Skift Take

Leave it to Marriott to figure out a way to make homesharing work for the hotel industry. But as we've noted before, this space has its challenges, and figuring out the logistics and differences between managing homes and hotels will be crucial.

The largest hotel company in the world is putting Airbnb, HomeAway, and Booking.com on notice — along with fellow hoteliers AccorHotels and Hyatt.

Marriott International today is launching its official foray into the homesharing market via a six-month pilot in partnership with London-based home rental management company, Hostmaker.

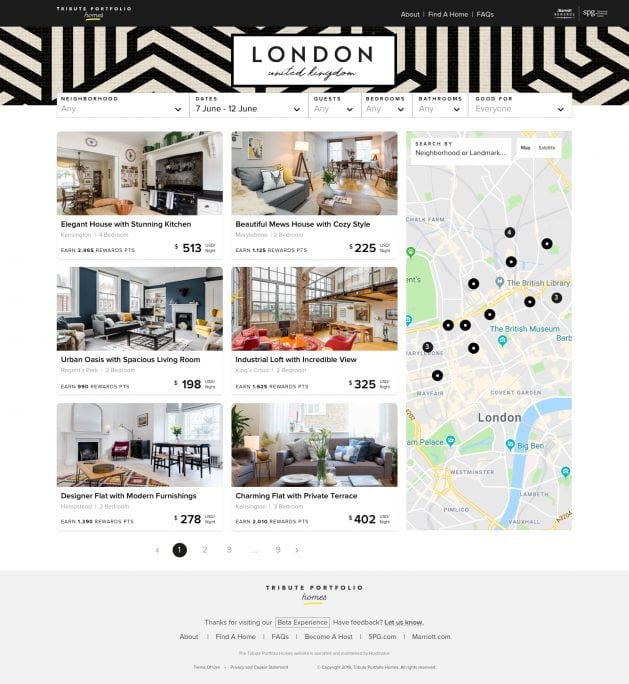

Travelers can log onto TributePortfolioHomes.com and book a stay in more than 200 homes in London, each of which has been chosen specifically by Marriott and Hostmaker.

These homes, all of which have one or more bedrooms, full kitchens, and laundry facilities, adhere to Marriott’s exacting standards regarding safety, design, security, and service. Guests who stay in them also receive additional services and amenities, such as 24/7 dedicated phone support and an in-person check-in/welcome experience.

Guests who book Tribute Portfolio Homes can also earn loyalty points for both Marriott Rewards and Starwood Preferred Guest, and beginning next month, they can redeem points for homestays as well. The average nightly rate for a one- or two-bedroom home in this pilot is 200 to 250 pounds sterling, or $280 to $351.

What Makes This Pilot Slightly Different

With this pilot, Marriott certainly isn’t the first major hospitality company to dip its toes into the sharing economy or professionally managed home rentals. Other hotel companies, such as Wyndham and Choice Hotels, have participated in the vacation rental market for years. And AccorHotels and Hyatt have made investments in the homesharing space with Onefinestay and Oasis. But what Marriott is doing here differs somewhat slightly.

For one thing, Marriott is using one of its own existing brands to market the homes, and not using the Hostmaker brand or creating a new brand. AccorHotels, for example, combined all three of its homesharing acquisitions — Onefinestay, Squarebreak, and Travel Keys — into the Onefinestay brand last year. Hyatt houses Oasis under its own soft brand, The Unbound Collection by Hyatt, but still uses the Oasis name to market the home rentals.

“Instead of creating a new brand, Marriott has this great collection of brands already,” explained Nakul Sharma, the founder and CEO of Hostmaker. “This extension of Tribute Portfolio made a lot more sense to us than trying to create a brand from scratch. It’s a seamless experience for guests when they come onto Marriott’s booking platform.”

Tribute Portfolio, a soft brand collection that Marriott inherited in its $13.3-billion acquisition of Starwood Hotels & Resorts in 2016, currently consists of 28 independent hotels around the world. The youngest of Marriott’s three soft brand collection brands, it has a relatively smaller footprint than Marriott’s Autograph Collection brand, and it skews toward the upper upscale category, which sits just below luxury.

Guests who book a Tribute Portfolio Home should expect, more or less, the same kind of experience that they’d find in a Tribute Portfolio hotel. And that’s because Marriott is also exercising control over which homes can be a part of the collection and is working very closely with Hostmaker to ensure quality and service.

Marriott chief customer experience officer Adam Malamut said the company handpicked each of the more than 200 homes that are participating in the pilot. “Hostmaker already does an incredible job of curating a great portfolio of homes and within that portfolio, and we added other types of design, safety, and security criteria that meet our standards.”

Although these same 200-plus homes can also be booked on Hostmaker’s own site, as well as other short-term rental platforms, Booking and Airbnb included, Marriott said guests who book stays via TributePortfolioHomes.com will receive an “exclusive experience.”

“Through curation among curation that already exists within Hostmaker, and our serious experience and amenities, and earn-and-redeem capabilities, all of that comes together in creating, maybe not an exclusive home, but an end-to-end exclusive brand experience for the customer,” Malamut said.

Another distinguishing factor of this experiment is the immediate loyalty tie-in. Hyatt extended its World of Hyatt loyalty program to include Oasis in March, months after announcing its initial investment in Oasis. It took AccorHotels nearly two years after its initial acquisition of Onefinestay to add it to its LeClub AccorHotels loyalty program.

And if this Marriott-Hostmaker pilot sounds a lot like what Airbnb is doing with its own selected, curated collection of verified homes, called Airbnb Plus, that would be an accurate comparison. However, unlike the homes in Airbnb Plus, the homes here will have consistent quality control measures and maintenance carried out by Hostmaker’s on-the-ground teams. With Airbnb Plus, only a one-time inspection and guest-host review system are in place to maintain quality control.

“We’re learning from other companies playing in this space, whether it’s AccorHotels or Hyatt. We all have to learn in this space,” said Malamut. “This is a distinct space within travel and hospitality, and partnership is key. That’s why we did a lot of due diligence to find the right partner to create this end-to-end customer experience that we wanted to have.”

The pilot is not without its risks. As Skift noted previously, there are a number of challenges when it comes to ensuring quality control of homes. The involvement of a hotel company that has access to professional resources like housekeeping staff could provide some solutions. Malamut noted he and Hostmaker have been thinking of ways to make their current partnership even more “synergistic.”

Why Did Marriott Choose to Work With Hostmaker?

Hostmaker was an ideal partner for Marriott for two primary reasons, the first being that Hostmaker founder and CEO Sharma had extensive previous experience working at InterContinental Hotels Group and Starwood Hotels & Resorts.

Even though Marriott recognizes that “home management is very different from managing a hotel,” the company felt strongly that Sharma’s hospitality experience would be “vital,” Malamut noted. It also helped that Hostmaker was also a finalist in Marriott’s Travel Experience Incubator program that it launched last year with Accenture and 1776, a startup incubator.

Secondly, Marriott liked that Hostmaker is a professional home management service with an on-the-ground presence, and one that places a heavy emphasis on the design of each and every home.

“We will not take a home unless it meets the design criteria that we have,” Sharma explained. “We help design the homes and we have relationships with the homeowners. We offer this up front to owners if they are looking for it, and we advise them on how their home would even more attractive if they were setting it up for a homestay.”

Sharma also said, “None of our competitors really offer this.” In piloted versions of Airbnb Plus, Airbnb did experiment with giving its hosts access to virtual interior design services, however.

Marriott and Hostmaker decided to launch the pilot in London specifically because they felt it was a market that is “conducive to learning quickly and complementary to our hotel inventory.” AccorHotels’ Onefinestay was also launched in London, and when Hyatt was an investor in Onefinestay, it also conducted its own pilot in the city in 2015.

London is also the headquarters city for Hostmaker, as well as a destination where short-term rental regulations are fairly straightforward; there’s a 90-day cap. Both Malamut and Sharma said they are being vigilant about making sure all Tribute Portfolio Homes are complying with local short-term rental regulations.

The Tribute Portfolio Homes site features the more than 200 homes in London that Marriott picked from Hostmaker’s portfolio of 1,500 homes in London. Source: Marriott International

What Happens After the Pilot Ends in October

Marriott and Hostmaker didn’t divulge the exact measures by which they hope to define the success (or failure) of this pilot, but they did say they would look closely at customer satisfaction, operational efficiency, and the financial impact of the business model, as well as return on investment.

If the pilot is successful, Marriott may consider expanding this into other markets. When asked if the company would consider buying Hostmaker or other management companies like it, Malamut said, “We’re testing and learning, but we haven’t ruled out any approach.”

Pointing Toward the Future of Private Accommodations

Homesharing has certainly been on Marriott’s mind for the past few years. The company’s CEO Arne Sorenson has often noted that in public interviews. So, why decide to enter the market now?

“We’ve been thinking about this for a while, and how this type of business affects ours,” Malamut said. “Timing is about finding the right partner to bring an idea to life that makes sense for our business. That’s what we’re offering here.”

There is no better time for companies like Marriott, Airbnb, and others to play in this space. Homesharing is no longer in its infancy. Products like Airbnb Plus, Onefinestay, Oasis, and now, Marriott’s Tribute Portfolio Homes, are indicative of the increasing professionalization, standardization, and maturation of private accommodations.

And it’s clear that consumers want this type of product, even if they’re not quite sure what to call it or how to define it.

“All different types of hospitality are becoming one, depending on the consumer’s requirements,” Simon Lehmann, the CEO and co-founder of AJL Consulting and former CEO of Interhome, a Swiss home rental platform told Skift previously in a conversation about “convergence” in accommodations. “The consumer is looking for whatever he or she requires at that moment. Most people don’t even know what they are booking, whether it’s a serviced apartment, vacation rental, or a hotel.”

Tribute Portfolio Homes, Airbnb Plus, and other more professionally managed and curated short-term rentals are exactly what the hospitality industry needs to bring homesharing into the mainstream at a time when it’s clear that consumers want to be able to find any and every type of lodging that suits their specific trip needs. On some occasions, travelers may prefer a hotel. And in others, they may prefer to stay in a home.

If companies like Marriott, AccorHotels, and Airbnb are successful in making these types of curated, verified homes more accessible and more appealing to consumers, they’ll have a direct hand in shaping the future of this sector of the hospitality industry.

A company like Marriott is particularly poised to benefit from the years of homesharing business that companies like Airbnb, HomeAway, and VRBO have cultivated among consumers for the past decade. Having been a brand that consumers have looked to for their lodging needs for the past 90 years, Marriott also has the global scale and a massive 110-million-member-strong loyalty program that can only boost its prospects for success in this space. If Marriott’s pilot with Hostmaker ultimately proves successful, it too could serve as a model for future hotel company investments in the sharing economy.

Update: This article was updated to reflect that AccorHotels added Onefinestay to its loyalty program, LeClub AccorHotels, in early April, almost two years after the company acquired it.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: homesharing, hostmaker, marriott, short-term rentals

Photo credit: Marriott's homesharing pilot with London-based Hostmaker is now live. Featured here is the kitchen of one of the more than 200 homes available on TributePortfolioHomes.com. Marriott International