Skift Take

President Obama's goal of bringing 100 million foreign travelers to the U.S. in 2021 may have been too ambitious given global instability and an unexpectedly strong U.S. dollar. The first challenge is to bring back Canadian tourists.

It looks like Brand USA’s stated goal of bringing 100 million inbound tourism arrivals to the U.S. in 2021 may not happen given a variety of global factors.

Brand USA quietly released its fiscal year 2015 annual report earlier this month, and on the organization’s quarterly board call its executives wrestled with the realization that tourism isn’t increasing quite as quickly as they had anticipated.

In order to play catch up, Brand USA has raised its target compound annual growth rate for inbound tourism from 4.2 percent to 4.8 percent from 2016 to 2021.

“We are significantly under where we need to be for that target [of 100 million visitors by 2021],” said Carroll Rheem, Brand USA’s vice president of research and analytics, on the June 9 Brand USA conference call. “The leading driver of our underperformance is the 10 percent decline in Canadian volume.”

Financially, Brand USA reported strong support from industry partners and said its marketing efforts have been successful on a global basis in terms of driving interest in leisure travel to the U.S.

Here are four slides from Brand USA’s latest board of directors presentation that illustrate the challenges its current model faces in reaching its goals of attracting 100 million travelers to the U.S. in 2021.

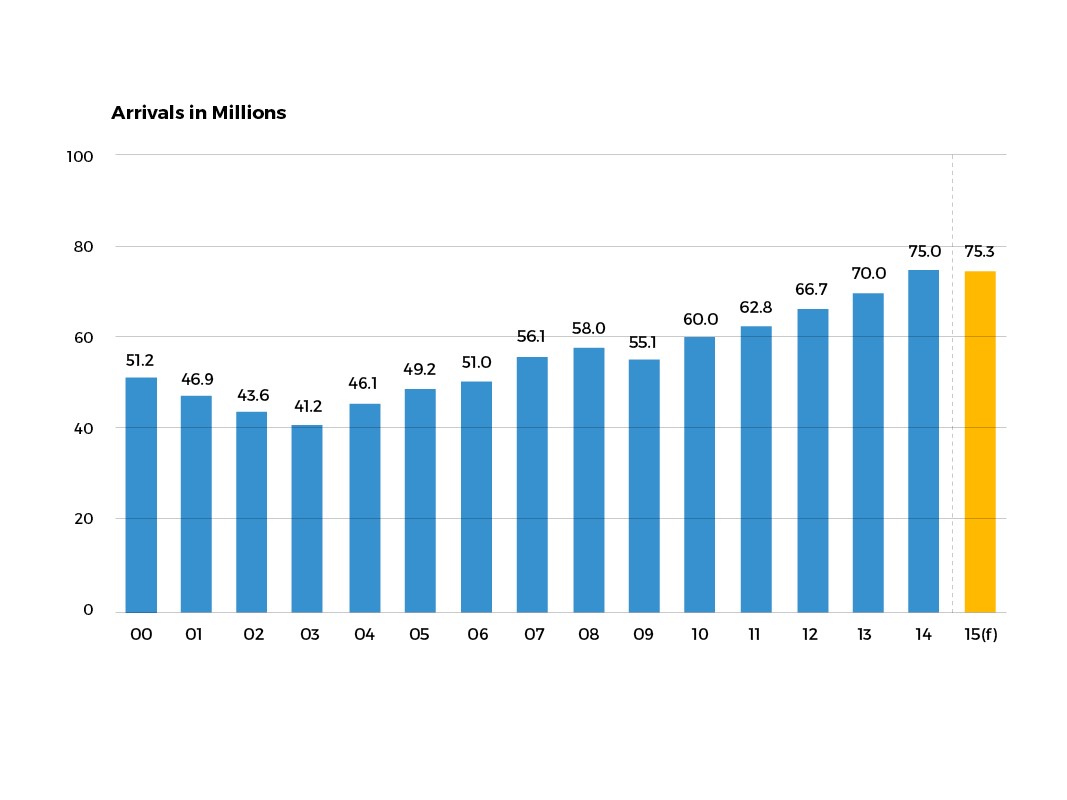

Tourist arrivals were flat from 2014 to 2015

Source: Brand USA

Arrivals to the U.S. didn’t grow as expected from FY2014 to FY2015, ending up basically flat, according to the latest forecast data from the National Travel and Tourism Office (NTTO).

The last time inbound tourism was flat or down was in 2009, as the Great Recession crushed global tourism demand.

The NTTO estimates now have inbound tourism six or seven million visitors shy of the 100 million mark in 2021.

“We have to make our dollars work harder than they ever had before,” said Rheem.

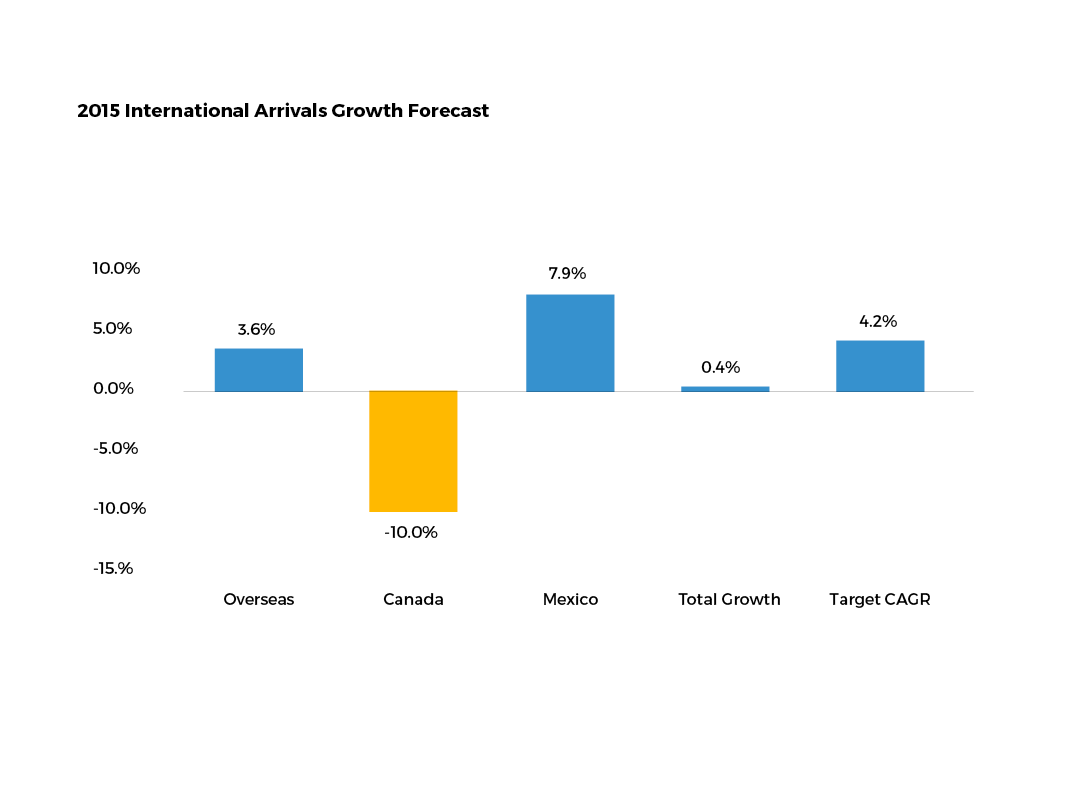

The strong dollar is killing Canadian tourism in the U.S.

Source: Brand USA

This chart bears out the brunt of the problem facing Brand USA in recent years. Canada and Mexico are usually the top countries for travel to the U.S. Canadian arrivals dropped 10 percent, mostly as a result of the strong U.S. dollar.

“If you think about the environment we’re operating in, where the Canadian dollar has lost 20 percent of value against the dollar recently, its not a surprise,” said Rheem. “It’s actually very much on trend to see the kind of decline we saw in 2015.”

Even total overseas arrivals missed the growth rate expected by Brand USA’s projections. This leaves the organization with the challenge of having to drive international tourism to the U.S. even above the high levels they had already budgeted and planned for.

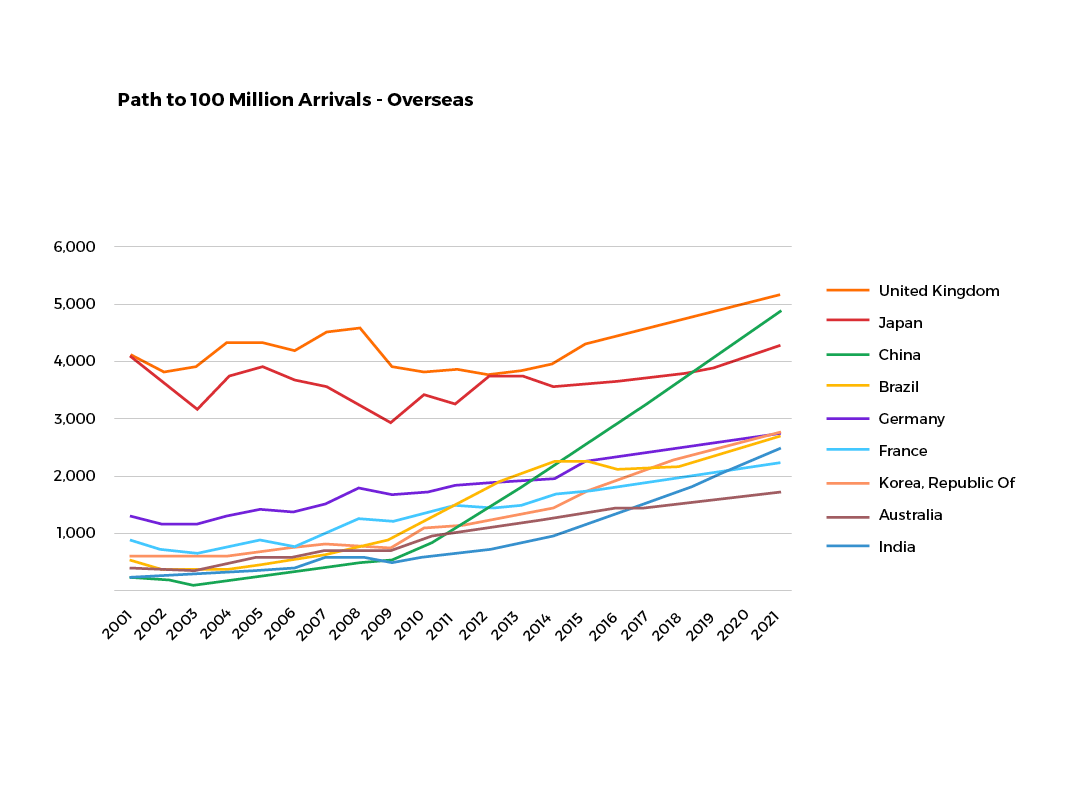

The UK, China, and Japan are crucial to U.S. tourism goals

Source: Brand USA

To meet U.S. tourism goals from overseas countries, Brand USA is reliant on driving tourism predominantly from the UK, Japan, and China.

With Brexit turmoil in the UK and overall economic concerns in Japan and China, it may be hard to stimulate demand if potential travelers are affected by a weak global economy.

These projects are also extremely reliant on Open Skies agreements in the global air travel industry, and a setback among carriers could limit access to the U.S. as a vacation destination.

Mexico, China, and India represent the greatest opportunity for Brand USA

| Country | 2021 (OOO) | 2021/2014 Growth (%) | Visitor Growth (000) | % of Required Growth |

|---|---|---|---|---|

| Mexico | 25,066 | 47% | 7,996 | 32% |

| Canada | 24,978 | 9% | 1,965 | 8% |

| United Kingdom | 5,135 | 29% | 1,162 | 5% |

| China | 4,880 | 123% | 2,692 | 11% |

| Japan | 4,252 | 19% | 673 | 3% |

| India | 2,885 | 200% | 1,923 | 8% |

| Brazil | 2,773 | 22% | 509 | 2% |

| Germany | 2,773 | 41% | 805 | 3% |

| South Korea | 2,688 | 85% | 1,238 | 5% |

| France | 2,308 | 42% | 683 | 3% |

| Australia | 1,750 | 37% | 474 | 2% |

| Colombia | 1,449 | 64% | 567 | 2% |

| Italy | 1,311 | 40% | 377 | 2% |

| Netherlands | 884 | 44% | 268 | 1% |

| Sweden | 798 | 47% | 255 | 1% |

| Chile | 422 | 69% | 173 | 1% |

| Others | 15,647 | 21% | 3,227 | 13% |

| Total | 100,000 | 33% | 24,989 | 100% |

A deeper dive into what Brand USA sees as the top growth markets for U.S. inbound tourism is surprising. India, South Korea, China, and Chile are expected to have the highest growth rates.

Unsurprisingly, Mexico, and Canada will account for about half of total visitation if Brand USA is able to hit its goal of 100 million travelers in 2021.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: brand usa, canada, china, mexico

Photo credit: Tourists taking a selfie on a New York City rooftop in 2015. Nicolas Mirguet / Flickr