Skift Take

The substitution effect is real, and car rental companies for the first time are beginning to look like transitory businesses.

The existential threat to the rental car business is real. That much is now evident to anyone not listening to the public relations spin coming out of the, well, the rental car world.

Hertz announced its earnings last week and cut its revenue expectations for the year, saying that the rental car market is suffering from excess capacity. And by “excess industry capacity” it might as well have said “Uber,” “Lyft,” or any other on-demand car service, though Uber is eating up everyone else in its market.

The evidence is coming from all sides: Uber eclipsed car rentals as a percent of total rides nationwide in U.S. for the first time, in Q4 of 2015, according to Certify’s SpendSmart Report on business travel spending for 2015. Uber also ranked the highest among users in customer satisfaction, compared with Lyft, car rentals and taxis, among Certify’s business expense userbase.

Players like Hertz are hoping for a blending of car rental and car-sharing services, which may not happen.

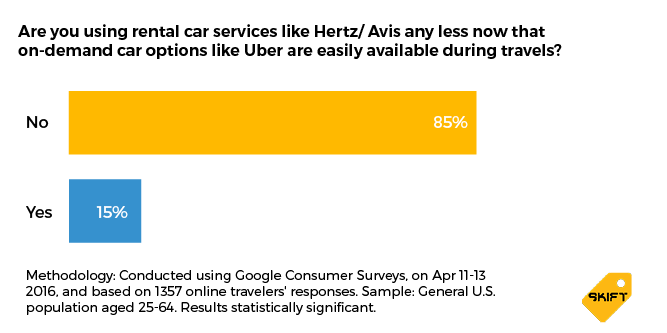

Skift decided to ask the general American traveler about the substitution effect happening in the ground transport market, via a Google Consumer Survey, last week. The question we asked, to about 1,400 online travelers aged between 25-64: Are you using rental car services like Hertz/Avis any less now that on-demand car options like Uber are easily available during travels?

The answer: about 15 percent of them are, which is a large enough dent in the market three to four years into Uber-type services hitting mainstream.

Some other observations based on further breakdown of demographic data from the results of the survey above:

- About twice as many American men using Uber instead of rental cars than women, while traveling.

- The 25-44 age bracket is substituting Uber at twice the rate than those in the 45-64 age bracket.

- U.S. Northeast and Midwest are more prone to sticking to rental cars than Uber, while U.S. Western region is using Uber at much higher rate while traveling than other U.S. regions.

- Not a surprise, urban American travelers are using Uber at twice the rate of rural Americans.

- And this is where it hits most for rental car companies: about 40 percent of those above $150K in yearly income are using Uber more now as a substitution for rental cars while traveling.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: avis, car rental, hertz, skiftasks, surveys, uber

Photo credit: Uber is becoming more popular among travelers, and hurting rental car business already. Mr. Leeds / Flickr