Skift Take

The decision by MakeMyTrip, India's largest online travel agency, to start selling Oyo budget lodging is significant. The move recognizes that the heavily funded Oyo is no longer a rival marketplace and is instead primarily a supplier. Asset-light hotel chains need to wake up to Oyo's rise.

MakeMyTrip, India’s largest online travel company, has added back properties from lodging booking company Oyo to the websites and mobile apps of its flagship MakeMyTrip brand as well as its recently acquired GoIbibo brand.

The move represented an about-face for the company. In October 2015, MakeMyTrip had blocked its main competitor in the budget category, Oyo, from displaying listings on its platform.

It had boycotted Oyo to nurture its own attempt at branded budget booking properties, GoStays, and because it didn’t like how Oyo was using deep discounting to woo travelers to book directly instead of via agencies.

This spring, executives came to believe that Oyo had changed its stripes, according to their comments during an earnings call Wednesday. But money may be an additional reason: Some analysts speculate that MakeMyTrip sees a chance to invest in Oyo, a company that has been growing fast thanks to backing by the world’s largest venture fund, Softbank’s Vision Fund.

Oyo, which began by in 2013 by aggregating budget hotel rooms run by independent owners, now says that it earns a majority of its revenue from properties that it has either leased or that are run on revenue-share deals. In effect, it is not unlike an asset-light hotel franchisor.

Given the changes, MakeMyTrip is now seeing Oyo as a supplier rather than a competitor aggregator.

“Clearly, their vision is to become a hotel chain and they have moved their strategy from being an aggregator of inventory to running as an asset-light, hospitality management business,” said Rajesh Magow, co-Founder of MakeMyTrip and CEO of its India unit during an earnings call Wednesday. “That was one of the fundamental reasons we entered into this partnership.”

“We’re trying to solve the real problem for consumers in the budget segment who need enough coverage in properties,” co-founder and group CEO Deep Kalra said Wednesday.

Speaking of his changed decision, Kalra added: “These are evolving things, with no hard stands.”

Another possible factor was not mentioned during the call, namely, a potential investment opportunity.

Since 2015, Oyo has raised astonishing amounts of financing. Taken altogether, it as now raised $446 million, to date. It plans to expand into China and Europe this summer.

MakeMyTrip may be interested in becoming an investor, too, and the strategic partnership may be a prelude to such a move.

MakeMyTrip’s deal with Oyo is more than merely a re-listing of properties. The deal gives its customers more access to last-minute availability to Oyo rooms than is available through rival domestic online travel agencies Yatra and Cleartrip.

That said, MakeMyTrip is listing 3,600 hotels from Oyo, which represents only a slice of Oyo’s at-least-ten-thousand properties.

In a separate move, MakeMyTrip also added to its platform Fab, another branded budget hotel chain, which raised a $25 million round led by Goldman Sachs last year.

But it de-listed Treebo, a budget hotel network that had raised $34 million in a Series C funding round last autumn, in a move that appeared to be a dispute over commission levels.

Executives made the comments during an investor call reporting earnings for the quarter ended March 31. During the quarter, MakeMyTrip generated revenue of $157.8 million, an increase of 31.5 percent over revenue of $120 million in the same period a year earlier.

The company continues to find profitability elusive. But it has been narrowing its losses. Its loss for the quarter ended March 31 was $44.1 million as compared to a loss of $73.1 million in the comparable period a year earlier.

Price competition and aggressive marketing of hotels by international and domestic players is the main explanation for the losses. On the premium hotel side, Booking.com, Expedia, and Agoda are active competitors to MakeMyTrip. Of those, only Booking.com is aggressive in marketing campaigns. That said, metasearch sales by Expedia-backed Trivago are increasing, too, executives said. Domestically, Yatra and Cleartrip continue to pressure the company’s margins.

A Long-Term Bet on Voice

The way online e-commerce growth may play out in India as its middle class expands could be different to the pattern seen in the past in other countries. India might be able to leapfrog to conversation-based internet past today’s use of search boxes and online forms with drop-down boxes, some analysts believe.

MakeMyTrip said it is betting on text-based and voice-based internet chatbots powered by artificial intelligence (AI).

On Wednesday’s call, executives said that given the prevalence of multiple languages in India and the mobile-first nature of much of India’s internet adoption, the company was investing heavily in natural-language processing technology.

Last year it rolled out chatbots — Myra on MakeMyTrip and Gia on Goibibo — to handle customer queries before and after a trip. Kalra said the Gia chatbot could field about 300 common queries, helping to reduce the need for call centers.

Goibibo is also developing voice-based commands via Amazon’s Alexa voice-powered assistant for providing hotel recommendations and pricing.

In another move to fit the distinctive ways that Indians shop online, MakeMyTrip earlier this year signed a deal with Flipkart, the most-used e-commerce platform by India’s middle class. In May Flipkart was bought by WalMart for $16 billion.

As of today, MakeMyTrip branded hotel offerings are available on FlipKart’s Android mobile app. More merchandising will be rolled out later this year, executives said.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: earnings, makemytrip, oyo rooms

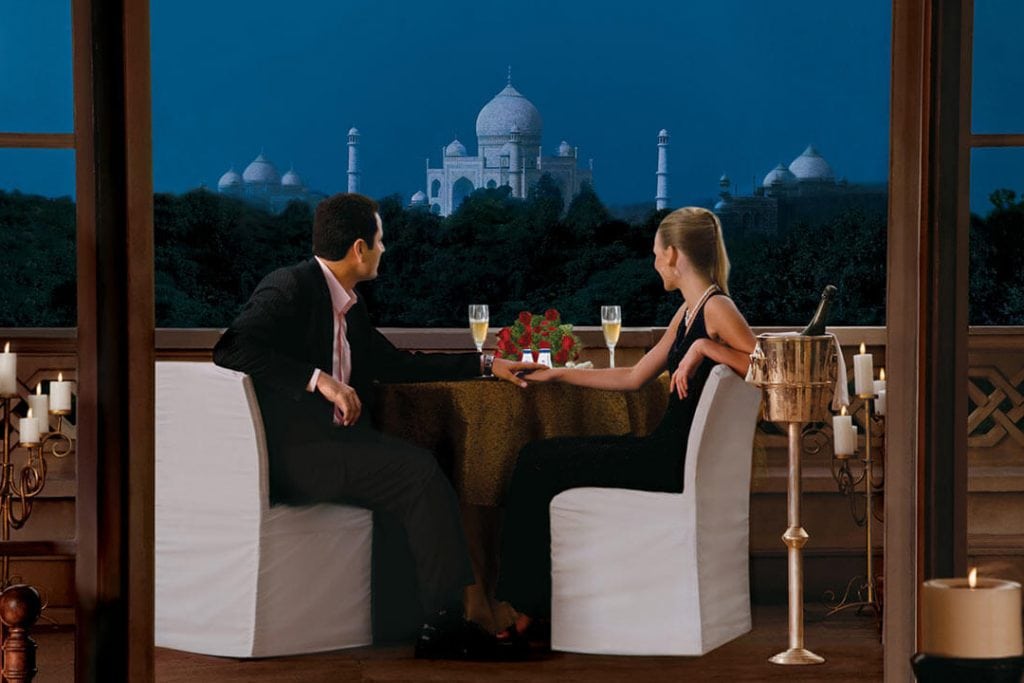

Photo credit: A view of The Oberoi Amarvilas in Agra, one of the many romantic vacation spots that are bookable via online travel agency MakeMyTrip. CEO Deep Kalra said he's optimistic that the number of Indians booking hotels online may double within the next several years. Oberoi Hotels