Skift Take

International travel to the U.S. will continue to grow this year, according to U.S. Travel. But given the unpredictability of the U.S. government at this time, the outlook could get worse in a hurry.

Solid evidence of a so-called Trump Slump in travel to and from the U.S. has been scant, with travel companies reporting they’ve seen no decrease in flight ticket sales or hotel stays. Other groups, like Foursquare, say they have research showing fewer international travelers in the U.S. this year compared to last.

Who should you believe?

The latest edition of The U.S. Travel Association’s monthly Travel Trends Index provides evidence that travel volume to and within the U.S. increased slightly in April year-over-year; at the same time, the report projects that international inbound travel growth will lag behind domestic growth through the late 2017. The rate of growth in travel volume is slowing overall, but it’s still growing and travel demand is expected to increase through the next six months.

International travel to the U.S. grew four percent year-over-year in April, in something of a surprise given the announcement of President Trump’s travel ban executive order on Jan. 27.

“Are we surprised by this data? The honest answer is yes,” said U.S. Travel Association president and CEO Roger Dow in a statement. “There have been many claims that the administration’s actions on travel have tarnished America’s brand abroad, but we’re seeing hard economic evidence of the U.S. travel sector’s remarkable resilience.”

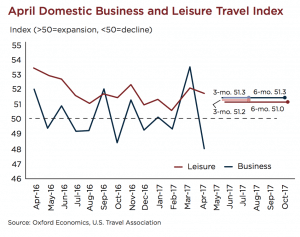

Diving deeper into the data, business travel stumbled in early 2017 after seeing negative growth in February and April along with a flat month in January. It’s expected to see a small but steady increase over the next six months.

U.S. Travel believes that the business travel slowdown was only a temporary phenomenon, with the April slowdown being attributed to the timing of Easter this year.

“Leisure travel led the domestic market once again in April, as the domestic business [current travel index] declined,” states the report. “However, this decline in business travel should be interpreted with caution: Business travel was stronger in March than in April in 2017, since the Easter holiday fell in April this year, and stronger in April than in March in 2016, because Easter 2016 fell in March. This is what drove a particularly strong [current travel index] reading (based on year-over-year growth) in March 2017 and a negative reading in April 2017.”

The worst outlook in the report is for domestic travel growth, which is expected to remain slightly negative for the next six months.

“This month’s [Travel Trends Index]—the first to reflect international traveler sentiment after January’s presidential order on travel and immigration, due to search/booking lag times—showed that international travel to the United States is still growing, despite a strong dollar and heated political rhetoric,” said U.S. Travel senior vice president of research David Huether. “April’s data is encouraging, because it indicates that international visitors are still drawn to all the U.S. has to offer business and leisure travelers.“

Read the full report below.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: business travel, tourism, u.s. travel

Photo credit: The outlook for increased travel is still strong for the U.S., according to U.S. Travel. Passengers walk to their gates through the terminal as American Airlines planes wait to depart at O'Hare International Airport in Chicago. Kiichiro Sato / Associated Press