Skift Take

It's nice that the FAA expects consolidation to have eliminated all the problems in U.S. aviation. But history has shown that the reality for these companies is usually more complicated, for a variety of reasons including corporate greed and geopolitical tension.

The last decade has been tumultuous for U.S. airlines but years of consolidation, along with innovations like unbundled fares, have improved the profitability of the airlines left standing.

The new structure of the industry will contribute to sustainable growth going forward, according to a new report from the Federal Aviation Administration (FAA) on the future of U.S. aviation through 2036.

The “FAA Aerospace Forecast: Fiscal Years 2016-2036” report paints a picture of solid fundamentals for commercial carriers, especially as international travel to the U.S. has become more popular.

While international turmoil will likely contribute to constrained growth compared to the last few years, capacity and demand growth are expected to increase gradually over the next 20 years without interruption.

“The 2016 FAA forecast calls for U.S. carrier passenger growth over the next 20 years to average 2.1 percent per year, slightly faster than last year’s forecast,” reads the forecast. “There are a number of headwinds that are buffeting the global economy – the fall in oil prices, recession in Russia and Brazil and inconsistent performance in other emerging economies, a ‘hard landing’ in China, and lack of further stimulus in the advanced economies.”

Here are three big takeaways on U.S. commercial aviation in the report.

1. Industry consolidation is over, because there’s nothing left to consolidate

The report asserts that the overall business model of the U.S. airline industry has shifted from a “boom-or-bust” model to some a more sustainable model that drives small yearly growth instead of large profit.

The result is likely to be a move away from further consolidation.

“The Big 3 (American, Delta, and United) plus Southwest accounted for more than 76 percent of the U.S. airline industry capacity and traffic [in fiscal year 2015],” it explains. “There appears to be little appetite for further consolidation as there are significant obstacles. For many low-cost carriers, the sheer size of merger transactions or the amount of financial risk associated with a merger makes further merger activity unlikely.”

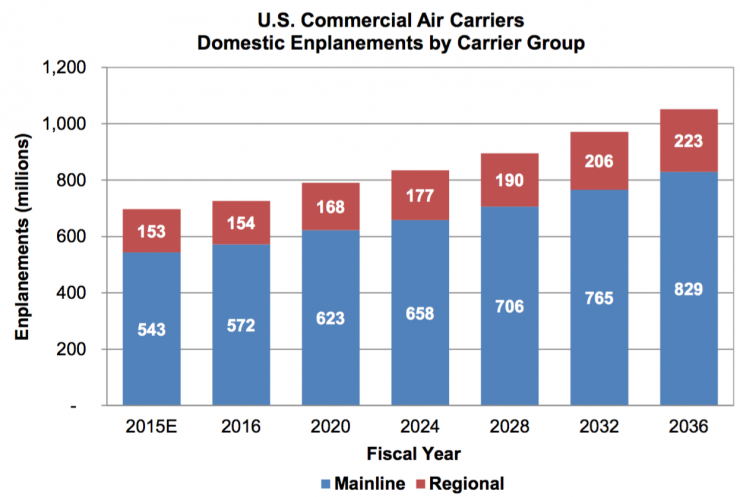

2. Regional carriers will see big growth after 2024

The FAA’s forecast calls for a big increase in enplanements by regional carriers as the U.S. economy becomes stronger following a recessionary dip in 2019. International travel will likely help grow demand for mainline carriers regardless.

“Over the long term, we see a competitive and profitable aviation industry characterized by increasing demand for air travel and airfares growing more slowly than inflation, reflecting over the long term a growing U.S. economy,” reads the report.

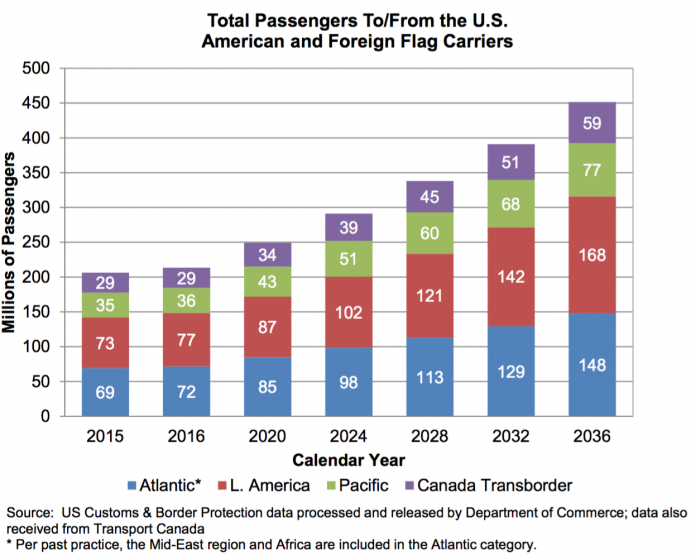

3. International travel is set to skyrocket… barring another global financial meltdown

The number of flyers to the U.S. from Latin America and the Middle East, Africa and Europe is expected to double over the next 20 years.

Macroeconomic weakness stemming from low oil prices, however, could lead to lower than expected international travel growth.

“While the financial situation across the world has weakened somewhat, lower fares enabled by falling oil prices and more efficient aircraft has boosted demand; at least in the short term,” concludes the report. “It is possible that historically low oil prices signal further weakening in the global economy and thus, lower travel demand in the future.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: faa

Photo credit: Chicago's O'Hare International Airport. Nicola / Flickr