Skift Take

To paraphrase a certain baseball philospher, it's getting late very early for flight-search startups. For any chance of success, they'd better offer something unique, have a lot of funding, and figure out how to attract substantial revenue elsewhere.

Here’s some unsolicited advice for entrepreneurs: If you want to launch a travel startup, avoid building a flight-search startup, and focus on hotels or something else.

OK, the hotel sector is over-crowded, too, but you’ll have more of a chance of surviving than trying to subsist on flight commissions (they only exist for huge OTAs or mega travel agencies), flight-search referral fees, or flight-related advertising revenue.

This is hardly revolutionary advice, but consider all of the flight-related startups out there, including, Routehappy, Pintrips, GetGoing, Superfly, MileWise, Darjeelin, Flights With Friends, SocialFlights, Flightfox, and many more.

Actually, strike one flight-search startup, MileWise, from the list as the company, founded in 2010, announced today that Yahoo is acquiring the MileWise team and its service is shutting down.

Still, despite all the hurdles, there are probably more flight-search startups in stealth mode, and on the way.

To be sure, these flight-search startups have divergent business models, with some commercing in airline miles, data licensing, opaque offerings, subscription revenue from contests, and other tweaks, but virtually all have to contend with the low margins in flight search.

By one estimate, hotel referral fees and advertising can be five times more lucrative than flight-search revenue, and the only way to even subsist on flight-search revenue, if that’s your only business line, is to have tons of volume and to be a fairly large company.

Consider some of these tidbits:

- One of the Hipmunk co-founders stated a year or so after the company’s 2010 launch that if they had known more about the travel industry when they got into it, then they would have focused on hotels instead of flights from the outset. Today, Hipmunk debuted a “Book on Hipmunk” option for hotel bookings as a way to up its revenue take, and to increase hotel transactions.

- Serge Faguet, CEO of Russia OTA Ostrovok says one of the best pieces of advice he received from two angel investors was for the company to abandon its initial focus on packaged travel, and to purse hotels instead.

- Kayak is overly dependent on its low-margin flight-search business, and is doing its best to expand on the hotel side. Somewhat counter-intuitively, though, consumers tend to start their travel planning with flights, and Kayak’s new global ad campaign emphasizes flight search.

- And Room 77 doesn’t bother with flights at all; it is hotel-only.

Companies such as Kayak, Hipmunk and Fly.com have built-in ways to navigate around their over-dependence on flights — at least temporarily.

Kayak’s margins on flights are much lower than on hotels, but Kayak has the volumes to make a business out of flights.

Hipmunk has more than $20 million in funding and a relatively small number of employees so it can afford to hang on for awhile to see if it can build its hotel business.

And, flight-only Fly.com is part of the larger Travelzoo so Fly.com benefits from Travelzoo’s subscriber base of travel-deal seekers, as well as cross-selling and mutual promotional activities.

But, one travel-startup veteran recently mused about what he considers to be the futility of flight-search startups, arguing that the margins they achieve are so low that most are destined to fail as they won’t be able to secure the resources to achieve any meaningful scale.

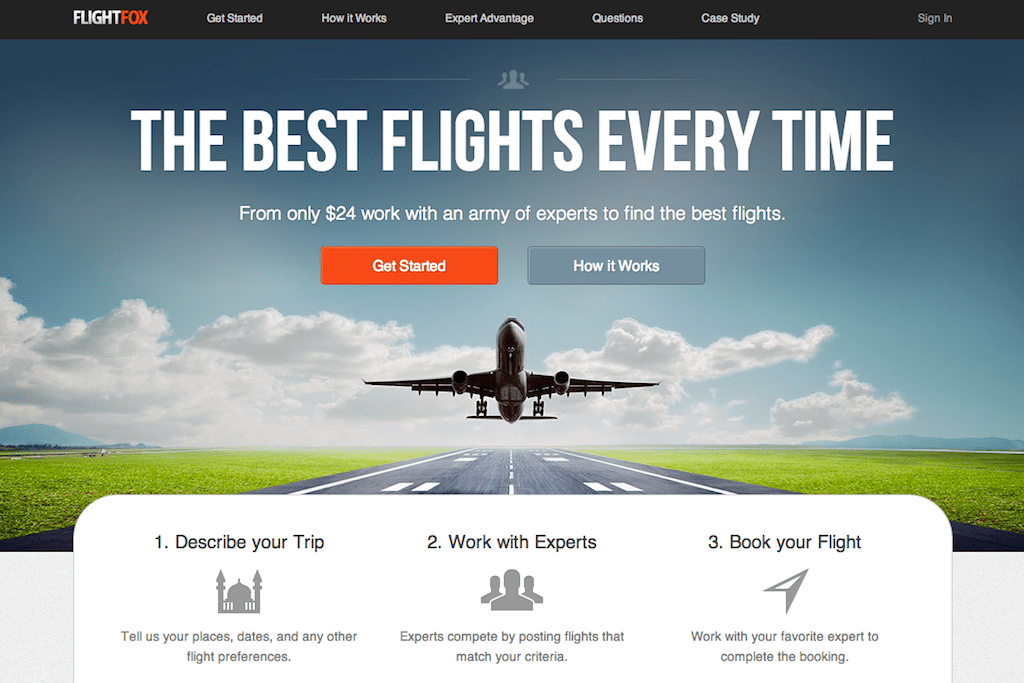

Flightfox’s human-powered search

That sort of talk doesn’t deter startups such as Flightfox, which debuted its “human-powered” flight-search business in 2012. Flightfox, with office in Australia and the U.S., charges travelers a finders’ fee starting at $24 for the most simple itineraries. And, flight experts compete for travelers’ business.

Todd Sullivan, Flightfox co-founder, says the company hasn’t perfected its business yet, but the company is on its way in “proving a flight startup in 2013 can still make it.”

“The economics of the flight industry are only difficult if a startup can’t create unique value,” Sullivan says. “If a startup innovates and creates enough value, they can readily charge for it. This makes them much less reliant on industry economics or commissions paid.”

The economics of it all, depends on your “worldview,” Sullivan contends.

“Also, the notion of poor economics is based on a particular worldview,” he says. “To some, travel means commuting SFO to JFK. To others, it involves multiple continents and many months away. In the case of complex and premium travel, the economics are still great.”

A couple of other flight-search startups, Routehappy and Superfly, separately indicate that they know flight search by itself is insufficient to build a sustainable business, and they have plans to diversify revenue beyond referral and affiliate fees.

Routehappy’s “Happiness Scores”

“We know most OTAs and metas think it’s all about hotel, and we get it — we’ve been there,” says Bob Albert, Routehappy founder and CEO, who previously was general manager of vacation-package seller Site59.

Routehappy recently redesigned its site, emphasizing flight Happiness Scores, taking into account amenities such as seat comfort and Wi-Fi, along with airfares.

“But it’s not metasearch business as usual for Routehappy,” Albert says. “We see a huge under-valued market in flight search.”

Albert believes Routehappy will make it based on its “unique content” because flyers need new ways to decipher “ever-changing flight products and services,” and “airlines need a meaningfully more modern distribution channel.”

“As a result, Routehappy will reach scale because of our unique content,” Albert says. “Happiness Factors that flyers care about personally and Happiness Scores that make selecting a flight easier than anywhere else.”

But, unique flight-search information, however long Routehappy maintains that advantage, will only go so far.

Albert says Routehappy is developing “unique targeting capabilities for airlines and others to upsell their products, which is an entirely different economic discussion from selling a low-fare ticket with airlines. We also have shopping and purchase analytics that are valuable to the industry.”

Superfly looking for a win

In that regard, Routehappy has some parallels with Superfly as Jonathan Meiri, founder and CEO of Superfly, points out that the company reasoned “that if we win flight search with a more personalized model, then we can win the higher margin business further down the value chain.”

With so many competitors, though, it will be an uphill battle for Superfly to “win” in flight search.

Superfly’s angle is to inform frequent flyers about the value of their airline ticket purchases based on the airfare itself, coupled with mileage accruals, and the company has plans to work with airlines on targeting big-spending passengers.

“If there is no strategy to create value further down the value chain, the company will fail,” Meiri says.

So will lots of others.

Have a confidential tip for Skift? Get in touch

Tags: search

Photo credit: One of the latest crop of flight-search startups, Flightfox charges travelers a finders' fee starting at $24 for the most simple itineraries. And, flight experts compete for travelers' business. Flightfox