Skift Take

The very nature of investment in the travel startup space remains complicated. A lot of hype but also plenty of opportunity and big payouts for those who can bring together the right tech, the right user experience, for the right market segments. This report delves into what has worked and what investors should be paying attention to moving into 2017.

Today we are launching the latest report in our Skift Trends Reports service, New Skift Trends Report: 2016 Venture Investment Trends in Travel.

A closer look at some of 2016’s biggest travel startup funding deals to date point to a number of investment trends. One is continued fundraising by travel startup titans Airbnb and Uber, both of whom have chosen to stay private and grow using debt and private equity rather than attempt an initial public offering (IPO). Another new shift is the growing travel startup interest from established companies like JetBlue, Marriott, and Audi, all of whom are experimenting with startup incubators or making strategic investments in early-stage companies. The last trend is the increasing range of travel startup funding moving to developing markets like India.

Preview and Buy the Full Report

Despite these promising signs, the very nature of investment in the travel startup space remains complicated. Both founders and VC investors have emphasized the specific difficulties of building a startup in the travel industry, where new companies face stiff headwinds from dominant incumbents and there are growth challenges due to consumers’ sporadic travel purchase habits. B2B travel startups have trouble as well, as travel business owners are often not tech-savvy, and often have limited budgets to experiment with new innovations. In the future, many investors and founders are looking to new technologies like artificial intelligence, personalization, and messaging “chatbots” as key areas of interest and experimentation.

Preview and Buy the Full Report

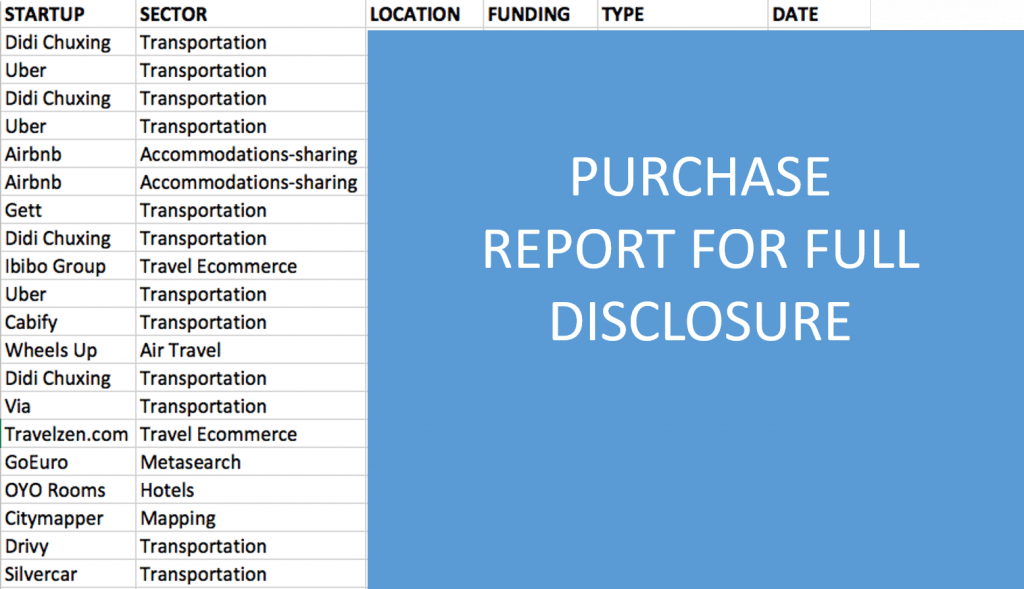

Looking at broader funding trends in travel startup investing can tell us a lot about the state of the industry and the broader economy. But using these macro-level figures alone doesn’t tell us much about the deeper factors shaping the current travel startup scene. What types of companies are getting the most investment? What investment models are founders using to fund these startups? What parts of the world are seeing the most interest? One of the best ways to answer these questions is looking at which startups received the most funding in 2016. Here’s that list, collected by Skift using its own reporting and data from other websites that track startup deals:

Subscribe to Skift Trends Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: research reports, Travel Trends