Skift Take

The $100 billion industry vacation rental sector could be going into over-drive as it attracts growing interest from investors, major hospitality brands and travelers seeking alternate accommodations.

This sponsored content was created in collaboration with a Skift partner.

In the pre-Internet era, vacation rentals were a largely mom-and-pop industry. Businesses advertised via classifieds or real estate agents; some mailed catalogs to mailing lists acquired from local visitors bureaus. Change came by the decade: A Colorado couple looking for a better way to rent their ski condo launched booking site VRBO in 1996. HomeAway acquired the business in 2006, becoming the dominant listings hub. Then last year, Expedia swallowed up HomeAway, paying $3.9 billion.

This cottage industry has blown up. The industry is believed to be worth $100 billion, with the U.S. accounting for just over a quarter of that — and Research and Markets predicts the global vacation rental market will close in on $170 billion by 2019. Meanwhile, Skift calculates that in the first four months of 2016 alone, vacation rentals startups attracted nearly $100 million in venture capital funding, concentrated in the U.S. and Europe.

The vacation rental industry is maturing “from a teenager to a young adult,” says Brandon Ezra, founder and CEO of Grand Welcome, a fast-growing vacation rental management company. The success of HomeAway and Airbnb has prompted a “stampede” that includes some of the biggest names in travel, notes Julian Castelli of LeisureLink, a distribution system and sales channel manager.

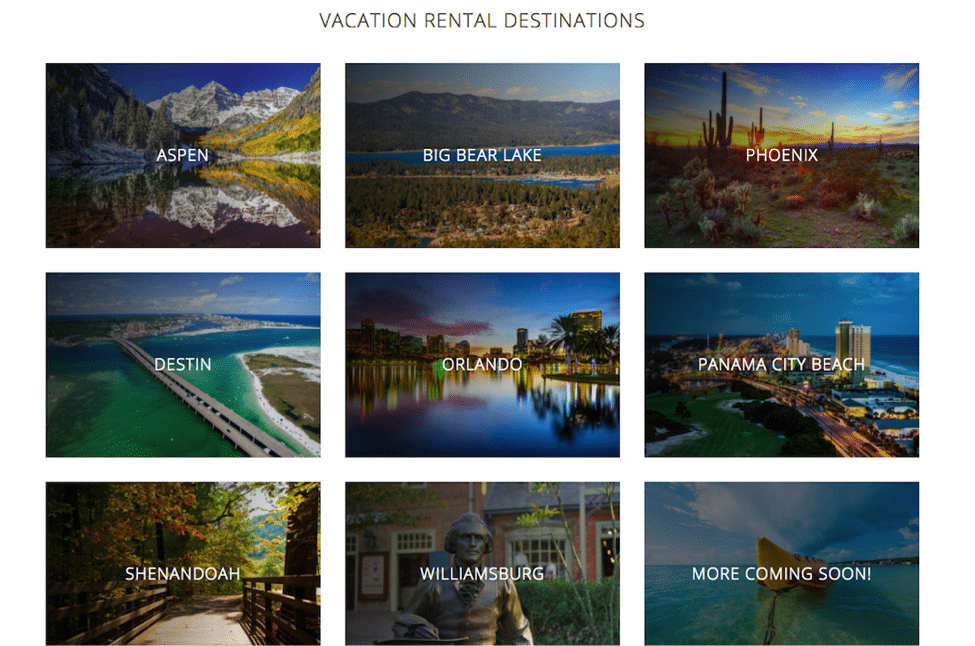

Choice Hotels, for example, announced earlier this year that it’s getting into the vacation rental business. Priceline recently said alternative accommodations — an umbrella term that includes vacation rentals as well as other apartments and short-term rentals — will be an important source of growth. The category already accounts for almost half of Priceline’s property roster thanks largely to Villas.com, which Priceline’s Booking.com business launched in 2014.

Airbnb, which has had a more urban focus than the traditional vacation rental market, has been focused on attracting more listings. The company named Shaun Stewart its first head of global vacation rentals in 2014 and recently started opening its API to vacation rental property management systems and connectivity partners to help property managers better work with the channel.

“Small players are getting bigger, and bigger ones are trying to buy in,” notes Andrew McConnell, CEO and co-founder of Rented.com, a wholesale marketplace for property managers. Ezra expects to see more billion-dollar companies arise over the next five to 10 years, given the industry’s fragmented state — the heavy hitters account for a small percentage of the market.

Consolidation as well as convergence are two key trends McConnell identifies — convergence meaning a blurring of traditional distinctions between lodging categories. The typical traveler isn’t differentiating between a “sharing economy” lodging — from an urban Airbnb apartment to an upscale Onefinestay home, generally the renter’s primary residence — versus a vacation rental, often a second home or investment property in a holiday destination like a beach or ski area. And as online travel agencies incorporate more vacation rental listings, options across categories are easily compared and blur together.

Convergence is one factor driving a professionalization of the industry. “When someone books on an OTA, they’re used to a more hotel-style product,” notes Jeremy Grogg, who runs Kees Vacation Rentals. Going back 15 years, he says, many vacation rental properties didn’t even provide linens. Today’s travelers expect the same amenities as a hotel, from shampoo and soap in the bathroom to wi-fi, and top property managers are providing these amenities to give guests the best of both worlds

If properties can meet expectations, demand is likely to rise, given that the 18-44 demographic accounts for the strongest growth in the sector, according to a 2015 Phocuswright study of private accommodations. Plus, HomeAway believes vacation rentals are under-penetrated for the core target of families and groups. Some 40 percent of Americans say they have ever stayed in a vacation rental, indicating “plenty of room for growth in awareness,” says Bill Furlong, HomeAway VP of North American Business.

Other optimists include John Dalton, chief marketing strategist for the Onsite Property Management Association. “Alternate lodging is going to become primary lodging — the market has no ending, none at all,” he says.

This content was created collaboratively by LeisureLink and Skift’s branded content studio SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: choice hotels, homeaway, sharing economy, vacation rentals

Photo credit: Image from Choice Hotels’ Vacation Rental site. Choice Hotels