Skift Take

More consumers have a credit card that lets them earn loyalty points with a travel brand but they want earning and redeeming to be more convenient for them, a shortcoming that some brands have tackled and one that's left others with catching up to do.

Some 97 percent of U.S. consumers have a credit card that earns them travel rewards loyalty points with a travel brand. Making it easy to redeem those points and rewards is the challenge brands face, considering that’s what consumers say they want more of.

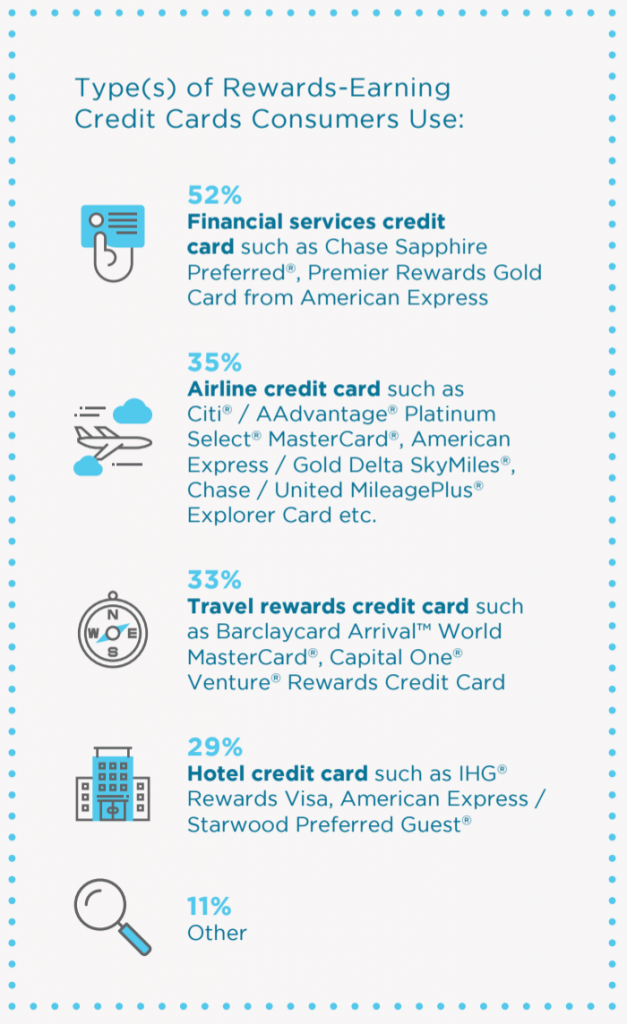

This is according to a study from Points.com, a loyalty program e-commerce and technology company that helps brands increase loyalty program revenue and engagement. It found 35 percent of consumers have an airline co-branded card, 29 percent have a hotel co-branded card and 33 percent have a travel rewards card such as a Barclaycard Arrival World MasterCard or CapitalOne Venture Rewards Credit Card. Points.com surveyed 1,500 U.S. consumers online and respondents were ages 18 and older, familiar with mobile wallets (cashless wallets where credit card information is stored on a smartphone), and a member of at least one loyalty program, travel or otherwise.

Nearly two-thirds of respondents said they’ve used a mobile wallet during the past year which allows all of their loyalty program currencies from different brands to sit in one place. (Points.com has an agenda here, of course. It has its own mobile wallet program: Points Loyalty Wallet.)

Mobile wallet adoption, which could be one way to help simplify loyalty accrual and redemption in travel, is growing but still not robust, said Danielle Brown, vice president of marketing at Points.com. “Earning loyalty has to be purposeful,” said Brown. “Consumers want to earn in a currency that they already know and love…I think the conversation is getting a little easier with travel brands and mobile wallets than it was a year or two ago. Before it was, ‘why would I want to put my loyalty currency next to my competitor’s?'”

The conversation has since shifted to the idea that more distribution is a good thing, said Brown. “It’s not like consumers don’t know that the other brands exist. If you are everywhere where your consumer wants you to be, that makes them more tied to you.”

Still, consumers are concerned about security with mobile wallets, with 79 percent of respondents indicating security is an important feature in their consideration of using them. Also, mobile wallet adoption could be a long-term game. Given the myriad of changes occurring in hotel and airline loyalty points structures and programs, will brands undergoing changes be keen to allow their currencies in mobile wallets before they understand how consumers are using them?

Loyalty and Mobile

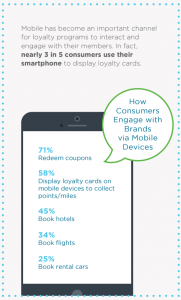

About 60 percent of respondents said they use their smartphone to access loyalty program information (not travel specific) and the chart below breaks down how respondents said they use loyalty on mobile devices.

Chart 1: A higher percentage of respondents said they access their loyalty information on their smartphones than those who said they book flights, hotels or rental cars on smartphones. Most respondents said they use their smartphones to redeem coupons from brands that are linked to loyalty.

Earning and Redeeming Travel Loyalty

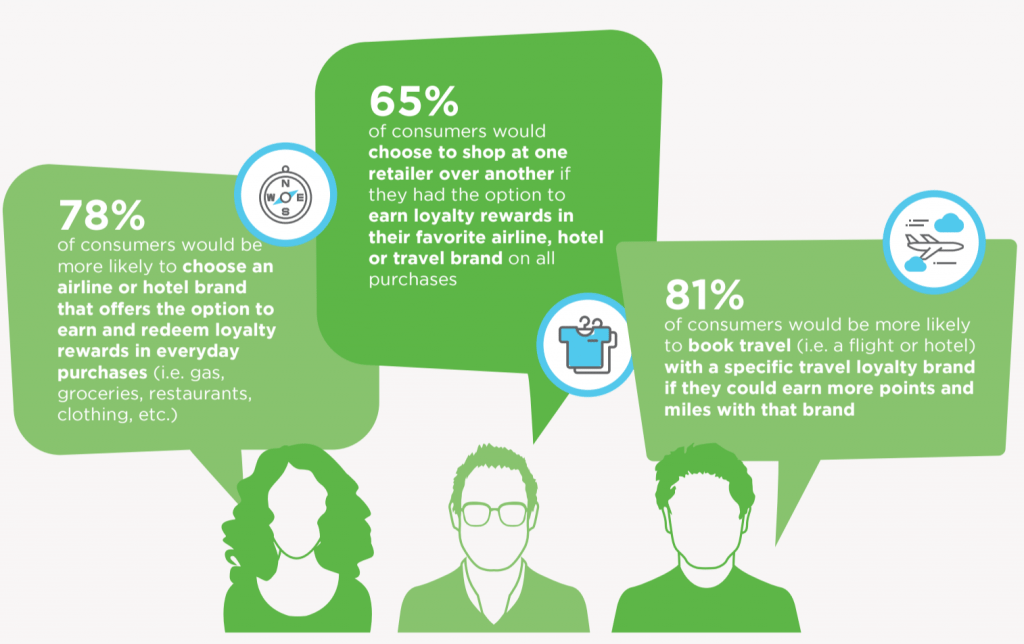

Consumers are willing to be picky about where they earn loyalty — some 65 percent of consumers would choose to shop at one retailer or another if they had the option to earn loyalty with their favorite airline, hotel or other travel brand with all purchases.

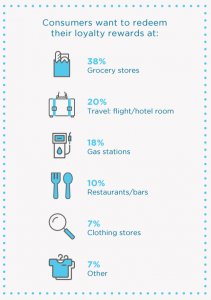

And its groceries, not travel, that the highest percentage of respondents said they want to redeem loyalty points for. “That finding surprised me at first, originally I thought that would be higher on the list but groceries are an everyday transaction so it’s easy to see why that’s on top,” said Brown.

Chart 2: The largest percentage of respondents (52 percent) said they have a financial services credit card but travel cards also loom large, with airline cards the second most popular card among respondents.

Chart 3: Travel ranks as the second most popular item that respondents said they want to redeem loyalty at (20 percent) after grocery stores at 38 percent.

Chart 4: Being able to earn and redeem loyalty rewards in everyday purchases is important — 79 percent of respondents said they would be more likely to choose an airline or hotel brand that offers them this option.

Source: Points.com

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: loyalty

Photo credit: Many U.S. consumers have a credit card, such as a Capital One card pictured here, that allows them to earn and redeem travel loyalty points. Capital One