Skift Take

We'd rather see PricewaterhouseCoopers or another neutral party estimate the revenue impact of hotel chains' direct-marketing campaigns instead of relying on Expedia, which obviously has vested interests. Still, Expedia's chart furthers discussion and the dialogue under way with hotels, and speaks to how seriously Expedia views the threat and the issue.

Expedia is trying to enlist a new ally — hotel property owners — in its fight against the moves by hotel chains such as Hilton Worldwide, Marriott International, and Hyatt to increase direct bookings by offering lower rates on their websites than they give to the online travel agencies.

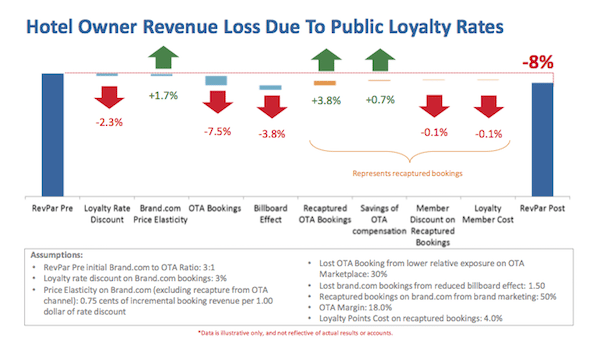

In a chart provided to Skift, Expedia lays out what it calls a conservative estimate on how hotel owners would be taking a revenue hit of around eight percent because of chains’ decisions to publicly offer hotel loyalty program members lower rates on hotel websites than they give to Expedia, for example.

Source: Expedia Inc.

In essence, Expedia argues that despite property owners saving money on distribution costs from direct bookings, the lower rates they are offering on brand.com sites, their reduced exposure on Expedia sites, a diminished billboard effect and higher loyalty program costs lead to reduced revenue per available room for owners of about 8 percent.

There will undoubtedly be plenty in Expedia’s numbers for hotel chains, owners, and others to pick apart, including the issue of whether the lost traffic from the billboard effect is overstated, or perhaps Expedia is downplaying the percentage (50 percent) of bookings that hotels are recapturing from the online travel agencies via marketing campaigns.

In fact, speaking on background only, representatives of a couple of chains disparaged Expedia’s numbers. One said these are early days with probably only one quarter of data to measure and direct booking amounts to the cheapest distribution channel for chains as well as owners.

An official from another chain pointed out that Expedia’s assumption that chains get 25 percent of bookings from Expedia is an inflated notion.

None would comment on the record because of earnings’ quiet periods or other factors.

To be sure, Expedia states its chart doesn’t represent actual figures but is directional in nature.

Whether Expedia’s numbers are on the mark or off the wall, the fact that the company went public with its estimates points to the concern at the online travel agency over these latest marketing initiatives within the hotel industry.

It remains to be seen whether a divide and conquer tack in trying to pit property owners against the chains will be effective.

What’s Changed?

Cyril Ranque, Expedia Inc.’s president of lodging services, argues that hotel owners didn’t have a say in what he considers the chains’ “short-sighted” and “strange” marketing strategy to emphasize direct bookings at the expense of online travel agency distribution.

In recent years, hotels marketed special rates to loyalty program members through email and other promotions but it was in a closed fashion because the chains weren’t offering these lower rates publicly on their websites. Rate parity and most-favored nation clauses were the rule of the day with chains giving online travel agencies their lowest rates, which were also offered on the hotel websites.

But over the last year or so chains such as Hilton, Marriott and Hyatt have begun to offer their lowest rates to loyalty program members openly and exclusively on their own websites. Ranque says these changes are not a contractual issue although they weren’t specifically addressed in recent rounds of contact negotiations.

Consider that Hilton.com, for example, is offering customers a “guaranteed discount” at a $260 rate and free Wi-Fi for the Hampton Inn Majestic Chicago Theatre District with a king bed for a May 16 stay. Expedia offers the same room type without the free Wi-Fi for $269.

Hotel chains have been screaming for more than a decade that they lost control of their distribution, and need to take back share from the online travel agencies. Some of the chains are supporting aggressive TV and digital campaigns to support getting consumer to book direct.

But chains such as Hilton Worldwide, which has been pushing the reduced loyalty program rates publicly the longest, are losing share and visibility on Expedia sites in a process that Ranque says is taking shape organically when consumers aren’t getting the content they desire.

Ranque says consumers are accustomed to using online travel agencies to compare prices and hotels, and reducing distribution through online travel agencies discriminates against Expedia customers and blunts the online travel agencies’ role in feeding new customers to the hotels through the billboard effect and in other ways.

“They are drying out their new-customer acquisition channel,” Ranque says.

“We thought this a strange marketing strategy” that reverses the progress of the last 20 years, he adds.

The chains themselves — as opposed to property owners — are likewise taking a revenue hit from their direct-booking campaigns, Ranque alleges, although to a lesser extent than owners.

If I Were A Hotel Chain

Putting on his hotelier hat, Ranque says owners and chains are reducing their revenue management flexibility by going beyond promotions to closed user groups and offering discounted rates publicly on their websites.

This removes “a layer of flexibility, which we feel is not correct,” Ranque says.

Some hoteliers also are creating friction with consumers by failing to disclose up-front that the “lead-in prices” they display on their websites require customers to join the hotel loyalty program, he says.

While Expedia estimates that hotel property owners are taking around an 8 percent hit in RevPar from the chains’ direct-booking initiatives, Ranque says the chains’ revenue, too, is being adversely impacted although to a lesser extent than for property owners.

“Hilton has definitely lost share” in the Expedia marketplace as it has been favoring its own websites over Expedia longer than the chain’s competitors, Ranque says. “We see independents doing pretty well.”

Have a confidential tip for Skift? Get in touch

Tags: advertising, expedia, hilton, hyatt, marketing, marriott

Photo credit: Expedia has benefits to hotels, argues Expedia.