Skift Take

In the HomeAway-Airbnb-Booking.com love triangle, it is maverick Airbnb and Booking.com that actually have the most in common in terms of their preference for instantly confirmable bookings. And, like a scorned lover, HomeAway has been ratcheting up its criticisms of Booking.com.

Toss out all of the rhetoric of several years ago that HomeAway and Airbnb are going after two separate markets.

HomeAway CFO Lynn Aitchison told an investor conference yesterday that the two companies have a 12 percent overlap in listings, adding “we know they are coming after our space.”

Aitchison told the Raymond James 36th Annual Institutional Investors Conference in Orlando that HomeAway is keenly aware that Airbnb is raising money but she argued that HomeAway will likewise benefit if Airbnb expands consumer awareness about alternatives to hotels.

The party line used to be that sharing economy proponent Airbnb was targeting primary dwellings in urban locales while HomeAway stuck mostly to second homes in resort areas so the two leaders in their respective categories weren’t necessarily on a collision course.

But these converging markets will ultimately lead to a lot more overlap than 12 percent of HomeAway’s listings in future years.

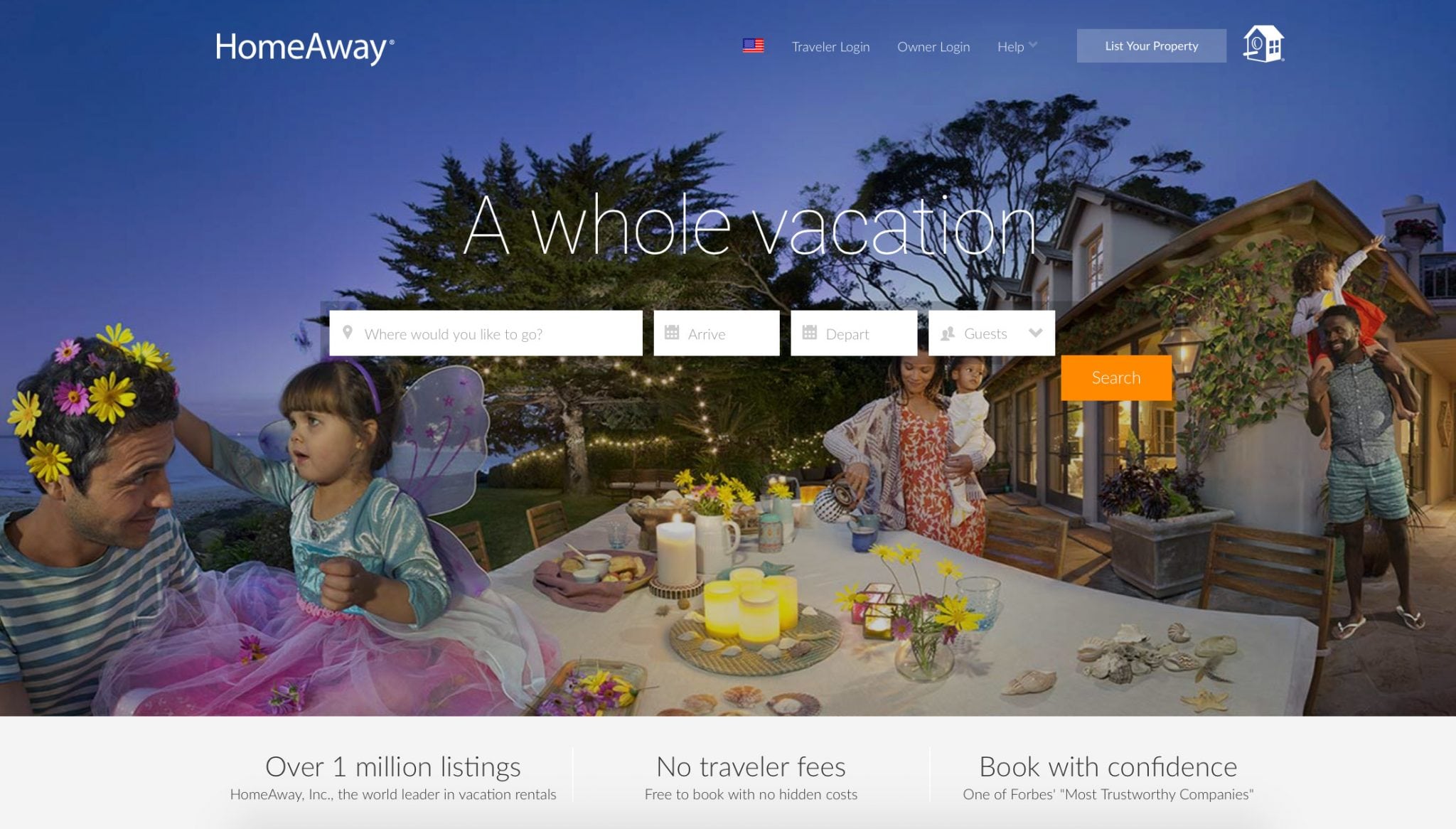

HomeAway is kicking off a new marketing campaign to promote vacation rentals and to point out its differences with Airbnb.

Atchison conceded HomeAway needs to do a better job than it did in the past of emphasizing that the two companies have varying business models and value propositions.

Among them, HomeAway doesn’t charge travelers a booking fee and gives owners more control over their cash flow, Atchison said.

If Airbnb is gunning for HomeAway, Atchison downplayed any strides that rival Booking.com may be making in vacation rentals in Europe.

Booking.com has added property managers such as Interhome to enroll apartment hotels in Europe but Atchison isn’t necessarily believing Booking.com’s recent claims that it is making progress in signing up individual vacation rental owners in Europe.

Atchison contends that vacation rental owners don’t want the instant online bookings and confirmations that Booking.com favors and instead they prefer the 24-hour window that HomeAway gives owners to vet potential guests.

Said Atchison of Booking.com’s efforts in enrolling vacation rental owners, which is a HomeAway strength: “We believe it is easier said than done.”

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, booking.com, homeway, sharing economy, vacation rentals

Photo credit: HomeAway's homepage with the brand's new marketing message. HomeAway