Skift Take

While the growth in summer online travel spending will decline in the U.S. this year compared to 2016, it's not all doom and gloom for the U.S. travel industry.

Headed into 2017, many in the U.S. travel industry expected another banner year of growth. Geopolitical events and economic realities, however, have contributed to reduced online travel spending growth in the U.S.

New research from Adobe finds that the year-over-year growth in online summer travel spending on U.S. travel will decrease 66 percent to $98 billion from the previous year.

Bookings overall remain strong, even if some travelers are choosing to avoid the U.S. this year.

Online summer travel spending is expected to reach $98 billion, which still represents an increase of 5.1 percent from 2016. Fewer inbound international flights are partly to blame, along with a strong U.S. dollar and the volatility introduced by President Trump’s travel policies.

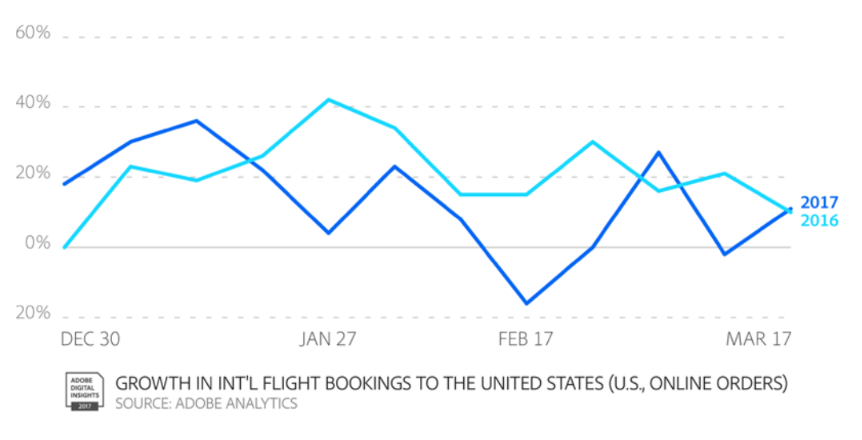

“International flight bookings had been slowing but dropped by another 26 percent during the week that travel restrictions were announced,” states the report. “Since then, they have been swinging up and down much more than last year.”

Adobe Analytics looked at data from 16 billion visits to online travel sites to conduct its research across flights, hotels, car rentals, cruises, online booking sites, and more.

Here are four important takeaways from the report.

Trump’s Travel Ban Had a Notable Effect

Comparing international flight bookings to the U.S. in 2016 and 2017, volatility is visible beginning with the announcement of the Trump Administration’s travel ban in late January and its next effort in early March. Bookings, in fact, appear to have dropped below 2016 levels around Inauguration Day.

This has caused bookings to remain essentially flat year-over-year through mid-March, affecting the summer travel season. Traditionally, most travelers book their summer vacations during this period.

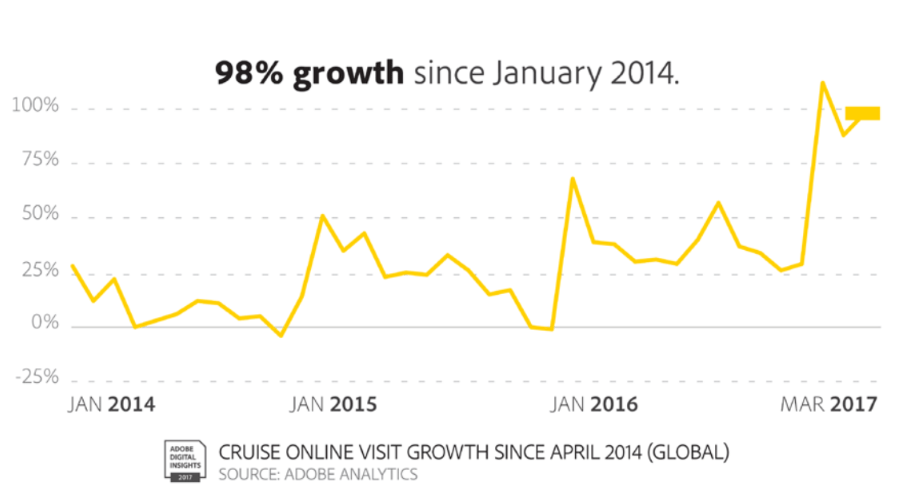

Cruising Interest Has Surged

Traveler interest in cruising, however, has surged in recent months, a likely result of the uncertainty surrounding international travel pushing vacationers to choose a type of trip that won’t be affected by airline restrictions. Visits to cruise sites have almost doubled over the last three years.

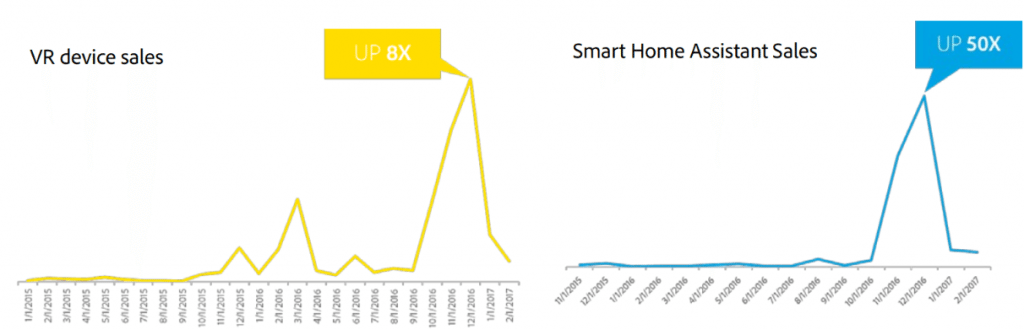

Virtual Reality and Smart Assistant Sales Are Seasonal

Many industry prognosticators think that virtual reality headsets and smart home devices could reinvent how consumers book traveler. Adobe’s data on device sales shows a big jump over the holiday season, but lackluster sales overall, perhaps indicating that these types of consumer electronics hold less appeal than initially suspected.

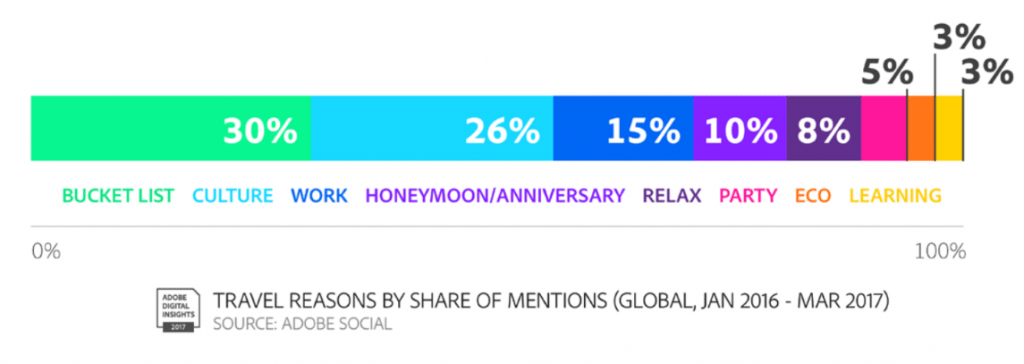

The Bucket List Is Still Big

Adobe also looked at social media mentions to gauge the reasons for travel bookings. Choosing a bucket list destination led the pack, followed by picking a destination because of its culture and having to travel for business purposes.

The impact of Millennials is likely a big part of this trend.

“Millennials value experiences over things: 70 percent of Millennials agree they would rather spend on amazing experiences vs. things (57 percent of those 35+),” reads the report. “Eighty-six percent of Millennials agree that they ‘don’t want to miss out on life experiences’ (45 percent strongly agree, vs. 39 percent of those over 35).”

You can read the full report below.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Photo credit: Online international bookings on flights to the U.S. have largely decreased in early 2017. Tourists in Chicago's Millenium Park mill around in this photo. erin m / Flickr