnb Select.” Only that day, the new product — which consists of verified home listings — made its debut under the name of Airbnb Plus.

When it debuted, Airbnb Plus consisted of 2,000 qualifying listings in 13 cities around the world, showcasing homes that have been verified by Airbnb to be “beautiful homes” with “exceptional hosts” and “premium support” for both hosts and guests.

Airbnb Plus is just one part of Airbnb’s overarching strategy, described as “Airbnb for everyone,” which isn’t just a company slogan, but a resounding statement of how far the private accommodations space has come — and how far it has to go as it becomes increasingly more standardized, professionalized, and in some cases, a lot more hotel-like.

Since the launch back in February, Airbnb Plus has grown — but not to the extent that Chesky had hoped. The company said it hoped to have 75,000 Airbnb Plus listings by year’s end. Instead, data from the Airbnb website would place the number of Plus listings at around 3,170 in 22 cities worldwide.

Even though it appears growth of Airbnb Plus isn’t as aggressive as Airbnb wanted, the product is still crucial for determining just how mainstream homesharing can become. It’s also an acknowledgement that guests’ expectations for private accommodations have changed and matured. If Airbnb and its peers want to continue to grow, they’ll need brands like Airbnb Plus to help them get there.

Read More

Airbnb Is Set to Launch a New Tier of Select Properties

Historic Qantas Flight Lands in London

March 24

Why It Mattered:

With every new generation of airplane, the world is getting smaller. It is finally possible to fly nonstop from Australia to to Europe. In the future, new technology might open even more ultra-long-haul routes.

In March, Qantas launched a new route from Perth, in western Australia, to London.

There have been longer routes, including Singapore Airlines’ epic New York-to-Singapore flight that resumed in October, but never before had an airline connected Australia and Europe with a scheduled nonstop flight, so the first departure received plenty of attention.

In many respects, though, this is just the beginning. Qantas is flying nonstop from Perth because its Boeing 787-9 aircraft do not have the range to fly from the country’s two biggest cities — Sydney and Melbourne — to Europe.

In an action called “Project Sunrise,” Qantas has challenged Airbus and Boeing to build it a jet capable of flying nonstop, more than 20 hours, from Sydney to London (or New York or Paris) by 2020. Now, that would be a real game changer.

Then again: Does anyone want to spend 22 hours on an airplane?

Read More

Historic Qantas Flight Lands in London in One of the Most Anticipated Arrivals in Recent Years

Qantas Hired This Professor to Help Flyers Beat Jet Lag

Behind the Hype of Qantas’ Grand Plans to Fly Nonstop to London and New York

Bermuda’s Same-Sex Marriage Battle Shows Industry Has Learned Value of LGBTQ Travelers

April 5

Why It Mattered:

Much of the travel industry, at least in the United States, has learned from the disasters that were discriminatory bathroom bills in North Carolina and Texas and the negative impact those pieces of legislation had on state economies. Bermuda was a particularly contentious case for travel because a handful of ships are registered on the island, and a same-sex marriage ban could have caused cruise lines to miss many lucrative same-sex weddings.

Reaction to Bermuda’s ban on same-sex marriage threatened tourism to beaches like this. Photo: Andrew Currie/Flickr.

Bermuda became one of the first Caribbean countries to legalize same-sex marriage, but it would later attempt to make history as the first country to repeal same-sex marriage. Bermuda drew the ire of much of the travel industry and traveling public in the process, and the appeals process is ongoing. The Bermuda Supreme Court ruled the law was discriminatory and violated constitutionally protected freedoms.

Bermuda, a popular cruise destination located in the middle of the Atlantic and about a two-hour flight from New York City, legalized same-sex marriage through a Bermuda Supreme Court case in May 2017. In early 2018, the island’s government voted to ban same-sex marriages as of June 1, and local gay rights advocates filed a lawsuit in the Bermuda Supreme Court against the ban. Carnival Corp., which has ships registered in Bermuda, announced that it would financially support the lawsuit and oppose the ban.

Bermuda Tourism Authority, the island’s tourism board, said that LGBTQ travelers were still welcome to visit Bermuda despite the legal battle. But at the time, the organization had little LGBTQ travel content and promotional materials on its website except for an FAQ section on the proposed ban.

The Bermuda Supreme Court ruled in June that the ban was unconstitutional, and government officials immediately announced they would seek an appeal. Bermuda is a tiny island in the middle of the ocean, but its same-sex marriage case had an outsized impact on the hearts and minds of travelers around the world. The travel industry’s reaction demonstrated how a welcoming environment for LGBTQ travelers has become non-negotiable with straight and LGBTQ travelers alike.

Read More

Bermuda Court Overturns Same-Sex Marriage Ban in Win For Tourism Industry

Bermuda Fears Tourism Hit as Same-Sex Marriage Reversal Draws Lawsuit

Inaccurate Tourism Data and a Glitch Made Travel Industry Question ‘Trump Slump’

April 11

Why It Mattered:

Many travel brands use data from the National Travel & Tourism Office as a source to project demand for international arrivals to the United States. While the office’s decision to withhold data caused some confusion for travel brands, that data is only one of several sources most companies use. What’s more concerning is the kiosk glitch that resulted in inaccurate data collection across the country, and whether the problem has truly been solved.

Glitches at airport passport kiosks like these were to blame for inaccurate inbound traveler data. Photo: Associated Press.

The National Travel & Tourism Office, part of the U.S. Commerce Department, left much of the U.S. travel industry in an information black hole for nearly a year. From September 2017 to September 2018, the office suspended international arrivals data that many brands use to project future demand and map out future strategies.

On April 11, after more than six months of no new data releases, the office announced that it was suspending further data releases. The office said in a statement that many international travelers had been counted as U.S. residents, and that likely resulted in an undercount for 2017. Some in the U.S. travel industry immediately called into question the so-called “Trump slump,” a dip in international arrivals which began a few months before President Donald Trump took office.

In the end, the National Travel & Tourism Office chalked up the inaccurate data to a glitch at U.S. Customs and Border Protection kiosks at large airports across the country such as New York’s John F. Kennedy International Airport. The kiosks have become commonplace at major airports, and the office said the machines were fixed to also expedite future data releases to the industry. Needless to say, travel brands will continue to get data from multiple sources rather than relying on a government entity.

Read More

U.S. Tourism Office Blocks Release of International Visitor Data

U.S. Tourism Office Has Put Out Inaccurate International Visitor Data For Years

U.S. Had Record Number of International Visitors in 2017 as Kiosk Data Glitch Is Fixed

Booking and TripAdvisor Buy Tour-Tech Providers

April 19

Why It Mattered:

Booking Holdings’ deal to buy FareHarbor and TripAdvisor’s follow-on announcement to acquire the smaller Bokun signaled an increasing maturing in a still-immature sector. The big incumbents’ consolidation of tours and activities tech represents a challenge to operators.

Similar in its broad outlines to how airlines once owned global distribution systems, Booking Holdings and TripAdvisor announced in consecutive days that they bought FareHarbor and Bokun, respectively. FareHarbor and Bokun offer connectivity software and other services to tours and activities providers so now two major online travel companies control the pipes that operators depend on.

As concentrated power had in the early days of airlines owning global distribution systems, the FareHarbor and Bokun acquisitions struck fear in tours and activities businesses that Booking Holdings and TripAdvisor would start biasing displays or email promotions in favor of companies that use their in-house solutions to the detriment of others who use independent services for connectivity.

Both Booking Holdings and TripAdvisor have pledged not to bias search results, but the sector will have to closely monitor how this plays out in the next few years.

For Booking Holdings, FareHarbor represents a key plank in its vision to provide a complete travel offering and to upsell once travelers are in a destination. TripAdvisor undoubtedly looked to buy FareHarbor as well, but when a deal didn’t come through it had to settle for the tinier Bokun.

Read More

Booking Holdings Buys Activities Distribution Startup FareHarbor

Booking.com CMO: FareHarbor Was a Smarter Buy Than GetYourGuide

TripAdvisor Buys Tours and Activities Tech Provider Bokun as Connectivity Race Heats Up

Lynching Memorial Opens in League With World-Class Human Rights Museums

April 26

Why It Mattered:

This memorial and museum honoring the victims of racial terror in the U.S. was the first of its kind. It directly confronted a history that most destinations merely skirt, and transformed what it means for domestic and international tourists to visit the Deep South.

The Equal Justice Initiative’s memorial to the victims of lynching in Montgomery, Alabama. Photo: Sarah Enelow-Snyder.

The opening of the National Memorial for Peace and Justice in Montgomery, Alabama came on the heels of two major events in heritage tourism: the inauguration of the country’s first national civil rights trail and the opening of the African American Smithsonian, the latter having utterly changed tourism to Washington, D.C. for people of color.

The lynching memorial and museum are the product of the Equal Justice Initiative in Montgomery, Alabama, a city rife with human suffering during slavery and segregation, then a primary font of civil rights activism. Now, Montgomery is a tourist destination that’s gaining international attention specifically because of the new memorial, which drew a flood of media attention.

The key to this civil rights attraction is the center of the memorial: a forest of oxidized steel columns bearing the names of over 4,400 victims, identified through the initiative’s unprecedented research. Each column represents a county — a twin column waits outside for the corresponding county to claim it and display it at the site of the crime.

Perhaps a model to replicate is South Africa’s. The country has a truth and reconciliation commission to confront apartheid and support the work of museums and historical sites that help the world to never forget. The U.S. has no such federal body, but this lynching memorial makes real progress.

Read More

Lynching Memorial Draws Tourists to a New Kind of Deep South

First U.S. National Civil Rights Trail Seeks International Tourism Appeal

African American Smithsonian Sets a New Standard for Museums as Destinations

Venice Tourist Checkpoints Were Short-Lived Attempt to Manage Crowds

May 2

Why It Mattered:

Venice had feared it was becoming a theme park with the way tourism was growing and locals were fleeing. Other cities have similar fears, but they also realize that checkpoints won’t get to the root of the problem.

Managing hordes tourists in Venice is an ongoing challenge despite efforts to curb crowds. Photo: Lauchlin Wilkinson/Flickr.

Venice tried a softball approach with tourists in 2017 that it thought would work. The city adopted the United Nations World Tourism Organization’s slogan and direction — “travel, enjoy, respect” — and placed placards around the city telling people how they should behave and visit responsibly. The city quickly saw its strategy was ineffective as tourism numbers kept rising and local tempers continued to flare.

Plan B: City officials thought an experiment with turnstile checkpoints at main points of entry was worth a try. Checkpoints were installed on peak summer days, but are no longer in place. Officials said it’s unclear if they will be reintroduced in the future.

But rather than limit the number of tourists who could enter the city, the checkpoints created separate entrances for locals and tourists with special entry cards that offered them a less-crowded route, an effort largely deemed as a failure.

Read More

Venice Tourism Checkpoints Are a Sign of Europe’s Fractured Approach to Overtourism

Venice Tackles Overtourism by Telling Visitors to Follow the Golden Rule

Venice Decides to Re-Route Big Cruise Ships to Blunt Environmental Impact

Royal Caribbean Made a Billion-Dollar Bet on Luxury With Silversea Deal

June 14

Why It Mattered:

In the first major consolidation in the cruise industry since 2014, Royal Caribbean Cruises filled in the luxury gap in its portfolio — and became the first operator to bring once-niche expedition cruising to the big leagues.

Silversea Cruises’ Silver Explorer is shown in Greenland. Photo: Silversea Cruises.

For the last several years, Royal Caribbean Cruises has had the distinction of operating the world’s largest cruise ships. But the Miami-based cruise company had less to boast about on the small-ship, big-spending side.

Other than Azamara Club Cruises — a three-ship brand that sails upscale, mid-sized vessels — the parent company was missing out on the luxury end of the cruise universe where its main rivals had strong positions.

Then, in the middle of 2018, Royal Caribbean made a surprise announcement: It was paying $1 billion to acquire a majority stake in Silversea Cruises, a Monaco-based line with nine luxury and expedition ships.

“You can see how this crown jewel completes us,” Richard Fain, chairman and CEO of Royal Caribbean Cruises, said at the time. “Ultra-luxury and expedition cruises are gaps in our portfolio today. Both are projected to have strong demand growth, and both are vacation products used by our higher-yielding guests.”

Since announcing the acquisition, Royal Caribbean has already revealed plans to make big moves with Silversea. The company is upgrading the brand’s existing fleet and adding three more ships on top of two already on order, which will bring the total to 14.

And while Royal Caribbean was the first of the world’s major cruise operators to dip a toe into the fast-growing expedition market — previously dominated by tiny independent lines — it already has company. Rival Carnival Corp. is building two expedition ships for its luxury Seabourn brand.

Read More

Royal Caribbean Is Buying a $1 Billion Stake in Silversea to Boost Its Luxury Offerings

Royal Caribbean Is Already Growing Its Luxury Silversea Line

Seabourn Is Building Expedition Ships as Demand for Luxury Adventure Grows

David Neeleman Confirms New Airline Startup

July 17

Why It Mattered:

You could argue that some U.S. airlines have gotten fat and happy in this post-consolidation age. A new airline could create more genuine competition and might lead to lower fares.

Entrepreneurial airline exec David Neeleman with a model plane of his then-planned airline Azul. Photo: Azul Airlines.

For the first time since 2007, when Virgin America began flying, the United States soon may see a new start-up airline.

David Neeleman, founder and former CEO of JetBlue Airways, said in July he plans to create a new U.S. airline, yet unnamed, with a fleet of new fuel- efficient Airbus A220 aircraft. If all goes according to plan, Neeleman’s startup will offer a hybrid low-cost, full-service experience, and fly from underserved airports across the country, within about two years.

“I doubt we’ll have a single route that has any competition,” Neeleman told Skift in October.

The airline industry has notoriously high barriers to entry, and if had this been anyone else, the competition would have scoffed at the proposed new competition. But Neeleman has an impressive track record, going back to Morris Air, which he sold to Southwest Airlines in 1993, and continuing to Azul Airlines in Brazil, which he founded after leaving JetBlue. He has also been an active investor in the consortium that owns Tap Air Portugal.

Said current JetBlue CEO Robin Hayes: “I think David will be successful in whatever he turns his hand to.”

Read More

JetBlue’s Founder Confirms He’ll Start a U.S. Airline With New Airbus Jets

JetBlue Girds for New Competition as Its Founder Prepares to Start a New U.S. Airline

JetBlue Founder Reveals Details on His New Tech-Focused International Airline

Booking Holdings Kicks Off Ridehailing Investments With Didi

July 17

Why It Mattered:

Booking’s Didi investment accentuated its investment and partner strategy for brand-building in assorted Asian markets, and brought into view the synergies it sees between travel, ridesharing, and food-delivery services.

Booking Holdings’ $500 million investment in Didi Chuxing in China foreshadowed its $200 million funding of fellow ridesharing service Grab in Southeast Asia three months later.

The online travel agent’s stake-taking in Asia, along with its $450 million investment in 2017 in China’s Meituan, an e-commerce platform offering food delivery, bike-sharing, and hotel booking, punctuates the synergies the company sees between travel and this panoply of hopefully related services.

It also highlights Booking’s commitment to strategic partnerships in Asia, where it has likewise invested heavily in China’s Ctrip, as an exploding set of markets rife with trend-setting developments in technology, including messaging and payments.

Booking Holdings CEO Glenn Fogel said at Skift Global Forum in New York in September that his customers will be able to go to Booking.com or its app and they be able to order transportation from Didi in their native languages. That will also spread Booking’s brand awareness in China as a hotel-booking option.

In addition to these strategic reasons, and not to be overlooked, Booking is investing in Didi, Ctrip, Meituan, and Grab because it seeks to make money the old-fashioned way — from stock market gains. For example, in early 2018 Booking recorded a $241 million increase in retained earnings from an unrealized gain from its Ctrip investments.

Read More

Booking Holdings Invests $500 MIllion in Ridehailing Platform Didi

Booking Holdings Invests $200 Million in Grab as Ridehailing Becomes More Strategic

Amadeus Signaled Its Hotel Tech Ambitions When It Bought TravelClick for $1.5 Billion

August 10

Why It Mattered:

Because it’s so fragmented, the market for technology services for hotels is ripe for well-funded players to grab share. Amadeus, well-capitalized from having been the market leader in airline distribution for years, wants to stalk the billion-legged beast of hotel tech services. Acquiring TravelClick, which offers business intelligence and operational services to thousands of hotels, will help it grow in hospitality much faster.

Amadeus paid $1.5 billion for TravelClick primarily for its business intelligence tools and the cross-selling potential of the business’ client list. But symbolism matters, too: The purchase also broadcasts to major hotel groups that Madrid-based Amadeus can be a reliable bet for hotels to use as a tech partner. Some hoteliers had previously doubted if Amadeus is in the game for the long-haul.

Some context: The thing people always talk about first, when they are talking about Amadeus, is airline distribution. But the tech giant’s acquisition of New York-based TravelClick proves such talk is somewhat anachronistic. The purchase signals to the industry that the tech giant is committed to becoming a market leader in hotel tech because it builds on the momentum of Amadeus’s 2013 nabbing of Newmarket International, a provider of cloud-based IT solutions for hotel groups and events businesses, for $500 million.

Amadeus wants to win big tech projects from large hotel groups. Its one marquee customer is InterContinental Hotels Group (IHG). In early 2019 Amadeus will finish the full deployment of IHG on a new central reservation system. Amadeus’s other big client is Premier Inn. This year it will port that chain onto its central reservation system, property management system, and payments solution.

Amadeus needs more than those two marquee customers, though. Before the TravelClick deal, a mere 28,000 properties worldwide were using at least one Amadeus hospitality product. Many of those were only using minor services, such as a housekeeping management software tool. The company’s latest acquisition may mark a turning point for its hotel tech ambitions, however. Expect to hear more clients announced in 2019.

Read More

Amadeus Buys Hotel Tech Firm TravelClick for $1.5 Billion

The State of the Hotel Tech Stack 2018

Amadeus Accelerates Hotel IT Business With $500 Million Acquisition of Newmarket International

Air France-KLM Names New CEO to Sort Relations

August 16

Why It Mattered:

Air France-KLM is one of the three behemoths of European aviation. But it has been slower to evolve than its competition, which has been a problem. It’s possible its new CEO — an outsider — will be able to force change.

Air France-KLM CEO Ben Smith looks fix a whole lot of problems at the airline company. Photo: Air France-KLM.

By historical convention, Air France-KLM, still part-owned by the French government, is supposed to have a French citizen at the helm.

But desperate times calls for desperate measures, and the company, the least financially healthy among the three major European airline groups, this year for the first time turned to an outsider to run it. Ben Smith is the new CEO, joining Air France-KLM after a long tenure at Air Canada, where he was the No. 2 executive.

Over the past decade, Smith helped Air Canada go from a weak player on the edge of bankruptcy to a global champion that not only could win passengers from other legacy carriers but also compete effectively against low-cost carriers, including WestJet.

Air France-KLM’s board would like to see him achieve similar success in Europe. But it won’t be easy. The company’s French workforce, in particular, is resistant to change.

Read More

How Air France-KLM’s CEO Wants It to Be Like Other Airline Groups

New Air France-KLM CEO Seals Labor Peace With French Unions

Air France Unions Aren’t Happy With Newly Appointed CEO’s Big Salary

U.S. Hotel Industry Commits to Giving Panic Buttons to Workers

September 6

Why It Mattered:

This is a laudable move by a major travel sector, but is it enough? Can the industry do more to address larger safety and well-being issues for its workforce?

In early September, the five leaders of the largest U.S.-based hotel companies came together to announce an unprecedented industrywide initiative — to pledge their commitment to enforce stronger safety and security measures for their hotel employees, which includes giving safety devices, or panic buttons, to their workers.

The hospitality industry, in particular, is not unaccustomed to issues relating to sexual harassment and assault of hotel employees, especially for housekeepers who often work alone in guest rooms. Response from the broader hotel industry, however, has not always been as proactive or receptive for a number of reasons and challenges.

In fact, the American Hotel & Lodging Association, the same trade group that brought together those five companies to pledge a “5-Star Promise” to improve safety is currently appealing a ruling that allows the city of Seattle to not only require hotels to give panic buttons to hotel employees, but also bans or blacklists guests who are accused of sexual assault from returning to hotels where they allegedly committed the crime for five years. AH&LA has said such a blacklist violates a guest’s right to due process.

Whether this industry-wide pledge was driven by either the MeToo or Time’s Up movement, it’s clear that the conversation about sexual assault and harassment in the workplace is changing. And at a time when the hospitality industry, in particular, is facing a labor shortage, anything the industry can do to assure its existing labor force, as well as its future one, is a good thing.

Read More

U.S. Hotel Industry Commits to Giving Panic Button Safety Devices to Workers

Hotels Give Panic Button Panic Buttons to Their Housekeepers

Meituan’s Hong Kong IPO and the Making of a Ctrip Rival

September 13

Why It Mattered:

Food delivery remains its cornerstone, but Meituan is becoming a serious irritant to Ctrip in hotel bookings, likely even more so after raising $4.2 billion in Hong Kong’s second-biggest technology IPO this year.

Give them food, then get them rooms. Food delivery and accommodation go hand-in-hand with Meituan, which last year coaxed some 80 percent of its hotel bookings from food delivery and in-store dining customers, according to iResearch.

Meituan said its in-store, hotel, and travel division, second largest after food delivery, is continuing to solidify its market-leading position. It sold 76.1 million domestic room nights in the third quarter ending September, an increase of 34.8 percent over the same period in 2017. Revenue rose 46.8 per cent to $640 million, which it attributed to a rise in number of active merchants spending more marketing budget on the platform, and an increase in both number of and average daily rate of room nights sold.

Last year, consumers booked 200 million domestic hotel room nights through Meituan, the company said.

Some analysts believe Meituan has already surpassed Ctrip (excluding inventory from Ctrip’s sister Qunar) in domestic hotels content and room nights. Its improvement in average daily rate also counters Ctrip’s dismissal that Meituan primarily caters to a budget audience.

The company, backed by Tencent, had said in its prospectus and listing ceremony that its future would be on food delivery, where it battles Alibaba’s food-delivery platform, Ele.me. With hotels growth working in tandem with food delivery, no doubt Meituan will use the proceeds from the IPO to fortify both areas.

Ctrip will be watching, if it isn’t already.

Read More

Meituan’s Hong Kong IPO May Intensify Its Rivalry With Ctrip

Meituan Raises $4.2 Billion in IPO Priced Toward Top

Priceline Invests $450 Million in Chinese E-Commerce Giant Meituan-Dianping

Marriott Deals With One of the Largest Hotel Labor Strikes in History

September 15

Why It Mattered:

Marriott won’t be the only major hotel or travel company to see labor strikes of this magnitude going forward.

Unionized labor strikes, especially in the hotel industry, are not uncommon. But the strikes that struck the world’s largest hotel company beginning in September — which involved more than 7,700 Marriott employees who are members of Unite Here — were unprecedented in their scope.

What those striking employees wanted from Marriott wasn’t unheard of; they wanted better pay and increased security measures, and they wanted corporations to face the consequences of not meeting those needs.

And while Marriott has settled the majority of those disputes by now, other hotel companies with expiring labor union contracts should view what happened to Marriott as a warning, and they should anticipate “patterned bargaining” from the unions to follow.

Why? Because America’s labor force wants change, and workers are willing to go on strike for it.

Read More

How Big a Problem Are Growing Worker Strikes for Marriott?

Marriott Contract Vote in San Francisco Could End Recent Labor Strife

Jet Fuel Prices Spike

October 3

Why It Mattered:

At most airlines, fuel is the first- or second-biggest cost, along with labor. When oil prices spiked in mid-2018, airlines were concerned and took quick action, but in the end, it may not have been necessary.

Airlines like JetBlue felt the need to pass on higher fuel costs to passengers by raising ticket prices. Photo: Associated Press.

Many airlines across the world were caught off guard in the summer and fall, when fuel prices rose more than 40 percent, year-over-year, with little warning. Prices peaked at more than $75 a barrel on Oct. 3.

As their costs increased, many rushed to cut unprofitable flights, such as American’s nonstops from Chicago to Shanghai and Beijing, while increasing fares and fees.

In the United States, customers on most carriers now pay $30 to check their first bag, up from $25. Airlines said they had no choice but to act decisively.

“Fuel prices are up over 33 percent this year,” JetBlue’s Robin Hayes told Skift in early September. “You end up having to pass those on. We’re about low fares. We hate increasing fares. But we had a couple of fare increases, and then we made the decision to increase the bag fee to $30 if you don’t buy it in the fare.”

But almost as quickly as prices increased, they dropped again. By late November, fuel prices were lower than they had been before the great fuel panic of 2018 began. Still, airlines weren’t celebrating too much. While they were pleased their costs unexpectedly decreased, which could lead to greater short-term profits, they knew they could rise again, almost at any moment.

“You never know,” Southwest CEO Gary Kelly told Skift on Nov. 30.

Read More

Southwest CEO: Cheaper Fuel Won’t Change Our 2019 Game Plan

U.S. Airlines Target Fares and Fees as They Try to Recoup Higher Fuel Costs

European Commission Probes Amadeus and Sabre for Anti-Competitive Behavior

November 23

Why It Mattered:

Europe’s antitrust cop already showed it meant business when, in 2017, it fined Google $2.7 billion. Now the watchdog has turned its investigative eyes on contracts among airlines, travel agencies, and the tech giants Amadeus and Sabre. The commission has a global influence. So its decision will either quiet a long-simmering industry debate on these contracts or turn the heat up to boil.

Margrethe Vestager, the European Commissioner for Competition, will be looking at Sabre and Amadeus. Photo: Bloomberg.

Be careful what you wish for. In 2015, Amadeus, Sabre, and Travelport indirectly prodded the European Union to investigate Lufthansa Group and its $18 fee on plane tickets that agencies book through the companies’ reservation systems. This year, they probably regretted that move.

To recap: The European Technology and Travel Services Association — a lobbying group backed by the three tech companies — filed a formal complaint to the commission alleging that Lufthansa’s practice was discriminatory and thus forbidden under European Union rules.

In response, the commission sent wide-ranging questionnaires to stakeholders about ticket distribution. This year, after reviewing the answers, the officials said they found no need to take up a probe of Lufthansa. The lobbying group complained.

In November, matters took an ironic twist. Margrethe Vestager, the European Commissioner for Competition, said her team would assess any possible anti-competitive effects in the agreements among Amadeus and Sabre and agents and airlines. The commission acted on its own initiative. No airline had filed a formal complaint. The commission started the query instead, in part, because of the answers to the questionnaires.

The case could have a wide industry impact. Air France-KLM and International Airlines Group, the parent company of British Airways and Iberia, have recently mimicked the surcharges. Other airlines have mulled similar moves.

It hasn’t been disclosed why the commission excluded from further scrutiny Travelport, a smaller rival of Amadeus and Sabre. But some experts speculated it was because Travelport is the only one of the three middlemen not to sell passenger service systems to airlines and perhaps lacks the same market power as its peers.

Who’s right, who’s wrong? For years, suppliers of all kinds of products have dissed middlemen for failing to sell their products well and for charging overly high fees. Sometimes these complaints have been justified, sometimes not. But this year we all learned one modern lesson for sure: Never poke a watchdog because the watchdog might turn its sights on you.

Read More

European Commission Is Probing Travel Distribution Systems for Anticompetitive Practices

European Regulators Will Focus on Distributors’ Restrictive Airline Contracts

Report Reiterates Travel’s Responsibility to Fight Climate Change

November 23

Why It Mattered:

From airline fuel emissions to outrageous amounts of water wasted in hotels, the travel industry has to shoulder some of the blame for a warming planet. Many brands have pledged to become more environmentally friendly, and the rest of the world hopes their actions aren’t too late.

Fallout from Hurricane Sandy, which some blamed on climate change, included this roller coaster along the New Jersey shore. Photo: Reuters.

The United States gets a report on climate change trends every four years, and the most recent report, released the day after Thanksgiving, was particularly ominous about threats to coastal communities. Extreme weather and rising sea levels will continue to wreak havoc along densely populated shorelines, the report found, and other findings indicate that much of the country remains unprepared.

Many travel industry CEOs understand that airplanes, hotels, and cruise lines haven’t been environmentally friendly in the past, and we’ve seen examples of leaders from those sectors introduce new planes, hotels, and ships that they promise aren’t spewing as much pollution and also offer healthier experiences for travelers. Norwegian Air, for example, has become one of the most popular fleets for transatlantic travel and was ranked the most fuel-efficient carrier earlier this year.

Hotels are arguably the travel sector most at risk from climate change. Yet, construction continues to boom along U.S. coastlines in some of the at-risk areas cited in the report, and other countries continue to allow new buildings in flood-prone areas. Hotels can’t be shuffled around as easily as planes, cruise ships, or tours. Tour operators are also making strides against climate change, whether that means switching to electric coaches or banning plastic water bottles on trips. Intrepid Travel, for instance, became one of the industry’s first B-corp certified companies this year.

Hurricanes, floods, and wildfires have offered plenty of wake-up calls to the travel industry in recent years. California certainly felt the impact in 2018 with wildfires across the state. Organizations such as California’s Central Coast Travel Commission are trying to be proactive against climate change, but destinations often have limited budgets and authority to address the issues at hand.

Read More

The New Climate Change Report Every Travel Executive Needs to Read

New Jets With Less Legroom Help Fight Climate Change

Los Angeles Tourism Sees Travel as a Buffer Against Climate Change

Marriott Reveals a Massive Data Breach

November 30

Why It Mattered:

This may mean the end of personalization in travel as we know it. The Marriott breach is certain to have far-reaching ramifications beyond just the hotel giant.

Massive doesn’t even begin to describe the magnitude of the four-years-long data breach that Marriott and its acquired company, Starwood Hotels & Resorts, unknowingly had, and only recently discovered this fall.

The data breach involved the personal data, including credit card information and passport numbers, of an estimated 500 million Starwood guests — making it the second largest data security breach in history, only behind Yahoo’s 2013 incident which affected 3 billion users.

Wherever this attack came from — reports suggest it could have originated in China — or whether this could have been prevented not only by Marriott but by Starwood as far back as 2015, the incident was a grave reminder to all travel companies of the importance of data security.

Marriott too has a long road ahead in terms of mitigating damage to consumer trust and brand reputation, and it didn’t help that this happened following the tumultuous merger of its Starwood and Marriott loyalty programs, as well as the massive labor strikes.

Read More

Marriott Says Hackers Breached Data on 500 Million Starwood Guests

What Marriott’s Data Breach Mean for the Hotel Giant and Guests

Marriott’s Starwood Data Breach Joins a Decade-Long List of Hotel Data Exposures

Travelport to Go Private in a $4.4 Billion Deal

December 10

Why It Mattered:

Travelport Worldwide is one of the three largest travel technology companies in the world, and the fate of its $4.4 billion buyout will be watched by rivals and countless airlines and travel agencies. Optimists hope the deal will prove a catalyst that speeds up Travelport’s profitable growth trajectory. Pessimists dread a repeat of what you see so often with private equity, where investors extract a quick profit while hobbling the company’s prospects in the process.

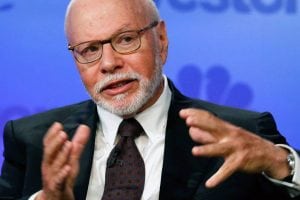

In early 2018, Elliott Management — an activist hedge fund led by Paul Elliott — decided that travel technology giant Travelport was worth more than its stock market capitalization. So Elliott took an 11 percent stake in Travelport and then in December persuaded Travelport’s board to agree to a $4.4 billion buyout offer. If the deal, done along with private equity firm Siris Capital, closes in the second quarter of 2019 as planned, Elliott will have made a quick profit on its shares.

Elliott’s ultimate goal appeared to be to restructure the UK-based travel distribution specialist and then sell it at a hoped-for additional gain. A key restructuring goal seemed to be a likely selloff of Travelport’s majority stake in a lucrative, fast-growing payments technology unit, eNett. The activist investor has hinted that it thinks eNett could fetch between $1 billion and $1.5 billion.

Some Travelport veterans may be shuddering, given their memories of how in 2006 private equity firm Blackstone took control of Travelport from Cendant for only a slightly lower sum, $4.3 billion. Blackstone loaded Travelport up with excessive debt, about $2 billion of which it still carries.

Travelport has all the makings of an enterprise that can take market share from rivals Sabre and Amadeus thanks to its investments in airline, hotel, and car rental distribution technology and its recent deals in fast-growing emerging markets like India.

The wild card would be if a Chinese tech giant, such as Alibaba, Ctrip, or Tencent, swept in to seize Travelport in the next couple of years. If it were creatively merged with a few smaller travel tech players in a roll-up or set of joint ventures, Travelport could become a juggernaut.

Read More

Travelport Is Being Taken Private in $4.4 Billion Deal

Travelport’s Proposed Buyout Deal May Not End the Drama

Activist Investor Pushes for a Travelport Sale to Private Equity

Skift editors Sarah Enelow-Snyder, Raini Hamdi, Sean O’Neill, Dan Peltier, Hannah Sampson, Dennis Schaal, Andrew Sheivachman, Brian Sumers, Deanna Ting, and Patrick Whyte contributed to this report.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Photo credit: Overcrowding in Venice continues to be a problem, prompting efforts to control throngs of tourists by using turnstiles. Skift