Skift Take

Oracle Hospitality doesn't fold sheets, bus tables, or stock shelves, but its software does keep hotels in order. It's taking a few years for the company to get itself in order, too.

Three years ago, business software maker Oracle acquired Micros, a hotel and restaurant technology company, for $4.6 billion net of cash.

Micros was the market leader. More hotels used Micros’s software to check in and check out guests than any other company’s reservation management software. For more than two decades its servers hummed under the front desks and in the back offices at tens of thousands of properties worldwide.

One of the knocks against Micros’ hotel software was that it was antiquated. One hotelier called it “a DOS pig with lipstick,” referring to the 1980s Microsoft disk operating system for computers.

Oracle found the integration of Micros tough sledding in a few ways. Execution of the merger did not meet the expectations of many hotel customers.

Oracle was caught off guard. As a company not used to dealing with call-center-based customer service, it suddenly had to handle help desk requests for thousands of vendors — half of whom were outside of the United States and Canada. At the time of the deal, Micros software managed payments and reservations for more than 300,000 hospitality owners worldwide.

Customers were also demanding cheaper software that is much more adaptable to today’s best practices and third-party tools. Some hoteliers were on versions of Micros that were 15 or 17 years old.

It took Oracle awhile to figure out how to plot a multi-year transition of Micros customers from license-based deals to Web-based, subscription services. The older deals represented more than 90 percent of Micros’s revenue at the time of the transaction.

Oracle did come up with a fix. But it took time to release product updates. For instance, it took two years to roll out a new solution suite that runs in the cloud and that replaces Micros’ typical on-premises applications.

When preparing our Skift Research’s Strategic Guide to a Modern Hotel Stack one year ago, we talked with hoteliers who, speaking anonymously, complained about the sluggish pace of change.

One hotelier said, “I know that Oracle recognizes that and [they are] very open about how much investment they need to make, but it is a risk to us as a business. As we are looking to try and innovate, not being able to plug other systems into Opera easily constrains what we can do.”

Some industry analysts have been disappointed at the company’s slowness in shifting its customers over to a software-as-a-service model. Yet they have said that the potential benefits are huge, with hotels forecast to spend $3.22 billion on software this year.

Oracle is cagey about how many customers have adopted the new tools but said that a majority of its customers are not yet on the cloud.

The first hotel group to agree to move all of its properties to Oracle’s cloud-based property management system is Mövenpick, which began the migration earlier this year and which owns 83 properties. Mövenpick already used other Oracle services for revenue management and some other purposes.

Despite the hiccups, Oracle has stayed the course on its investment.

It has roughly doubled the size of the hospitality organization — with Micros being renamed Oracle Hospitality — to be able to strive to fulfill its ambitions of scaling globally.

Oracle top brass’ passion for the sector is unclear. Recent earnings calls haven’t mentioned the hospitality division and have left undiscussed the long-promised cross-selling of Oracle products such as its human capital management software used by hotel companies like Fairmont and Raffles.

Yet a year ago chief executive Mark Hurd did call out the hospitality global business unit for having a “superb” growth rate.

Moving Past Early Hiccups

Mike Webster, senior vice president and general manager, Oracle Retail and Oracle Hospitality, said in an interview that Oracle Hospitality is “growing above the market average.”

“We’re the number one provider of property management systems in North American and worldwide,” he said. “We’re also taking market share in geographies where Micros had operated through partners.”

Webster said that any possible missteps in the early part of the integration are history. “Probably the transition of [customer] support was an area that we needed to course-correct,” he said.

Since the acquisition, the company boosted its number of customer service representatives by more than 30 percent to better handle the volume of requests. Webster said that the Oracle is now “providing significantly better help desk service than customers were getting before the acquisition.”

To make the turnaround, Webster said, “We researched to discover the best-in-class metrics we should create to run a support organization.”

One global benchmark was to cut the wait time for customers calling the help desk to under two minutes, on average. The company is now meeting that goal, he said.

The company set a goal of resolving at least 70 percent of customer support requests within an hour. Webster said it is now achieving that.

To beat these benchmarks, Oracle has nearly doubled its number of account managers, he added.

Webster acknowledged that another problem area had been one of retooling the company’s administration. For instance, Micros had a myriad of contracts sprinkled with entities around the world. A typical global brand might have a dozen agreements with local Micros offices. Oracle streamlined the patchwork of deals into a single worldwide agreement.

“But the process probably had some execution challenges,” Webster acknowledged.

Webster rejected the idea that his company is behind the game in shifting hotel customers to the cloud. “We’ve made massive progress in bringing [the Micros property management system] Opera to the cloud,” Webster said.

He noted that the company has been investing “tens and tens of millions of dollars into hospitality IT every year,” and that Oracle Hospitality has boosted its research-and-development headcount by about 50 percent.

Webster said, “Given Oracle’s technology competency, we’ve moved the entire architecture to a service base that’s as modern in its technical underpinnings as any cloud application available in the world.”

“We’ve modernized the user interface and streamlined the way customers interact with us. That’s let us reduce the training time for staff by almost half and improve the speed of service for guests by nearly 40 percent.”

“We’ve innovated in hardware, too. In the last year, we’ve been able to bring our complete new line of hardware onto tablets, not just fixed work stations, and a complete line of mobile solutions for our Opera property management system. We brought out a new housekeeping operations application via mobile, too.”

More broadly, Oracle has added marketing, sales, and service services via the cloud that Micros hadn’t offered. Hotels can use the tools to attract guests via digital marketing. They can also capture information about the guests in customer profiles that they can use to help retain the guests as repeat customers via targeted promotions.

“We’re now focused on helping our hotel customers create exceptional guest experiences while reducing the cost and complexity of IT.” He said hotels using Oracle no longer need database administrators or other IT support staff to manage the technology.

He said that Oracle had replaced Micros’s “Byzantine architecture for point-to-point interfaces” to open platforms via a single API set that lets it connect with third-party systems, such as revenue management software or other legacy technology that hotel brands use. It’s cloud-based and on-premise Opera Property Management System for multi-tenant hotels has integrations with more than 1,400 third-party tools, such as for accounting and revenue management.

This year the company also brought out a new line of reporting and analytics capabilities using Oracle’s business intelligence engines. “Micros didn’t have a library of proven algorithms like we have that help convert guest preference details into marketing campaigns that boost conversion rates,” Webster noted.

Critical Voices

Not everyone believes that Oracle Hospitality is where it needs to be. Last winter, Claude Rath, general manager at Hotel Napoleon in Paris, wrote an angry article on LinkedIn critiquing the company. Dozens of executives at independent hotels and small hotel groups shared the article approvingly.

Rath had a few things to say. But the comments posted on the article from hoteliers worldwide suggest that the consensus complaint was about customer support.

Christian Weste, the boss of Hotel Lundia in Sweden, wrote: “Seems to be the same all over Europe and probably the rest of the world also. It takes months to get in touch with someone and even then the issue will most likely not be solved.”

The mood of the commenters was perhaps summed up by Avery Palos, chief information officer at the publicly traded Melco Resorts & Entertainment in Hong Kong, when he wrote: “Let’s find a partner who wants to treat us like the customer rather than meal ticket.”

Competitive Field

While Oracle has labored at its integration of Micros other players have been seeking slices of the market. (For a full overview, see our Skift Research report “The Strategic Guide to a Modern Hotel Technology Stack.“)

Amadeus Hospitality, a recently formed collection of acquisitions (such as of property management system Itesso) by giant tech company Amadeus, has been wooing customers. One of its biggest client wins has been InterContinental Hotels Group, which has begun to migrate to a Amadeus’s central reservation system from an older internally built one.

Sabre Hospitality Solutions said it has 36,000 properties using its central reservation system. One of its most high-profile enterprise clients is Wyndham. Sabre plans an accelerated rollout of its updated SynXis property management system, which would compete in some overlapping ways with Oracle’s Opera.

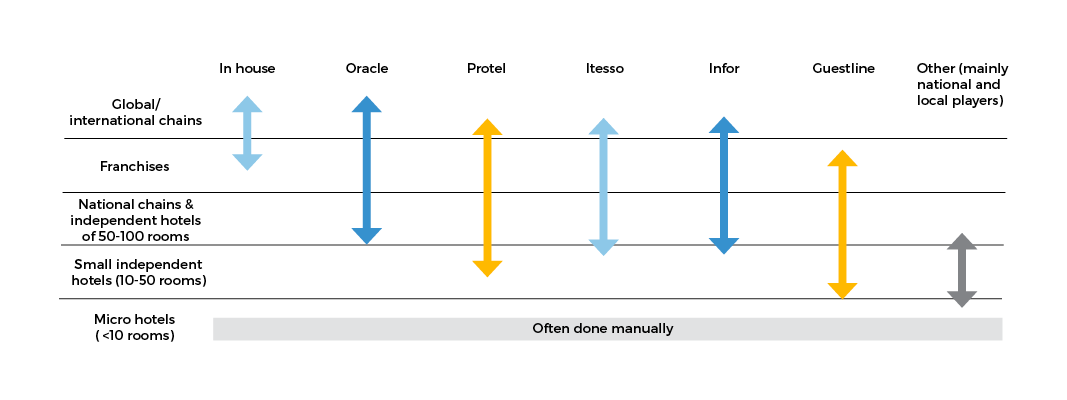

Guestline, Infor, Protel, and Springer-Miller are all significant players, too. See this chart from Skift Research’s Strategic Guide to a Modern Hotel Stack:

In China, Shiji dominates the hotel tech software market, and the company has been expanding abroad through acquisitions.

“We know there are many companies that can’t invest at the rate that we can,” Webster said. “And if there are exceptions that do, they do so at the compromise of something that’s critical. They might be able to build out some functionality for one brand that works for customers in one country, but then they’ll, say, leave gaps in handling security and compliance with data protection laws in multiple countries.”

Oracle Hospitality has responded to competition by widening the aperture of its target market. While Micros had tended to focus on larger hotels and chains, Oracle Hospitality says it wants it all — from so-called tier-one hotels in global capitals down to small independents in tiny corners of the globe.

Oracle’s pricing strategy may tell a different story. Its relatively high fees tends to favor large chains and pose obstacles for small group and independent hotels.

Robert Cole, the owner of RockCheetah, a hotel marketing strategy and travel technology consulting firm, said that while he is an Oracle admirer in many ways, the company has left a gap in the market by not developing the equivalent of a Salesforce for hospitality — meaning a subscription-based enterprise software product that is focused on only core features and that integrates well with other popular services.

On that front, Oracle may run into competition from an array of smaller tech vendors that aim to provide property management systems or central reservation systems for the so-called long-tail of customers. These include firms like eZee FrontDesk, FrontDesk Anywhere, HotelLogix, InnQuest, Mews Systems, and MSI, and Trivago’s Base7Booking.

Webster said he doesn’t worry about companies like those just mentioned. “We’re the only true cloud company [in hotel tech]. There are a lot of companies that are out there that are providing hosted services, which I would respectfully submit are not the same as cloud. We’ve architected our solutions to be fully multi-tenant software-as-a-service.” He said he was also skeptical of the wide appeal of fixed-subscription models, which are common to many smaller competitors.

Webster said Oracle is unique in working to perfect both the best systems for food-and-beverage and for hotels (Oracle for hotels and Simphony for restaurants) — a parallel effort that may appeal to hotels for whom food and beverage is an important revenue driver.

Vendor Bloat

Meanwhile, there are countless tiny tech vendors offering niche services. Hotels no longer seem to have seven-year replacement cycles. Some general managers may find themselves using as many as 70 vendors for services.

Oracle Hospitality has accomplished a lot since the acquisition of Micros. The challenge ahead may be more daunting than it lets on. The pace of change coming to hotel tech is speeding up, which means that the length of time available to adapt is shrinking.

Oracle will win the day only if it acts as a platform that can play nicely and affordably with new third-party tools, such as for revenue management; new businesses, such as alternative lodging, and new ways of doing business, such as alternative forms of payment like Apple Pay, Alipay, bitcoin, and Google Wallet.

In that context, some people may ask the question: Is the traditional one-stop shop model that Oracle is pushing still relevant?

“There’s just a tremendous amount of fragmentation that has thwarted innovation in hotel IT,” said Webster. “All these hotels are dabbling with these point solutions: I call it “shiny object syndrome,” or SOS — and I use SOS as an intentional pun. Because you know you’re in trouble if you think that’s what’s going to save your brand.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: hotels, oracle, Oracle Hospitality

Photo credit: Opened in November at the Oracle Hospitality office in Columbia, Maryland, the Customer Experience Center offers demonstrations of the company's software in action. Oracle