Skift Take

Rich travelers, or those with multi-million annual incomes and assets, are getting richer and they're also getting more loyal and becoming stronger advocates for hotels. They also expect value from loyalty programs like every other kind of traveler and choose programs accordingly.

More than 14.5 million U.S. households have annual incomes greater than $150,000 and are frequent travelers with plenty of disposable income for hotels. But that’s not the ceiling of the American affluent population — the ultra affluent are even more loyal and devoted advocates for hotel brands.

That’s according to global polling and market research firm YouGov, which surveyed about 2,700 affluent travelers with household incomes greater than $150,000 from the U.S., Canada, Mexico, the UK, France, Germany, the UAE, China, Korea, Japan, Singapore and Australia. These people have at least $3 million in assets and account for 11.3 percent of the U.S. population, a number that YouGov said grows consistently each year and causes them to raise the income entry levels for this annual hotel loyalty survey.

Climbing even higher, the 400,000 ultra affluent U.S. households, which YouGov named “wealthy” for its survey, account for 0.3 percent of the total population and earn more than $1 million per household with assets greater than $20 million. YouGov found hotel loyalty is strongest among this particular niche of affluent travelers and they’re often staunch brand advocates with their families, friends and communities (see charts below).

“Last year about 10 percent of the U.S. population was considered affluent by our definition and this year that number was more than 11 percent,” said Cara David, managing partner at YouGov. “The big difference is when you look at affluence as a whole, at the end of the day it’s really about the assets you have to give you the personal freedom to live your life the way you want to live it.”

David said travel has benefited from the growing affluent class, which has been coined the “one percent,” but might actually be closer to the two or three percent now. “These travelers have the wherewithal to not have the concerns that other people in the general affluent population have. This group is extremely enthusiastic about travel and they’re rebalancing their spending towards experiences since the recession.”

Wealthy travelers have more choices than anyone else and more resources to make any kind of trip happen. “It’s much easier to find other options because everyone has TripAdvisor and Google. And it’s very difficult to reach affluent travelers because these are people who can afford to not look at your ads. They have the money to consume media without the annoyance of advertising. They don’t spend as much time online as other people, so they’re harder to find.”

During the past six months various rankings haven’t counted Marriott Rewards and Starwood Preferred Guest, for example, among top hotel loyalty programs mainly because they make it easier for elite and affluent travelers to redeem points but more difficult for middle class or less frequent travelers to boost points, a sign that these programs are focusing on wealthy members. Recent rankings have instead favored programs like Wyndham Worldwide’s because it better caters to Middle America, for example.

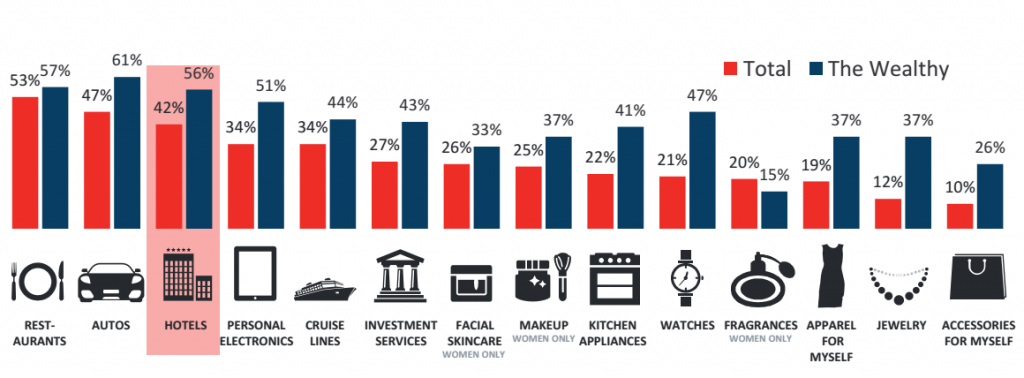

Chart 1: Hotels have the third highest percentage of advocacy among wealthy travelers, more than cruise lines, personal electronics, jewelry and makeup.

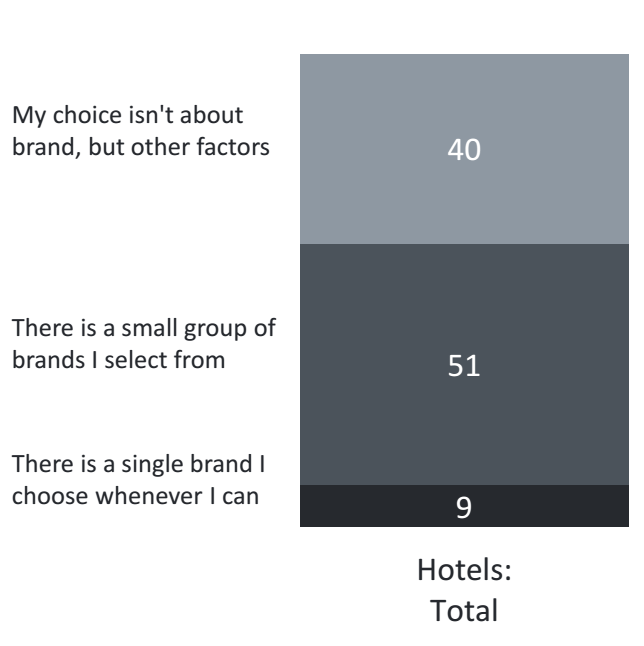

Chart 2: Affluent travelers that advocate for hotel brands and those that don’t is about 50/50. David added these affluent travelers that advocate for hotel brands usually spend more and expect fewer freebies.

Chart 3: Some 40 percent of affluent consumers said they’re not loyal to a single hotel brand or a small group of brands, but 60 percent said they are loyal to particular brands. The 40 percent are making their hotel decisions based on other factors such as location and price.

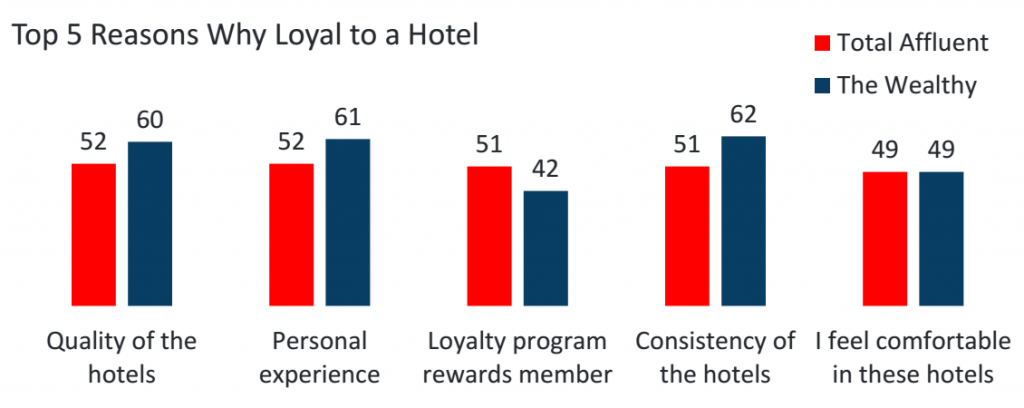

Chart 4: There Is little difference between quality, experience, reward programs. Among the wealthy, though, quality, consistency and personalized services of hotels matter more than with all affluent respondents while rewards programs are less important with the wealthy.

David said it’s important to remember that most affluent travelers are probably members of several programs and while they say loyalty programs aren’t the biggest reason why they’re loyal to a brand that’s likely because they’re loyalty to several brands. “We’ve found that the more affluent you are, you’re actually more loyal to a smaller group of brands. But we’re also seeing a lot of nervousness with economy and election in general among the affluent U.S. population. But those people will still continue to look for more value in the traditional sense of the term, like upgrades.”

Source: YouGov

Have a confidential tip for Skift? Get in touch

Tags: loyalty, skiftstats

Photo credit: U.S. affluent travelers are becoming more loyal towards hotel programs and are more likely to stay in a room like a suite at IHG's Hualuxe property pictured here. InterContinental Hotel Group