Skift Take

As the developed markets reach their saturation point in outbound travel, emerging markets are moving in to become the dominant contributors to international tourism expenditure.

There’s been a dramatic shift in recent years in global tourism spending by outbound travelers . In 2015, some 49 percent, or $672 billion, came from tourists heading off to explore the world from developing countries.

A decade earlier, developing countries accounted for just 25 percent of these so-called International Tourism Expenditures. The development of China, and its dramatic flow of tourists heading abroad, has done much to turn the tables.

Last week, we launched the latest report in our Skift Research service, Key Emerging Outbound Travel Markets 2017. In the report, we examine these changing dynamics in international tourism spending and the role of emerging markets.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

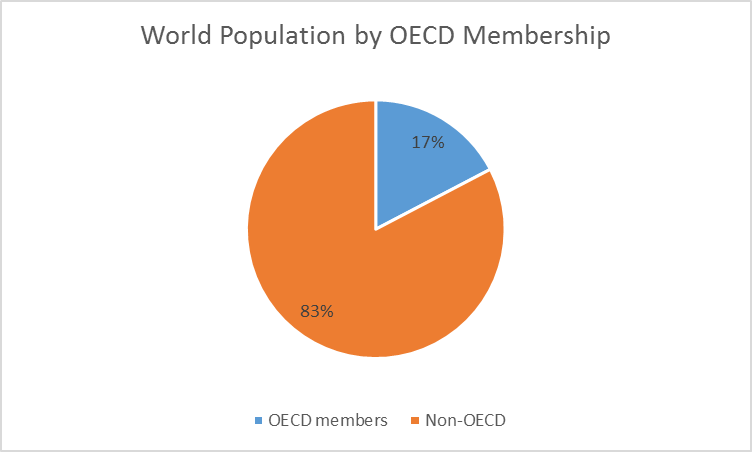

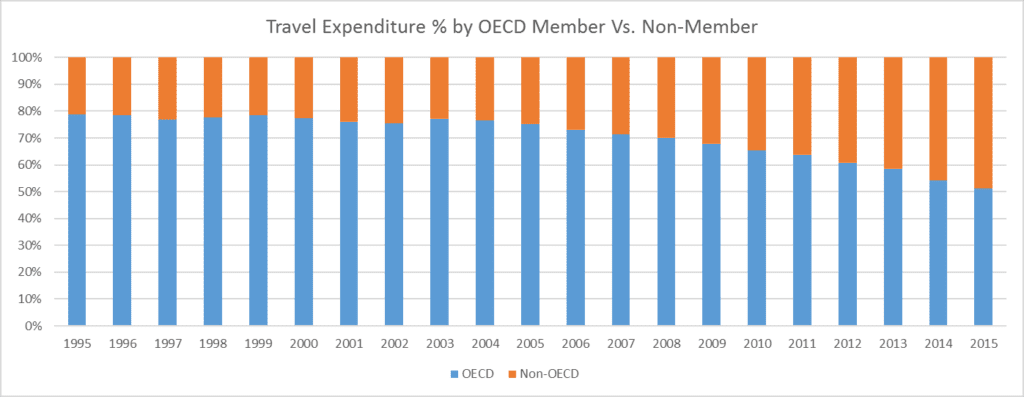

While China has grown at unprecedented rates, other countries are also starting to accelerate their economic growth and consequently their International Tourism Expenditure (ITE). Over the past decade, travel expenditure has begun shifting from developed markets to emerging markets. Traditionally, countries part of the OECD (Organisation for Economic Co-operation and Development), mostly developed countries, made up the vast majority of ITE. Between 1995 to 2005, OECD members accounted for 74 to 79 percent of all travel expenditure while just making up 17 percent of the world’s population.

Preview and Buy the Full Report

Source: World Bank Data and UNWTO.

Source: World Bank Data and UNWTO.

The landscape has begun to change due to the economic growth seen in emerging markets, particularly China. In 2005, non-OECD members accounted for just 25 percent of travel expenditure. By 2015, the figure reached 49 percent, amounting to $672 billion growing year-over-year in the past decade of which $292 billion come from China alone.

Preview and Buy the Full Report

Source: World Bank Data and UNWTO.

Source: World Bank Data and UNWTO.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst calls, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst calls, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Have a confidential tip for Skift? Get in touch

Tags: china, emerging markets, outbound, skift research

Photo credit: A tourist from China takes pictures of Japanese traditional masks at a souvenir shop in the Asakusa district of Tokyo July 17, 2014. REUTERS/Yuya Shino