Skift Take

The relationship between American tourists and Mexico is nearly a century old and has weathered ups and downs. Today's drug-related violence, mounting border tension, and political rhetoric won't stop these trips, but are clearly disrupting them.

Twenty years of escalating violence and recent political tension between the U.S. and Mexico are changing how Americans plan, book, and take vacations south of the border.

Despite the turmoil, few Americans are deterred. They are still going — Mexico’s beaches in particular have been a staple for the better part of a century — showing how the countries need this tourism relationship to succeed, even as it evolves. Americans are asking new questions and making new choices when booking trips to Mexico, factoring in safety and costs. Getting tourists away from the coastal resorts and off the beaten path is a growing challenge now.

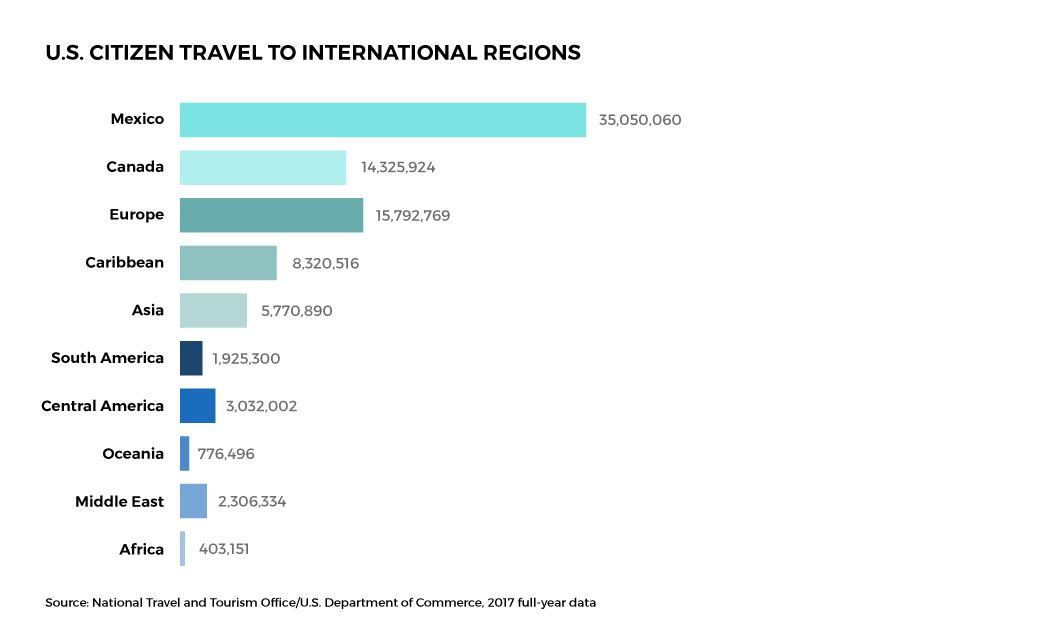

Still, as destinations expand and lure new travelers across the globe, Mexico remains the most popular country for Americans to visit outside the U.S., according to the U.S. National Travel and Tourism Office.

For some Americans, going to Mexico is the only international vacation they can afford. For others, it means access to healthcare. For many of the 36 million Mexican-Americans in the U.S., it’s about cultural connection and seeing family. Conversely, Mexico tourism arguably can’t survive without American visitors — Americans comprised 59 percent of Mexico’s inbound air visitation in 2016 and 2017, followed distantly by Canada at 10 percent for both years, according to Mexican government data.

“The natural market for us has to be the U.S., because of the connection between the two countries, the proximity,” said José Carlos Azcárraga Andrade, CEO of Mexican hotel company Grupo Posadas, which includes eight brands and more than 170 hotels. “But nevertheless, you always have to be prepared to have a diversified portfolio of customers going to your hotels.”

That long mutual relationship perseveres through some of the worst tension the two countries have faced in recent years.

U.S. President Donald Trump’s administration instituted a wildly unpopular “zero tolerance” policy at the U.S.-Mexico border, in which those who cross illegally face criminal prosecution, leading to thousands of children being separated from their parents. The policy fueled stereotypes about Mexico and Latin America. What’s more, people remember that Trump referred to Mexican immigrants as criminals and rapists. Trump continues trying to build a border wall, for which Mexico adamantly refuses to pay, and he pursues isolationist policies like the travel ban. He also imposed tariffs on Mexico and other countries, and moved to replace the North American Free Trade Agreement with a new trade agreement.

Through all of this, American visitation to Mexico is climbing.

Visit México’s Querido Estados Unidos video appears below, the script of which is a heartfelt letter from Mexico to the U.S. lauding their longstanding mutual relationship:

A grand total of 35 million Americans traveled to Mexico in 2017, up 12.4 percent from 2016, with steady gains since 2012, according to the U.S. National Travel and Tourism Office. By comparison, fewer than 16 million went to Europe and just over 14 million went to Canada. The number of American passengers arriving to Cancún Airport rose 13 percent from 2015 to 2016, then another 5 percent from 2016 to 2017 — plus, arrivals in 2018 were already at 98 percent of the previous year’s in July, according to the Quintana Roo Tourism Board.

In fact, Mexico is watching for signs of overtourism, according to text from an educational course titled El Turismo del Futuro by Mexico’s ministry of tourism. President-Elect Andrés Manuel Lopez Obrador even wants to build a train along the Yucatán Peninsula to disperse crowds.

In those moments when visitation does slump, prices often dip to compensate. “At a certain price, people start to forget about their fears,” said Zachary Rabinor, founder and CEO of luxury tour operator Journey Mexico, about prices dropping in Mexico between 2010 and 2014. Rabinor is a native New Yorker who’s been living in Puerto Vallarta for 12 years.

Airlines, cruise lines, and hotels continue to invest in Mexico — often not in places like Acapulco that have been heavier hit by violence, but certainly in places like Cozumel and Los Cabos. “We remain very bullish in Mexico,” said Eduardo Marcos, president of AA Vacations at American Airlines.

“I’m very happy about our return to Cancún with the Hilton and the Waldorf in the next couple of years,” said Juan Corvinos, Hilton’s vice president of development, Latin America and Caribbean. Hilton’s had a presence in Mexico for over 45 years, and currently, it has more than 50 properties in Mexico, comprising about half its Latin America portfolio. Hilton also plans to expand its portfolio of all-inclusive resorts in Latin America, including Mexico. “I think Mexico has gone through several cycles but demand has continued to increase … My agenda would be to someday have more than 100 hotels [in Mexico],” he said.

But changes in traveler behavior are developing, despite the optimism. Travelers are aware of Mexico’s drug-related unrest, express their concerns, and make different choices when purchasing their trips. Some of these choices help them feel safer, some are more expensive, and some make their trips less fulfilling.

How Mexico Went From Old Favorite to Safety Question

Mexico’s profile as a close, easy, affordable destination made it a solid option for Americans starting in the 1950s, and a staple from the 70s, according to the World Bank, as families and businesses recovered from the trying World War II years.

American Airlines has an especially long, 76-year history in the market, having entered back in 1942 with a route from Dallas to Mexico City with a fuel stopover in Monterrey. World War II delayed the initial launch to Mexico and the carrier had to build its Monterrey infrastructure essentially from scratch, according to an American spokesperson. It took another four decades to add service to Cancún in 1981, followed by San José del Cabo in 1996.

Major changes began in the 1990s when Colombia suppressed its major drug cartels, which shifted activity north into Mexico. Then in 2000, Mexico’s reigning political party, the PRI, fell out of power for the first time in 71 years, prompting a period of political instability as President Vicente Fox came in, followed by Felipe Calderón.

This transitional period saw the weakening of local law enforcement, increasing political corruption, and flourishing drug-related violence — the cause of many tourists’ concerns today.

The PRI returned with President Enrique Peña Nieto in 2012. In July, a new leftist president was elected by a landslide, López Obrador, who pledged to reduce violence and forge a healthier relationship with the U.S. in the wake of sharp tension with U.S. President Donald Trump. López Obrador takes office in December and has named Miguel Torruco Marqués his secretary of tourism. The incoming secretary studied hospitality at Cornell University and has been secretary of tourism of the country’s federal district since 2012.

These ups and downs certainly never stopped Mexican culture from being an integral part of American culture.

“Mexicans are so prevalent and present as part of American cultural fabric,” said Rabinor of Journey Mexico about the culture’s accessibility.

“I didn’t really think of Mexico as that foreign because there are so many Latinos in New York, there are so many Latinos in the country, I hear Spanish every day,” said Carla Murphy, a 41-year-old traveler from New York who was recently in Mexico City on her third trip to Mexico. “I think of it the same way I think of Canada.”

To illustrate, nearly 40 percent of Texas is Latino, according to the U.S. census. Many border state residents will always see Mexico as familiar, not scary, and accessible. Others won’t.

The U.S. has a level-two travel advisory for Mexico, requesting that travelers exercise increased caution due to widespread violent crime including homicide, kidnapping, carjacking, and robbery.

“Before I travel, I always check the State Department advisory website,” said Murphy. “Usually it’s not the whole country.” She said she doesn’t visit the do-not-travel states.

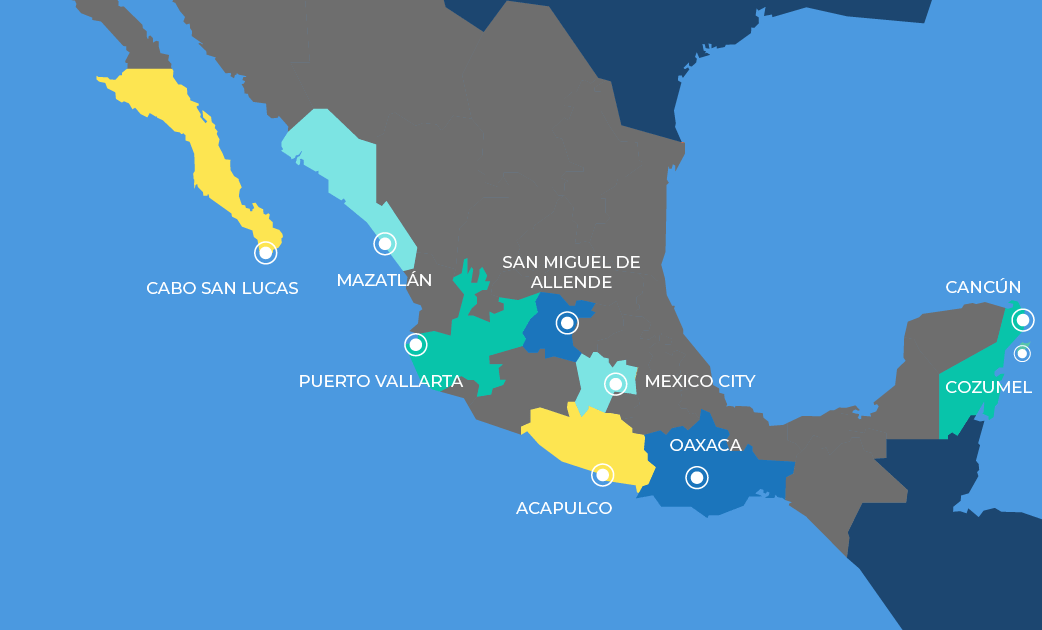

The resort towns of Acapulco and Mazatlán notably lie in level-four, do-not-travel states: Guerrero and Sinaloa respectively. Acapulco in particular has fallen dramatically over the years from an archetypal tourist haven — up there with Niagara Falls in the American consciousness, not to mention Frank Sinatra lyrics — to a hub of violence and a cautionary tale.

PBS NewsHour investigates violence in Acapulco:

The appearance of a superhighway between Mexico City and Acapulco in 1993 was a game-changer for the resort town, reducing a six-hour drive to three hours. This attracted more local tourists, but at the same time, violence began to swell in the beach resort town.

“It went from being an international jet set hotspot to being much more of a local market,” said Rabinor. “It dragged the whole destination into more middle-market territory.”

To give Acapulco some context, Rabinor compared it to Rio de Janeiro safety-wise. “The perception and the reality of more crime is less about drug trafficking and narcos and gangs, and more about petty crime, robberies, and muggings,” said Rabinor.

The drug-related violence from the last 20 years is real, but many in tourism predictably say that none of this really affects the industry — Mexico is open for business and tourists are not involved in the drug trade.

“[Clients] like having their concerns relativized,” said Rabinor. “The areas of Mexico that people are typically visiting are safer than Chicago and Detroit.”

Kelley Austin, a Cruise Planners franchise owner, likewise compared Mexico to Chicago, and David Fishman, president of Cadillac Travel Group, a Travel Leaders Network franchisee, brought up Baltimore and Washington, D.C.

Comparing violence on each side of the border may be futile, but when brands and travelers make such comparisons, they sometimes note that Americans face chronic safety concerns at home, including mass shootings, other gun violence, and police brutality. According to American traveler Natisha Willis, the threat of police brutality and “driving while black” are “part of why I’m moving to Mexico.” Shayla Hunter, a 39-year-old traveler from New York who was recently in Isla Mujeres on her third trip to Mexico, similarly said, “As a woman of color, I’ve felt safe and welcomed [in Mexico] … possibly more safe than traveling in some parts of the U.S.”

Some travelers feel quite differently. “There are different types of violence and the United States does not have this,” said Murphy, the 41-year-old traveler from New York. “The United States does not have incidents of people having their heads f——g chopped off,” she said, noting that the violence doesn’t target tourists and revolves around the drug trade.

Isolated Incidents Vs. Long-Term Unrest

History suggests that destinations may rebound more quickly from isolated events than from ongoing unrest. For example, a cluster of attacks resonates differently with travelers than a years-long civil war.

The 2015 Paris terror attacks were incredibly jarring and frightening, but visitation did start to rebound within about a year. At that point, hotel stays showed signs of renewed health despite that additional factors were at play, including labor protests and floods.

Similarly, mass shootings in the U.S. have not led to mass trip cancellations, according to a Skift survey of travelers from the UK, Germany, and Japan in June. Only 7 percent of respondents were reconsidering their trips because of these incidents.

Egypt is a different story. The Arab Spring began in 2010, and with the ousting of Egyptian President Hosni Mubarak in 2011, such extensive unrest bludgeoned Egypt’s previously strong tourism industry for years. Only since 2017 has Egypt’s tourism revenue looked more promising.

Mexico seemingly lies somewhere in the middle. Theoretically, the violence is too concentrated to shut down tourism altogether — if you avoid the drug trade, you’ll probably avoid most of the risk. But the unrest is ongoing for two decades and has seeped into the American public’s mind, and is a frequent topic of conversation between travelers and the brands with which they book.

Booking Behaviors Evolve When ‘Living Like a Local’ Appears Dangerous

So if American visitation to Mexico is healthy, what kinds of changes are happening beneath the surface?

Some Americans are wary of off-the-beaten-path excursions, because theoretically, it might expose them to violence. Others stay at all-inclusive resorts or pre-book every last part of the trip, to feel safer and make sure nothing is left to chance. Others lean on the knowledge of a travel agent instead of booking independently.

“I’ve had that conversation twice today already,” said Cruise Planners franchisee Austin about safety in Mexico. “They ask me ‘Are the drug wars going to get me? Do the cartels run the resorts? Am I going to get shot?’” Austin said she’s gotten more safety questions in the last year and a half than previously.

The luxury clients of Journey Mexico pose similar questions. “They ask ‘Is it safe to go there? Should we be concerned?’ They really want to hear from people who are on the ground,” said Rabinor, founder and CEO of the luxury tour operator.

When it comes to the safety conversation, Austin said she tries to keep the news reports in perspective while respecting travelers’ valid concerns, and is up-front about the crime rate in places like Acapulco and Mazatlán. However, air service to Mazatlán isn’t as plentiful as in other destinations anyway. Rabinor echoed that Journey Mexico operates very little in Mazatlán as it’s more popular with the local market.

Austin said the top destinations for her clients remain the tried-and-true coastal hotspots, in descending order: Riviera Maya, Cancún, Puerto Vallarta, and Los Cabos. Short nonstop flights from hubs like Houston continue to be crucial — two and a half hours or less to Los Cabos, Puerto Vallarta, and Cancún — in addition to the attractive price point of all-inclusive resorts. Three- to four-night weekend getaways are easy under these conditions, especially when Houston is closer to Mexico than to Miami.

Austin said that her 2018 Mexico business is up, though she’s seen dips in demand over the nine years she’s been a Cruise Planners franchise owner. What’s really changing is traveler behavior during the booking process.

Many travelers now use a transfer service, pre-book their tours and activities, and generally stay on the beaten path instead of playing it by ear, according to Austin. They also want to tell their concerned friends and family members that everything is pre-booked with well-known brands, to assuage their fears.

“I think when you’re traveling on leisure, and you’re traveling with family, you’re more prone to actually planning things ahead,” said Juan Corvinos of Hilton. “You don’t want anything to go wrong and have to wait for a driver. It’s not just security, it’s convenience … Our travelers of course are concerned with safety. We try to provide a comfort blanket, that our properties will do everything possible to make them safe.”

“The all-inclusives have security on the ground and people really can’t get in the resorts unless they are supposed to be there,” said David Fishman of Cadillac Travel Group. “This is not security because of crime, but mainly because the resorts don’t want to serve food and drinks to people who shouldn’t be in there.”

“There has been a fall in demand just recently, especially with families,” said Fishman about overall demand for Mexico. “The majority of our clients are still going. Some may ask [safety-related] questions because it’s in the news, but this is not deterring them from going.”

This all leads to less interaction with locals, meaning a more manufactured, sterile, tourists-only environment.

Some Settle for a Superficial Experience

By design, cruising is one of the safest, most protected ways to travel, making travel warnings of relatively little consequence. Some cruisers have minimal desire to even disembark, and those who do often take brief guided tours near the port, then head right back to the ship for more food and cocktails. Getting off the beaten path is just not part of it.

The whole experience is designed to ensure the traveler doesn’t have to make any difficult decisions, or any decisions at all, so naturally, this is a very different way to experience Mexico than navigating independently, on the ground, in the interior. From a cultural exploration perspective, cruising is deeply limiting, but it’s safe and comfortable, and that’s a selling point for many.

That kind of product also makes investment in Mexico a little less nerve-racking.

An unusual new route for Carnival Cruise Line indicates the company’s strong relationship with Mexico: year-round service from Long Beach, California, to Cabo San Lucas, Puerto Vallarta, and Mazatlán that will begin in December, 2019. Carnival Panorama is the company’s first new ship homeported on the West Coast in 20 years.

Mexico is currently Carnival’s most visited destination, receiving half its fleet. Cozumel is predictably among its top locales, hosting over 2 million Carnival guests annually, and the company indicated a desire for continued growth in the region in an emailed statement.

In terms of ports in level-four travel advisory areas, like Acapulco and Mazatlán, some people do see changes over time.

“There was a time when cruise ships didn’t go there [to Mazatlán], or to Acapulco, and then they go back. It’s a constant flowing dynamic,” said Austin, the Cruise Planners franchise owner.

At times, cruise lines including Royal Caribbean and Carnival have pulled back from Mexico’s West Coast in large part due to safety concerns, but now, an overall increase in cruise activity on the West Coast is promising, according to Stewart Chiron, a cruise industry expert. But the most popular ports to the east have held up well over time. “Cozumel’s been a very steady, consistent port,” he said.

Cruising offers an attractive safety in numbers, said Chiron. “A lot of people do feel safer visiting many destinations because of the safety that ships provide.” He also said that overall, cruisers aren’t declining to go on excursions in order to stay close to the safety of the port — travelers trust the partnerships that major cruise lines have with their on-the-ground tour operators.

However, cruising to Mexico isn’t so invincible as to support new ports in peripheral places like South Padre Island (near Brownsville, Texas) or Puerto Peñasco (near Tucson and Phoenix, Arizona). The people just aren’t there, said Chiron.

The director general of Quintana Roo Tourism Board, Darío Flota Ocampo, naturally doesn’t see the beaten path as a bad, inauthentic thing. In some areas, like Bacalar Lagoon, “You cannot see the difference between what’s touristic and what’s local,” he said. The state of Quintana Roo includes more famous hotspots than many others, including Cancún, Playa del Carmen, Cozumel, Tulum, and Isla Mujeres.

The superficiality of cruising and staying on the beaten path also raises cultural questions. “A lot of Americans go down there because it’s cheap and they behave badly,” said Reuben Reynoso, a 47-year-old Mexican-American traveler from Los Angeles. “They wanna act like big shots … [brands should] start marketing more toward Mexican-Americans who actually appreciate our culture.”

Smart Brands Speak to the Latino Market

Low-cost Mexican airline Volaris started operations in the U.S. in 2009 in large part to court the Mexican-American market. This “visiting friends and relatives” market remains a strong focus for Volaris — similarly, Visit Mexico targeted Mexican-Americans with its recent Viajemos Todos por México campaign.

Visit Mexico’s Viajemos Todos por México campaign:

According to the census, 18 percent of the U.S. population is Latino, 63 percent of which is of Mexican origin, totaling around 36 million Mexican-Americans. Brands heavily invested in U.S.-Mexico travel can’t really afford to neglect the Mexican-American market when the census estimates that the greater Latino population will reach 119 million by 2060.

“In general, the majority of the [marketing] that you see is mainly aimed at white Americans going to resorts like Cozumel and Ixtapa,” said Reynoso, who has paternal and maternal family in the Sonora and Colima areas of Mexico. “I wish there would be more marketing toward Mexican-Americans. This is where you come from. This is where your family comes from.”

Brands are missing an opportunity to market heritage tourism to Mexican-Americans, according to Reynoso, especially because of easy and affordable DNA testing, which often goes back further than your average family tree.

Nathan Aguilera, a 38-year-old Mexican-American traveler, expressed great interest in doing a trip to Mexico based on a DNA test. He said “wanting to see where my family comes from” is a primary driver of his trips. He also has family in Mexico, whom he’d see once or twice a year; he grew up in Oklahoma.

“I feel like most of the marketing is more toward Americans than it is Mexican-Americans,” said Aguilera, adding that he wants to see more marketing of destinations beyond coastal resort towns like Cancún.

“I was lucky because my mom’s an anomaly,” said Reynoso. “She’s Mexican, she grew up out there, and she was always like, ‘You guys need to travel and explore the world.’ You don’t really hear that much in Latino families. It’s more about get married, have kids, get a job.”

“In a Mexican-origin family, the son or daughter are the ones who buy the flight ticket for the parents,” said Volaris Executive Vice President Holger Blankenstein. “How the family gets to know Volaris and the brand is passed down from generation to generation.”

For traveler Lainie Herrera, who is half Mexican-American and lives in Los Angeles, many things drive her to repeatedly visit Mexico. She doesn’t have family there, but she said the affordability, closeness, and cultural connection are all very compelling.

“My draw to Mexico was to understand another Spanish-speaking place other than my Puerto Rican family,” said traveler Yvonne Maffei, who is mixed Latina and lives in Chicago. On a trip to Los Cabos, Maffei said many people stuck to the resort instead of exploring. “That made me really sad because I didn’t, and I felt safe, but speaking the language helps a lot.”

The Mexican-American market is valuable to Mexican hotel company Grupo Posadas, but it does not eclipse other customer segments. “It is important because obviously there’s a natural propensity of people that are of Mexican descent or Latin descent in the U.S. to go to Mexico,” said José Carlos Azcárraga Andrade, the Grupo Posadas CEO. “But the way I see it, we don’t target that specific market, as we’ve probably been more successful with other markets.”

Most Americans remain unfamiliar with Mexican low-cost carrier Volaris — 12 percent of its passengers are foreigners, although 98 percent of those are American. In 2009 with seven routes to the U.S., Blankenstein said Volaris carried around 190,000 passengers on U.S. routes. In 2017, it carried more than 2.8 million, and in the first half of 2018, it’s holding steady at almost 1.5 million.

In January Volaris also announced a codeshare with U.S. low-cost carrier Frontier, which could help increase brand recognition. Volaris naturally serves the coastal hotspots in Mexico, but also offers direct routes to some smaller in-land destinations like Durango, Zacatecas, León (near the city of Guanajuato), and Morelia. Blankenstein said Volaris will soon add additional non-stops targeting American leisure travelers.

Volaris has a track record of converting Mexican travelers from the nationwide bus network to planes — but this has been less impactful on American travelers. Blankenstein also noted that many Americans are looking for a one-stop shop, for example a travel agent or an online travel agency. Volaris has a presence on Despegar, Best Day, and Expedia, the latter having the strongest recognition among American shoppers.

Affordable Care Act Spurs Medical Tourism to Mexico

American medical tourism to Mexico is as old as traditional tourism, dating back to approximately the 1950s, according to Josef Woodman, CEO of Patients Beyond Borders. The organization estimated that in 2017, 1.4 million Americans engaged in medical tourism, which can be defined as seeking treatment abroad, often involving a leisure element, typically within a four-hour plane ride from home. Pricey procedures tend to drive these trips: dental work, cosmetic surgery, fertility treatments, and bariatric surgery.

Medical tourism is rising in part due to the Affordable Care Act. “ACA really encouraged people, and sometimes forced people, to shop around for care, which is something that Americans were just not used to doing,” said Woodman, adding that some doctors began lowering fees to retain patients. The ACA, signed into law by former President Barack Obama in 2010, did reduce costs for many, but holes in coverage and fees for being uninsured still frustrated others.

Woodman believes that the U.S. travel advisory for Mexico could hinder medical visitation. “It was a painful decision, but we don’t even link to those travel warnings. They’re paranoid,” he said. But medical tourism is designed to be “a very protected experience,” said Woodman — many providers pick up travelers at the airport and shuttle them around.

While many Americans — often those older than 50 who live in border states — rely on medical tourism, it still hasn’t permeated the public consciousness, according to Paul McTaggart, founder of agencies Medical Departures and Dental Departures, and a former senior employee at Expedia. Medical Departures’ revenue comes from the care providers, not the shoppers, and in Mexico, McTaggart has seen 40 percent growth year-over-year. “For us, for healthcare, we’re quite happy with that,” he said, adding that low-cost airlines strengthen his business.

Medical Departures does not sell flights or hotels, but McTaggart is open to the idea. “I’m always interested in making auxiliary revenue. Like any other online travel agency, I want to have add-ons,” said McTaggart. He tried selling hotels for a 20 percent margin in Cancún, Tijuana, and Puerto Vallarta, but decided he didn’t have the infrastructure to be competitive. The company has an affiliate agreement with Booking.com, suggesting nearby three-, four-, and five-star hotels.

“We’re a largely xenophobic culture,” Woodman said of some Americans’ distrust of care in Mexico, which could be waning. In 2006, Mexico had no facilities accredited by Joint Commission International, a nonprofit that accredits health care organizations, according to Patients Beyond Borders. Now it has eight. Mexico welcomed between 1.4 million and 3 million medical tourists in 2016, the discrepancy likely arising from undocumented individuals returning home for care.

“Cancún, Los Cabos, Puerto Vallarta, to a lesser extent Tijuana, that’s where you have just a blossoming of high-quality clinics … they set up shop in these areas that have naturally high tourism rates,” said Woodman, who also cited Monterrey, Mexico City, and Guadalajara for their high-quality hospitals.

Los Angeles-based traveler Reuben Reynoso knows people who’ve had dental work and plastic surgery done in Mexico. “I know people who go down there to get their medication just because it’s a thousand times cheaper,” he said.

Border Tension Won’t Keep Americans Out of Mexico

The political relationship between Mexico and the U.S. has been increasingly strained since President Donald Trump took office in 2017. Trump is still attempting to build a border wall between the two countries, and despite his repeated claims that Mexico would pay for the wall, its last three presidents and its president-elect — Fox, Calderón, Peña Nieto, and López Obrador — vehemently deny the possibility. Fox has become somewhat famous for comedically trolling Trump.

Racist rhetoric from Trump still stings as well, when he referred to Mexican immigrants as criminals and rapists. The Trump administration also instituted a “zero tolerance” policy at the U.S.-Mexico border, in which those who cross illegally face criminal prosecution, leading to thousands of children being separated from their parents. This policy largely affected people migrating from elsewhere in Latin America through Mexico to ultimately reach the U.S.

These discriminatory tactics will likely have the greatest effect on Mexican travelers coming to the U.S.

Mexico is the United States’ second-largest inbound market and after seven years of continued growth in Mexican visitation to the United States, arrivals from Mexico declined by 6.1 percent in 2017, with the downward trend starting around the 2016 presidential election, according to the U.S. Travel Association.

The association cited recent political developments, particularly the discussion of a border wall and increased border security measures, coupled with a relatively weak Mexican peso.

“[Border tension] would affect me seeing my family if they wanted to come to the United States,” said Mexican-American traveler Nathan Aguilera. “I feel fully free to travel in and out of Mexico as I please on an American passport.”

Americans may still be going to Mexico, but the toxic border situation affects how Americans approach the destination. The Trump administration engages in “fear-mongering” according to Reynoso. Before going to Mazatlán, his friends warned him about getting kidnapped.

“There’s been kind of a backlash to the current [Trump] administration that’s been so overly anti-Mexico. It’s desensitized people,” said Rabinor of Journey Mexico. “He’s constantly beating up on Mexico so much that people are over it … This overt, exaggerated, unbelievable public racism, hatred, that seems quite inappropriate.”

“Before coming [to Mexico] I was a little worried about how I was going to be received because of the disgusting acts and agenda of our current administration and how they are treating the people of Mexico,” said traveler Shayla Hunter.

“I’ve become hyper-aware of how badly U.S. media talks about Mexico and Mexicans, and the stuff that Donald Trump says too,” said traveler Carla Murphy. “I always think to myself, what do Mexicans think now when Americans come to visit?”

Americans Adjust to Keep Tradition Alive

With the glaring exception of Trump, practically everyone with a stake in the nearly century-old U.S.-Mexico tourism relationship wants it to succeed.

Mexico tourism arguably can’t survive without American visitors, and Americans want to keep going, for all kinds of reasons: family, cultural connection, affordability, and pure desire. That means each party will keep making the necessary adjustments to keep things moving forward.

“There’s never been more flights to more places; there’s never been more robust infrastructure in terms of luxury accommodation; there’s never been more access to the more hard-to-get areas,” said Rabinor of Journey Mexico.

“We’re in a golden age, despite all the political posturing,” he said.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: borders, cruises, mexico, tour operators, travel agents, trump, united states

Photo credit: A tourist bungee jumps in Acapulco on October 18, 2012. Acapulco has been hard hit by crime and violence in recent years, seriously damaging its tourism industry. Comisión Mexicana de Filmaciones / Flickr