Skift Take

Travel to the U.S. is more resilient than some other countries, but there are already warning signs that the current climate should be cause for concern.

The picture of the current state of the United States on cable news and social media is one of a country torn by widespread gun violence, increasing racial tension, and a race for the presidency filled with open hatred of foreign tourists and immigrants (at least from one political candidate).

It’s not exactly a welcome mat for tourists.

In addition to headlines that have led multiple countries to issue travel warnings cautioning their citizens of dangers traveling to the U.S., the strength of the dollar is already having an impact on inbound tourism. Canadian numbers were projected to be down by 10 percent in 2015, caused largely by the decline of the Canadian dollar versus the U.S. dollar. The decline of the British pound to a 30-year low against the U.S. dollar is not expected to help either.

The U.S. is relying to a great extent on inbound tourism from countries including the UK, Canada, and Brazil to hit its tourism goal of 100 million visitors by 2021. But so far, the last two years have not been banner ones for international tourism to the U.S. “We are significantly under where we need to be for that target [of 100 million visitors by 2021],” said Caroll Rheem, Brand USA’s vice president of research and analytics, on the June 9 Brand USA conference call.

All of these things are happening in an environment that is considered one of the most open to tourism in generations. The visa waiver program expanded by the Obama administration opened the door for nationals of 38 countries to visit the U.S. more freely than ever before, with 52 percent of visitors in 2015 coming in through the program. Tourism leaders at this year’s World Travel and Tourism Council Global Summit openly worried about threat to the program amidst partisan political posturing.

Three countries that are key to U.S. tourism are the UK, Canada, and Brazil. The UK is the largest source of overseas international travel, while Canada is the largest source of travel from anywhere (Mexico is in second place). Brazil is a bellwether country because, outside of South America, the U.S. is the most popular foreign destination.

In three surveys conducted between July 10 and 11, we asked three sets of 1,500 members of the general Internet population in the UK, Canada, and Brazil about how current conflicts in the U.S. were influencing their plans to visit.

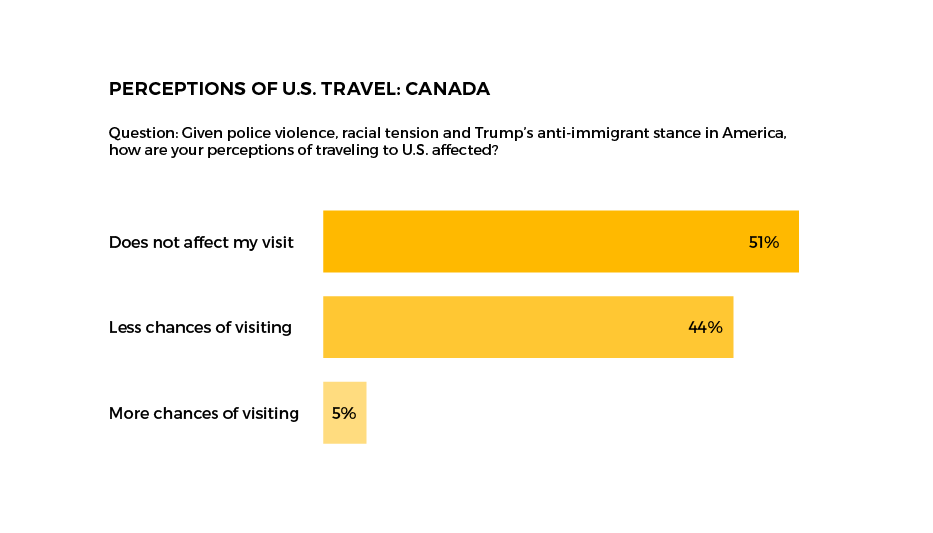

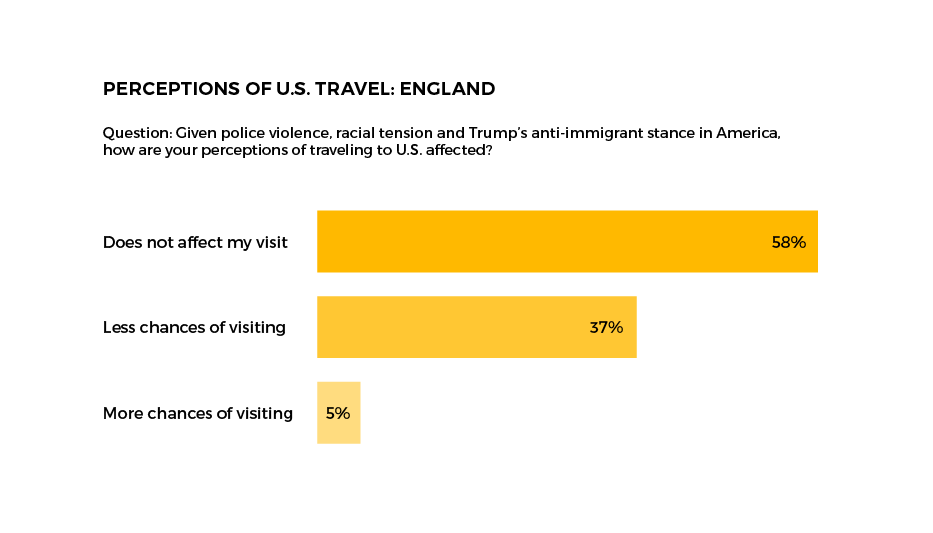

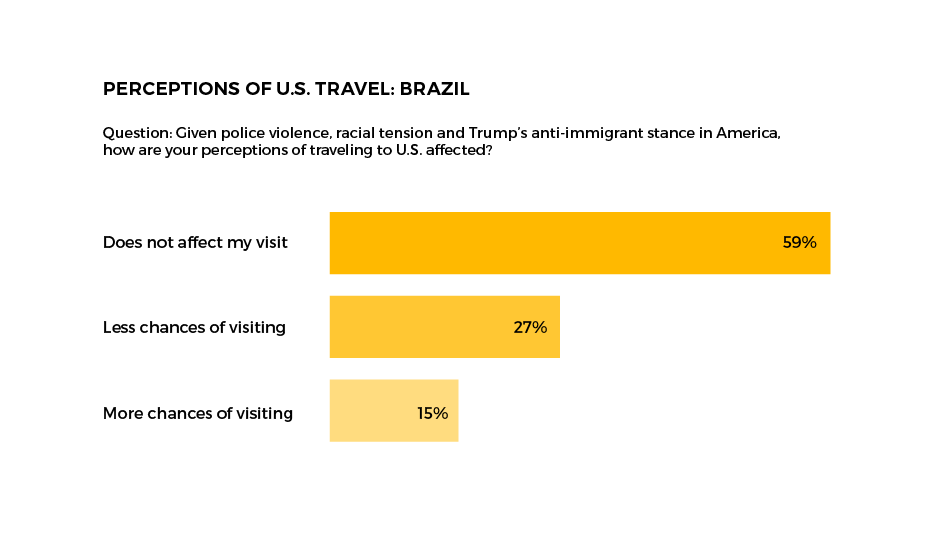

The question we asked was: “Given police violence, racial tension and Trump’s anti-immigrant stance in America, how are your perceptions of traveling to U.S. affected?” For the Brazilian audience we asked this question in Portuguese, in Canada and the UK we only asked in English.

Important: This survey — not served to Skift users — was administered to members of the adult internet population in three countries in July 2016, through Google Consumer Surveys. The methodology is explained here.

Respondents had the choice of four questions: No plans to visit, Does not affect my visit, Less chances of visiting, More chances of visiting.

Interestingly, a majority of respondents noted that they were considering or planning a trip to the U.S. While “No plans to visit,” was the most popular answer — Brazil (42.9 percent), UK (48.4 percent), and Canada (32 percent) — it was not a majority in any market.

For visitors who were planning a visit or considering a visit, the majority in each country answered that the current news would not affect their visit.

More takeaways from the survey:

- The highest response number for “Less chances of visiting” were in Canada, where 44 percent of those considering a visit were now less likely to do so.

- Brazilian respondents were the most likely to say “Does not affect my visit.” They were also three times more likely than Canada or the UK to say “More chances of visiting.”

- In Canada, men were more likely than women to answer “Does not affect my visit.”

- In Canada, younger respondents (18-24 and 25-34) were more likely to answer “Less chances of visiting” than any other demographic.

- Age was also a factor in the UK, with 18-24 year olds answering “Less chances of visiting” in greater numbers than any other group.

- In Canada, suburban areas picked “Less chances of visiting” more than urban areas.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: brazil, canada, money, surveys, tourism, uk, unrest

Photo credit: Tourists taking a selfie on New York City's Highline. New York tourism, like many other parts of the U.S., relies to a great extent on inbound tourism from countries including the UK, Canada, and Brazil. Skift