IPO-Bound Virgin America Plans Route Expansion

Skift Take

Virgin America would use an unspecified portion of its net proceeds from its hoped-for IPO for sales and marketing and acquiring additional flight equipment as it looks to expand its operations from Los Angeles, San Francisco, and soon Dallas Love Field.

A huge chunk of the net proceeds, though, would go toward repaying principal and interest to note holders Virgin Group and Cyrus Capital, which currently hold 61.8% and 38.2%, respectively, of $654.4 million in notes.

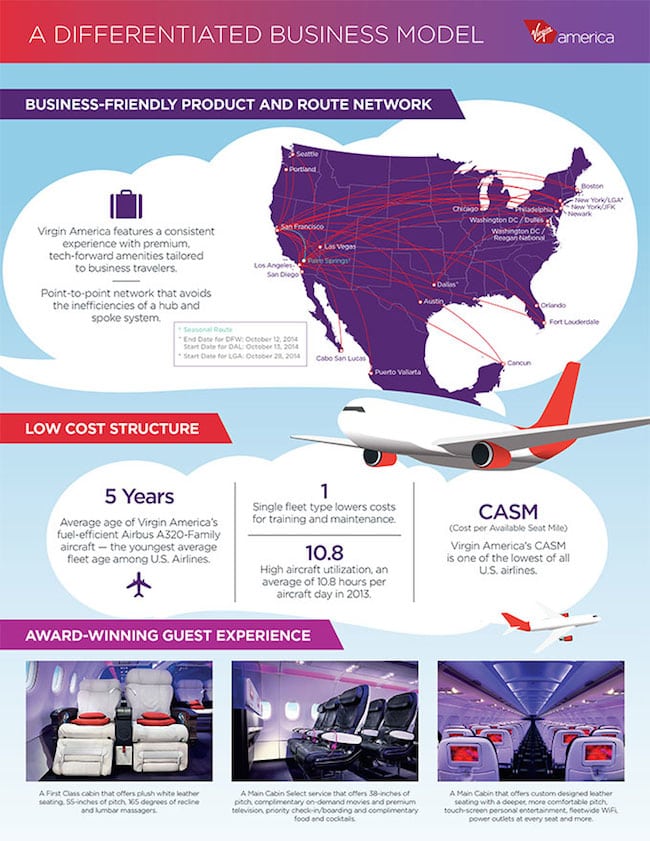

Virgin America currently serves 15 metropolitan areas in the U.S. and three cities in Mexico, and "believes there are significant opportunities to expand our service from our focus cities of Los Angeles and San Francisco to other large markets throughout the United States, Canada and Mexico," according to the airline's S-1 filing.

In addition to expanding service from Los Angeles and San Francisco, Virgin America will begin service from Dallas Love Field, once the Wright Amendment restrictions expire, to newly acquired slots at New York LaGuardia and Ronald Regan Washington National Airport beginning in October 2014.

Virgin America also plans to transfer operations from Dallas Forth Worth Airport over to Love Field.

"In addition, we intend to expand our codeshare and interline relationships with other airlines that are complementary to our network, expanding travel destination options for our guests while adding new sources of revenue and more guests," Virgin America states.

Although Virgin America notched its first profitable year in 2013, the airline recorded an operating loss of $13.1 million in the first quarter of 2014, slightly narrower than the $14.9 million it lost a year earlier. Operating revenue rose 4% to $313.3 million in the first quarter of 2014.

Founded in 2004, Virgin America, which had what it calls 175 "major corporate customers" in 2013, says its strategy is to maintain what it believes its highest average passenger revenue per available seat mile versus other low cost carriers in most markets it serves while containing costs.

The airline is counting on the boost it gets from licensing the Virgin brand and the "premium guest experience" it offers through Main Cabin, Main Cabin Select and First Class service classes to keep an advantage.