Skift Take

Hertz's investment in on-demand valet-parking service Luxe should be seen in the context of Accorhotels recently acquiring Onefinestay. Car rental companies and hotels are both feeling pressure from the sharing economy and they will be making more such investments and acquisitions as these startup mature.

Hertz’s decision to lead a $50 million Series B investment into San Francisco-based on-demand valet-parking service Luxe highlights Hertz’s plan to completely overhaul its technology as it envisions a future convergence of the car rental and car-sharing sectors.

That’s the view of Michel Taride, president of Hertz International, who says he’s “paranoid” about the market and competitors.

Speaking at the World Travel & Tourism Summit in Dallas April 7, Taride said Hertz operates some 1,800 applications and the company decided to overhaul them as it moves toward cloud computing.

Taride said it will take an extended period to transition the rental-car company’s technology.

Hertz currently owns four brands, including Hertz, Dollar, Thrifty and Firefly, as well as Hertz 24/7, a membership service that enables members to rent a car by the hour or day.

Taride believes there will be an ongoing blending of car rental and car-sharing services, and Hertz’s investment in Luxe highlights the trend.

Hertz announced its Luxe investment, in tandem with existing investors Redpoint Ventures and Venrock last week, and Hertz CEO John Tague joined the Luxe board.

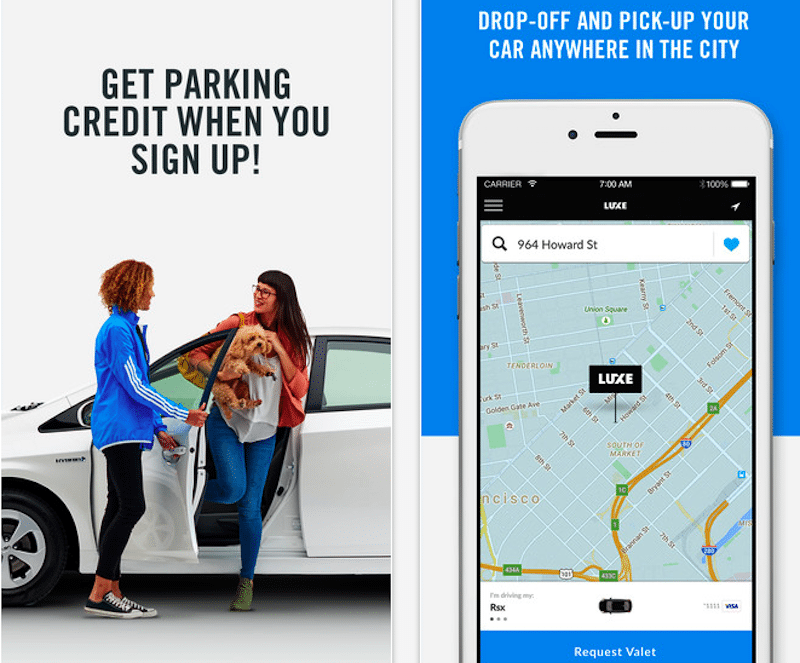

Luxe enables users in San Francisco, Los Angeles, Seattle, Austin, Chicago and New York to use its mobile app to request a valet to park and return users’ cars.

“Our investment will support Luxe’s ability to scale its successful service to other major urban centers, while offering our customers enhanced convenience and value with regard to their urban parking needs,” Tague said in a statement. “Building on an expanded Luxe footprint and capability, we will partner together to develop new innovative and integrated services that will enhance the relevancy of our core products in urban markets.”

The Series B round brings Luxe’s total funding to some $75.5 million, according to Crunchbase. Luxe states it will use its new funding to expand its valet, operations, product and engineering team.

Hertz’s investment in Luxe is believed to be a minority stake.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: hertz, sharing economy, wttc

Photo credit: The Luxe app is an on-demand parking service in a handful of U.S. cities. Luxe