Skift Take

The new Fulcrum report gives tourism bureaus a better idea of the business challenges facing planners, and how they can help planners deliver better business performance without giving them a free handout.

Conference organizers are looking for more direct financial help and sponsorship opportunities from destination marketing organizations (DMOs) in 2016, due to the sharp rise in hotel, venue, and food costs.

That’s according to this month’s “Destination Marketing Insights from Meeting Executives” survey conducted by the newly formed Fulcrum Marketing company. Its founders are David Kliman, principle of The Kliman Group, a veteran DMO consulting agency, and Bruce MacMillan, past CEO of Meeting Professionals International and Tourism Toronto.

The purpose of the survey was to hear what North American planners had to say specifically about the business of global meetings, and how the rising cost of large conferences will impact their working relationships with DMOs.

The hospitality industry posted record numbers in 2015, especially hotels in the upper upscale segment, many of which have plentiful meeting space and attractive downtown locations. According to STR hospitality analytics, average daily rate in that segment for the first 10 months of 2015 rose 4.3%. Revenue per available room (RevPAR) increased 5.2%, marking the 68th straight month that RevPAR showed positive gains.

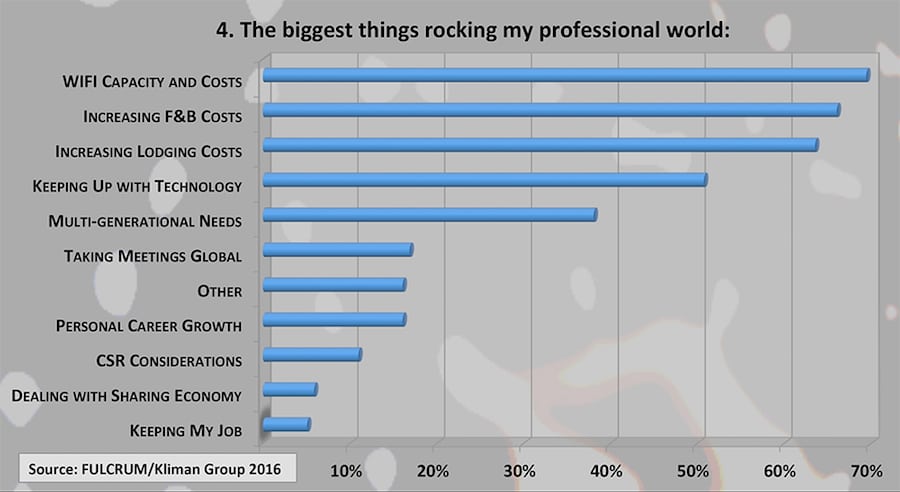

For many of the 398 meeting planners who participated in the survey, however, their organizations are not increasing meeting budgets to the same degree, placing more pressure to deliver the same results with less resources.

“Many organizations still see meetings as a cost center, or a hospitality expense, rather than an investment in strategic development,” MacMillan told Skift. “So meeting professionals are now turning to DMOs as a source to help grow their revenue. They’re requesting financial incentives and subsidies, more marketing support to boost attendance, and more help to secure sponsorship in the destination to drive a meeting’s overall business performance.”

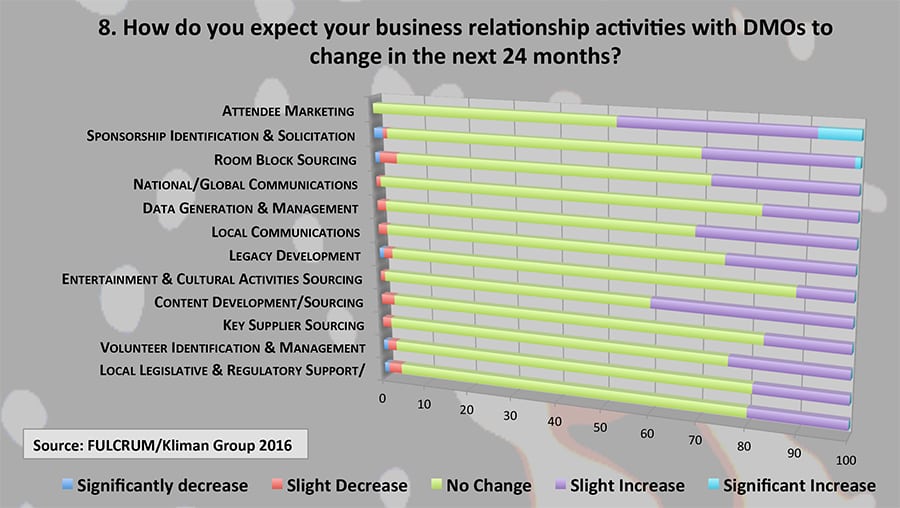

In the Fulcrum survey, the two most significant ways that planners envision their relationships with DMOs shifting over the next two years focus on attendee marketing and sponsorship solicitation. Already, over the past 12 months, 48% of planners said they worked more closely with DMOs than they have in the past, while 44% responded that there was no change.

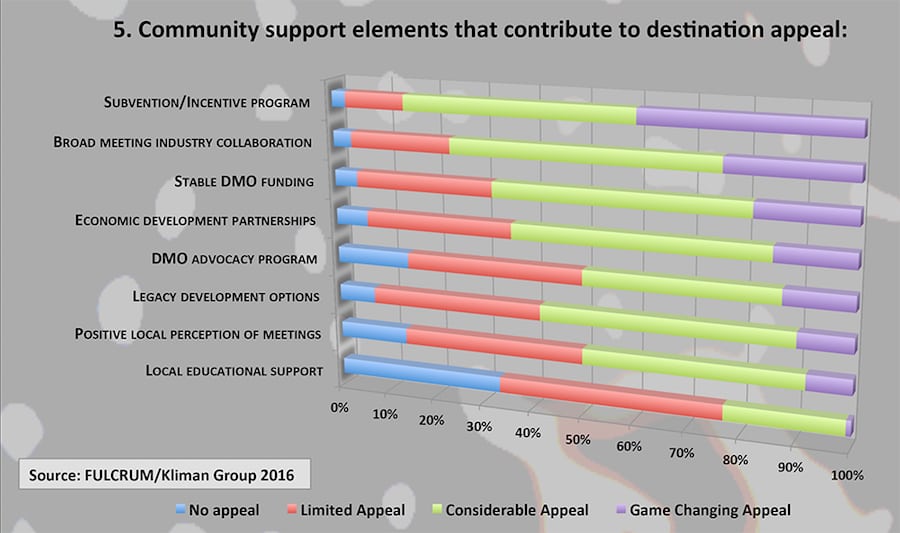

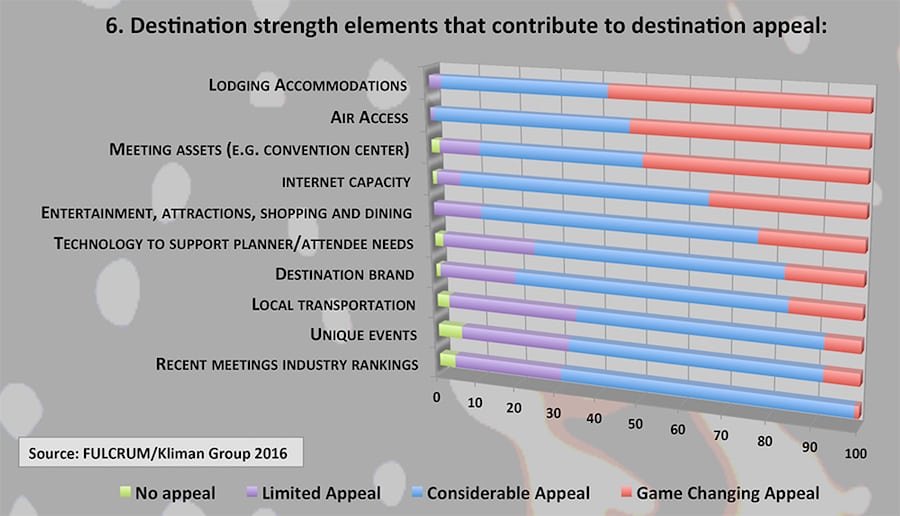

Also, survey respondents reported that the two most appealing selling points for a potential meeting destination were the availability of financial incentives and broad meeting industry collaboration.

We mentioned to Kliman and MacMillan that many DMOs are strapped for cash themselves, so this whole economic dynamic seems like it’s potentially going from bad to worse for some meeting planners.

Sensing that growing demand for financial assistance from planners, even well-funded destinations like Singapore are opposed to offering cash incentives to groups, or what’s also known as “subvention.”

“I think there is an interesting trend that is happening, where in this competitive world everyone is kind of dangling a big carrot,” said Kershing Goh, North America director of the Singapore Tourism Board. “Like, you need to bring your event to XYZ destination because I have a great grant, or you need to bring your event because I’m giving a really generous assistance program.

“I foresee that is not sustainable for the industry, and I don’t think that is the way the industry should go,” she added. “Because then it becomes just a buy-and-sell trade, and at the end of the day in the meetings industry, there has to be value as to why someone needs to meet.”

“To Singapore’s point,” responded MacMillan, “it is hard to sustain this but the survey shows it’s what the marketplace is saying it wants.”

Beyond The ‘Jurassic’ Model of Marketing Rates, Dates & Space

If DMOs are either unwilling or unable to offer meeting planners increasing financial incentives, MacMillan says they can provide the other primary support mechanisms in demand as expressed in the survey.

That includes soliciting in-destination sponsorship and industry-specific intelligence to add value to a business event, and helping planners promote their conferences to potential attendees and exhibitors locally and worldwide.

MacMillan pointed out the DMOs in Denver, New Orleans, Melbourne, Vancouver and others as sample organizations leading this trend. They’re attempting to proactively differentiate their destinations by selling themselves as business partners for visiting groups.

“I think increasing the trend is shifting towards planners saying, ‘Help us grow our business by doing things like introducing us to your intellectual capital and assets,'” MacMillan explained. “That’s a transformational opportunity for the DMO because that’s not what they’re used to doing very often. They’re used to selling and marketing.”

Kliman added, “It really gets away from the Jurassic model of ‘dates, rates and space,’ so now DMOs are helping partner with planners as strategic meeting executives. When we asked what current emerging trends would enhance destination appeal, that’s overwhelmingly what people said.”

Denver provides a good example of this trend in action. Richard Scharf, president and CEO of Visit Denver, has been vocal about the need for DMOs to raise their relevance in the convention industry by better connecting visiting groups with local business industry and academic thought leaders.

Many times, he says, business and academic stakeholders are not aware that conferences are in town that are related to their fields of interest. That poses a lost opportunity for both sides of the supplier and buyer equation.

“We’re seeing that DMOs, and I think this has started happening in the last several years, are becoming more like partners with planners, because again, we have a common goal of driving attendance,” said Scharf. “Meeting success is all about good attendance, a good experience, so I think that’s where we’ve been very active is helping boost attendance, whether that’s creating webpages or helping finding speakers or local experts.”

Another example, Denver converted an army base under a decade ago into the Anschutz Medical Campus for the University of Colorado Health Science Division. Scharf and his conference services team go out to the medical facility to meet with department heads, many of whom have served on national boards of medical associations.

So they clearly know their respective industries, but they don’t necessarily know what Denver can offer to support those industries on a global basis.

“We have events now where we bring them into downtown and show them our facilities, because many of them are traveling all over the world speaking, and they’re never getting a chance to see what we’re doing in Denver,” said Scharf.

As a result of that strategy, the World Conference on Lung Cancer met in Denver last September, which Scharf says “was a collaboration of our office, the economic development folks, and the campus to bring that business together.”

MacMillan says this isn’t necessarily new for the most advanced DMOs, but the challenge is that many planner don’t see the economic benefits for their groups. So they’re not asking for these services.

“The smart DMOs are reaching out and going into the community and saying, ‘Here’s an opportunity to support customers of yours, and hey, if you want to participate in this experience, here’s one way you can do it as a partner or sponsor in the conference,'” he said. “They’re making those business connections and taking it to the next level for meeting professionals.”

More Case Studies & Data Needed

MacMillan and Kliman assert that there’s a lot of potential for both DMOs and the meeting planning community to adopt new collaborative strategies by speaking the language of business versus the language of logistics and banquets.

Part of their motivation behind the development of Fulcrum Marketing was the clear need for more case studies and data showing how meetings drive business performance, and how DMO and planners can impact that positively.

Getting meeting planners to share those numbers and that strategy is another deal all together, although the association industry is often more likely to do so, compared to corporate and government. That works, however, because the association groups are really the ones in most dire need of this intelligence to develop incremental revenue streams.

The first step, Fulcrum will be reaching out to all of the survey respondents to start putting that research together.

“The interest is coming from association executives, where content, education and financial return are all key drivers,” summed up MacMillan. “That’s what you’re hearing people talk about now. Typically, the talk has always been about how many people showed up at a conference, versus the real business outcomes. That’s what DMOs are better understanding today.”

Have a confidential tip for Skift? Get in touch

Tags: destination marketing, meetingsiq

Photo credit: Visit Denver executives go out to University of Colorado to learn about advanced industries potentially interested in meeting in Denver. University of Colorado