India's Outbound Tourism Spending Is Expected to Grow Rapidly

Skift Take

India has everything necessary to become a formidable outbound travel market. Boasting the world’s second-largest population and the fastest-growing major economy, it is already showing signs of its power, along with indicators that the real boom is still to come.

India’s economic growth means that citizens are earning more disposable income to spend on travel. In response, air travel out of the country has expanded significantly, and with passports in hand, the youthful population is excited to visit new places and motivated to have unique travel experiences.

In the latest Skift Research report, The State of India Outbound Travel 2018, we provide an in-depth primer of this up-and-coming market. We look at how it has grown, by the number of travelers and their expenditures, along with key factors that are driving this growth. We then focus on consumer behavior, from tech use to travel-specific preferences. Then, we identify case studies of travel brands and destinations that have taken action by implementing strategic initiatives to prepare for the impending boom in outbound travel from India.

Preview and Buy the Full Report

Last week we launched the latest report in our Skift Research service, The State of India Outbound Travel 2018.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

The Market by the Numbers: Expenditure

In addition to the size of the market, the growth of its international tourism expenditure also makes the Indian market an attractive one. In 2016, Indian outbound travelers spent nearly $19.2 billion on outbound tourism-related expenses. This amount puts it in the top 20 countries in terms of outbound tourism expenditure, according to the World Tourism Organization.

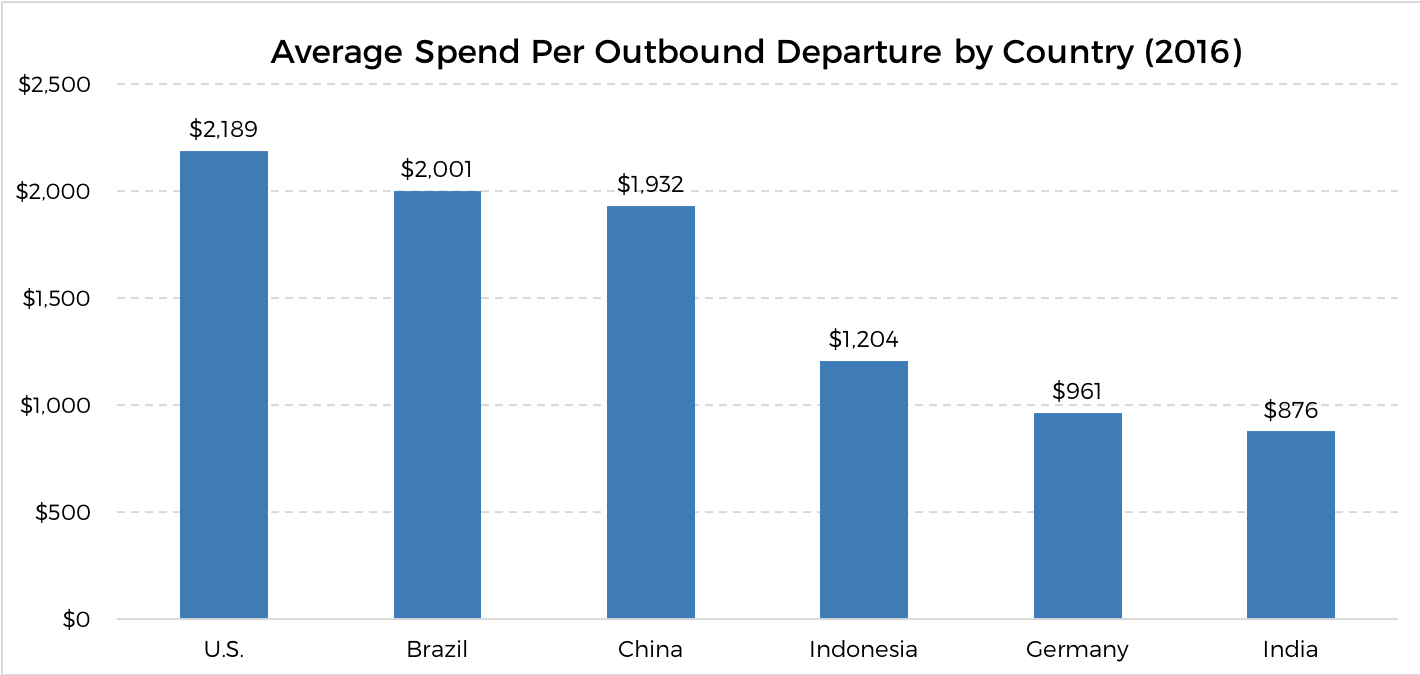

Based on the 21.9 million outbound trips taken that year, this amounts to an average per-person, per-visit expenditure of $876. Compared to other emerging markets, this per-visit spend is comparatively low. The report by CAPA India and Expedia calculates the average spending by Indian outbound travelers on short-haul trips is about $857 per trip per person, and long-haul trips is about $1,687.

Source: Skift Research, The World Bank

Source: The World Bank

Preview and Buy the Full Report

From 2006 to 2016, India’s outbound travel expenditure increased 7% on average year-over-year, and this rate seems to be increasing. From 2015 to 2016, the market saw an 8.5% increase in expenditure, which is higher than the rates China, Indonesia, Brazil, the U.S., and Germany experienced in the same period (4.5%, 2.5%, -16.5%, 7.1%, and 2.5% respectively).

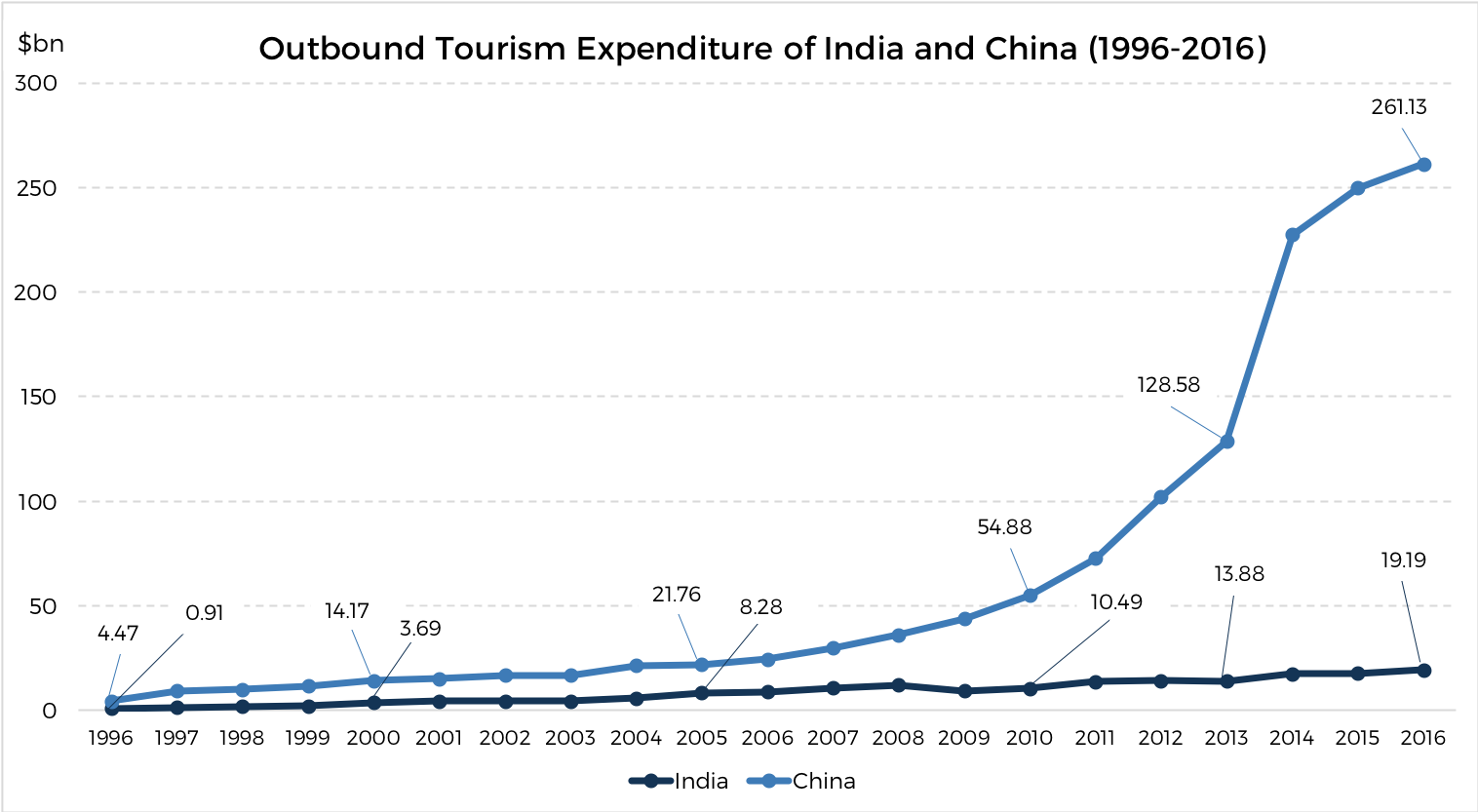

If the outbound tourism market grows as quickly as forecasters like the UNWTO estimate, we can expect that the market’s expenditure will also increase rapidly. We just have to look at China to see how dramatically outbound tourism expenditure can grow in a short period of time. The China market’s expenditure was growing at a similarly steady rate that India is experiencing now until about 2010, when growth exploded.

If India’s economic growth and other driving factors continue as they have been and are currently, then this market could experience a similarly dramatic boom well within the next decade. In fact, between 1996 and 2016, the compound annual growth rate of outbound tourism expenditure for India, at 23%, was higher than that of China at 17%, so signs are already pointing to a boom.

Source: The World Bank

Subscribe now to Skift Research Reports

This is the latest in a series of research reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.