Skift Take

Greg Maffei made no mention of TripAdvisor playing the long game with its Instant Booking transition. Instead, he almost informally invited bids to acquire TripAdvisor. While the odds seem to be stacked up against Tripadvisor it could still turn things around -- if it gets the time to do so.

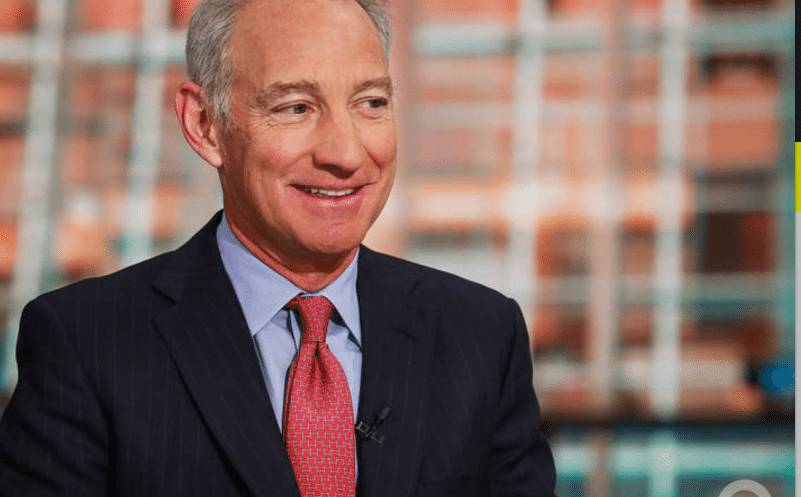

TripAdvisor chairman Greg Maffei, who’s Liberty TripAdvisor Holdings is the company’s controlling shareholder, thinks a potential acquirer might be able to extract more value out of the company’s 375 million user base than the market currently ascribes to it.

That wasn’t exactly a vote of confidence in TripAdvisor’s transition into becoming a hotel-booking site, a changeover that Maffei characterized as “crossing the chasm.”

Speaking in his role as CEO of Liberty Media at a financial conference earlier in the week, Maffei asked himself a rhetorical question and then answered it.

“Would potentially another owner of this business see more value in the 375 million unique travel visitors per month? Perhaps. I think that to some degree puts a floor on value.”

TripAdvisor’s share price increased around six percent Wednesday when a financial analyst Kevin Kopelman of of Cowen Research wrote about Maffei’s comments.

Kopelman wrote: “Our thoughts: (1) We view the comments as a bad sign for TRIP fundamentals; (2) we expect increased takeout speculation; (3) “Meta Wars” challenges make a sale at $40+ difficult before year-end, but outlook could improve longer-term if product & brand initiatives succeed.”

Still, Cowen saw some upside potential, saying TripAdvisor’s outlook could improve over the longer term if a potential branding campaign proves successful.

Maffei also talked about the “bets” TripAdvisor has made on its Instant Booking initiative, which seeks to improve the economics of booking on TripAdvisor to supplement its click-to-book elsewhere metasearch proposition.

Competitors and Partners Cite the Difficulties

Competitors such as Booking.com, which is an important TripAdvisor Instant Booking partner and also a competitor, and rival Kayak have taken note of the difficulties of what TripAdvisor is trying to accomplish — namely a change in user behavior.

On Thursday, when being interviewed on-stage at the ITB-Berlin travel industry event, Booking.com CEO Gillian Tans was asked for her thoughts about TripAdvisor’s situation. She said she was reluctant to comment without knowing the data and what had happened inside. Yet she added:

“It’s always complicated if you have a meta, or a price-comparison product, and you suddenly are offering customers something else. A different experience requires different functionality and different knowledge. I don’t exactly [know] what went wrong or why it’s not the success it should be, but it is a complex project [that TripAdvisor took on].”

Separately, in a Skift interview this week, Kayak CEO Steve Hafner speculated that TripAdvisor will need to change course and he wondered about TripAdvisor CEO Steve Kaufer’s job security.

Maffei at the financial conference noted that TripAdvisor has made some promising “bets” on Instant Booking, including adding Expedia as a partner and making the site more e-commerce-friendly.

He also speculated that the online travel industry will get more competitive and could see a bevy of new players, including Facebook, Alibaba and Amazon, entering or increasing their footprints in travel over the next three to five years.

He didn’t say it: But perhaps one of them would like to add TripAdvisor to the portfolio?

Interestingly, he had relatively harsh comments about Google’s activities in travel and basically predicted that Facebook, which launched a City Guides feature last week, would get more aggressive.

Maffei’s Comments in Full

Here are Maffei’s comments from Deutsche Bank’s 25th Annual Media & Telecom Conference March 6 related to TripAdvisor and the online travel sector:

“Look I think I’ve described this as crossing the chasm. They are making several bets around IB but they are other bets around trying to make sure we are more purchased-focused for the consumer. We have a full inventory of supply, bringing Expedia on as a supplier behind the scenes it’s good for us, as we’ve done. Honing our both our product and marketing message. Bringing those together is interesting.

“Would potentially another owner of this business see more value in the 375 million unique travel visitors per month? Perhaps. I think that to some degree puts a floor on value.

“I think you’ll see the potential for other players to come into the market. You know, people who are beyond the Priceline, Expedias. The Alibabas, potentially the Amazons. I think if you look at Google has extracted quite a lot of value out of the travel business through what it’s done through paid inclusion and effectively driving free out of the process. I think players like Facebook look and say we really are not getting our share of travel which is one of the largest e-commerce categories. We are not getting our share of the value.

“So I think you’ll see increased competition but also increased entry in terms of potential consolidation from players like Alibaba, like Facebook, like even potentially Amazon.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: mergers and acquisitions, tripadvisor

Photo credit: Greg Maffei's company is the controlling shareholder of TripAdvisor. His comments at a financial conference were less than bullish about the company's prospects. Liberty Media