Skift Take

Better, faster, stronger. We pinpointed 20 venture-backed companies — mostly young — that promise breakaway potential. These startups prove that innovation is happening everywhere, from Atlanta to Ramallah to Queensland.

No scooter startups or flying taxis. No blockchain-based dreams. And nothing from Silicon Valley — which hogs the spotlight enough as it is.

When Skift put together its list of the year’s top 20 travel startups, we wanted to ignore the ones hyped elsewhere.

We also only included startups that have raised less than $25 million in venture funding. The reason? We’ve reviewed hundreds of emerging travel companies over nearly six years, and we’ve found that fundraising is a separate skill from building solid companies. Here’s our all-star list, presented in alphabetical order.

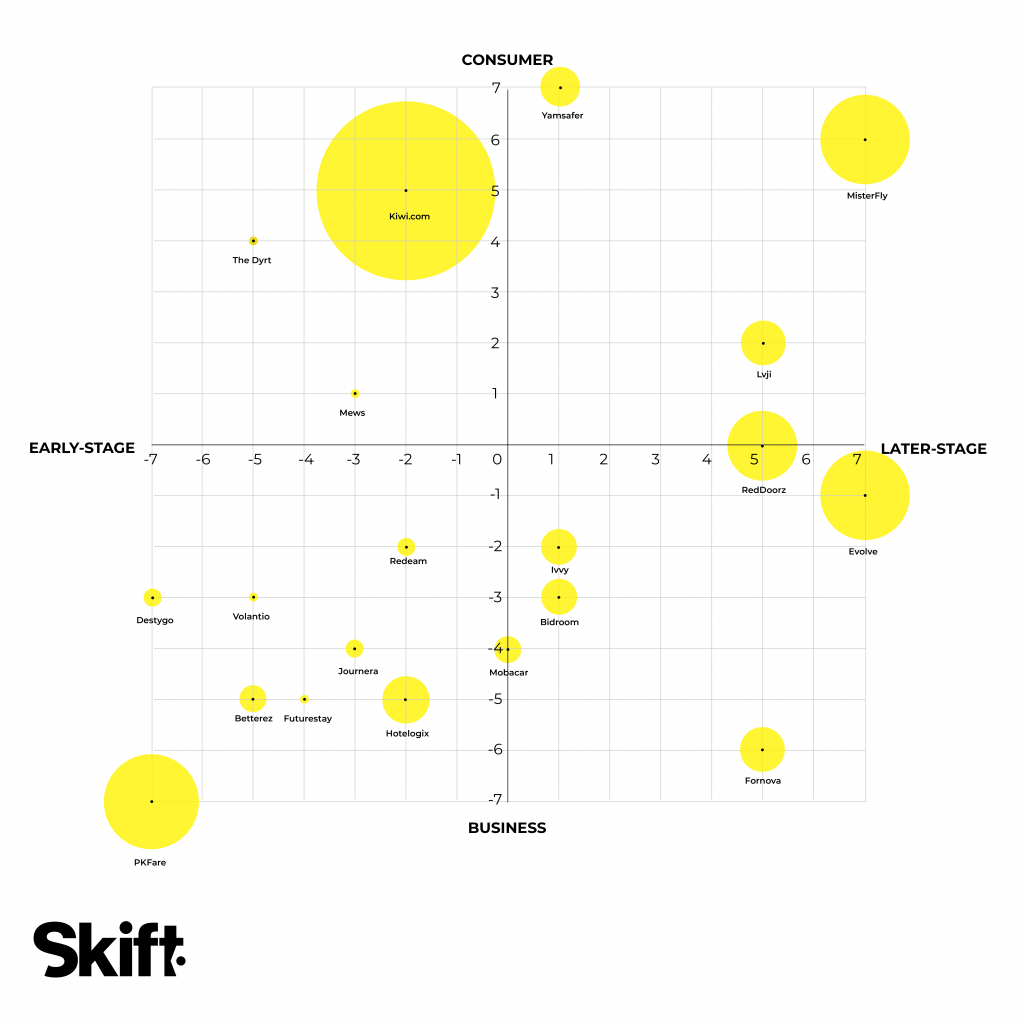

20 Startups to Watch in 2018 (see our 2019 list here)

Click to enlarge The size of the yellow spheres represents the estimated size of a company’s staff. The larger the sphere, the higher the headcount and estimated average annual revenue.

Betterez

Toronto, Canada

Bus companies get the modern reservations and ticketing tools they need

Money Raised: Undisclosed

Headline Investors: Amadeus Ventures and JetBlue Technology Ventures

Skift Take: This company has taken seven years to crack the complicated technical problem of building a set of tools that can help ground transportation providers shift up a gear and run their businesses more efficiently. It appears to have built a product that can scale up, at last — just in time for a sector in desperate need of a tech upgrade. Think: bus-side mobile ticket scanning, accurate ridership reports, optimized pricing for demand, and mobile shopping and upselling.

Bidroom

Amsterdam, The Netherlands

An Amazon Prime for hotel bookings

Money Raised: Undisclosed

Headline Investors: Egyptian multi-millionaire Samih Sawiris

Skift Take: Booking Holdings and Expedia Group are squeezing independent hotels with commissions and costs that can total as much as 30 percent. Many owners are eager for alternatives. Bidroom aims to offer one, charging hotels zero commissions after a one-time $174, or €149, fee. It charges travelers $69, or €59, a year for access. Recent changes in contracts between the online travel giants and hotels allow each side to offer discounted rates via membership-based platforms. Credit card issuer Visa is marketing Bidroom to its users in Europe.

Destygo

Paris, France

Chatbots for travel

Money Raised: $1.3 million (€1 million)

Headline Investors: Partech Ventures, with AccorHotels in a small stake

Skift Take: Building a chatbot isn’t the same thing as building a business. Destygo stands apart from other chatbot builders by creating a conversational artificial intelligence platform specialized for the travel industry. Only a year old — and a graduate of International Airlines Group (IAG)’s Hangar 51 accelerator — the company already builds chat- and voice-assistants for companies, such as travel management company Carlson Wagonlit Travel and Iberia Airlines.

Evolve

Denver, Colorado

Uber-izing vacation rental property management

Money Raised: $23 million

Headline Investors: PAR Capital and T. Rowe Price

Skift Take: Yes, many well-funded companies like Vacasa are wringing efficiencies out of the vacation rental sector with new tech and new business models. But the market is large and fragmented, with room for fresh models. Evolve stands out by offering owners services a la carte. Its basic set comes with only a 10 percent commission, while some rivals require a larger package of services and charge commissions of up to 30 percent. Evolve has signed up owners or managers of 7,500 active units of inventory, which it expects to double within a year.

Fornova

Yokneam Ilit, Israel

Helping hotels preserve rate integrity

Money Raised: $20.1 million

Headline Investors: Deutsche Telekom Capital Partners, Waypoint, and JAL Ventures

Skift Take: Fornova got its start, essentially, as the world’s most sophisticated web scraper. It helped customers like Priceline and Expedia trawl online rates for hotels and compare how often hotels and other websites were undercutting them on price. The startup has since expanded with an array of technologies that help hotels maintain the integrity of their rates. So far, Marriott, Accor, and other hotel groups use Fornova to monitor and benchmark online rates and automatically react to ensure they sell every room in the smartest way.

Futurestay

New Brunswick, New Jersey

A genuinely end-to-end management platform for vacation rental owners

Money Raised: $2.8 million

Headline Investors: Newark Venture Partners

Skift Take: Managers of vacation rental properties want to market their properties on Airbnb, Booking.com, and other platforms, and many companies have popped up to sell software to help. But almost none of these online tools are comprehensive in automating the tasks required after a traveler has clicked a “book now” button, such as handling any refund issues that might crop up. Futurestay strives to handle it all, leaving owners with less manual work. CEO Philip Kennard said it serves more than 100,000 properties, despite having spent nothing on search engine marketing or ads of any kind.

Hotelogix

Noida, India

Letting hotels ditch their servers

Money Raised: $8 million

Headline Investors: Accel, Saama, and Vertex

Skift Take: Most hotel groups in India and emerging markets run server-based management systems at their properties and lack centralized control at the corporate level. The hoteliers also have little ability to transact with online travel agencies in real-time. Hotelogix stitches all of this together with mobile-first, internet-based software for customers in 100 countries. Other startups, such as Mews and SiteMinder, have products with overlapping functions, but the long-overdue competition is welcome news for the sector.

Ivvy

Varsity Lakes, Queensland, Australia

Like a SABRE or TRAVELPORT for meetings and events

Money Raised: $11 million ($15 million AUD) venture, and about $7.5 private.

Headline Investors: Undisclosed

Skift Take: CEO Lauren Hall wants to take her booking engine for events to a global audience, having opened UK and U.S. offices last year and already having offices in Australia and South Africa. Meeting planners and venue suppliers like hotels remain mired in systems that don’t talk to each other seamlessly. Other companies, like Social Tables, Groupize, and Breather, are also tackling overlapping parts of the problem. But Hall has a big ambition for Ivvy to create the first global distribution system for events.

Journera

Chicago, Illinois

Linking scattered data to give companies a unified view of a traveler’s journey

Money Raised: Undisclosed

Headline Investors: Undisclosed

Skift Take: Travel suppliers know that customers want seamless personalized experiences and relevant offers, but each brand only has a small set of data on any given traveler. Journera is attempting to find a way to piece together the data and help companies make more relevant offers at each stage of a trip. Other companies, including Adara, Adobe, and Sabre, have head starts in tackling this critical industry problem in various ways. We include Journera on our top startups list partly because of faith in the team, led by Co-founder and CEO Jeffrey Katz — who was previously CEO of Orbitz and Swissair — and partly because affiliates of several major U.S. airlines and hotel chains have shown support.

Kiwi.com

Brno, Czech Republic

The fastest-growing travel site Americans have never heard of

Money Raised: $1.75 million (€1.5 million)

Headline Investors: Jiri Hlavenka, a Czech entrepreneur

Skift Take: How can a startup scale up in five years to support nearly 1,900 workers when it has only raised $1.75 million? Through cash flow or profitable growth. Exhibit A is Kiwi.com, which has sold 6 million tickets since its founding in 2012. It offers a distinctive model of combining flights from non-partner airlines into single itineraries. Think: flying first on Ryanair and then on easyJet on two one-way tickets to reach your final destination.

Lvji

Guangzhou, China

Tourism information for the New Silk Road

Money Raised: $19 million

Headline Investors: Qianhai Fund of Funds and Pufeng Fund.

Skift Take: Anyone who has traveled in China outside of its best-known cities knows that the amount of tourism information infrastructure is limited for Mandarin-speakers — let alone for international visitors. To fill the gap, Lvji has developed audio travel guides for mobile apps and electronic kiosks for destinations. Once the company has solved China’s destination marketing problem, it will have learned enough to build products that could travel far and wide.

Mews

Amsterdam, The Netherlands

A hotel property management system that outwits incumbent players

Money Raised: $8.8 million

Headline Investors: Notion Capital, Axivate Capital, and Thayer Ventures

Skift Take: Hotel innovation has been held back by the 300 or so property management systems used today. Most property management systems are too complicated for new services to integrate with quickly and smoothly — either because they charge high connectivity fees or are clunky to use. Mews charges nothing for integrations, and it has built its property management system from scratch to work well with the APIs (application programming interfaces) that enable digital innovation. Apaleo, Hotelogix, Impala, and SiteMinder have similar products, but the market can support competition.

MisterFly

Paris, France

Like an online travel agency but without the greed

Money Raised: $23 million in venture capital, plus other funding

Headline Investors: Montefiore Investment

Skift Take: MisterFly is an online travel agency in the sense it takes payments and rebooks customers when anything goes wrong. But its search results look like a metasearch company’s, such as Kayak’s or Skyscanner’s. It has pioneered other innovations, too, such as letting consumers pay for their trips in quarterly installments and selling more fully flexible cancellation insurance than legacy players do. Founded only in 2015, the agency sold about $270 million (€231 million) worth of travel last year and claimed profitability. So far, it has avoided the high cost of acquiring customers online in part by deals with corporate travel agencies, on-the-street agencies, and other partners.

Mobacar

Kerry, Ireland

Using artificial intelligence to provide semi-personalized car rental offers

Money Raised: $10 million

Headline Investors: Delta Partners

Skift Take: Travelers shopping for car rentals, airport shuttles, or ride-hailing apps get tired of trawling through long lists of choices. Mobacar taps machine learning to forecast the mode of transport and type of vehicle a traveler will want and aims to push only relevant offers first. It claims to be able to divine the mindset of any given traveler, such as how much he or she would be willing to pay and how much of a rush they may be in. In 2018, the startup forecasts it will process 2 billion searches a month on behalf of clients including Travelport, Gulf Air, and Flight Centre.

PKFare

Beijing, China

China’s new distribution capability

Money Raised: $1.7 million

Headline Investors: Civil Aviation Investment Fund and Caissa Tourism Group

Skift Take: Four major middlemen technology companies, including China’s TravelSky, aggregate a huge share of the world’s airline tickets and distribute them to travel agencies. But the giants leave gaps in coverage. A few upstart companies, such as India’s Mystifly and Germany’s Peakwork, aim to plug those gaps with next-generation tech. PKFare is China’s star in this category. It is building a business-to-business marketplace where agencies, suppliers, and companies like TravelSky can access branded airline and hotel wholesale inventory. Finnair, for example, already uses the 200-employee company to distribute its fares to Chinese agencies.

RedDoorz

Singapore

An Oyo with Singaporean characteristics

Money Raised: Close to $20 million

Headline Investors: Susquehanna International Group and InnoVen Capital

Skift Take: Launched in 2015, RedDoorz is a network of budget branded lodging, with more than 500 properties primarily in Indonesia but also in Singapore and the Philippines. Yes, the company is mimicking a model that others pioneered in India. But we bet that its executives, led by co-founder and CEO Amit Saberwal, have the rare skills needed to lead their team of 180 workers in fending off looming competition from Chinese-owned budget hotels.

Redeam

Boulder, Colorado

No more paper tickets for tours and activities operators

Money Raised: $7.7 million

Headline Investors: Vertical Ventures, Thayer Ventures, JetBlue Technology Ventures

Skift Take: CEO Melanie Ryan Meador now leads a company that helps tourist sites, museums, and other attraction operators automate and digitize many of their administrative processes. The company works with more than 380 resellers and serves nearly 200 customers, such as Gray Line New York and Ripley’s Believe It or Not. The total addressable market is vast. By wiring up operators, the company could enable tours-and-activities businesses to live up to the sector’s recent hype.

The Dyrt

Portland, Oregon

The user-generated review trend finally hits camping sites

Money Raised: $2.6 million

Headline Investors: Peninsula Ventures

Skift Take: Millions of people go camping, but most still use old-school methods to plan their trips. Since its start three years ago, The Dyrt has built campground search mobile apps that have aggregated more than 70,000 pictures, videos, and reviews of campsites. It has rewarded frequent contributors with camping-themed prizes provided by suppliers who are trying to tap into the billions of dollars spent on outdoor recreation each year.

Volantio

Atlanta, Georgia

Zeroing out the melodrama of flight overbooking

Money Raised: More than $2.6 million

Headline Investors: International Airlines Group, JetBlue Technology Ventures, and Qantas Ventures

Skift Take: This startup helps to predict when a flight might experience a disruption many hours in advance. Then it helps airlines tempt flexible passengers with compensation in exchange for rebooking on other flights. Volantio tackles knotty operational, commercial, and technological problems, and its goal is to help airlines avoid drama at airport gates and boost overall airline revenue CEO Azim Barodawala said United is already testing the startup’s service with real customers.

Yamsafer

Ramallah, West Bank

An online travel agency for Arabic-speaking travelers

Money Raised: $10 million

Headline Investors: Sadara Ventures and Global Founders Capital

Skift Take: Saudi Arabia and the broader Middle East and North Africa market have been underserved by Western and Chinese online travel multinationals. Yamsafer, which echoes the Arabic word for traveler, has successfully outmaneuvered other regional players to become one of the most-used companies for booking hotels and apartment rentals. Credit the company’s mobile-first approach and its creativity in adapting to local needs for payment methods.

In making our picks, we kept in mind a survey of travel entrepreneurs worldwide that Skift conducted last winter on behalf of travel technology giant Amadeus. Founders told us that their number-one definition of success was “achieving profitability with at least double-digit annual growth.”

We agree. You don’t have to build the next Airbnb to be a success. While most of our picks are not yet profitable, they are demonstrating rapid growth, have promising products that are scalable, and we believe have business models that are likely to be profitable.

How did we do last year? Check out Skift’s 2017 list of top travel startups. A couple of our picks included Alice, which Expedia later took a majority stake in, and Baoku, which was later acquired by Shiji, the hotel tech giant backed by Alibaba Group.

Have an aviation-startup? Take it to the next level by participating in the Air Pitch Startup Competition 2018.

Editor’s note: Check out Skift’s 2019 list of top travel startups.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: startups, venture capital

Photo credit: An entrepreneur tests the used of mixed reality technology in the workplace in an experiment at Citi Innovation Lab using Microsoft's HoloLens. Startups are a key source of innovation in the travel industry, just as in other sectors, and this list salutes the year's most promising young companies. Microsoft