Skift Take

Consumers' perception on the accessibility of luxury brands is shifting through their daily, almost intimate interactions with both luxury products and the influencers who tout them on social media.

Consumers today have a far more intimate relationship with brands than in the past, which is driving the rise of thoughtful brands and more engaging marketing.

It is also making brands that previously felt unattainable feel accessible to a larger and younger segment of consumers.

Social media drives much of this shift. Brands are communicating with consumers through a breadth of channels, which creates challenges and opportunities for luxury marketers.

This new breed of luxury is driving by digital, experiential offerings and deeper, more personal relationships with customers, according to digital marketing agency PMX in its recent Luxury Study. The study looks at the $289 billion luxury goods market with a focus on brands’ digital presence and the interconnectedness of each channel.

While the study didn’t deal with luxury travel as a distinct category, some of the trends in consumer behavior would no doubt be useful markers for these companies consider.

Louis Vuitton’s top two engaging Instagram posts in 2017 revolved around the hashtag #SpiritofTravel, and featured “new luggage for the 21st Century traveler,” the PMX study found.

Unsurprisingly the largest percentage of shoppers on luxury websites are Gen Xers (22.7 percent) and Millennials (22.4 percent).

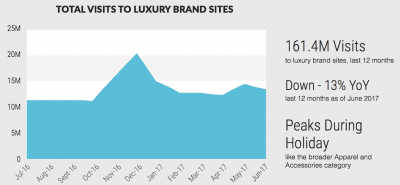

Although Web traffic to luxury brand sites is up in recent months, total website visits over the last 12 months were lower than the previous year.

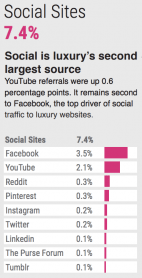

An increase in consumers’ interaction with brands on social platforms could be a critical factor. Thus, it is interesting to note where traffic for luxury brand sites originates.

Google is the largest source of traffic (48 percent), but social media is the second largest source (7.4 percent). Social traffic comes from Facebook (3.5 percent) and YouTube (2.1 percent).

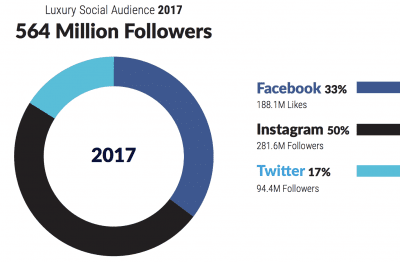

Although not a driving source of traffic to luxury websites, Instagram’s worth to luxury brands continues to grow, and brands are starting to see similar-sized or larger followings on Instagram than Facebook.

The number of luxury social media followers on Instagram grew 54 percent in the past year compared to just 4 percent growth on Facebook and 16 percent growth on Twitter. Instagram accounted for 50 percent of the luxury social audience and 93 percent of the more than 936 million engagement actions across all social channels last year, according to the study.

In its recent report on millennials’ luxury purchasing behavior, Deloitte found that more respondents discover new luxury products and trends through social media (20.5 percent) than a brand’s website (15.1 percent) or magazines (14.4 percent). And luxury brands’ performance rates can be as much as 30 percent higher than mass brands’ efforts on Instagram, according influencer marketing agency HelloSociety recently reported.

The democratization of luxury can be perceived in two ways. One in which luxury goods feel more attainable to a larger population due to their social relationship with brands, and another in which luxury brands have more accessible channels with which to reach new customers.

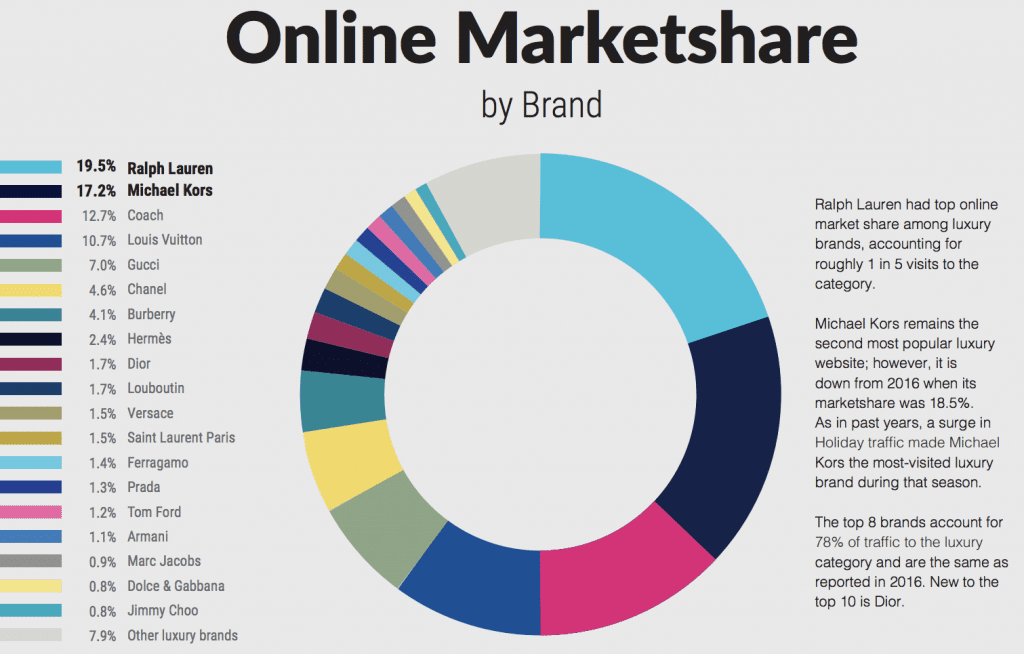

Despite this breadth of channels and opportunities for luxury brands to interact, a handful of luxury brands continue to have the most success.

The top eight luxury brands account for 78 percent of traffic to the luxury category and are the same as reported in 2016 with the exception of Dior. One takeaway is that there is still room for luxury brands to grow and capture the attention of a younger, digital customer base.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: luxury, millennials, social media

Photo credit: Influencer La Revue de Kenza at Le Dokhan's, a Tribute Portfolio Hotel, as part of the LiketoKnow.it Partnership. Starwood Hotels & Resorts