Skift Take

Strategic and smart budget travelers could once keep up with the business class flyers in the rewards earning world. That world has changed now.

In August of this year, American Airlines became the last of the big three legacy domestic carriers to incorporate revenue-based factors into its AAdvantage loyalty program, effectively pinning the number of earned award miles to the cost of the passenger’s ticket.

As billed, airlines originally suggested that revenue-based programs would be equal-to if not better than distance-based programs. So to see whether the new program lived up to its hype this week, I took a look at my mileage earnings from before and after the transition.

The results were disappointing.

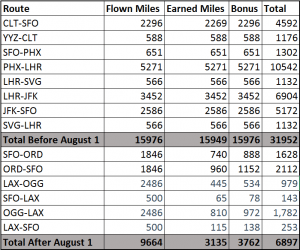

From June through the end of August this year I flew 15,976 miles on American Airlines. Traditional loyalty programs award elite and redeemable miles based on distance-flown, so my travel earned me a straightforward base of 15,976 miles. On top of that, though, an elite tier bonus at the Executive Platinum level earned me another 15,976 miles, yielding a total income of 31,952 redeemable miles, or a ratio of 2 to 1 earned vs. flown miles.

After August 1, that ratio dropped to 0.71 to 1. As an Executive Platinum member of the new AAdvantage program I’m now awarded miles based on the base fare (without taxes) multiplied by 11. From August 1 through November 21 I flew 9,664 miles but only earned 6,897 redeemable miles — merely 36% of the 19,328 that I would have earned in the former program. A leg from Los Angeles to Maui, for example, would have earned 2,486 times two or 4,972 miles in July, but in October it only earned me 979.

Indeed, part of the meager earnings are a result of the fares that I typically book as a budget traveler. That trip to Hawaii originally cost just under $350. When taxes are taken out of the award mileage calculation, I was only allocated 11 times $285 or just over 3,000 miles for the entire trip. In the former distanced-based program I would have earned 5,972 plus an Executive Platinum 5,972 for a total of 11,944. To earn that many miles in today’s AAdvantage program would require a $1,085 base-fare ticket — over $1,200 including taxes.

Through these calculations, its also easy to see how the global AAdvantage user base — especially those on a shoestring budget — may soon start earning fewer miles across the board. My trip to Hawaii, for example, earned 3,157 miles with an Executive Platinum 11x bonus, but a general AAdvantage member would only earn a 5x bonus, or 1,435 miles.

At the end of the day, revenue-based loyalty programs will end up drastically reducing the number of miles I earn on a yearly basis. In my case, I’ll continue to fly aggressively to keep up with busy work and life schedule. But for many others who similarly book budget fares and look forward to the award miles, the road to free tickets is about to get a lot longer.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: aadvantage, american airlines, loyalty

Photo credit: An American Airlines Boeing 787 Dreamliner takes off for Chicago O'Hare International Airport. American, like other carriers, has changed its loyalty program to look at spending first. Ron Jenkins / The Fort Worth Star-Telegram via AP